Managed Infrastructure Services Market Report Scope & Overview:

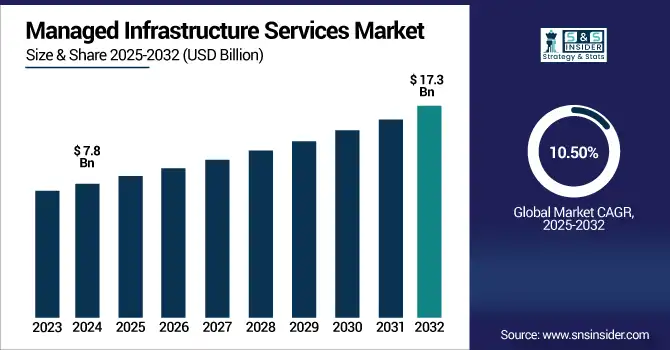

The managed infrastructure services market size was valued at USD 7.8 billion in 2024 and is expected to reach USD 17.3 billion by 2032, growing at a CAGR of 10.50% during 2025-2032.

To Get more information on Managed Infrastructure Services Market - Request Free Sample Report

The numerous companies that strive to increase IT productivity, scalability, and cost-efficiency by outsourcing their IT operations during the past several years fuel the managed infrastructure services market growth. The market for this software is broadening in verticals, such as BFSI, healthcare, and manufacturing, driven by increasing IT environment complexity, burgeoning cloud adoption, and an urgent need for secure and always-on infrastructure. Some of the key managed infrastructure services market trends include remote infrastructure monitoring, hybrid cloud integration, and cybersecurity services, among others.

Demand increases due to technological innovations and improving digitization. Managed infrastructure services market analysis says that the managed infrastructure services market will grow at a strong CAGR till 2032, largely driven by increased remote work and growing demand for disaster recovery solutions. While the tactics of strategic partnerships and service innovation will likely evolve as the opportunity landscape changes in a global economy, these concepts will remain at the forefront of sustaining competitive advantage.

The U.S. managed infrastructure services market is estimated at USD 2.53 billion in 2024 and is projected to reach USD 5.52 billion by 2032, registering a compound annual growth rate of 10.28%. The increase in cloud migration, continued demand for cybersecurity, and new forms of digital transformation across industries are the fundamental drivers for growth. In addition, the rise of AI-enabled automation and the transition to hybrid/remote-work models are driving managed infrastructure services and positioning the markets for long-term sustained growth.

Market Dynamics:

Drivers:

-

Surged Cloud Migration Drives Higher Demand for Managed Infrastructure Services Globally

Organizations are increasingly moving away from on-premise infrastructure and are adopting cloud-based models to enhance scalability, flexibility, and cost efficiency. Managed infrastructure services facilitate hybrid and multi-cloud environments to allow businesses to get up and running faster with expert support, monitoring, and maintenance around the clock. With digital transformation gaining momentum among industries, such as healthcare, BFSI, and retail, enterprises are opting for managed services to enjoy services with optimal performance, ensuring minimal downtimes without capital expenditure. The increasing demand for cloud-native applications and data center outsourcing has also promoted market growth. The increased emphasis on the strategic priority of cloud adoption is expected to boost the demand for managed infrastructure service providers that are enabling the delivery of secure, compliant, and resilient IT ecosystems in the enterprise, making it a growing market.

For instance, 66% of companies planned to boost their cloud migration budgets in 2025 to enhance agility and innovation, reflecting growing investment in managed support services.

Restraints:

-

Concerns Over Data Breaches and Compliance Limit Adoption of Managed Infrastructure Services

While outsourcing of IT infrastructure has many benefits, data security and privacy are still the top concerns. Third-party service providers are preferred to handle enterprise data, but at the same time, they bring about risks of unauthorized access, data breach, and compliance violations, among others. Such concerns could limit the adoption of managed services for data-sensitive sectors, such as healthcare, banking, and government.

