Filter Needles Market Size Analysis:

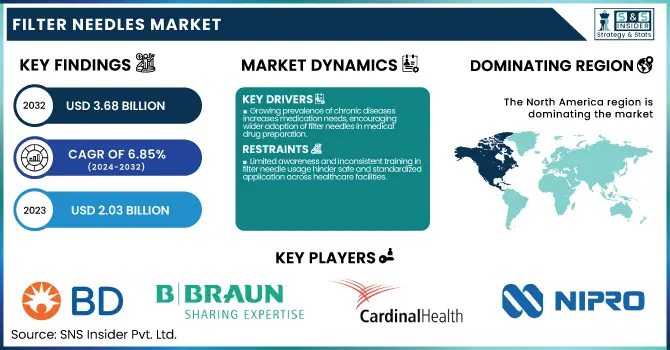

The Filter Needles Market Size was valued at USD 2.03 billion in 2023 and is expected to reach USD 3.68 billion by 2032, growing at a CAGR of 6.85% over the forecast period of 2024-2032.

To Get more information on Filter Needles Market - Request Free Sample Report

The report presents key statistical information and emerging trends in the Filter Needles Market, which highlight the increasing clinical requirement for sterile drug preparation and delivery. It highlights the incidence and prevalence of conditions for which injectable therapies are needed, and regional prescribing trends for parenteral drugs. It also includes analysis of filter needle utilization volumes by healthcare facility type and study of the pharmaceutical handling volumes associated with reconstitution. It also proffers a range of perspectives on the healthcare expenditure on drug preparation equipment and the regulatory compliance trends shaping adoption across regions. Key market drivers include growing demand for secure Injection and drug delivery systems in healthcare facilities, fueled by the rising prevalence of chronic diseases and stringent regulations on medication administration.

The U.S. filter needles market has shown a consistent upward trajectory, from USD 0.57 billion in 2023 to USD 1.02 billion by 2032. This reflects a compound annual growth rate (CAGR) of 6.64%, fuelled by the rising demand for aseptic drug preparation in hospitals and clinical settings. The increasing number of chronic diseases and injectable therapies drives the market growth in the region. More than 129 million Americans, or 63% of the adult population, have at least one chronic disease like diabetes or heart disease needing frequent injections, according to the Centers for Disease Control and Prevention (CDC). Furthermore, innovations in medical device technology have improved the safety of filter needles, which now play a crucial role in minimizing contamination risk when preparing drugs.

Filter Needles Market Dynamics

Drivers:

-

Growing prevalence of chronic diseases increases medication needs, encouraging wider adoption of filter needles in medical drug preparation.

The increasing number of chronic diseases, including diabetes, cancer, and cardiovascular diseases, is contributing to a significant increase in drug administration by injectable routes. This continuous trend of clinical management suggests the need of the safe and effective drug preparation tools. Filter needles are important devices which help in filtering out particulates, glass shards or rubber particles during vial access. As intravenous and intramuscular drug delivery become more common for chronic disorders, healthcare practitioners are enacting safety measures that require using filter needles whenever drugs are administered. Chronic disease burden due to aging populations worldwide also contributes towards an increase in demand for injectable medications. This guidance is driving the adoption of the use of filter needles in drug administration as standard safety practice in all areas of healthcare environment from hospital to homecare.

Restrain

-

Limited awareness and inconsistent training in filter needle usage hinder safe and standardized application across healthcare facilities.

Limited awareness among healthcare professionals regarding the importance and correct usage of filter needles continues to affect adoption rates in some regions. In many developing and under-resourced healthcare systems, staff are not consistently trained in the use of filter needles, leading to either improper application or complete avoidance. This results in unsafe drug administration practices and increases the risk of contamination or particulate transfer. Additionally, absence of uniform safety protocols and lack of policy enforcement concerning filtration practices contribute to inconsistent usage. When training programs do exist, they may not prioritize filter needle usage as a critical safety component, thus undermining its significance. This disconnect between product availability and proper clinical application remains a significant hurdle to the widespread adoption and benefits of filter needle technology in healthcare settings.

Opportunities

-

Expansion of healthcare infrastructure in emerging economies drives potential growth in filter needle adoption across new regions.

The emergence of new hospitals, clinics and diagnostics centers to accommodate the expansion of healthcare systems in emerging economies is facilitating new demand for safe medical equipment like filter needles. In countries in the Asia-Pacific region, Latin America and the Middle East, governments and private players are investing heavily in medical infrastructure, patient safety protocols, and the production of a potential vaccine. With the implementation of international healthcare standards in these regions, the demand for the administration of contamination-free injectable medications has increased. Almost all facilities rely on filter needles because they are vital for the safe preparation of drugs, and there are significant updates for those newly constructed. Furthermore, international NGOs, healthcare aid organizations working in such underserved areas are providing the necessary consumables for safety, as well, such as filter needles. This rapidly evolving medical environment therefore presents a huge opportunity for filter needle manufacturers to gain a deeper global presence.

