Virtual Clinical Trials Market Size Analysis

Get more information on Virtual Clinical Trials Market - Request Sample Report

The Virtual Clinical Trials Market was valued at USD 8.78 billion in 2023 and is expected to reach USD 14.89 billion by 2032, growing at a CAGR of 6.07% over the forecast period 2024-2032.

The increasing deployment of digital health technologies, rising R&D activities, and integration of telehealth into healthcare services are fueling the rapid expansion of the virtual clinical trials market. The evolution of mobile and wearables, AI, cloud computing, and data platforms is changing clinical trials by making data collection more accurate, frequent, and multi-dimensional. This change has been ensuring the development of new, innovative trial designs. Patient recruitment and retention along with experience are made better through virtual trials. Virtual clinical studies also ensure the establishment of novel endpoints in clinical studies. Virtual trials allow the participant to participate remotely because they allow greater inclusivity. They reduce site visits hence improving patients' recruitment and retention rates. The use of wearables directly connected to the smartphone of the patient enhances the real-time collection of data and makes direct communication possible, thereby enhancing the engagement of patients and reducing the burdens on the participants and CRCs.

The COVID-19 pandemic expedited the shift toward virtual clinical trials because of the constraints in the traditional system of conducting trials. Changes in the digital health world, which are constantly going on not only improve the delivery model but also connect virtual connectivity, remote monitoring, and management for both participants and investigators, which reduces the time commitment and is expected to move the market forward. Further fueling the market is the new patient-centric approach of clinical trials where sponsors realign their strategies in consonance with the needs of patients. Another critical focus here is on patient safety, informed consent, and regulatory compliance, still a giant concern in these remote settings. In this case, the market is observed to remain in the mid-growth stage, with acceleration gradually increasing due to innovations in telemedicine, remote monitoring, and electronic data capture. Beyond that, key mergers and acquisitions among some major players are enabling companies to expand their portfolio of services and increasingly solidify their places in the developing virtual clinical trial environment.

The regulatory hurdles are still shaping the market, and it is clear that agencies pay more attention to participant safety and data integrity in virtual trials because they have to be stronger and hence, aligned more strictly with the strict guidelines. Even though the industry is growing at an average level for the expansion of services, it is diligently working toward the standardization of technologies and tools to ensure they are fully integrated, which will further strengthen the market growth trajectory.

Market Dynamics

Drivers

-

Growing Disease Burden and Technological Advancements Drive Surge in Virtual Clinical Trials Market

The virtual clinical trials market has significant growth prospects, driven by the growing global burden of diseases. Increases in chronic, infectious, and life-threatening disease incidences create a huge demand for the adoption of innovative treatment options. For instance, the CDC estimates that on average, 6 in 10 persons in the U.S. manage a chronic illness, and 4 in 10 manage two or more chronic conditions that make such diseases the leading cause of death in the country. This health burden fuels the need for easy, safe, and effective virtual solutions for clinical trials to enable rapid advancement in the development of treatments.

Additionally, the surge in virtual and decentralized clinical trials is further propelling market growth. In recent years, the number of these trials has more than doubled globally, as clinical research organizations (CROs) and eClinical software providers have expanded their virtual capabilities to meet escalating demand. Virtual trials enhance patient experiences by leveraging digital technologies and remote services, thereby attracting substantial industry interest.

Furthermore, the COVID-19 pandemic has highlighted the advantages of decentralized clinical trials, accelerating their adoption, and creating new opportunities for participants in the market. The pandemic accelerated numerous biotech and pharmaceutical companies to concentrate their efforts on the development of vaccines and treatments through decentralized trials as a model of interaction between patients and physicians saving time. Additional capabilities related to the adoption of wearable devices and mobile technologies will further boost the market's potential. Some of the examples include clinical trials or virtual studies like those performed by Johnson & Johnson and Apple, in which a study called the Heartline Study is being conducted on an Apple Watch. All of these technologies enhance patient monitoring and participation in clinical research.

Restraints

-

Stringent Regulatory Compliance that is strict regulations by the FDA and EMA challenge virtual clinical trial growth.

