Payment Processing Solutions Market Size & Overview:

To Get More Information on Payment Processing Solutions Market - Request Sample Report

Payment Processing Solutions Market size was valued at USD 52.1 billion in 2023 and is expected to grow to USD 139.7 billion by 2032 and grow at a CAGR of 11.6 % over the forecast period of 2024-2032.

The global payment processing solutions market grew owing to the increasing government initiatives to promote digital payments and reduce the use of cash. According to the latest data from the U.S. Federal Reserve, digital payments in the U.S. grew by 19% in 2023. Similar trends were observed at an international level as well, as the European Central Bank reported that, throughout the Eurozone, cashless transactions increased by 16% during 2023, with governments encouraging contactless and mobile transactions for more transparency and security. The Indian government’s adoption and promotion of their Unified Payments Interface also showed impressive results, as the National Payments Corporation of India reported a total of 12.7 billion transactions in June 2023, marking a 44% increase year on year. In addition, the rise of e-commerce and the increasing penetration of the internet and smartphone usage also played a crucial role in the widespread adoption of payment processing solutions. Moreover, governments are now mandating tighter rules and regulations to prevent online transaction fraud and money laundering, contributing to the rise in demand for reliable and efficient payment processing tools. Overall, those factors are contributing to the growing need for fast, secure, and reliable payment solutions is helping the payment processing solutions market grow rapidly.

The increasing emphasis on fraud prevention measures and security in payment processing solutions is crucial for encouraging consumers trust, protecting sensitive payment data, and reducing the financial risk of fraud. Implementing secure payment processing tools enables payment processors and merchants to create the necessary conditions for secure online transactions, which, in turn, allows consumers to have more confidence in digital payment systems. Payment data can be protected using encryptions, which serve the purpose of converting the payment information in transit into an unreadable format with the help of a code. In addition to that, two-factor authentication helps add an extra layer of security by requiring users to log in using a PIN sent to their mobile devices.

Payment Processing Solutions Market Dynamics

Drivers

- The growing need for fast and efficient payment systems is driving the adoption of real-time payment solutions. Initiatives like the Federal Reserve's FedNow are enhancing opportunities for both B2C and B2B transactions.

One of the important drivers for payment processing solutions is the demand for real-time payments. With more and more customers and businesses requiring the possibility to make instant transactions, there was no other way to develop a proficient payment processing system. For example, FedNow which was recently introduced by the Federal Reserve will allow the whole country to make real-time payments and send money at any time of the day. Moreover, by the end of 2025, the real-time payment market will grow by more than 30% annually.

In addition, according to the World Bank report, around 1.7 billion people remain unbanked highlighting the need for efficient, low-cost payment solutions that can cater to diverse demographics. Mobile wallets gained much popularity because they offer not only instant payments but also enhanced security. For example, Venmo which popular mobile payment service, has recently reported a flow of more than $1 trillion. The increased demand for real-time payments both improves the level of customer satisfaction and allows businesses to manage liquidity more efficiently. That is why this factor is one of the most important drivers in the field of payment processing solutions.

-

Banks are increasingly offering BaaS models that allow businesses to integrate payment services into their platforms via APIs. This approach streamlines payment processing and enhances customer experience, leading to greater adoption of these solutions.

-

Corporates are opting to manage their payment processes internally to enhance control and improve customer experience. This trend is fueling the growth of corporate treasury management systems, enabling companies to handle payments more efficiently.

Restraints:

-

The evolving regulatory landscape poses a significant challenge for payment processing solutions. Companies must continuously adapt to comply with new regulations, which can increase operational complexities and costs.

-

As payment solutions become more advanced, they also attract more sophisticated cyber threats. Companies face risks related to fraud and data breaches, which can undermine customer trust and lead to financial losses

Cybersecurity risks are a significant restraining factor in payment processing solutions. While the payment industry is rapidly developing due to state-of-the-art technologies, it has become targeted by cybercriminals. Attacks on payments can lead to various issues, including data breaches, identity theft, and payment fraud. Thus, a loss of consumer trust may occur, and the company’s reputational costs will have to be covered. The more transactions are processed, the more financial losses may happen due to fraud. Organizations need to implement costly cybersecurity measures to prevent data and payment handling from being compromised. Encryption, multi-factor authentication, and real-time fraud detection systems are commonly adopted. However, as technology and payment processing solutions advance their features to increase security, the costs and the complexity of these solutions increase as well. Most companies especially small businesses cannot afford to maintain the highest level of security, implying transaction payments at certain risks. Moreover, the lack of compliance may result in severe financial penalties.

