IVD Market Size Analysis:

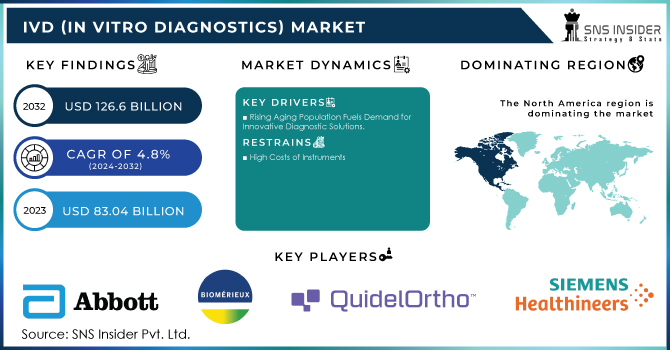

The IVD (In Vitro Diagnostics) Market size was valued at USD 83.04 billion in 2023 and is expected to reach USD 126.6 billion by 2032, with a growing CAGR of 4.8% over the forecast period 2024-2032.

Get more information on IVD (In Vitro Diagnostics) Market - Request Free Sample Report

The IVD (In Vitro Diagnostics) market is growing rapidly, mainly driven by the increasing prevalence of infectious and chronic conditions, noncommunicable diseases (NCDs) in particular. NCDs cause 41 million deaths annually, accounting for 74% of the total deaths globally; 17 million occur at less than 70 years of age. Of these early deaths, an alarming number occurs in low- and middle-income countries, suggesting that there is an immediate necessity to develop the right diagnostics that would allow detection in its early stage. With the ever-growing burden, there is a significant increase in the demand for sophisticated IVD technologies.

In response to the growing demand for more accurate and faster diagnoses, there has been some emerging development in automated IVD systems that are designed for use in laboratory or hospital settings. These innovations should raise diagnostics from earlier benchmarks for improved patient benefits. For instance, the AAV5 DetectCDx developed by ARUP Laboratories is a companion diagnostic to determine the eligibility of patients with severe hemophilia A for gene therapy, Roctavian from BioMarin received CE marking in November 2023. In this regard, Toray Industries, Inc. received approval for a pancreatic cancer diagnostic tool APOA2-iTQ in June 2023.

Technological advancements play a crucial role in propelling the IVD (in vitro diagnostics) market forward. Advances in accuracy, portability, and cost-effectiveness of diagnostic solutions increasingly tempt both healthcare providers and patients. The recent approval of life-threatening conditions IVD tests further opens new opportunities within the market. In October 2023, the World Health Organization published the Essential Diagnostics List and presented evidence-based recommendations to improve the availability of essential diagnostics to more underserved regions.

Growth in routine health checks is mainly driven by rising populations of geriatrics and an increased awareness of early testing. Alongside rising healthcare costs, especially in the UK, financial burdens in caring for elderly patients may also help boost positive trends for the IVD (in vitro diagnostics) market. The industry currently grows mid-rate but slows down due to decreased demand for COVID-19 testing; however, the industry remains vibrant and technologically driven. Mergers and acquisitions by key players are a reflection of competitive scenarios as they aggressively try to strengthen their presence, especially in emerging markets. Generally, IVD seems to be entering a period of substantial growth with growth in diseases, technological advancement, and favorable regulatory frameworks.

|

Region |

Regulatory Body |

Key Regulations |

|---|---|---|

|

North America |

FDA |

21 CFR Part 820, CLIA |

|

Europe |

European Medicines Agency |

IVDR (EU) 2017/746 |

|

Asia Pacific |

PMDA (Japan), TGA (Australia) |

Various national regulations |

|

Latin America |

ANVISA (Brazil) |

RDC 36/2015 |

|

Middle East & Africa |

Various national agencies |

Depends on the country; often follows WHO guidelines |

In Vitro Diagnostics Market Dynamics

Drivers

-

Rising Aging Population Fuels Demand for Innovative Diagnostic Solutions

A major driver of the IVD (in vitro diagnostics) market is the rapid growth of the aging population in the world and this continues to contribute to the higher prevalence of age-related chronic and infectious diseases. According to UN DESA, nearly 10% of the world's population will be aged 65 or older in 2022, and it is expected that this number will increase to nearly 12% by 2030 and to 16% by 2050. Statistics from the US almost 80% of the elderly population suffers from at least one chronic condition, according to the National Council on Aging: 94.9% of adults aged 60 and older have at least one health issue, and 78.7% have two or more. This demographic shift is poised to propel the demand for diagnostic testing, particularly heart disease diabetes, and other chronic conditions. The incidence of acute and chronic disorders is also an impetus for medical device innovation; point-of-care testing devices are currently being adopted. Point-of-care testing devices can provide rapid results on-site while ensuring clinical decision-making within the required timeframe. In short, it launched its Sonosite PX ultrasound system in India in January 2023 and a point-of-care testing device by Cipla Inc. to aid in enhanced diagnosis and treatment results.

