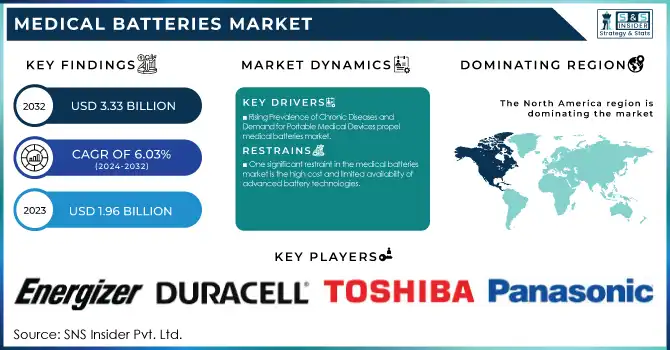

Medical Batteries Market Size & Overview:

The Medical Batteries Market was valued at USD 1.96 billion in 2023 and is expected to reach USD 3.33 billion by 2032, growing at a CAGR of 6.03% from 2024-2032.

Get More Information on Medical Batteries Market - Request Sample Report

The medical batteries market is witnessing considerable expansion, fueled by the increasing use of portable and implantable medical devices. Elements like the rising incidence of chronic illnesses, progress in medical device technology, and the escalating demand for remote patient monitoring solutions are driving the necessity for dependable and durable medical batteries. Batteries are vital for energizing numerous devices, including pacemakers, insulin pumps, hearing aids, and wearable health monitors, which are crucial in contemporary healthcare services.

The market is experiencing a transition towards advanced battery technologies such as lithium-ion and zinc-air because of their elevated energy density, extended lifecycle, and compact designs. These innovations meet the need for smaller, lighter batteries appropriate for wearable and implantable medical devices. For example, the recent launch of LG Chem's new line of rechargeable batteries for wearable medical devices in August 2024 highlights the emphasis on innovation in healthcare technology.

Regional dynamics are influencing the market as well, with Asia-Pacific becoming the quickest-growing area due to developing healthcare infrastructure and increased use of advanced medical devices in nations such as China, India, and Japan. Furthermore, the growing elderly population in North America and Europe has increased the need for implantable devices that rely on durable batteries.

Major companies are investing significantly in research and development to improve battery efficiency and sustainability. For instance, Panasonic's July 2024 announcement about high-capacity lithium-ion batteries for medical implants demonstrates the continuous focus on enhancing device longevity and functionality. Also, EnerSys' purchase of Bren-Tronics in May 2024 underscores strategic initiatives aimed at enhancing their footprint in vital medical and defense sectors.

These developments and the incorporation of intelligent battery management systems are anticipated to change the market, in line with the rising need for dependable and effective energy solutions in the medical industry.

Market Dynamics

Drivers

-

Rising Prevalence of Chronic Diseases and Demand for Portable Medical Devices propel medical batteries market

The global burden of chronic illness, including diabetes, cardiovascular disease, and respiratory disease, is rising, and contributing to the increased use of portable and implantable medical devices. Insulin pumps, pacemakers, defibrillators portable oxygen concentrators, and a broad range of devices with many of them relying on sophisticated advanced batteries to ensure seamless operation. Cardiovascular diseases are responsible for an estimated 17.9 million deaths each year according to the World Health Organization (WHO), thus requiring the implantation of battery-powered devices like pacemakers and cardiac monitors. Likewise, the most current International Diabetes Federation (IDF) estimates also indicate a substantial increment in diabetes cases, which is SPURRED to further demand for delivery of insulin systems with reliable battery technology. Lithium-ion batteries are among the most important medical batteries used for enabling the longevity and efficiency of said devices, allowing patients to effectively manage their conditions. The trend of delivering healthcare, particularly the implementation of wearable medical technologies that provide real-time health data, also affects the demand for reliable battery systems.

-

The medical batteries market is experiencing rapid growth due to technological advancements that enhance battery performance, reliability, and safety.

