Insulin Pump Market Size & Analysis:

To Get More Information on Insulin Pump Market - Request Sample Report

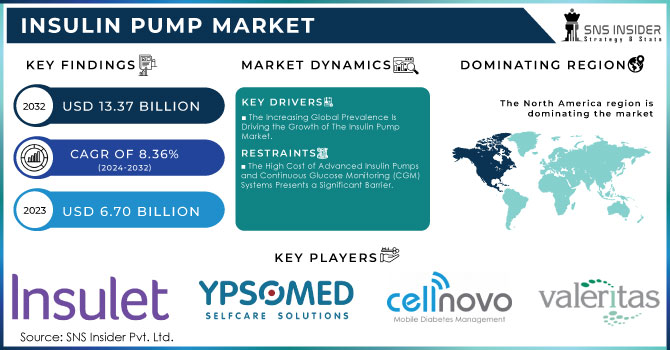

The Insulin Pump Market Size was valued at USD 6.70 Billion in 2023, and is expected to reach USD 13.37 Billion by 2032, and grow at a CAGR of 8.36%.

Insulin pumps play a critical role in diabetes management by delivering continuous subcutaneous insulin to patients, helping them maintain optimal blood glucose levels. The latest government data from the Centers for Disease Control and Prevention (CDC) indicates that over 37.3 million people in the U.S. have diabetes, with 1.9 million being Type 1 diabetic patients—those who are most likely to use insulin pumps. According to the National Institutes of Health (NIH), nearly 7 million people in the U.S. utilize insulin therapies, with insulin pump usage on the rise.

As of 2023, the global insulin pump market was valued at approximately USD 7 billion, driven by increasing diabetes prevalence, technological advancements, and government initiatives aimed at promoting better diabetic care. Additionally, policies aimed at improving reimbursement for insulin pump devices have bolstered their adoption, particularly in developed markets. Continuous innovation in smart, closed-loop systems also accelerates market expansion. The rising focus on patient-centric care and government backing for diabetes management programs is set to further increase insulin pump adoption in the coming years.

Insulin Pump Market Dynamics:

Key Drivers:

-

The Increasing Global Prevalence Is Driving the Growth of The Insulin Pump Market.

-

Technological Innovations in Insulin Delivery Devices, such as the Development of Automated Insulin Pumps and Smart Pen, are Driving Market Growth.

Restraints:

-

The High Cost of Advanced Insulin Pumps and Continuous Glucose Monitoring (CGM) Systems Presents a Significant Barrier.

-

Some Insulin Delivery Devices, Particularly Advanced Pumps, May Require Extensive Training and Technical Knowledge for Proper Operation Which May Hinder Market Entry.

Opportunity:

-

The Growing Healthcare Infrastructure and Increasing Awareness of Diabetes Management in Emerging Economies Offer Significant Market Opportunities.

-

The Rise in Demand for User-Friendly, Discreet Wearable Insulin Delivery Devices, Such as Patch Pumps and Smart Insulin Pens, Presents A Lucrative Opportunity for Manufacturers.

Insulin Pump Market Segmentation Overview:

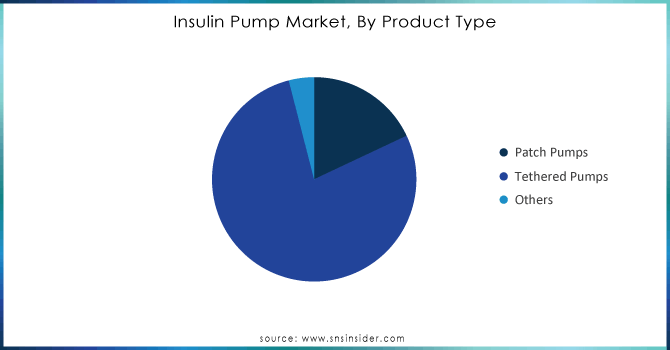

by Product Type

Among product types, tethered pumps accounted for the largest market share in 2023, holding nearly 60% of the total insulin pump market. Tethered pumps are favored because of their reliability and longer track record in the market. Their ability to deliver precise doses of insulin and the option to adjust basal rates according to patient needs has contributed significantly to their dominance. Government statistics show that as of 2023, over 500,000 people in the U.S. with Type 1 diabetes use tethered insulin pumps. Moreover, advances in device connectivity and remote monitoring technologies have made these pumps highly attractive to healthcare providers. Patch pumps, although growing in popularity due to their compact design and ease of use, remain a smaller segment, accounting for around 30% of the market in 2023. However, government-backed initiatives, especially in Europe, are driving further adoption of these newer and more discreet devices.