Government and private funding for the development of IVDs is also encouraging. For example, the European Commission has spent roughly USD 203 million on the AGLYC Project with a blood-based biomarker being developed for early ischemia detection worldwide to fight the global burden caused by cardiovascular diseases. All these factors are together leading to solid growth in the IVD (in vitro diagnostics) market.

Restraints

-

High Costs of Instruments

-

Need for Skilled Professionals

IVD (In Vitro Diagnostics) Market Segmentation Analysis

By Product Type

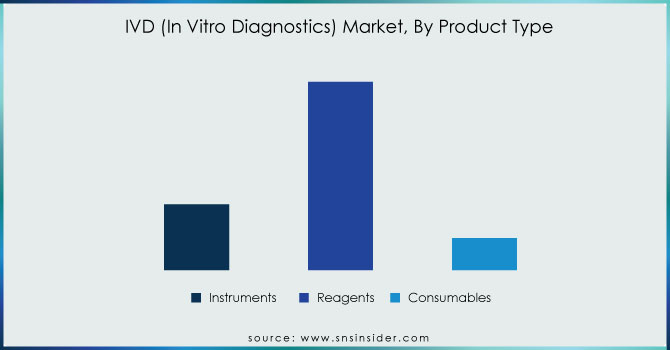

In 2023, the reagents segment remained at the top position with a market share of approximately 65.8%. The reagents segment is also expected to maintain its leadership position and post the highest CAGR during the period 2024-2030, the primary cause for this being continuous research and development initiated by the major companies for new reagents as well as test kits. For example, BD won market approval in February 2023 for the BD Onclarity HPV Assay, which is intended to be used with the ThinPrep Pap Test in the United States. Growing R&D work focused on the facilitation of faster diagnosis and acceleration of precision medicine is supporting companies in focusing on niches and profitable positions within the IVD space. An important collaboration was noted when in March 2023, QIAGEN teamed up with Servier to co-develop a companion diagnostic test for TIBSOVO, indicated for the treatment of acute myeloid leukemia.

The growing demand for precision medicine is likely to increase the demand for such novel reagents and consumables further. The instruments segment accounted for the second-largest share in 2023 and is expected to be driven further by the rising approvals for new IVD instruments. For instance, in April 2023, bioMérieux SA submitted a 510(k) application to the U.S. FDA for the VITEK REVEAL rapid antimicrobial susceptibility testing system. In addition, companies are always aligned with new launches of their instruments concerning the increased current international demand for genetic testing. For instance, Thermo Fisher Scientific launched the Ion Torrent Genexus Dx Integrated Sequencer in March 2022, specifically for both research and diagnostic applications.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Technology

In 2023, the immunoassay segment emerged as the largest revenue contributor in the market. The rising incidence of chronic and communicable diseases, coupled with the growing need for early diagnosis, has significantly increased the demand for immunological methods, particularly various types of Enzyme-Linked Immunosorbent Assays (ELISAs). Additionally, major players in the industry are directing their research and development (R&D) efforts toward creating innovative immunological diagnostic instruments and tests for IVD applications. For example, in October 2023, Sysmex Corporation partnered with Fujirebio Holdings, Inc. to enhance their R&D, production, clinical development, and marketing initiatives in the immunoassay field.

The coagulation segment is projected to experience the fastest compound annual growth rate (CAGR) from 2024 to 2032. This growth can be attributed to the increasing prevalence of cardiovascular diseases, blood disorders, and autoimmune conditions. Furthermore, advancements in instruments, including handheld coagulation analyzers like the Xprecia Stride Coagulation Analyzer, are expected to improve the overall workflow for detection. Key players providing instruments and coagulation tests include Abbott, Siemens Healthcare GmbH, and Beckman Coulter, Inc.

Regional Insights

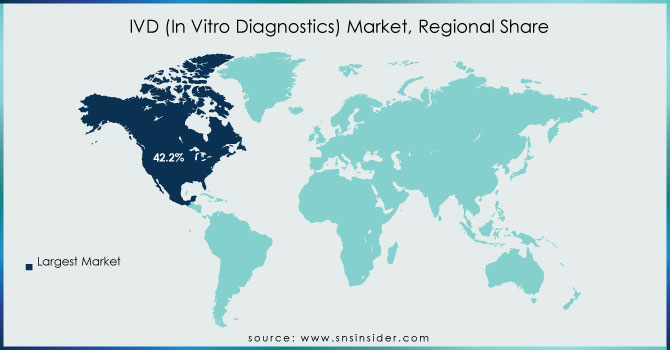

In 2023, North America dominated with a significant 42.2% of the total market share. This region is anticipated to continue holding a significant position in the market in the forecast period. Major factors propelling the region include the surge of increasing chronic diseases, major players dominating the region, the launch of new tests, and robust government support for healthcare programs in the region. For example, in January 2023, BD and CerTest Biotec received EUA from the U.S. FDA for a PCR-based test to detect the Mpox virus. The growing need for genetic testing in support of personalized healthcare, particularly in diabetes and cancer cases, is expected to drive market growth in North America over the forecast period.