-

Complexity of Virtual Trials means data privacy, regulatory hurdles, and non-controlled environments complicate virtual trials.

Key Market Segments

By Study Design

The interventional design segment was a dominant revenue share in the virtual clinical trials market in 2023, and this is expected to continue through the forecast period. This has been due to the increasing number of experiments related to new drugs for various diseases alongside the trend for the digitalization of laboratories. With COVID-19, a surge was witnessed in the demand for testing drugs and vaccines since the methods of traditional clinical trials posed a greater risk of infection. Hence, requirements for interventional study designs have surged. Virtual trials are specifically well-suited for chronic diseases and less interventional observational studies, such as in cardiovascular diseases, immunology, gastrointestinal, dermatology, respiratory, and endocrinology. The company that invented this method performed the first fully virtual interventional Phase 2b "site-less" clinical study with 372 patients across 10 states, through their proprietary mobile telemedicine-based platform, "NORA."

The expanded access segment is anticipated to grow rapidly at a 5.9% compound annual growth rate during the forecast period. Expanded access provides a future route for patients wherein the potential benefits outweigh the risks, and the continued development of new COVID-19 strains is expected to drive up demand for accelerated access to new drugs in the short term.

By Indication

In 2023, the oncology segment dominated the virtual clinical trials market and accounted for more than 25.0% of the revenue share in the market. The segment is expected to retain the highest market share over the forecast period. This growth can be attributed to the increasing cancer burden worldwide and also the oncology clinical trials that are on the rise. During the COVID-19 pandemic, cancer patients, being highly vulnerable, prompted investigators and sponsors to rapidly adopt virtual and remote trial methods to ensure patient safety and keep trials progressing.

The cardiovascular segment is anticipated to be the fastest growing over the forecast period because of the incidence of cardiovascular diseases in multiple parts of the world. According to the World Health Organization (WHO), cardiovascular diseases are responsible for approximately 17.9 million deaths annually, making them the leading cause of death globally. In the United States, the Centers for Disease Control and Prevention (CDC) reported that one person dies every 36 seconds due to cardiovascular diseases, further highlighting the need for increased focus on this segment.

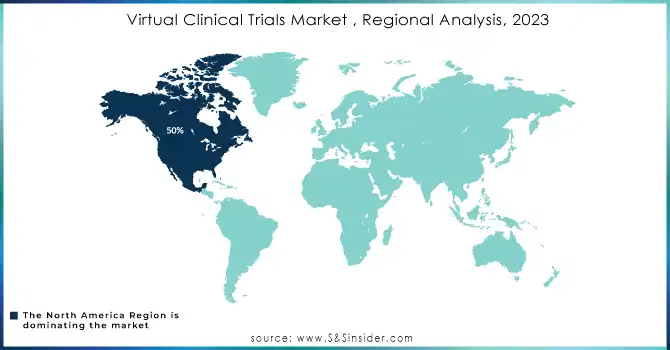

Regional Analysis

In 2023, North America accounted for the highest market share of 48.73% for virtual clinical trials and is expected to continue throughout the forecast period. This is driven due to critical research and development investments, general acceptance of innovative technologies into clinical research, as well as robust government support. More and more market players in the region embrace digital technologies to meet client demands. Company Parexel, for instance, conducts over 100 decentralized trials through the hybrid and virtual models, while Covance uses 1,900 LabCorp Patient Service Centers spread across the U.S. to take trials straight to patients. The U.S. alone accounts for more than 90% of the North American market in virtual clinical trials and is further being driven by major players such as ICON plc, IQVIA, Covance, PAREXEL, PRA Health Sciences, and Medable, Inc. Furthermore, the COVID-19 pandemic is expected to drastically increase interest in virtual trials; the number of studies will be implemented rapidly and possibly change the future of clinical research.