Battery technology developments keeping pace with improving features, quality, and safety of batteries further drive the medical batteries market. The introduction of high-energy-density lithium-ion batteries and bio-compatible materials has transformed the capabilities of implantable and wearable devices. One example is that in August 2024, LG Chem launched rechargeable batteries tailored for wearable medical devices, which shows the industry's focus on areas like this that require small, light, and durable energy storage. These developments respond to calls for sophisticated features including longer battery life, smaller size, and improved energy efficiency ideal for devices such as neurostimulators, hearing aids, and infusion pumps. Similarly, in July 2024, Panasonic launched high-capacity lithium-ion batteries designed for medical implants, illustrating a trend toward enhancing the performance and effectiveness of medical devices for the patient. This continued technological progress resolves concerns of battery shortens, while allowing the healthcare ecosystem to provide minimally invasive, highly accurate.

Restraint

-

One significant restraint in the medical batteries market is the high cost and limited availability of advanced battery technologies.

One of the major factors hampering the growth of the medical batteries market is the high cost and limited availability of advanced battery technologies. High-performance batteries with superior energy density, long lifecycle, and enhanced safety features are increasingly required in medical devices. However, research, manufacturing, and material costs are significant for third-generation battery development and production, especially with lithium-ion and solid-state batteries. As an example, bio-compatible materials, in conjunction with miniaturization technologies, increase the production cost, resulting in making these batteries less accessible to smaller healthcare providers or low-income regions. High demand and supply chain constraints of some critical raw materials, such as lithium and cobalt, make availability a challenge for manufacturers to provide a consistent supply of quality batteries. These reasons, combined, are slowing the adoption of advanced medical batteries around the world, predominantly in food economies due to the importance of cost in the healthcare purchasing decision-making process.

Segmentation Insights

By Type

Lithium-ion batteries dominated the market with around 45% of market share in 2023 because of their high energy density, longevity, and lightweight structure, which makes them perfect for advanced medical equipment such as implantable cardiac devices and portable diagnostic instruments, where reliability and long battery life are crucial. This segment is also witnessing the fastest expansion, fueled by continuous technological advancements and the rising need for compact, high-performance medical devices. With the rising importance of these batteries in contemporary medical technologies, the lithium-ion segment is expected to maintain robust growth.

Conversely, nickel-metal hydride (NiMH) batteries, alkaline batteries, and zinc-air batteries fulfill more niche functions within the market. NiMH batteries are frequently utilized in hearing aids and various smaller medical devices because of their ability to be recharged and their affordability. Alkaline batteries are primarily used in non-rechargeable medical equipment, while zinc-air batteries are mainly utilized in hearing aids, appreciated for their high energy density and extended shelf life.

By End User

In 2023, the hospital's segment dominated the market as a vast number of medical devices are used which are required to receive reliable power sources. Hospitals use a wide variety of equipment, from oxygen and life-support systems to diagnostic tools, that all rely on high-performance batteries for uninterrupted operation. Medical devices are used widely in hospitals, and most clinical applications require continuous power, confirming the dominance of this segment in the market.

The home healthcare settings segment is the fastest growing segment because of the rising trend of remote monitoring and management of chronic diseases. Also, the rise of portable medical devices as well as the increasing trend of home-based patient care are increasing the demand for batteries customized for home healthcare applications. Enhancements in battery technology are also driving growth as they make devices used at home more portable and energy-efficient. Ambulatory surgical centers and research institutes play a role as well, but their market impact pales in comparison to that of hospitals and home healthcare settings.