Furthermore, different global data protection regulations (GDPR, HIPAA, and others.) add another layer of complexity and difficulty to compliance, making it even more challenging, especially for organizations with a multinational presence. Now, even though providers are advancing encryption, access controls, and compliance frameworks, there is sufficient skepticism around external data control that may further restrict the market opportunities. This constraint tends to be applicable in high regulatory surveillance industries or where enterprises have legacy IT ecosystems.

For Instance, over 60% experienced public cloud security incidents in 2024, and 80% of companies were affected by cloud security breaches in the prior year, intensifying hesitancy to outsource critical infrastructure

Opportunities:

-

Rising Need for Intelligent Operations Boosts Adoption Of AI-Driven Managed Services

Managed infrastructure service is in a position to significantly grow, especially with artificial intelligence and automation coming into play. By using AI-powered tools, predictive maintenance, real-time tuning, and incident management all assist in lowering the chances of human error while also making operations much more efficient. IT automation accelerates repetitive and low-value tasks including patch management, performance monitoring, and compliance reporting, giving IT teams more time for other substantive initiatives. With organizations striving more than ever for intelligent, self-healing IT infrastructure, service providers with AI-enhanced solutions are positioned to gain a competitive advantage. Additionally, AI and automation are so important to track and manage the difficult hybrid cloud surrounding, providing flexibility and agility. This technological development not only opens new revenue streams for managed service vendors but also helps in improving customer satisfaction.

Challenges:

-

Lack of Skilled Professionals Restricts Delivery and Scalability of Services

As IT infrastructure technologies continue to evolve rapidly, the need for a skilled workforce becomes imperative, especially concerning skillsets in cloud platforms, cybersecurity, automation, and compliance. But there is a global skill gap for professionals skilled in designing, deploying, and managing complex infrastructure services. For service providers aiming to scale their operations or deliver next-generation capabilities, this talent gap represents a major hurdle. Consequently, the high turnover rates and competition for skilled IT talent further bump up the operational costs and the timelines. Managed service providers that cannot hire and retain enough skilled resources to meet demand will find it difficult to meet SLAs, innovate offerings, or enter new markets. Whether it be through investing in skills development, creating partnerships, or attracting talent from around the world, this challenge demands a response.

Segmentation Analysis:

By Service Type:

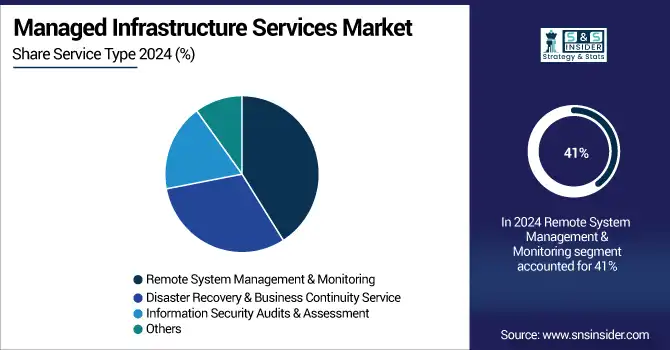

The remote system management & monitoring segment dominated the market and accounted for 41% of the managed infrastructure services market share in 2024 due to the surging requirement for uninterrupted infrastructure visibility, real-time troubleshooting, and the potential of remote IT operations that are both time-saving and economical. As hybrid work models and complex IT environments become the norm, greater numbers of enterprises have begun to rely on 24/7 managed monitoring. This segment is also expected to retain its dominance through 2032, owing to the growing customer inclination towards operational efficiency.

The disaster recovery & business continuity service is expected to grow with the fastest CAGR due to the increasing tendency of cyber-attacks, ransomware attacks, and GDPR or HIPAA & PCI compliance. Business continued to work on resilient, IT infrastructure to reduce downtime and provide always-on services.

By Industry:

The Telecom & IT segment dominated the managed infrastructure services market in 2024 and accounted for the largest market share, owing to the high and ongoing demand for comprehensive and specific infrastructure management, as it needs to be robust, scalable, and secure. The demand for managed services is driven by growing data traffic, 5G launches, and the proliferation of hybrid cloud. This trend is likely to continue until 2032, with telecom companies more often outsourcing infrastructure management to focus on innovation and better core services.

