Medical Device Regulatory Affairs Market Size & Overview:

The Medical Device Regulatory Affairs Market was valued at USD 6.38 billion in 2023 and is expected to reach USD 12.69 billion by 2032, growing at a CAGR of 7.93% from 2024-2032.

To get more information on Medical Device Regulatory Affairs Market - Request Free Sample Report

The medical device regulatory affairs market is witnessing strong growth on account of significant advancements in technology and the evolving regulatory framework. As medical devices become increasingly complex driven particularly by the introduction of artificial intelligence and machine learning the need for comprehensive regulations governing the devices is likely to grow to ensure that they are safe and effective. This has led to a greater demand for regulatory affairs services navigating the complex approval processes across different regions.

Demand for specialized regulatory affairs teams has accelerated due to the push including those involving new regulatory frameworks such as the EU’s Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) for compliance. These frameworks are meant to protect patients while maintaining strict quality for devices available to the market.

Indian companies like Poly Medicure have done extremely well getting 510(k) for various infusion therapy products and are entering the U.S. market regarding this industrial growth. This would reflect the growing focus of medical device manufacturers towards globalization and compliance.

Many medical device companies focus on their core competencies and outsource noncore tasks to improve productivity and operational efficiency. Increasingly, these companies seek external support to comply with complex and time-consuming global regulations. Urgency to launch innovative devices within feasible timelines and budgets is likely to drive demand for CROs and regulatory service providers. Companies that have traditionally outsourced R&D and manufacturing functions to emerging markets in Asia Pacific and MEA are now also outsourcing regulatory affairs to reduce costs and focus on their primary operations.

Besides, small and medium-sized enterprises without dedicated in-house regulatory departments, especially new market entrants, have no other choice but to outsource regulatory affairs. For these companies, they usually employ regulatory consultants to help them through the international markets. Such practices are a major growth driver in the market during the forecast period.

With strict and changing global regulatory requirements, medical device companies are either establishing in-house regulatory departments or outsourcing their regulatory affairs functions. Offshore locations often are not practical for setting up in-house regulatory services. Thus, companies opt for outsourcing based on the size of the project and priorities, significantly contributing to the growth of the outsourcing segment in the regulatory affairs market.

Medical Device Regulatory Affairs Market Dynamics

Drivers

-

The increasing integration of advanced technologies like artificial intelligence (AI), machine learning (ML), and connected devices in the medical device market is a significant driver for regulatory affairs services.

These innovations enhance diagnostic and therapeutic capabilities but also introduce complexities in terms of regulatory compliance. Machine learning devices, for instance, in general, require data-driven algorithms that improve over time and can therefore create unique challenges to comply with rapidly evolving regulatory standards. It has also been made necessary by an increase in the adoption of frameworks like the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), thereby adding more complexity and thus the need to deal with such complexities through the regulatory process itself. In recent years, the process for securing regulatory approval for AI and software-based medical devices has largely been simplified through initiatives such as the FDA’s Digital Health Center of Excellence and the Software Precertification Pilot Program, and increased specialization is becoming a necessity.

-

The shift toward more stringent and standardized regulatory requirements worldwide has become a significant driver for the medical device regulatory affairs market.

The FDA and the European Medicines Agency (EMA) have introduced stringent protocols aimed at improving patient safety and product quality. Regulatory affairs specialists are now more in demand to address these growing needs. For instance, the EU's Medical Device Regulation (MDR), which replaced the Medical Device Directive (MDD), has increased the complexity of documentation, labeling requirements, and clinical evaluation processes, making it a more arduous compliance process for manufacturers. The Safer Technologies Program (STeP) of the FDA further allows medical devices with significant benefits for public health while preserving their stringent safety standards. In alignment with these shifting demands, firms like Poly Medicure have been keen on getting approval by high standards of regulations, for instance, to get a 510(k) status for better exposure and establishment across the global markets and indicate the necessity of being strictly compliant with regulatory issues within the firm.

Restraint

-

One of the key restraints in the medical device regulatory affairs market is the high cost and time-intensive nature of regulatory compliance.

Developing, testing, and gaining approval for medical devices involves substantial investments of money and considerable timelines. This can delay market entry, especially for smaller companies and startups.