Challenges

-

Risk of needle-stick injuries and disposal challenges continue to create safety concerns for healthcare staff and institutions.

Risk of needle-stick injuries during the use or disposal of filter needles remains a significant concern for healthcare workers and institutions. Although safety-engineered devices have come into use, occupational exposure continues due to improper handling, accidental recapping, and unsafe disposal practices. This not only endangers healthcare professionals but also results in additional safety protocol burdens for medical facilities. Furthermore, filter needles, being single-use products, contribute to increasing medical waste, complicating hospital waste management efforts. In regions without appropriate biohazard disposal facilities, used needles present a hazard of environmental and community contamination. These safety and environmental challenges require ongoing training, monitoring, and advancement of safe needle technologies; however, frameworks that address these concerns are not globally adopted and continue to be an ongoing challenge within healthcare ecosystems.

Filter Needles Market Segment Analysis

By Raw Material

In 2023, among the product type, the stainless-steel segment accounted for the largest revenue share of 43% in the global filter needles market. Stainless steel's widespread use stems from its durability, corrosion resistance, and biocompatibility qualities essential for medical applications. Stainless steel filter needles have enhanced strength and stability, allowing for more accurate drug delivery processes. As a result, the material is much preferred for use in hospitals and pharmaceutical applications, where the sterilization cycles can be quite intense without damaging the material. Such the segment is also supported by various government initiatives. Government initiatives further bolster this segment's growth. For example, regulatory agencies like the FDA emphasize stringent standards for medical devices to ensure patient safety, indirectly driving demand for high-quality materials like stainless steel. Additionally, technological advancements have led to innovations such as smart filter needles with integrated sensors that enhance safety and reduce errors during drug preparation.

Historically, stainless steel has been preferred due to its cost-effectiveness compared to alternatives like glass. While glass is used in specialized applications requiring chemical inertness or transparency, stainless steel remains dominant because of its versatility across various healthcare settings. For instance, hospitals frequently use stainless steel filter needles in oncology and critical care procedures where contamination risks must be minimized.

By End Use

In 2023, hospitals emerged as the leading end-user segment in the filter needles market, holding a revenue share of 44%. This dominance is due to the high procedural volumes seen by hospitals that require sterile medication administration, as well as strong adherence to strict safety protocols. These filter needles are extensively used across intensive care units and oncology wards to avoid contamination while preparing these drugs. Ministerial statistics underscore the importance of hospitals as big buyers of sophisticated medical devices. For example, CDC data show that U.S. hospitals perform millions of surgical procedures every year, among many other reasons that sterile equipment such as filter needles are required. Some market-leading hospitals have embraced the latest technologies, including smart filter needles with safety technologies.

Hospitals also benefit from favourable reimbursement policies that encourage investment in high-quality medical devices. These policies provide optimal patient outcomes and limit the risk of infections during injectable procedures. Also, hospitals are early adapters of innovations like ergonomic designs and needlestick prevention mechanisms that are embedded in filter needle systems. This need has been exacerbated by the increasing incidence of chronic conditions in hospital environments. Chronic conditions such as diabetes need a high volume of injections which are performed under strict safety protocols that cancer hospitals can deal with only through procurement, thus making them an important stakeholder in this segment of the market, according to data from the Centers for Disease Control. Overall, hospitals' emphasis on patient safety and their capacity to handle large-scale procedures solidify their leading position among end-users.

Filter Needles Market Regional Insights

North America held the largest revenue share 35% of the global filter needle market in 2023. This dominance is due to the region's well-equipped healthcare facilities, extensive adoption of advanced medical devices, and presence of key industry players like Becton Dickinson and Cardinal Health. Injectable drugs and medical devices are subject to stringent safety regulations imposed by the U.S. government, coupled with a rising demand for high-quality filter needles. Healthcare applications have driven implementation of advanced filtration technologies due to strict compliance requirements such as The Food and Drug administration (FDA) sterilization and prevention of contamination standards. Furthermore, the growing clinical burden of chronic diseases in North America (diabetes, cancer, etc.) has resulted in a greater number of injectable therapies being offered, propelling market growth.