The healthcare and life sciences segment is anticipated to record the fastest growth during the forecast period due to the pervasiveness of digitization of patient records, expansion of virtual healthcare and telehealth, and stringent adherence requirements. Increasing dependence on a secure, high-availability infrastructure drives an increase in demand for managed services.

Regional Analysis:

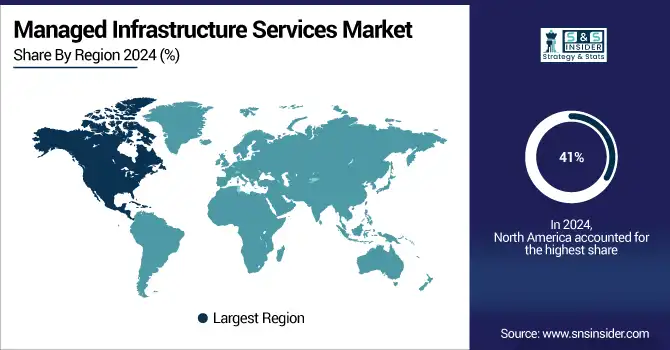

North America dominated the managed infrastructure services market and accounted for 41% of revenue share in 2024, due to factors, such as early cloud adoption trends, advances in IT infrastructure, and the presence of major managed service providers. Outsourcing of infrastructure in the U.S. and Canada is growing for agility, compliance, and security. Investment in AI, automation, and hybrid cloud models will ensure that North America retains its leadership position up to 2032.

The fastest CAGR is expected to be registered in Asia-Pacific owing to increasing digital transformation across India, China, and Southeast Asia. The market is expanding due to the fast-growing SMEs, an increasing number of governments pursuing cloud-first initiatives, and demand for secure and elastic IT infrastructure. The growth is expected to gain further acceleration over 2025 to 2032 due to the growing adoption of managed services among regional enterprises to overcome skill gaps and decreasing overall IT costs.

The rapid digitalization coupled with the adoption of cloud, backed by the government, pushed tech modernization, making China dominant in the Asia-Pacific managed infrastructure services market. As data centers grow and AI proliferates, demand for managed services is booming. Stronger growth will continue through 2032 as this sector continues to invest in 5G, smart cities, and enterprise IT outsourcing.

The digital transformation of banking, manufacturing, and healthcare in Europe is propelling growth in the managed infrastructure services market. The demand is driven by a rise in cloud adoption, stringent data regulations (GDPR), and cyber threats.

With a strong industrial sector, advanced IT infrastructure, and an emphasis on data security, the European market has responded quickly to Industry 4.0 initiatives, led by the capabilities in Germany. With more Enterprise firms adopting Industry 4.0 or rapid digitization, demand for managed services is on the rise. Continued growth through 2032 will be fueled by government support of digital innovation and automation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players :

The major managed infrastructure services market companies are IBM, Fujitsu, Cisco Systems, Dell Technologies, AT&T, Hewlett-Packard Enterprise (HPE), Tata Consultancy Services (TCS), DXC Technology, NTT Data, Capgemini, and others.

Recent Developments:

-

In April 2024, IBM announced its plan to acquire HashiCorp for $6.4 billion, enhancing its hybrid and multi-cloud infrastructure management capabilities through Terraform and Vault integration.

-

In November 2024, at HPE Discover, HPE launched its GreenLake unified virtualization management solution, streamlining hybrid IT environment control and enhancing managed infrastructure for enterprise customers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 7.8 Billion |

| Market Size by 2032 | US$ 17.3 Billion |

| CAGR | CAGR of 10.45% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Remote System Management & Monitoring, Disaster Recovery & Business Continuity Service, Information Security Audits & Assessment, Others) • By Industry (Telecom & IT, BFSI, Consumer Goods and Retail, Manufacturing, Healthcare and Life Sciences, Education, Energy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | IBM, Fujitsu, Cisco Systems, Dell Technologies, AT&T, Hewlett Packard Enterprise (HPE), Tata Consultancy Services (TCS), DXC Technology, NTT Data, Capgemini and others in the report |