Implementation of stringent frameworks such as the EU's Medical Device Regulation (MDR) has further escalated compliance costs through detailed documentation, clinical evaluations, and post-market surveillance. It has caused delays in product launches and resource allocation to regulatory affairs, thereby diverting attention from innovation and product development.

In addition, the complexity and diversity of regulatory environments between regions create additional financial and administrative burdens. For instance, devices entering both the EU and U.S. markets must meet different standards, requiring knowledge of multiple regulatory regimes. Such issues can hinder market expansion and deter smaller companies from investing in new medical device development.

Medical Device Regulatory Affairs Market Segment Analysis

By services

The regulatory writing and publishing segment dominated the market with the largest market share in 2023. The regulatory writing & publishing segment generated 35% of the market share. This is because the increasing demand for regulatory writing & publishing services can provide quality documentation throughout the product lifecycle, from early-stage development through premarket approval. In addition, these types of services play a very crucial role in making the product clear, concise, and accurate, which contributes a lot to the success of the product in the market. These aspects will contribute to the growth of the market.

The product registration and clinical trial application segment is also poised for the fastest growth during the forecast period, primarily due to stringent regulations, various legal and regulatory reforms, and a growing trend of FDA approvals in developing markets. In addition, these services assure regulatory agencies, medical professionals, and patients that the medical devices that will be used in health care are safe. Thus, this market segment is expected to present high growth prospects in the ensuing years.

By service provider

The service provider segment of the market is divided into outsourced and in-house categories. In 2023, the outsourcing segment dominated the market with a market share of 57%. This growth is driven by factors such as reduced costs, minimized staff training time, the offshoring of medical device manufacturing to emerging markets, evolving regulatory requirements, and increased collaborations between medical device companies and regulatory compliance providers for device approvals and product launches.

Additionally, many medical device companies outsource their R&D activities due to the availability of numerous service providers catering to businesses of all sizes. Outsourcing enables companies to save costs, reduce staff training requirements, improve efficiency, and achieve greater operational flexibility, enhancing overall effectiveness and boosting the segment's growth.

The in-house segment is projected to grow at the fastest CAGR during the forecast period. Growth in this segment is linked to the need for more funding and infrastructure among medical device companies to support in-house regulatory functions. In-house services are particularly effective for low-to-medium production levels, making them suitable for small and mid-sized companies. They offer advantages in product management, operational efficiency, and cost-effectiveness. Established medical device companies with extensive product portfolios and pipelines often possess highly skilled regulatory affairs teams, making in-house services a practical and viable option. These factors are expected to contribute to the steady growth of the in-house segment during the forecast period.

Regional Analysis

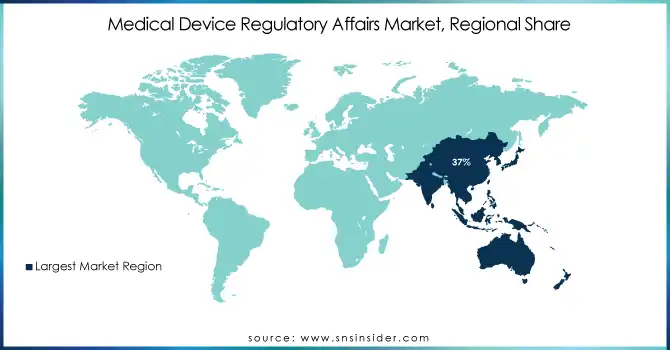

The Asia Pacific medical device regulatory affairs market had dominated the market with a market share of 37% in 2023. This leads to an increased regulatory framework, a significant number of medical device companies, and clinical trials in the region. It is also augmented by more R&D activities, a greater prevalence of chronic diseases, an aging population, and supportive government healthcare initiatives. Low-cost manufacturing capabilities of the region also attract medical device manufacturers. These factors are expected to attract more entrants into the market, thus driving regional market growth.

