Managed Application Services Market Report Scope & Overview:

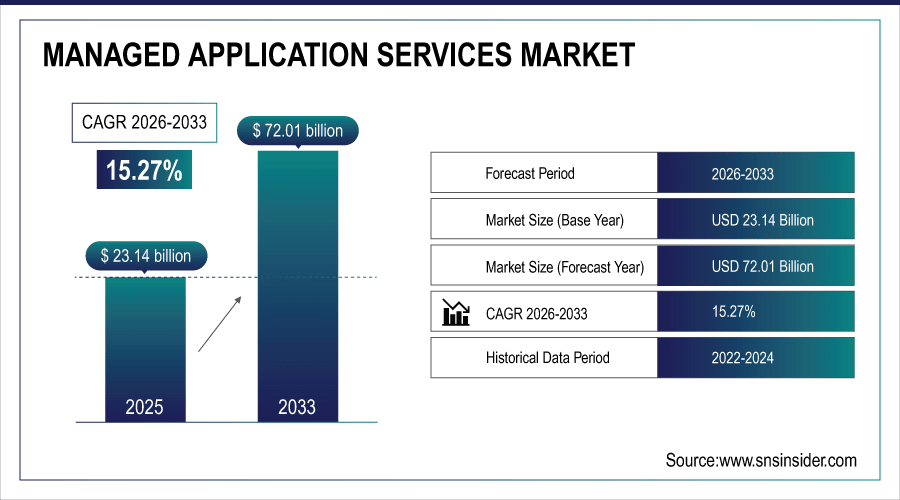

The Managed Application Services Market Size was valued at USD 23.14 Billion in 2025E and is expected to reach USD 72.01 Billion by 2033 and grow at a CAGR of 15.27% over the forecast period 2026-2033.

The Managed Application Services Market is primarily driven by the increasing complexity of modern IT environments and the projected demand for businesses to ensure application performance, scalability, and security. With enterprises moving towards managed application services in order to lower costs, improve flexibility and concentrate on key areas of the business, by outsourcing application development, management/monitoring and support to focused providers, managed application services adoption is on the rise. The transformation into cloud-native architectures and approach to digital transformation initiatives, coupled with the growing demand for mobile and web applications are allowing the market contestants to leverage their proficiency in integrating, modernizing and maintaining their application systems driving the market growth. According to study, 65–70% of enterprises adopting digital transformation initiatives are outsourcing at least one application function to managed service providers.

To Get More Information On Managed Application Services Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 23.14 Billion

-

Market Size by 2033: USD 72.01 Billion

-

CAGR: 15.27% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Managed Application Services Market Trends

-

Rising cloud-native adoption drives demand for scalable managed application services.

-

Enterprises outsource application management to reduce costs and improve agility.

-

Digital transformation accelerates need for integration and modernization of applications.

-

Growing reliance on mobile and web applications boosts MAS provider engagement.

-

AI-driven automation reshapes application monitoring, optimization, and predictive maintenance services.

-

Advanced analytics in MAS enable smarter decision-making and improved application performance.

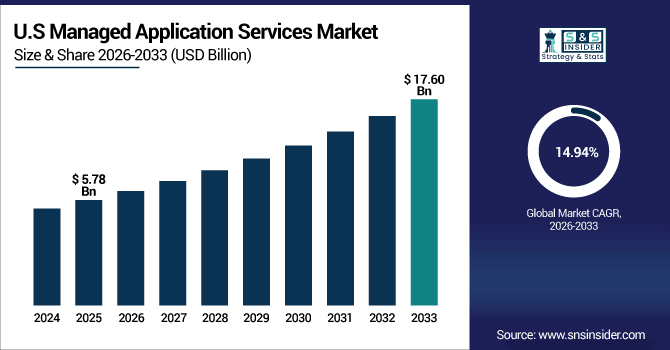

The U.S. Managed Application Services Market size was USD 5.78 Billion in 2025E and is expected to reach USD 17.60 Billion by 2033, growing at a CAGR of 14.94% over the forecast period of 2026-2033, driven by widespread digital transformation, enterprise focus on application modernization, and integration of AI and automation. Strong IT infrastructure and strategic outsourcing adoption reinforce efficiency, scalability, and innovation across industries.

