Glucaric Acid Market Report Scope & Overview:

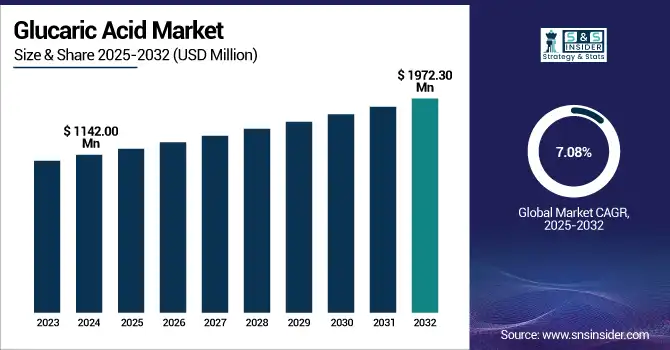

The Glucaric Acid Market size was valued at USD 1,142.00 million in 2024 and is expected to reach USD 1,972.30 million by 2032, growing at a CAGR of 7.08% over the forecast period of 2025-2032.

To Get more information on Glucaric Acid Market - Request Free Sample Report

The glucaric acid market is driven by the increasing demand for sustainable chemicals in detergents, food additives, and corrosion inhibitors. As phosphates are being eliminated, biodegradable glucaric acid is emerging as a highly sought-after alternative, thereby promoting vital glucaric acid market growth. Its status as a top value-added chemical from biomass, acknowledged by the U.S. Department of Energy, is driving consistent glucaric acid market expansion. Companies such as Rivertop Renewables are working toward production, and Solugen’s USD 213.6 million DOE-subsidized Bioforge Marshall plant is expected to contribute to large increases in the glucaric acid market. Preventium by Applied Food Sciences is now GRAS approved by the FDA for food sector application.

Additionally, Montana DOT tests conducted a 70% reduction in corrosion with glucaric acid-based solutions. Such advancements are enhancing competitive advantage, making glucaric a pillar in glucaric acid market analysis, which drives global use and glucaric acid market volume worldwide.

Glucaric Acid Market Dynamics:

Drivers:

-

Expansion of Sustainable Manufacturing Platforms Accelerates Glucaric Acid Market Growth

The growing trend toward sustainable biomanufacturing platforms will stimulate the demand for glucaric acid. Solugen and similar firms were able to score a USD 213.6 million loan guarantee from the U.S. Department of Energy in 2024 to build their Bioforge Marshall facility, which was intended to build organic acids at scale. Rivertop Renewables has a similar project underway to supply the phosphate-free market. These investments are in line with the drive toward green alternatives for industrial and consumer uses. As firms incorporate innovative catalytic and fermentation techniques, the glucaric acid market share is expected to rise, enhancing its commercial potential.

-

Regulatory Endorsements and Safety Approvals Boost Glucaric Acid Market Confidence

Supportive regulations have stimulated confidence in the industry for glucaric acid. In 2024, the U.S. Food and Drug Administration gave GRAS status to Preventium for use in food formulations. The U.S. Environmental Protection Agency handed the 2019 Green Chemistry Challenge to fermentation-based glucaric acid as part of the solution for eliminating dangerous phosphate-based cleaners. These authorizations have spurred product availability and simplified market access for the regulated food, water treatment, and cleaning markets. Support from government organizations enforces confidence among the glucaric acid companies and helps expand the glucaric acid market reach to the international market.

Restraints:

-

Feedstock Supply Variability and Competition for Biomass Feedstocks Create Supply Chain Risks

The glucaric acid market is dependent on the availability of sugar and starch-based biomass, with seasonality and regionally available variations. Price volatility is often spurred by competing uses for corn and sugar in ethanol, food, and bioplastics markets. Poor harvest seasons can result in a 25% increase in biomass input costs, as reported by the National Renewable Energy Laboratory. Such instability also disrupts long-term procurement planning of glucaric acid producers and restricts the production scale. Competition for feedstock where the market increases could result in price pressure and supply tightness that would limit manufacturers' ability to provide sustained production volumes and competitiveness on a global basis.