On the other hand, the Asia Pacific region is expected to witness high growth over 2024-2032. Factors that are likely to spur the regional market include improved economies, a rapidly growing middle-class population, supportive government policies, and rapid urbanization. For instance, in October 2023, Fapon and Halodoc recently collaborated to strengthen sales and services of in vitro diagnostic products in Indonesia. Also, leaders in the Asia Pacific are now more interested in engaging with local players in developing countries to expand their market shares across the region.

Key Players in the In Vitro Diagnostics Market Based on Product Offerings

-

-

Point-of-care testing devices

-

Molecular diagnostics

-

Immunoassays

-

-

bioMérieux SA

-

Microbiology diagnostics

-

Infectious disease testing

-

Immunoassays

-

-

QuidelOrtho Corporation

-

Rapid diagnostic tests

-

Molecular diagnostics

-

Point-of-care testing

-

-

Siemens Healthineers AG

-

Laboratory diagnostics

-

Imaging systems

-

Point-of-care testing

-

-

-

Clinical diagnostics

-

Immunoassays

-

Quality control products

-

-

Qiagen

-

Molecular diagnostics

-

Sample preparation products

-

PCR testing solutions

-

-

Sysmex Corporation

-

Hematology analyzers

-

Urinalysis systems

-

Immunochemistry products

-

-

Charles River Laboratories

-

Preclinical and clinical laboratory services

-

Biopharmaceutical testing

-

-

Quest Diagnostics Incorporated

-

Clinical laboratory testing

-

Diagnostic services

-

Molecular diagnostics

-

-

Agilent Technologies, Inc.

-

Genomics and molecular diagnostics

-

Mass spectrometry

-

Microarray technologies

-

-

Danaher Corporation

-

Diagnostic instruments and reagents

-

Molecular diagnostics

-

Point-of-care testing systems

-

-

BD

-

Diagnostics solutions for infectious diseases

-

Blood culture systems

-

Molecular diagnostics

-

-

F. Hoffmann-La Roche Ltd.

-

Molecular diagnostics

-

Tissue diagnostics

-

Point-of-care testing

-

-

Seegene Inc.

-

Molecular diagnostics

-

Multiplex PCR tests

-

-

DiaSorin S.p.A.

-

Immunodiagnostic assays

-

Molecular diagnostics

-

Recent Developments in the IVD Market

-

In January 2024, F. Hoffmann-La Roche Ltd. acquired LumiraDx's point-of-care diagnostics platform for USD 295 million. This acquisition will enable Roche to leverage LumiraDx’s innovative technology, enhancing the market presence of point-of-care diagnostic products.

-

In December 2023, ARUP Laboratories partnered with Medicover to enhance diagnostic and healthcare services across Europe. As part of this collaboration, ARUP Laboratories has created the AAV5 DetectCDx in partnership with BioMarin Pharmaceutical Inc. to identify suitable therapies for patients with severe hemophilia A.

-

In November 2023, Veracyte teamed up with Illumina to develop molecular tests aimed at decentralized in vitro diagnostic (IVD) applications. The collaboration focuses on advancing Veracyte's Prosigna breast cancer and Percepta nasal swab tests.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 83.04 billion |

| Market Size by 2032 | US$ 126.6 billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Instruments, Reagents, Consumables) • By Technology (Immunoassay, Hematology, Clinical Chemistry, Molecular Diagnostics, Coagulation, Microbiology, Others) • By Test Location (Point of Care, Home-care, Others) • By Application (Infectious Diseases, Diabetes, Oncology, Cardiology, Nephrology, Autoimmune Diseases, Drug Testing, Other applications) • By End-user (Hospitals, Laboratory, Home Care) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Qiagen, Sysmex Corporation, Charles River Laboratories, Quest Diagnostics Incorporated, Agilent Technologies, Inc., Danaher Corporation, BD, F. Hoffmann-La Roche Ltd., Seegene Inc., DiaSorin S.p.A. |

| Key Drivers | • Rising Aging Population Fuels Demand for Innovative Diagnostic Solutions |

| Restraints | •High Costs and Accessibility Issues • Data Privacy and Ethical Concerns |