The North American medical device regulatory affairs market is expected to grow at the fastest CAGR of 10.23% during the forecast period. This growth is supported by the presence of numerous medical device companies outsourcing regulatory consulting and clinical trial applications to specialized service providers. This also owes to the high demand in the region for efficient healthcare services, and medical device manufacturing has been rapidly increasing to cater to such needs. These factors are collectively putting North America at the forefront of overall growth in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Emergo by UL (Regulatory Pathway Planning, Device Registration Services)

-

ICON plc (Clinical Trial Submissions, Regulatory Consulting)

-

Parexel International (Regulatory Submission Management, Global Compliance Support)

-

IQVIA (Regulatory Strategy Development, Post-Market Surveillance Support)

-

TÜV SÜD (CE Marking Assistance, Technical Documentation Review)

-

Intertek Group plc (Pre-Market Approval (PMA) Support, Quality Management System Audits)

-

NAMSA (Biocompatibility Testing Submissions, FDA 510(k) Filing Services)

Medistri SA (EU MDR Compliance Services, Product Testing and Validation) -

SGS SA (Notified Body Services, Risk Assessment Support)

-

Wuxi AppTec (Regulatory Submission Writing, Preclinical and Clinical Study Management)

-

Eurofins Scientific (Risk Analysis and Usability Testing, Product Registration Services)

-

Covance Inc. (Labcorp Drug Development) (Global Regulatory Consulting, Post-Approval Monitoring)

-

ProPharma Group (Regulatory Affairs Outsourcing, FDA Meeting Preparation)

-

NSF International (Gap Analysis for Regulatory Compliance, QMS Implementation Support)

-

MCRA (Medical Device Regulatory Advisors) (Pre-Submission Services, FDA Clearance Submissions)

-

Qserve Group (Clinical Evaluation Reports (CER), EU MDR Readiness Programs)

-

RQM+ (ISO 13485 Compliance Services, Regulatory Due Diligence)

-

Certara (Model-Based Regulatory Submissions, Health Authority Interaction Support)

-

Greenlight Guru (Quality Management Software for Compliance, Regulatory File Submission Tracking)

-

PharmaLex GmbH (Post-Market Compliance Services, Global Registration Dossier Preparation)

Key suppliers

These suppliers play a significant role in providing tools, technologies, and resources that support the regulatory compliance efforts of the companies.

-

Thermo Fisher Scientific Inc. Suppliers

-

Medidata Solutions (Dassault Systèmes) Suppliers

-

Oracle Health Sciences Suppliers

-

Veeva Systems Suppliers

-

Bio-Rad Laboratories Supplier

-

Agilent Technologies Suppliers

-

Waters Corporation Suppliers

-

PerkinElmer, Inc. Supplier

-

SAP SE Suppliers

-

IBM Watson Health Suppliers

Recent Developments

-

In June 2024, IMed Consultancy released a white paper evaluating the regulatory landscape for Artificial Intelligence (AI) and Machine Learning (ML)-driven medical devices across the U.S., UK, and EU.

-

In August 2023, Intertek’s medical division, IMNB UK Ltd, was granted the UK Approved Body Designation by the Medicines and Healthcare Products Regulatory Agency (MHRA), allowing them to perform UK Conformity Assessed (UKCA) marking and issue certificates for various medical devices in the UK post-Brexit, as a replacement for the CE marking.

-

In May 2023, Emergo partnered with the Shanghai Center for Medical Testing and Inspection (CMTC) to conduct ongoing usability testing for medical devices in China. This collaboration aimed to ensure compliance with the Human Factors Engineering (HFE) guidelines set by China’s National Medical Products Administration (NMPA).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.38 Billion |

| Market Size by 2032 | US$ 12.69 Billion |

| CAGR | CAGR of 7.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Regulatory Consulting, Legal Representation, Regulatory Writing & Publishing, Product Registration & Clinical Trial Applications, Other Services) • By Type (Diagnostic, Therapeutic) • By Service Provider (In-house, Outsource) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emergo by UL, ICON plc, Parexel International, IQVIA, TÜV SÜD, Intertek Group plc, NAMSA, Medistri SA, SGS SA, Wuxi AppTec, Eurofins Scientific, Covance Inc. (Labcorp Drug Development), ProPharma Group, NSF International, MCRA (Medical Device Regulatory Advisors), Qserve Group, RQM+, Certara, Greenlight Guru, PharmaLex GmbH, and other players. |

| Key Drivers | •The increasing integration of advanced technologies like artificial intelligence (AI), machine learning (ML), and connected devices in the medical device market is a significant driver for regulatory affairs services. •The shift toward more stringent and standardized regulatory requirements worldwide has become a significant driver for the medical device regulatory affairs market. |

| Restraints | •One of the key restraints in the medical device regulatory affairs market is the high cost and time-intensive nature of regulatory compliance. |