Glucaric Acid Market Segmentation Analysis:

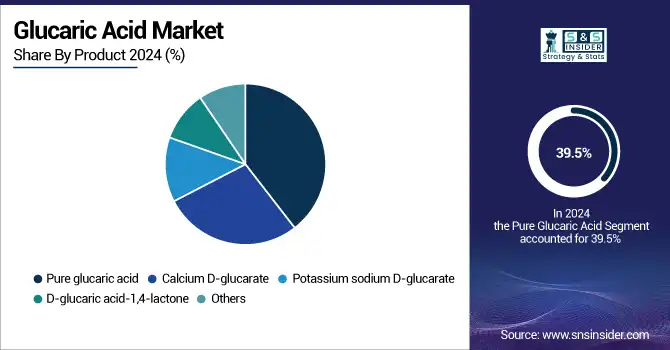

By Product

Pure glucaric acid dominated and accounted for 39.5% of the glucaric acid market in 2024. Its technical grade and purity also make it the product of choice in several applications, including detergents and agrochemicals. Rivertop Renewables has scaled to manufacture phosphate-free cleaners that comply with strict regulations, facilitating wide adoption. Montana Department of Transportation studies indicated a 70% decrease in steel corrosion when using pure glucaric acid inhibitors, confirming the performance advantage. In addition, the U.S. Department of Energy's recognition of glucaric acid as one of the "Top Value-Added Chemicals from Biomass" further highlights the strategic value of pure glucaric acid in Greenfactory's sustainable manufacturing processes.

Calcium D-glucarate achieved the highest growth rate in the glucaric acid market during the forecast period of 2025-2032 with a CAGR of 7.55%. Nutraceuticals and pharmaceutical manufacturers are increasingly using this derivative as clinical trials continue to demonstrate its capacity for supporting detoxification pathways, resulting in a surge of demand. Applied Food Sciences’ Preventium line gained FDA GRAS status, allowing for use in functional foods and beverages. Kalion Inc.'s collaboration with academic partners has resulted in increased fermentation yields, which reduce production costs and increase market access. These developments make calcium D-glucarate the fastest growing segment, areas that need to be focused upon during the glucaric acid market analysis in the future.

By Application

Detergents captured 37.6% of the glucaric acid market in 2024, making it the dominant application segment. Traditionally, a phosphate builder, they are replacing it with a glucaric acid-based surfactant to comply with tough environmental regulations and consumer desire for eco-friendlier cleaning products. Rivertop Renewables announced that it had worked with some of the leading laundry product companies to incorporate its bio-based formulations at commercial scale. Government agencies, such as the U.S. Environmental Protection Agency have reported reduced eutrophication from runoff from the use of glucaric acid detergents. This regulatory backing, plus industry cooperation, is why detergents are leading in market share and are paving global glucaric acid market trends.

Food ingredients recorded a 7.64% CAGR in the glucaric acid market over the forecast period of 2025-2032. Preventium glucarate by Applied Food Sciences has attained FDA GRAS status for use in beverages and snack bars. Leading food producers in markets have conducted evaluations for shelf-life and antioxidant effects. Such partnerships between companies producing glucaric acid and food associations point to escalating demand for bio-based solutions, drawing attention toward transformative trends in the food ingredients industry, and further consolidating the growth potential of the glucaric acid market.

Glucaric Acid Market Regional Outlook:

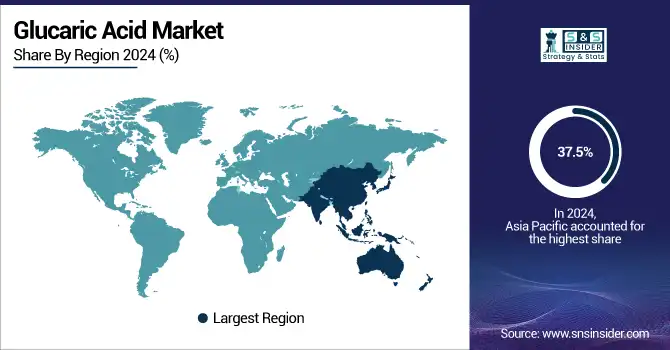

Asia Pacific dominates the glucaric acid market in 2024 with a commanding market share of 37.5% and the highest CAGR of 7.57%. This dominance is attributed to rapid industrialization, rising awareness among consumers about biodegradable products, and government policies promoting sustainable chemical use in countries, such as China, India, and Japan. The region’s expanding detergent and food ingredient business also contributes to the glucaric acid market demand. The increasing focus on green manufacturing in Asia Pacific and investments by local companies in the region are consistent with international trends, which further substantiates the predominance of Asia Pacific in the market for glucaric acid.

