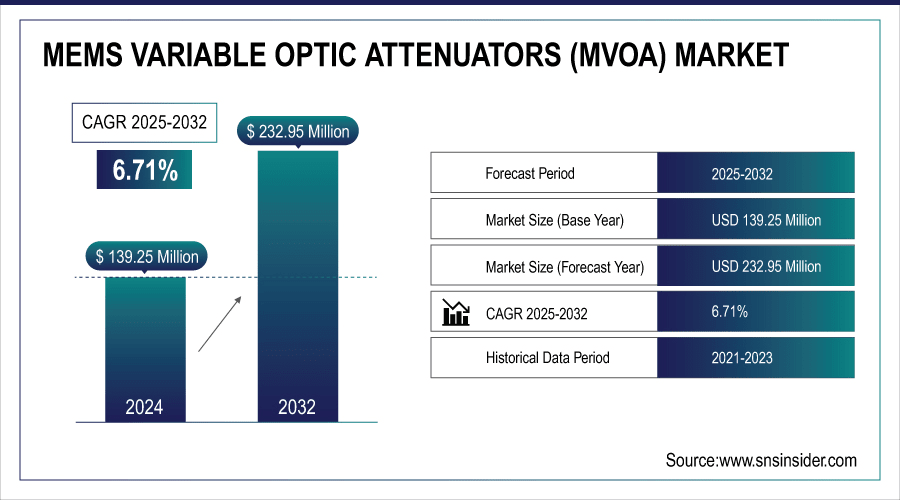

MEMS Variable Optic Attenuators (mVOA) Market Size Analysis:

The MEMS Variable Optic Attenuators (mVOA) Market Size was valued at USD 139.25 million in 2024 and is expected to reach USD 232.95 million by 2032 and grow at a CAGR of 6.71 % over the forecast period 2025-2032.

The global market is driving strong growth based on growing optical network installations, escalating bandwidth needs and the cloud required signal attenuation and control accuracy that the mVOA provides, making the mVOA a key element in several high growth markets. The growing 5G momentum, surging demand in data centers and proliferation of photonics in IoT and AI are additionally driving global demand.

To Get More Information On MEMS Variable Optic Attenuators (mVOA) Market - Request Free Sample Report

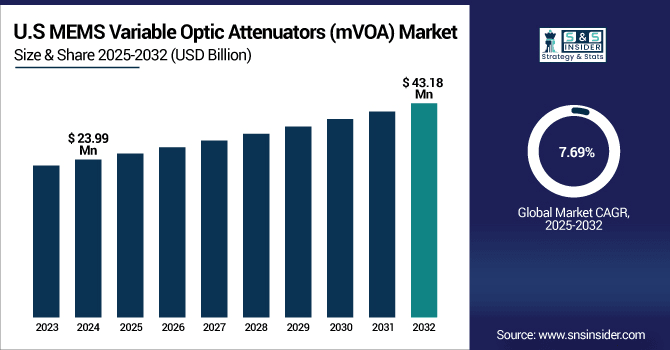

The U.S. MEMS Variable Optic Attenuators (mVOA) Market size was USD 23.99 million in 2024 and is expected to reach USD 43.18 million by 2032, growing at a CAGR of 7.69 % over the forecast period of 2025–2032.

The US MEMS Variable Optic Attenuators (mVOA) Market growth is fueled by high-speed internet demand, larger fiber optic networks, and quick 5G uptake. These developments demand highly accurate optical signal control and are driving an increasing demand in the telecom infrastructure and data transmission space for mVOA’s. Furthermore, growing deployment of defense communications and cloud services are also driving the market growth.

MEMS Variable Optic Attenuators Market Dynamics

Key Drivers:

-

Growing demand for compact, low-power optical components in advanced telecom infrastructure accelerates mVOA market growth.

Compact and power-efficient components are increasingly demanded in the next-generation telecom infrastructure, for high density integration and lowering system cost. The MEMS-based VOAs, small in size and low in power consumption, are ideal devices to meet the demands. High mechanical stability and rapid response time make the two platforms good candidates for 5G, FTTH and other high-speed data transmission applications. As worldwide optical networks advance, more MEMS-based components are being included by operators, and this is driving demand and a market for mVOAs in high-performance telecommunications systems.

According to research, MEMS VOAs typically consume up to 50% less power compared to traditional VOAs, reducing operational costs and heat generation.

Restrain:

-

Complex packaging and reliability challenges hinder widespread deployment across varying environmental conditions.

Advanced packaging technologies are necessary for MEMS-based optical attenuators to ensure device performance and to protect delicate microstructures from environmental factors, such as temperature changes, humidity, and mechanical vibration. Long-term reliability in severe environments especially when installed outdoors or in industrial settings, has yet to be effectively addressed. In addition, the packaging must accommodate low insertion loss and accurate alignment, adding to the complexity. These reliability and packaging constraints can limit deployment in applications that require ultra-ruggedized devices, hindering the market penetration into the larger industrial and defense applications.

Opportunities:

-

Increasing integration of photonic components in AI, IoT, and quantum computing offers new application avenues for mVOAs.