Managed Application Services Market Growth Drivers:

-

Digital Transformation Fuels Demand for Scalable Managed Application Services

A key driver of the Managed Application Services market is the accelerating pace of digital transformation. Different industries are replacing legacy systems with cloud-native and hybrid environments in order to deliver better flexibility and customer experience. This change heightens the need for MAS providers who are more skilled in managing complex application ecosystems and ensuring operations are less hindered while organizations can devote their energies toward strategic growth instead of everyday IT management.

AI and automation adoption in MAS is expected to increase operational efficiency by 30–40%.

Managed Application Services Market Restraints:

-

Security and Compliance Challenges Restrain Growth of Managed Services

The increasing data security and regulatory compliance concern is one of the key factors restraining MAS adoption. Outsourcing application management means releasing sensitive business and customer data to third-party providers. This raises fears, risk of security breaches, data misuse, or noncompliance with sobering industry regulations. In tight regulated industries like finance and health care these risks cause businesses to hesitate in embracing managed application services.

Managed Application Services Market Opportunities:

-

AI and Automation Unlock Future Opportunities in Application Services

The significant opportunity for Managed Application Services Market growth is the increasing integration of artificial intelligence and automation. With AI-enabled solutions, you can monitor in real-time and catch issues before they occur, make proactive maintenance and automatically resolve application issues, leading to enhanced efficiency and reduced operational downtime. Automating other repetitive chores gives human capital time to move on to more valuable enterprise strategic activities. This evolution places MAS providers as innovation enablers alongside service managers, enabling businesses to become more agile and competitive.

Automation of repetitive tasks allows IT teams to focus 40–50% more on strategic initiatives.

Managed Application Services Market Segmentation Analysis:

-

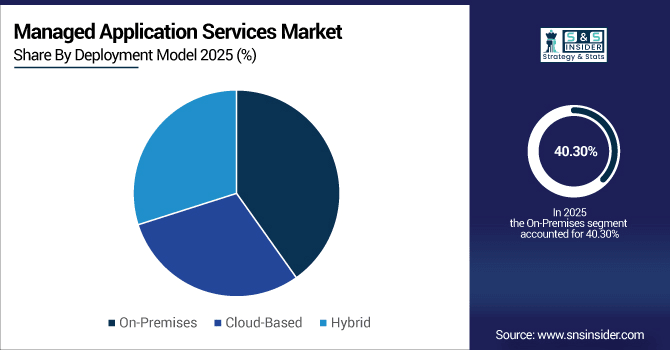

By Deployment Model: In 2025, On-Premises led the market with a share of 40.30%, while Cloud-Based is the fastest-growing segment with a CAGR of 17.20%.

-

By Service Type: In 2025, Application Management and Support Services led the market with a share of 32.46%, while Application Development Services is the fastest-growing segment with a CAGR of 15.80%.

-

By Application: In 2025, Enterprise Applications led the market with a share of 38.60%, while Cloud Applications is the fastest-growing segment with a CAGR of 18.26%.

-

By End-User: In 2025, BFSI led the market with a share of 32.16%, while Healthcare is the fastest-growing segment with a CAGR of 16.50%.

By Deployment Model, On-Premises Leads Market and Cloud-Based Fastest Growth

The On-Premises deployment model in the Managed Application Services Market retains the highest market share as most of the enterprises are still engaged in on-site infrastructure for better security, compliance, and integration with legacy systems. On-premises solutions are usually preferred for organizational-critical applications needing stringent control, reliability, and compliance with regulatory requirements. Simultaneously, Cloud-Based deployment model is growing fastest pace driven by cloud-native architecture, hybrid environments, and digital transformation trends. Scalability, flexibility, and cost efficiency of Cloud-based Managed Application Services helps businesses in accelerating application modernization and streamlining operation, while also enabling businesses to rapidly adapt to changing market requirements leading to significant growth of this segment.

By Service Type, Application Management and Support Services Leads Market and Application Development Services Fastest Growth

In the Managed Application Services Market, Application Management and Support Services leads the market, capturing the largest share due to need for maintaining, optimizing, and keeping mission critical applications secure is ever present. The segment continues to command the highest market share as organizations gradually move towards ensuring optimal performance, low downtime, and outsourcing mundane IT management services to the providers equipped with brains. On the other hand, Application Development Services is the most quickly rising section, propelled by the expanding demand for custom, cloud-native, and mobile apps. As enterprises focus on their digital transformation initiatives, modernization of legacy systems, digital innovations with the implementation of modern disruptive technologies to ramp up their development skills, integration services and rapid deployment solutions, this segment is seeing sustained growth for IT services.