Do You Need any Customization Research on Insulin Pump Market - Enquire Now

by Disease Indication

In terms of disease indication, Type 1 diabetes represented the largest share of the insulin pump market in 2023, contributing over 65% of total sales. According to government data from the CDC and NIH, patients with Type 1 diabetes rely heavily on insulin pumps as they cannot produce insulin naturally. The CDC reports that Type 1 diabetes affects approximately 1.9 million people in the U.S., and a significant portion of these patients use insulin pumps to manage their condition. The high prevalence of Type 1 diabetes globally, coupled with increased awareness and access to advanced insulin delivery technologies, has driven the market's growth. Type 2 diabetes patients, though comprising a smaller proportion of pump users (around 35%), are increasingly turning to insulin pumps, especially as their conditions worsen, and traditional insulin therapies become less effective. Government healthcare initiatives to improve access to insulin therapies have played a vital role in expanding pump adoption among Type 2 diabetes patients as well.

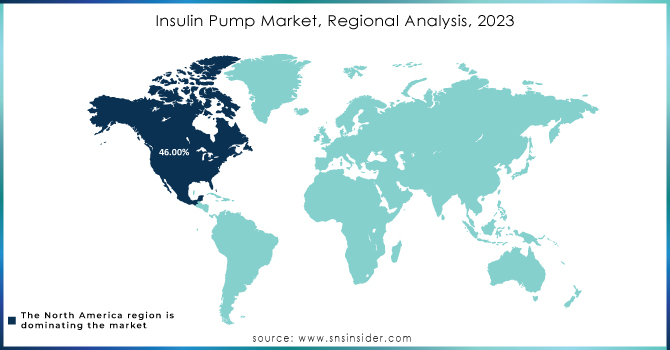

Insulin Pump Market Regional Analysis:

In 2023, North America dominated the insulin pump market, capturing nearly 45% of the total global market share. The U.S., driven by a high prevalence of diabetes and strong healthcare infrastructure, leads the regional market. Government statistics reveal that diabetes is the seventh leading cause of death in the U.S., and nearly 10% of the population is living with the disease. The CDC's 2023 report highlights that over 3 million Americans use insulin pump therapy, reflecting the region's advanced healthcare systems, higher disposable income, and the strong presence of key market players such as Medtronic and Insulet. In addition, favorable government policies and insurance reimbursements have supported the market's expansion. Canada has also witnessed growth in insulin pump adoption, backed by government-led healthcare initiatives aimed at reducing the financial burden on diabetic patients. While Europe and Asia-Pacific are growing markets, their adoption rates are slower due to less favorable reimbursement frameworks and varying levels of healthcare access.

Key Players:

The players operating in the Insulin Pump market are the following:

-

Medtronic: MiniMed series (e.g., 670G, 780G)

-

Insulet Corporation: Omnipod

-

Tandem Diabetes Care: t:slim X2

-

Ypsomed: MySugar

-

F. Hoffmann-La Roche Ltd: Accu-Chek Combo

-

Abbott Laboratories: Freestyle Libre 3 CGM system

-

Cellnovo: Cellnovo MiniMed

-

Animas Corporation: Vibe

-

Valeritas, Inc.: V-Go

-

Sooil Development Co., Ltd.: Durius

-

Modular Medical: Modular insulin pump system

-

AgVa Healthcare: AgVa insulin pump

-

Wuxi Apex Medical: Insulin pump

-

MySugr: Digital health platform with insulin pump integration

-

Dexcom: CGM system (can be integrated with insulin pumps)

Recent Developments

-

In February 2023, Roche Diabetes Care Inc. announced the 510(k) approval for premarketing of its Accu-Chek Solo micropump system with interoperable technology.

-

In March 2024, the Sequle Twist automated insulin delivery system received FDA Clearance. System features and benefits for people with type 1 diabetes. The twist system is the first to directly measure insulin delivered with each dose. This allows for more precise insulin control. The system also integrates with Tidepool Loop technology which uses CGM readings to adjust insulin delivery.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.70 Billion |

| Market Size by 2032 | US$ 13.37 Billion |

| CAGR | CAGR of 8.36 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Patch Pumps, Tethered Pumps, and Others) • By Disease Indication (Type1 Diabetes and Type 2 Diabetes) • By Distribution Channel (Hospital Pharmacy, Retail & Online Pharmacy) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Hoffmann-La Roche Ltd., Insulet Corporation, Ypsomed, Cellnovo, Sooil Development, Valeritas, Inc., JingasuDelfu Co., Ltd. Medtronic plc, andem Diabetic Care, Inc. Microport Scientific and others |

| Key Drivers | • The High Cost of Advanced Insulin Pumps and Continuous Glucose Monitoring (CGM) Systems Presents a Significant Barrier. • Technological Innovations in Insulin Delivery Devices, such as the Development of Automated Insulin Pumps and Smart Pen, are Driving Market Growth. |

| Market Restraints | • The High Cost of Advanced Insulin Pumps and Continuous Glucose Monitoring (CGM) Systems Presents a Significant Barrier. • Some Insulin Delivery Devices, Particularly Advanced Pumps, May Require Extensive Training and Technical Knowledge for Proper Operation Which May Hinder Market Entry. |