Need any customization research on Medical Batteries Market- Enquiry Now

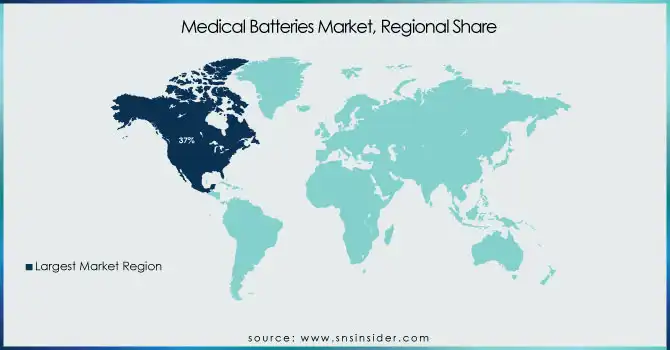

Regional Analysis

North America region dominated the market with around 37% of medical batteries market share, propelled by its well-established healthcare system, high need for new medical technologies, and large-scale investment in medical technology. The region's mature medical device industry depends on high-performance medical batteries for pacemakers and defibrillators, hearing aids, and other devices. Moreover, the increasing incidence of chronic diseases and the elderly population in the U.S. and Canada have fueled the demand for sustainable and high-performing battery solutions in medical devices. The U.S. is also at the forefront of research and development, exploring advances in batteries for next-generation medical devices. Similarly, it is additionally materialized by government dynamics, referring to regulatory frameworks (i.e. FDA approvals for new battery-powered medical devices), hence favoring market growth. North America dominates with a weighty presence of major vendors such as Johnson & Johnson, Medtronic, and Boston Scientific.

Asia-Pacific is anticipated to be the fastest-growing region with a CAGR of 7.69% of the medical batteries market due to rapid developments in healthcare infrastructure, rising healthcare expenditure, and increasing demand for medical devices. Countries like China, India, and Japan are pouring money into their healthcare systems to cope with the increasing burden of chronic disease along with an aging population. The growing adoption of portable health monitoring systems and portable medical devices in these regions is also fueling the demand for reliable medical batteries. In addition to this, the growing medical tourism industry in the Asia-Pacific region, particularly in nations such as India and Thailand, is generating high demand for cost-effective and rugged medical devices, subsequently bolstering battery adoption. Local manufacturers are also supporting the increasing shift in the region towards affordable healthcare solutions by focusing on cost-effective, durable, and compact battery solutions to meet the specific needs of emerging markets. Hence, Asia-Pacific has become a vital growth part of the medical batteries market.

Key Players:

Some of the major key players in the Medical Batteries Market

-

Panasonic Holdings Corporation (Lithium Batteries, Nickel-Metal Hydride Batteries)

-

Duracell Inc (Medical Alkaline Batteries, Medical Lithium Coin Cells)

-

Varta AG (Rechargeable Lithium Batteries, Zinc-Air Batteries)

-

Energizer Holdings, Inc. (Lithium Batteries, Zinc Carbon Batteries)

-

Saft Group S.A. (lithium-ion batteries, Lithium Sulfur Dioxide Batteries)

-

Murata Manufacturing Co., Ltd. (Rechargeable Lithium Batteries, Coin Cell Batteries)

-

Toshiba Corporation (Lithium-ion Batteries, Sodium-ion Batteries)

-

Maxell Holdings, Ltd. (Rechargeable Lithium Batteries, Silver Oxide Batteries)

-

BYD Company Ltd. (Lithium Iron Phosphate Batteries, Lithium Polymer Batteries)

-

A123 Systems, LLC (Lithium-ion Batteries, Lithium Iron Phosphate Batteries)

-

Samsung SDI Co., Ltd. (Rechargeable Lithium-ion Batteries, Lithium Polymer Batteries)

-

LG Chem Ltd. (Lithium-ion Batteries, NCM (Nickel Cobalt Manganese) Batteries)

-

Sanyo Electric Co., Ltd. (Lithium-ion Batteries, Nickel Metal Hydride Batteries)

-

Zhongtai Electric Co., Ltd. (Lithium-ion Batteries, Lead-Acid Batteries)

-

Eve Energy Co., Ltd. (Lithium Iron Phosphate Batteries, Lithium-ion Batteries)

-

Johnson Controls International plc (Lead Acid Batteries, Lithium-ion Batteries)

-

EnerSys (Lithium-ion Batteries, Lead-acid Batteries)

-

Aker Wade Power Technologies (Lithium-ion Batteries, Nickel-Cadmium Batteries)

-

PowerStream (Rechargeable Lithium Batteries, LiFePO4 Batteries)

-

EVE Energy Co., Ltd. (Lithium Ion Batteries, Rechargeable Li-ion Batteries)

Suppliers (These suppliers play an integral role in ensuring the production of high-performance, durable, and safe medical batteries.)