Payment Processing Solutions Market Segmentation Analysis

By Payment Method

The credit card segment was established as the leading payment segment and held a 35% revenue share in 2023. This was facilitated by several factors, such as the wide availability of credit cards and the strong credit infrastructure of both developed and developing countries. For instance, in the United States, it was reported in 2023 that over 75% of adults have at least one credit card, highlighting the ubiquity of this payment method. It is still highly demanded because of the level of convenience, various bonuses, and money-back programs, which attract customers. Moreover, such methods of payment are provided with the highest level of security if compared to other payment types, including fraud protection. In addition, the credit card segment was supported by the government’s actions. For instance, the revised Payment Services Directive required financial organizations of the European Union to ensure that users of credit card fraud and illicit actions will comply with the appropriate level of protection. This allowed customers to have confidence in using credit cards for both online and in-store purchases. The latest data show that the level of penetration is still extremely high in Northern America and Europe, given credit card support, which implies that it is highly probable that this segment will be the leading one in the future years.

The E-wallet is expected to be the fastest-growing segment during the forecast period. The main drivers that explain this assumption are the growing customer demand for such digital wallets, which are convenient and fast and, therefore, ensure the safest transactions. According to recent data, the global e-wallet is expected to grow significantly, which presupposes the promotion of mobile technology, which also contributes to the strong adoption as the majority of people have smartphones. At the same time, both governments and financial institutions cater to greasing the trend toward cashless purchases, which implies the active usage of E-wallets in various industries, such as retail, travel, and hospitality.

By End-Use

The hospitality sector was the leading segment in the payment processing solutions market in 2023, capturing a substantial market share. According to the U.S. Bureau of Economic Analysis, the hospitality industry accounted for around 3.3% of the U.S. GDP in 2023, with a vast majority of the generated revenue through transactions going the digital way. The global tourism revival from the pandemic conditions, coupled with the implementation of sophisticated payment methods in the hospitality industry, has resulted in an increasing acceptance rate for the business. The sector, which is currently at the forefront in embracing digital and contactless payment methods, including at hotels, restaurants, and on travel, is demanding a rise in the number of payment processing solutions serving these firms. Information from the European Commission showed that more than 58% of payments processed in the hospitality sector in Europe were made digitally in 2023, spurred by the rising popularity of mobile wallets and restaurants’ need to provide efficient, quick, and safe payment means. The increase in the use of online booking platforms, mobile check-ins, and room payments has contributed to the growing demand for hospitality payment processing systems.

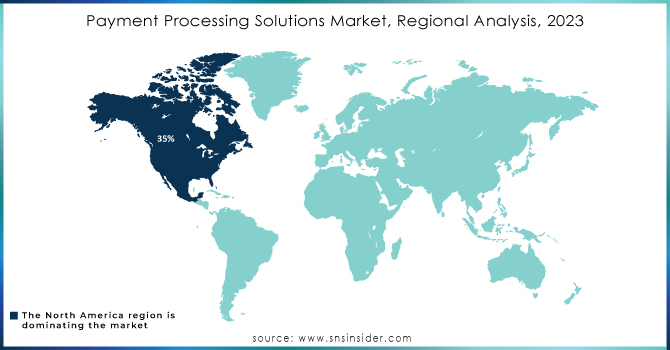

Regional Insights

The payment processing solutions market of 2023 was dominated by North America which held a market share of 35%. One of the reasons behind the dominance of the region is the high penetration of digital payment and the wide acceptance of credit as well as debit cards among the people. The governments in North America actively support digital payments and cashless transactions which contribute to the strong position of the region. It also hosts various payers in the payment processing business in general, such as PayPal, Stripe, and Square. These companies have been focused on innovation, introducing alternative technological solutions to meet the exact demands of the customers. In comparison with other regions, the digital infrastructure in North America is quite developed. North America's mature digital infrastructure and regulatory support, such as the Payment Card Industry Data Security Standard (PCI DSS), have also contributed to the region's stronghold on the market.