North America is the second-largest market globally for glucaric acid, 2024 accounted for a massive market share of 30.4%. The U.S. is dominating the region with 66.2% market share and a market size of around USD 229.92 million in 2024 and is projected to reach to a market size of USD 391.22 million in 2032 with a CAGR of 6.88% on account of robust product demand from detergents, food ingredients, and pressure-sensitive films industries, on account of the rising trend of eco-friendly product use encouraged by bodies including the EPA (Environmental Protection Agency). Canada is among the fastest-growing countries with increasing industrial applications and supportive government policies on sustainable chemical production. This strong regional presence positively motivates the trend of the glucaric acid market and has helped ensure a market share.

Europe is the third leading region in the glucaric acid market due to the stringent regulation of chemical safety and sustainability by the European Chemicals Agency (ECHA). The German and French markets lead in industrial applications, with the market profiting from high demand across personal care and detergent applications. Market in Europe is experiencing strong growth in the glucaric acid market, with a high market value. A group of overseas glucaric acid companies focuses on green chemistry products as a production base in Europe. These trends in the market contribute to the favourable growth of the glucaric acid market in the region.

The glucaric acid market is expanding in Latin America as the region’s food processing and detergent sectors expand, especially in Mexico and Brazil. Increased government-led sustainable agricultural and chemical manufacturing initiatives also encourage bio-based product development, with entities, such as the Brazilian Ministry of Agriculture advocating this progress. Emerging export potentials coupled with a growing preference for green products by consumers continue to boost shares in the regional glucaric acid market, and the forecast period will witness significant growth.

The Middle East & Africa glucaric acid market size is also substantial and is driven by growing industrialization and surging interest in environment-friendly cleansing agents. Governments in nations including Saudi Arabia and South Africa are developing green chemical technologies for environmental protection as regulatory policies consider sustainability. Although not among the fastest growing, the region’s rising infrastructure, and increased awareness regarding biodegradable chemicals, have been contributing significantly to the global glucaric acid market and making the key gamut of glucaric acid companies set deep roots in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major competitors in the glucaric acid market include Rivertop Renewables, Rennovia Inc., Kalion Inc., Jungbunzlauer Suisse AG, Roquette Frères, Biosynth Carbosynth, Haihang Industry Co., Ltd., Anhui Elite Industrial Co., Ltd., Shaoxing Marina Biotechnology Co., Ltd., and Chemfaces Biochemical Co., Ltd.

Recent Developments:

-

September 2024: Applied Food Sciences launches CelluThrive Calcium D-Glucarate, a bulk glucarate ingredient for nutraceutical and beverage applications, backed by over two decades of clinical research on detoxification pathways

-

June 2024: Solugen secures a conditional USD 213.6 million loan guarantee from the U.S. Department of Energy Loan Programs Office to build its Bioforge Marshall facility in Minnesota, significantly expanding domestic bio-based glucaric acid production capacity

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1,142.49 million |

| Market Size by 2032 | USD 1,972.30 million |

| CAGR | CAGR of 7.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Pure glucaric acid, Calcium D-glucarate, Potassium sodium D-glucarate, D-glucaric acid-1,4-lactone, Others) •By Application (Food ingredients, Detergents, Corrosion inhibitors, De-icing applications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rivertop Renewables, Rennovia Inc., Kalion Inc., Jungbunzlauer Suisse AG, Roquette Frères, Biosynth Carbosynth, Haihang Industry Co., Ltd., Anhui Elite Industrial Co., Ltd., Shaoxing Marina Biotechnology Co., Ltd., and Chemfaces Biochemical Co., Ltd. |