By Application, Enterprise Applications Leads Market and Cloud Applications Fastest Growth

The Enterprise Applications segment leads in the Managed Application Services Market, capturing the highest share end-to-end services focusing on the management, optimization, and security of core business applications that support vital operations have become a high-priority item for organizations. This supremacy is based on the unending demand for smooth performance, compliance, and integration with legacy systems for business continuity in sectors such as BFSI, healthcare, retail, and many more. On the other hand, the fastest-growing segment is cloud applications, supported by the rise of cloud-native solutions, mobile apps, and web-based platforms. Cloud in large, are helping organizations to build scalability, elasticity and quickly deploy, which in-turn is helping organizations to fasten their digital transformation process, better application management, and improve user experience, thus contributing to the high growth in the segment.

By End-User, BFSI Leads Market and Healthcare Fastest Growth

In the Managed Application Services Market, the BFSI sector leads the market, capturing the largest share due owing to the utmost necessity of secure, reliable and compliant application management systems in the sector. MAS providers play a vital role for enterprises in this sector to ensure smooth functioning, minimal downtime, and regulation adherence, thereby managing large number of complex and mission-critical applications. Simultaneously, the Healthcare segment is experiencing the most rapid growth due to the increasing adoption of digital health solutions, telemedicine platforms, and cloud-based applications. On the other hand, managed services help to seamlessly integrate, monitor and maintain the applications in healthcare organizations, enhance patient care and expedite digital transformation.

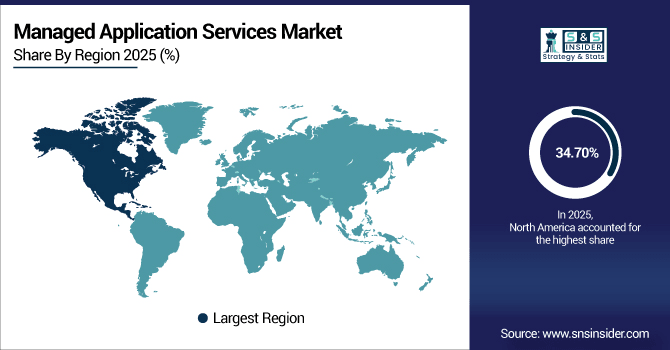

Managed Application Services Market Regional Analysis:

North America Managed Application Services Market Insights:

The Managed Application Services Market in North America held the largest share 34.70% in 2025, owing to an early adoption of advanced IT solutions, widespread digital transformation initiatives and high investments on cloud, enterprise technologies. Market growth is further propelled by high concentration of major MAS providers in the region, presence of strong IT infrastructure, and large enterprises in various sectors including BFSI, healthcare and retail. North American organizations are increasingly outsourcing their application management, development, and security services to enhance operational efficiency, reduce costs, and streamline innovation. Besides, the increasing acceptance of cloud-based, hybrid, and AI-centric managed services is further enhancing the region's leadership position, making it a saturated and very competitive industry.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Managed Application Services Market with Advanced Technological Adoption

The U.S. leads the Managed Application Services Market due to early adoption of cloud, AI-driven solutions, robust IT infrastructure, and extensive outsourcing of application management across industries.

Asia-Pacific Managed Application Services Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Managed Application Services Market, projected to expand at a CAGR of 16.50%, owing to fast-paced digital transformation, growing cloud adoption, and increasing IT infrastructure across enterprises. Many organizations are spending billions of dollars to transform legacy applications into more suitable, cloud-native solutions while implementing AI and automation in the case of automation-driven practices to improve efficiency and operational agility. A surge in demand from verticals like BFSI, healthcare, and retail will also drive MAS adoption. Enterprises, especially small and medium enterprises (SMEs), outsource application management to MAS providers to reduce cost and optimize agility. Strong market growth prospects in Asia-Pacific strengthen due to the growing talent population of IT in the region and supportive government initiatives to digitalization.

China and India Propel Rapid Growth in Managed Application Services Market

China and India drive Managed Application Services Market growth through large-scale digital transformation, increasing cloud adoption, rising IT investments, and expanding enterprise demand for application management and modernization services.

