Ion Chromatography Market Report Scope & Overview:

Get more information on Ion Chromatography Market - Request Sample Report

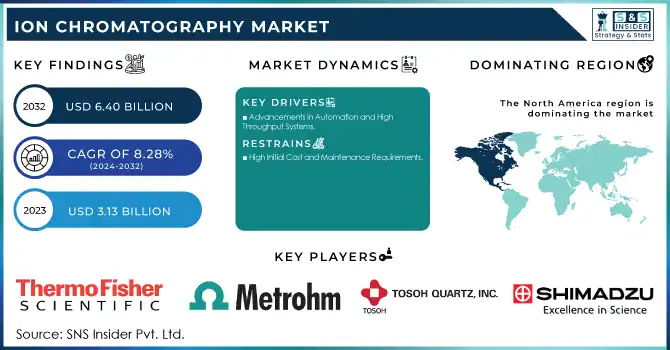

The Ion Chromatography Market Size was valued at USD 3.13 billion in 2023 and is expected to reach USD 6.40 billion by 2032 and grow at a CAGR of 8.28% over the forecast period 2024-2032.

The ion chromatography (IC) market is experiencing growth, driven by technological advancements and increasing demand across various sectors. A major factor contributing to the growth of the market is the growing need for efficient, high-precision analytical methods, especially in the face of stricter regulations in industries such as environmental monitoring, pharmaceuticals, and food safety.

Technological innovations, particularly the development of high-pressure ion chromatography (HPIC) systems, are central to the market’s expansion. HPIC systems enable faster sample analysis, higher resolution, and increased throughput. Systems like the Thermo Fisher Dionex ICS-5000+ Universal HPIC have proven essential in streamlining workflows, enabling laboratories to manage high sample volumes and achieve greater productivity. These advancements not only reduce operational costs but also enhance the ability to monitor multiple ions simultaneously, responding to the rising complexity of the samples being analyzed.

In the environmental sector, the demand for ion chromatography is increasing as regulatory bodies tighten standards on water quality testing and pollutant detection. IC is the preferred technology for monitoring trace-level contaminants such as nitrates, sulfates, and heavy metals in water and soil. With regulations becoming stricter in both developed and developing countries, governments, and industries are investing in more advanced ion chromatography systems to meet compliance. For instance, IC’s application in the detection of harmful substances like perchlorate and hexavalent chromium in water is becoming more crucial, spurring market growth.

In the food and beverage industry, ion chromatography is gaining significant traction due to rising consumer concerns over food safety and quality. IC systems are used to test for additives, preservatives, and contaminants in food products. As food manufacturers face increasing scrutiny over the safety and purity of their products, ion chromatography systems are integral to meeting regulatory standards and ensuring compliance with safety guidelines. The technology’s ability to analyze complex matrices like beverages and processed foods, where various ions are present, has expanded its role in ensuring product integrity.

Furthermore, the pharmaceutical industry is a significant growth driver for ion chromatography. As pharmaceutical companies focus on quality control, IC’s role in analyzing drug compositions, detecting impurities, and ensuring the purity of ingredients is indispensable. Recent innovations have improved the sensitivity of IC systems, enabling more precise analysis of complex biological samples and pharmaceutical formulations. This development is especially important as the pharmaceutical sector pushes forward with the production of biologics and personalized medicines, where high-quality analytical methods are paramount.

Overall, the market for ion chromatography is poised for significant expansion, driven by continued advancements in system capabilities, increased regulatory pressure, and the growing demand from high-precision industries like pharmaceuticals, environmental monitoring, and food safety. With the ongoing development of more efficient and automated systems, the ion chromatography market is expected to see continued growth over the next decade.

Market Dynamics

Drivers

-

Rising Demand for Water Quality Testing

A major driver of the ion chromatography (IC) market is the increased demand for effective water quality testing. As environmental pollution awareness rises and the need for strict water safety regulations grows, both industries and government agencies are increasingly relying on ion chromatography to detect trace contaminants, including heavy metals, nitrates, and pesticides, in water sources. This growing concern for ensuring safe drinking water and preventing environmental contamination is fueling the adoption of IC systems.

-

Pharmaceutical Industry’s Role in Market Growth

The pharmaceutical industry also plays a key role in driving the market. As drug development becomes more complex, especially with biologics and personalized medicine, the need for accurate and reliable analytical methods for drug formulation and impurity detection is pushing pharmaceutical companies to adopt ion chromatography. This technology offers the sensitivity required to meet the industry’s high standards for quality control.