-

Asahi Kasei Corporation

-

3M Company

-

Sumitomo Chemical

-

Toray Industries, Inc.

-

Cabot Corporation

-

Umicore N.V.

-

DOW Inc.

-

Shenzhen Capchem Technology Co., Ltd.

-

Johnson Matthey

-

DSM Engineering Materials

Recent Developments

-

April 2024: Murata Manufacturing (Japan) announced the expansion of its silicon capacitor production capabilities with the establishment of a new 200-mm mass production line in Caen, France. This initiative aims to enhance the company’s manufacturing capacity and address growing global demand.

-

May 2024: EnerSys (U.S.) acquired Bren-Tronics, Inc., a prominent manufacturer of portable power solutions for military and defense applications. The acquisition is expected to bolster EnerSys' Specialty Aerospace & Defense segment, enhancing its presence in critical defense markets and driving growth in revenue and profitability through advanced lithium products.

-

July 2024: Panasonic introduced a new range of high-capacity lithium-ion batteries specifically designed for medical implants. These batteries aim to enhance device performance and longevity, addressing the growing demand for advanced power solutions in the medical sector.

-

August 2024: LG Chem launched a new series of rechargeable batteries developed for wearable medical devices. The initiative reflects the company’s focus on advancing healthcare technology and meeting the rising need for compact, high-energy-density batteries for personal health monitoring systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.96 Billion |

| Market Size by 2032 | US$ 3.33 Billion |

| CAGR | CAGR of 6.03 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

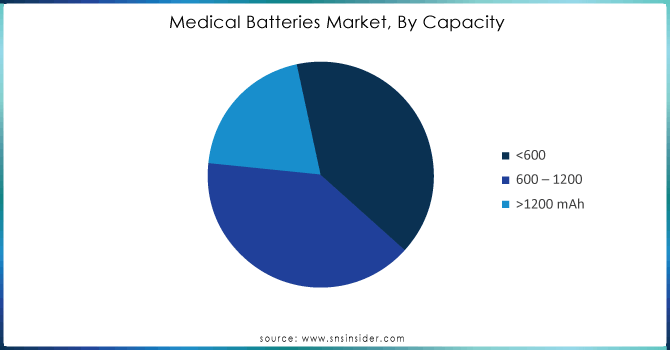

| Key Segments | • By Battery Type (Lithium Batteries, Alkaline, Zinc Air, Nickel) • By Lithium Battery Type (Li-Ion, Li Metal) • By Application (Implantable Devices Batteries, Non-Implantable Devices Batteries, Portable & Wearable Medical Devices) • By Capacity (<600 mAh, 600 – 1200 mAh, >1200 mAh) • By End User (Hospital, Clinic, Diagnostics Centers, Home Care Settings, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Panasonic Corporation, EaglePicher Technologies, LLC, EnerSys, Saft Groupe SA, Tadiran Batteries GmbH, Ultralife Corporation, Murata Manufacturing Co., Ltd., VARTA AG, Quallion LLC, Medtronic plc, Boston Scientific Corporation, GE Healthcare, Philips Healthcare, Abbott Laboratories, ZOLL Medical Corporation, Maxell, Ltd., EVE Energy Co., Ltd., Renata SA, Sony Corporation, LG Chem Ltd., and other players. |

| Key Drivers | •Rising Prevalence of Chronic Diseases and Demand for Portable Medical Devices propel medical batteries market •The medical batteries market is experiencing rapid growth due to technological advancements that enhance battery performance, reliability, and safety. |

| Restraints | •One significant restraint in the medical batteries market is the high cost and limited availability of advanced battery technologies. |