On the other side, the Asia-Pacific (APAC) region is estimated to achieve the fastest compound annual growth rate (CAGR) throughout the predicted phase. The likes of China and India are currently experiencing fast economic growth and huge spending on healthcare infrastructure. For example, government projects such as India’s Ayushman Bharat scheme are seeking to make affordable healthcare services more readily available, including by upgrading hospitals, modernizing equipment, and adding a wider range of medical devices such as filter needles. Likewise, China’s National Health Commission has placed greater emphasis on hospital infection control, creating demand for sterile medical equipment. The APAC region’s growth is further fueled by increasing awareness of patient safety and infection prevention protocols. Improving surgical capacity in these nations, combined with the increasing geriatric population requiring regular medical interferences, are driving the demand for filter needles. In 2023, APAC's market share steadily increased as healthcare providers adopted Western-style safety standards and regulations. In 2023, APAC's market share steadily increased as healthcare providers adopted Western-style safety standards and regulations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Filter Needles Market Key Players

-

Becton, Dickinson and Company (BD) – (BD Blunt Filter Needle, BD Eclipse Filter Needle)

-

Braun Melsungen AG – (Sterican Filter Needle, B. Braun Medical Filter Needle)

-

Cardinal Health, Inc. – (Monoject Blunt Fill Needle with Filter, Monoject 5 Micron Filter Needle)

-

Nipro Corporation – (Nipro Blunt Fill Needle with Filter, Nipro Hypodermic Filter Needle)

-

Terumo Corporation – (Terumo Blunt Fill Filter Needle, Terumo Hypodermic Filter Needle)

-

Smiths Medical (ICU Medical) – (Jelco Filter Needle, Blunt Fill Needle with 5 Micron Filter)

-

Thermo Fisher Scientific Inc. – (Nalgene Syringe Filter Needle, Thermo Scientific Sterile Filter Needle)

-

Medline Industries, LP – (Medline Blunt Fill Filter Needle, Medline 18G Filter Needle)

-

Retractable Technologies, Inc. – (VanishPoint Filter Needle, RTI Safety Filter Needle)

-

Hamilton Company – (Hamilton Microliter Filter Needle, Hamilton Gastight Syringe Needle with Filter)

-

Kawasumi Laboratories, Inc. – (Kawasumi Filter Needle 18G, KPack II Filter Needle)

-

EXELINT International Co. – (Exel Filter Needle 18G x 1.5", Exel Blunt Fill Filter Needle)

-

JCM MED – (JCM Blunt Fill Needle with Filter, JCM Safety Filter Needle)

-

SolMillennium Medical Group – (SOLCARE Blunt Fill Needle with Filter, SOLM Filter Needle)

-

HiTech Medical Products – (HiTech Blunt Fill Filter Needle, HiTech Safety Filter Needle)

-

Vita Needle Company – (Vita Blunt Tip Filter Needle, Vita Industrial Filter Needle)

-

Thomas Scientific – (Thomas Blunt Filter Needle, Thomas Scientific Filter Needle 18G)

-

CODAN Medizinische Geräte GmbH & Co KG – (CODAN Filter Needle 18G, CODAN Blunt Fill Filter Needle)

-

Bastos Viegas S.A. – (BV Filter Needle, BV Blunt Fill Needle with Filter)

-

Qosina Corp. – (Qosina Filter Needle 5 Micron, Qosina Blunt Fill Filter Needle)

Recent Developments in the Filter Needles Market

-

In March 2022, ICU Medical completed the acquisition of Smiths Medical, a move intended to enhance its offerings in infusion therapy and related products, including filter needles. This strategic acquisition is expected to bolster ICU Medical's competitiveness in the market.

-

in January 15, 2025, Terumo launched its Injection Filter Needle as the first product under its INFINO Development Program. This needle is designed for both hypodermic and intravitreal injections and features an integrated 5-micron polyamide mesh filter to prevent particulate contamination.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.03 Billion |

| Market Size by 2032 | USD 3.68 Billion |

| CAGR | CAGR of 6.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Stainless Steel, Glass, Others) • By End Use (Hospitals, Ambulatory Surgery Centers, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company (BD), Braun Melsungen AG, Cardinal Health, Inc., Nipro Corporation, Terumo Corporation, Smiths Medical (ICU Medical), Thermo Fisher Scientific Inc., Medline Industries, LP, Retractable Technologies, Inc., Hamilton Company, Kawasumi Laboratories, Inc., EXELINT International Co., JCM MED, Sol-Millennium Medical Group, Hi-Tech Medical Products, Vita Needle Company, Thomas Scientific, CODAN Medizinische Geräte GmbH & Co KG, Bastos Viegas S.A., Qosina Corp. |