However, the Asia-Pacific region is projected to grow at the highest compound annual growth rate from 2024 to 2032. This is mainly due to the People’s Bank of China reported an increase of 24% in digital transactions. Alipay and WeChat pay similarly expanded, increasing customer traffic in the process. As such, it is evident that the high population density in the region and the relatively advanced mobile and communication technologies will ensure that the Asia-Pacific region remains a significant market for technological innovations in digital banking in the next several years. The rapid increase in online transactions in China and India. In 2023, the Reserve Bank of India reported a growth of 46% in traffic within the Indian digital payment market, which was thanks to the introduction of UPI by the Indian government and the Digital India program.

Do You Need any Customization Research on Payment Processing Solutions Market - Enquire Now

Key Players

Key Service Providers/Manufacturers

-

PayPal (PayPal Payments Standard, PayPal Here)

-

Square, Inc. (Square Point of Sale, Square Online)

-

Adyen (Adyen Payment Gateway, Adyen Terminal)

-

Stripe (Stripe Payments, Stripe Atlas)

-

Authorize.Net (AIM API, Accept.js)

-

Worldpay (Worldpay Gateway, Worldpay eCommerce)

-

FIS (Worldpay Gateway, FIS Payments)

-

Ingenico (Ingenico Connect, Ingenico Move/5000)

-

PayU (PayU Payment Gateway, PayU Wallet)

-

Alipay (Alipay Wallet, Alipay QR Code Payment)

Key Users of Payment Processing Services/Products

-

Amazon

-

Walmart

-

Airbnb

-

Uber

-

Expedia

-

Netflix

-

Starbucks

-

eBay

-

Target

-

Booking.com

Recent News and Developments

-

In August 2023 -The U.S. Treasury Department and the Federal Reserve rolled out the Real-Time Payments network. This system significantly accelerated the time of payment processing all over the country. Furthermore, it provides a way to settle transactions between financial institutions in real life. This can help digital payment to various businesses, such as in the domain of e-commerce or retail, to work more efficiently.

-

In June 2023 – Stripe announced a collaboration with the Google workspace. This feature allows businesses to automate bookings through Google Calendar. In addition, companies can also make customers pay for booking and scheduling their appointments of various services all on Google Calendar at once.

-

In May 2023 – ACI Worldwide reached a partnership with Red Hat OpenShift. This new advancement allows financial institutions as well as other companies and payment providers to access and utilize ACI’s solution to working on Red Hat OpenShift.

-

In April 2023, PayPal Holdings, Inc. introduced new features to its payment solution for small businesses, offering customers multiple payment options, including PayPal, PayPal Pay Later, and Venmo.

| Report Attributes | Details |

| Market Size in 2024 | USD 52.1 billion |

| Market Size by 2032 | USD 139.7 billion |

| CAGR |

CAGR of 11.6 % From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payment Method (Credit Card, Debit Card, eWallet, Automatic Cleaning House (ACH), Other Payment Methods) • By Vertical (BFSI, Government and Utilities, Telecom, Healthcare, Real Estate, Retail, Media and Entertainment, Travel and Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

PayPal, Square, Inc., Adyen, Stripe, Authorize.Net, Worldpay, FIS, Ingenico, PayU, Alipay |

| Key Drivers | •The growing need for fast and efficient payment systems is driving the adoption of real-time payment solutions. Initiatives like the Federal Reserve's FedNow are enhancing opportunities for both B2C and B2B transactions •Banks are increasingly offering BaaS models that allow businesses to integrate payment services into their platforms via APIs. This approach streamlines payment processing and enhances customer experience, leading to greater adoption of these solutions. •Corporates are opting to manage their payment processes internally to enhance control and improve customer experience. This trend is fueling the growth of corporate treasury management systems, enabling companies to handle payments more efficiently |

| Market Restraints | •The evolving regulatory landscape poses a significant challenge for payment processing solutions. Companies must continuously adapt to comply with new regulations, which can increase operational complexities and costs •As payment solutions become more advanced, they also attract more sophisticated cyber threats. Companies face risks related to fraud and data breaches, which can undermine customer trust and lead to financial losses |