In the Asia Pacific region, the market is poised to be accelerating at a rate of 6.8% during the forecast period. The growing incidence of cardiovascular diseases, rising geriatric population, and augmented clinical trials of managing these conditions are all expected to drive the demand for virtual clinical trials. India is set to be the fastest-growing market in the region, while it is followed by China. Japan is the largest market in Asia Pacific in 2023 and also is seen retaining its leadership with high healthcare and R&D expenditure, coupled with strong demand for cost-effective and innovative clinical trials. Such tremendous growth is mainly supported by strong technology infrastructure in the country, several number of contract research organizations, and CROs engaged in offering virtual trial solutions.

Need any Customized Research on Virtual Clinical Trials Market - Enquiry Now

Key Players

-

ICON, plc – eClinical Solutions

-

Parexel International Corporation – Virtual Trial Solutions

-

IQVIA – Virtual Trial Solutions

-

Covance – Covance Decentralized Trial Solutions

-

PRA Health Sciences – PRA Virtual Trials

-

LEO Innovation Lab – Digital Trial Solutions

-

Medidata – Medidata Solutions for Decentralized Trials

-

Oracle – Oracle Clinical Trials

-

CRF Health – eSource Solutions

-

Clinical Ink – SureSource

-

Medable, Inc. – Medable Decentralized Clinical Trial Platform

-

Signant Health – Signant Health eClinical Solutions

-

Halo Health Systems – Halo Virtual Trial Solutions

-

Croprime – Virtual Trial Management Platform

-

Dassault Systèmes SE – BIOVIA Solutions for Virtual Trials

-

Medpace Holdings Inc. – Medpace Virtual Trial Services

-

Laboratory Corporation of America Holdings – LabCorp Virtual Trial Solutions

-

Wuxi AppTech – Wuxi Virtual Clinical Trial Solutions

Recent Developments

-

In Oct 2024, Dassault Systèmes announced the release of the world’s first guide for the medical device industry, detailing how virtual twins can be utilized to accelerate clinical trials. This guide was published after the successful completion of a five-year collaboration with the U.S. Food and Drug Administration (FDA).

-

In Sept 2024, PicnicHealth, a health tech company, introduced its new Virtual Site program, enabling researchers to conduct clinical trials entirely online. Part of the company's Clinical Services offering, Virtual Site allows in-house medical providers to schedule virtual visits, perform health assessments, order diagnostic tests, and report adverse events without the need for a physical location.

-

In July 2023, Signant Health completed its acquisition of DSG, strategically enhancing its eClinical solution suite for both traditional and decentralized clinical trials. By incorporating DSG's integrated platform, the acquisition enabled the creation of a comprehensive trial ecosystem with advanced software, analytics, and logistics solutions. This integration ensures smooth study execution and data collection across all trial modalities, moving closer to the goal of fully digitalizing clinical trials.

-

In June 2023, Medable Inc. introduced a comprehensive toolkit specifically designed for Institutional Review Boards (IRBs) and Ethics Committees (ECs) to standardize ethics review procedures for decentralized clinical trials (DCTs). The successful deployment of this toolkit streamlined and accelerated the IRB/EC process, significantly improving efficiency and fostering a more patient-centered approach to DCT execution.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.78 billion |

| Market Size by 2032 | US$ 14.89 billion |

| CAGR | CAGR of 6.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Study Design (Interventional, Observational, Expanded Access) • By Indication (CNS, Autoimmune/Inflammation, Cardiovascular Disease, Metabolic/Endocrinology, Infectious Disease, Oncology, Genitourinary, Ophthalmology, Others) • By Phase (Phase I, Phase II, Phase III, Phase IV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ICON, plc, Parexel International Corporation, IQVIA, Covance, PRA Health Sciences, LEO Innovation Lab, Medidata, Oracle, CRF Health, Clinical Ink, Medable, Inc., Signant Health, Halo Health Systems, Croprime, Dassault Systèmes SE, Medpace Holdings Inc., Laboratory Corporation of America Holdings, Wuxi AppTech |

| Key Drivers | • Growing Disease Burden and Technological Advancements Drive Surge in Virtual Clinical Trials Market |

| Restraints | • Stringent Regulatory Compliance that is strict regulations by the FDA and EMA challenge virtual clinical trial growth. • Complexity of Virtual Trials means data privacy, regulatory hurdles, and non-controlled environments complicate virtual trials. |