Europe Managed Application Services Market Insights

Europe is expected to capture a larger share of the Managed Application Services Market owing to the high adoption rate of cloud and hybrid deployment models and increasing enterprise application modernization need driving demand at a high rate for cloud-based application managed services in this region. Critical industries such as BFSI, manufacturing, healthcare, and retail are looking to outsource their application management and support services to a third-party service provider to increase operational efficiency, lower costs, and direct their resources toward strategic growth. Enterprise applications still reign king here, but the world is embracing cloud at a breakneck pace. the adoption is only supported by Europe due to its stable political purpose, well-structured compliance framework, mature IT infrastructure and further investment in automation and AI.

Germany and U.K. Lead Managed Application Services Market Expansion Across Europe

Germany and the U.K. drive Managed Application Services Market growth in Europe through advanced IT infrastructure, high cloud adoption, strong enterprise demand, and increased outsourcing of application management and modernization services.

Latin America (LATAM) and Middle East & Africa (MEA) Managed Application Services Market Insights

The Managed Application Services Market in Latin America and the middle east & Africa is growing steadily, driven by increasing digital transformation initiatives, adoption of cloud and hybrid deployment models, and the expansion of IT infrastructure. Companies in sectors like BFSI, health care, and retail are outsourcing application management and support services to increase operational efficiencies, cut down costs, and to focus on core business objectives. The trend of cloud-based, automated application solutions is proving positive impacting both scalability and agility, but more importantly the ability for organizations to get the applications they want to have the performance they need.

Managed Application Services Market Competitive Landscape

Atos delivers AI-powered Managed Application Services designed to meet evolving business demands. Their services focus on application modernization, cloud migration, and digital transformation. Atos emphasizes measurable outcomes and simplification of IT operations to help clients achieve business agility and innovation.

-

In July 2025, Atos renewed its partnership with Google Cloud as a Premier Managed Service Provider. This renewal highlights Atos's proven expertise in cloud migration, data analytics, AI, security, and application modernization.

Capgemini provides end-to-end Managed Application Services, specializing in application modernization, multicloud management, and strategic advisory. Recognized as a leader by Forrester, they excel in leveraging AI and machine learning to enhance service delivery. Their offerings aim to drive digital transformation and operational efficiency for clients.

-

In September 2024, Capgemini was positioned as a Leader in the IDC MarketScape for Worldwide Cloud Professional Services, recognized for its cloud-native solutions and managed services capabilities.

Fujitsu offers comprehensive Managed Application Services encompassing the entire application lifecycle from development and modernization to management and transformation. Their services focus on reducing operational costs, enhancing user satisfaction, and driving business innovation through automation and cloud integration. Fujitsu's approach emphasizes continuous improvement and strategic IT transformation.

-

In October 2024, Fujitsu launched an AI-powered application to improve mobile network communication quality, focusing on energy efficiency and optimized network operations.

Managed Application Services Market Key Players:

Some of the Managed Application Services Market Companies are:

-

Accenture

-

IBM

-

Fujitsu

-

HCL Technologies

-

Wipro

-

Cognizant

-

Capgemini

-

Atos

-

Infosys

-

TCS (Tata Consultancy Services)

-

DXC Technology

-

NTT DATA

-

Tech Mahindra

-

LTI (Larsen & Toubro Infotech)

-

Mindtree

-

CGI

-

Sopra Steria

-

Hexaware Technologies

-

Virtusa

-

Mphasis

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 23.14 Billion |

| Market Size by 2033 | USD 72.01 Billion |

| CAGR | CAGR of 15.27 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Development Services, Management and Support Services, Integration Services, Hosting Services, Security Services) • By Deployment Model (On-Premises, Cloud-Based, Hybrid) • By Application (Enterprise Applications, Mobile Applications, Web Applications, Cloud Applications) • By End-User (BFSI, Retail and E-commerce, IT and Telecom, Manufacturing, Healthcare, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Accenture, IBM, Fujitsu, HCL Technologies, Wipro, Cognizant, Capgemini, Atos, Infosys, TCS (Tata Consultancy Services), DXC Technology, NTT DATA, Tech Mahindra, LTI (Larsen & Toubro Infotech), Mindtree, CGI, Sopra Steria, Hexaware Technologies, Virtusa, Mphasis, and Others. |