-

Increasing Regulatory Pressures in Food and Beverage

In the food and beverage sector, market growth is driven by increasing regulatory pressures related to food safety and a rising consumer demand for cleaner, safer products. Ion chromatography serves as a vital tool for testing additives, preservatives, and contaminants, helping manufacturers comply with regulatory standards while meeting consumer expectations.

-

Advancements in Automation and High-Throughput Systems

The shift towards automation and high-throughput systems in laboratories is accelerating the adoption of ion chromatography. Recent innovations in IC systems that integrate automation and enhance sample throughput allow for faster, more efficient analyses, meeting the growing demands of industries that require high accuracy and manage large sample volumes. These advancements make ion chromatography an essential tool for industries needing high-efficiency applications.

Restraints

-

High Initial Cost and Maintenance Requirements

The high cost of ion chromatography equipment, along with ongoing maintenance and operational expenses, can be a significant barrier for smaller laboratories or organizations with limited budgets.

-

Complexity in Operation and Training

Ion chromatography systems require skilled operators and specialized training to ensure accurate results, which can limit their adoption in environments lacking sufficient technical expertise.

Key Segmentation

By Technique

In 2023, ion exchange chromatography (IEC) emerged as the dominant technique with a 43.0% share in the ion chromatography market. This technique has long been favored for its versatility and ability to effectively separate ionic species in complex mixtures. IEC is widely used across various industries, including environmental testing, pharmaceuticals, and chemicals, due to its high resolution and reliable results. In particular, its efficiency in separating ions in water and other liquids makes it a go-to solution for detecting trace contaminants such as nitrates, sulfates, and heavy metals in environmental samples. The dominance of IEC can also be attributed to its cost-effectiveness and adaptability to various sample types, which makes it an ideal choice for routine testing. In 2023, IEC held a significant portion of the market share, accounting for approximately 45.0% of the total ion chromatography market. This continued dominance reflects its established position as a standard technique across several key industries and its broad range of applications.

Ion-exclusion chromatography is the fastest-growing technique in the ion chromatography market, with significant advancements in recent years. Unlike other techniques, ion-exclusion chromatography is highly effective for separating neutral and charged species, making it especially useful in analyzing complex food and beverage samples. This technique is gaining traction in the food industry, where it is increasingly used to analyze sugars and organic acids.

By Application

The environmental testing application segment was the dominant segment of the ion chromatography market in 2023, largely due to the increasing global focus on environmental pollution and stringent regulatory standards. Ion chromatography is an essential tool for detecting trace contaminants such as heavy metals, nitrates, and pesticides in environmental samples like water, soil, and air. With growing concerns over water safety and air quality, both industrial players and governmental bodies are increasingly turning to ion chromatography for accurate and efficient environmental testing. In 2023, environmental testing accounted for 40.0% of the total ion chromatography market share. The rising demand for water quality testing and the need to comply with global environmental regulations are key factors contributing to this dominance.

The pharmaceutical industry is the fastest-growing application segment for ion chromatography, driven by the increasing complexity of drug development and the demand for high-precision analytical techniques. With the rise of biologics, personalized medicine, and more stringent regulatory frameworks, pharmaceutical companies are placing greater emphasis on drug quality and purity.

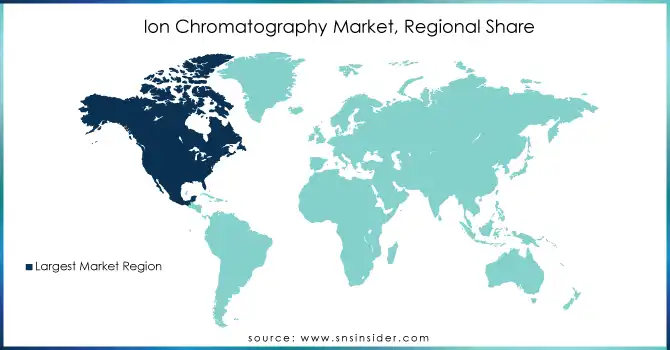

Regional Analysis

In 2023, North America dominated the ion chromatography market, primarily driven by its well-established pharmaceutical, environmental, and chemical industries. The demand for advanced analytical solutions is high, particularly in environmental monitoring and pharmaceutical applications. In the U.S. and Canada, regulatory requirements such as the Clean Water Act have significantly increased the adoption of ion chromatography for water quality testing. Additionally, the pharmaceutical industry's focus on drug quality and purity has further accelerated the use of ion chromatography in drug formulation and impurity detection.

Europe also held a strong position in the market, with countries like Germany and the UK being major contributors. The region’s stringent regulatory environment, particularly regarding food safety and environmental protection, is a key driver of market growth. The European Union's emphasis on high standards for water, food, and pharmaceutical quality has spurred increased adoption of ion chromatography across these industries. The food and beverage sector in Europe uses ion chromatography extensively to test for additives, preservatives, and contaminants, further fueling market demand.

In the Asia Pacific region, ion chromatography is witnessing the fastest growth, driven by rapid industrialization and increasing awareness of environmental pollution. Countries such as China and India are investing heavily in both environmental monitoring and healthcare infrastructure. The demand for high-quality pharmaceuticals, along with growing regulatory measures in environmental and food safety, has contributed to the rising adoption of ion chromatography. This growing focus on industrial and environmental standards is making the Asia Pacific a key region for the future of ion chromatography.

Key Players

-

Dionex Ion Chromatography systems, Dionex ICS-5000+ Series, Dionex IonPac Columns

2. Metrohm

-

850 Professional IC, 881 Compact IC Pro, 930 Compact IC Flex, Metrosep Ion Chromatography Columns

-

TSKgel IC Ion Chromatography Columns, Tosoh Bio-Systems IC systems

4. Shimadzu

-

Nexera XR, Prominence UFLC, Shimadzu IC-2010 Plus Ion Chromatography System

5. Qingdao Shenghan Chromatograph Technology Co., Ltd

-

Shenghan Ion Chromatography Systems, Ion Chromatography Columns

6. MembraPure GmbH

-

High-Purity Water Systems for Ion Chromatography

7. Nittoseiko Analytech Co., Ltd

-

Ion Chromatography Columns, IC Systems for Environmental and Industrial Analysis

8. Qingdao Puren Instrument

-

Ion Chromatography Systems for Water and Environmental Testing

9. East & West Analytical Instruments

-

Ion Chromatography Systems, Ion Chromatography Columns for Various Industries

10. Qingdao Luhai

-

Ion Chromatography Systems for Water and Environmental Analysis

11. Sykam

-

Ion Chromatography Systems and Accessories for Pharmaceutical and Environmental Testing

12. Cecil Instruments

-

Ion Chromatography Systems for Environmental and Pharmaceutical Testing

13. Bio-Rad Laboratories Inc

-

Bio-Rad Ion Chromatography Systems and Columns

14. Metrohm AG

-

930 Compact IC Flex, 850 Professional IC, Ion Chromatography Columns and Consumables

15. Agilent Technologies Inc

-

1260 Infinity II Ion Chromatography System, IonPac Columns

16. Danaher Corporation (Cytiva)

-

Ion Chromatography Systems and Consumables for Water and Pharmaceutical Applications

17. Mitsubishi Chemical Corporation

-

Ion Chromatography Systems for Environmental and Industrial Testing

Recent Developments

-

In Dec 2024, IonOpticks entered a long-term supply agreement with Biognosys to provide custom chromatography columns, enhancing Biognosys’ TrueDiscovery, TrueSignature, and TrueTarget contract research services. The custom columns are designed to meet Biognosys' rigorous standards, improving sensitivity, reproducibility, and depth of coverage in proteomics research workflows.

-

In Feb 2024, Thermo Fisher Scientific launched the Thermo Scientific Dionex Inuvion Ion Chromatography System, designed to enhance reliability, efficiency, and functional adaptability for laboratories. This new system streamlines ion analysis and broadens testing capabilities for ionic and small polar compounds, offering improved performance for diverse applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.13 billion |

| Market Size by 2032 | USD 6.40 Billion |

| CAGR | CAGR of 8.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technique (Ion-exchange chromatography, Ion-exclusion chromatography, Ion-pair chromatography) • By Application (Environmental testing, pharmaceutical industry, Food industry, Chemical industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Metrohm, Tosoh Bioscience, Shimadzu, Qingdao Shenghan Chromatograph Technology Co., Ltd, MembraPure GmbH, Nittoseiko Analytech Co., Ltd, Qingdao Puren Instrument, East & West Analytical Instruments, Qingdao Luhai, Sykam, Cecil Instruments, Bio-Rad Laboratories Inc, Agilent Technologies Inc, Danaher Corporation (Cytiva), and Mitsubishi Chemical Corporation |

| Key Drivers | • Rising Demand for Water Quality Testing • Pharmaceutical Industry’s Role in Market Growth • Increasing Regulatory Pressures in Food and Beverage • Advancements in Automation and High-Throughput Systems |

| Restraints | • High Initial Cost and Maintenance Requirements • Complexity in Operation and Training |