Integrating optical systems in AI, IoT, quantum computing and other next-generation devices is advancing, generating new needs for precision optical control. Such advanced photonic circuits can be well-adapted by the MEMS VOAs, which offer a fast-response time and high-accurate attenuation. The new areas can only be realized with small-footprint, low-latency, and high dynamic-range components for signal control and management, and mVOAs will be a key part of the hardware that can meet these requirements. As these sectors continue to develop, there is a huge, undervalued market potential for ground-breaking new applications of mVOA, outside of traditional telecom.

According to research, Low-latency optical components like MEMS VOAs can reduce data transmission delays by up to 50% compared to electronic-only systems.

Challenges:

-

Technological complexity in MEMS design and fabrication leads to longer development cycles and higher defect rates.

The complexity of MEMS micro-fabrication and design processes is a major contributing factor to lengthy product development cycles. Obtaining the necessary accuracy in the use of moving parts at the micro level requires sophisticated machinery and quality checks at every step. This complexity results in increased defect rates and decreased yields especially as production is scaled. As a consequence, it is difficult for vendors to balance performance and cost, delaying time-to-market and causing innovation cycles to lock down for highly competitive mVOA market.

MEMS VOA Market Segmentation Analysis:

By Type

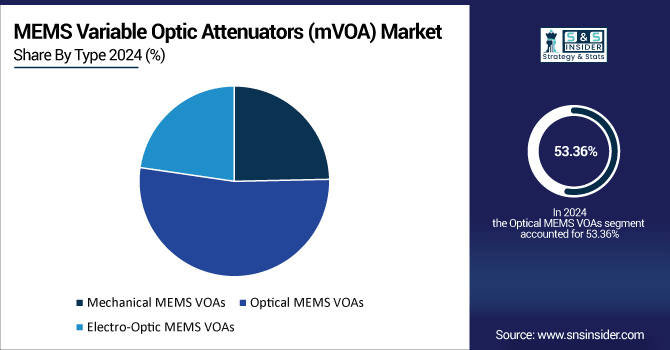

Optical MEMS VOAs segment dominated the MEMS Variable Optic Attenuators (mVOA) Market in 2024 with a revenue share of 53.36%. This is because the design and manufacturing process of these filters is expected to be accurate/compact and these filters to be used in high density wavelength division multiplexing (DWDM) systems, respectively. These properties make them good candidates for application in the emerging advanced optical communication networks where they are used as tunable optical filters. Their minimal power consumption and ease of integration in complex photonic circuits continue to fuel their demand in high data rate (and high speed network environments such as telecom and enterprise infrastructure applications.

Mechanical MEMS VOAs segment is expected to grow at the fastest CAGR of 7.98% from 2025 to 2032 due to their simpler structures, lower cost, and applicability to simple optical attenuation tasks. Players such as Accelink Technologies are also increasingly adding products in this space to support regional network’s cost-sensitive demands. These attenuators are widely used in small and medium form-factor pluggable devices, and in low-cost markets. They perform very well in milder environments, require minimal maintenance, and attract manufacturers’ interest.

By Application

The telecommunications segment held the largest revenue share of 41.20% in 2024, because of the significance of mVOAs in order to preserve signal quality in growing fiber optic networks. Due to increasingly high requirements for broadband and high-speed mobile services, thuse the mVOA are more and more deployed by telecom operators for intelligent signal processing and dynamic power control. In such applications (which support 5G-based next process for next generation network) their support to real-time network is necessary from real-time performance perspective for getting high quality of transmission.

The data centers segment is projected to grow at the fastest CAGR of 8.35% from 2025 to 2032, driven by the massive growth in cloud computing, AI workloads and hyperscale storage demand. MEMS Variable Optic Attenuators (mVOA) Companies like Coherent Corp. (formerly II‐VI Incorporated) provide precision MEMS VOAs specifically designed for high status density. The mVOAs play a key role in maximizing the optical signal routing, power balancing and system performance of high-density data applications. Their capacity to control the optical power very precisely allows greater energy efficiency, but also faster data transfer.

By End-Use Industry

Telecommunications service providers dominated the MEMS Variable Optic Attenuators (mVOA) Market share of 33.89% in 2024, because of extensive implementation of fiber-optic networks and high demand for flexible signal management devices. mVOAs help these operators improve the quality of the network, lower latency, and deliver a consistent level of service. As carriers further scale up 5G / IPTV and broadband infrastructure, they are rolling out mVOAs as a way to provide advanced traffic load balance and bandwidth scaling capabilities, whether in urban or rural deployments.

The government and defense segment is expected to grow at the fastest CAGR of 8.11% from 2025 to 2032, due to increasing expenditure on safe, high-speed communication systems. Helping to enable these applications, EMCORE Corporation is now offering specialized optical MEMS devices for defense applications. Precise and reliable optical control is required for military and defense applications, to include surveillance and satellite, and tactical communication networks. MEMS VOAs combine the performance, smallness, and ruggedness required for mission critical services.

MEMS Variable Optic Attenuators (mVOA) Market Regional Insights:

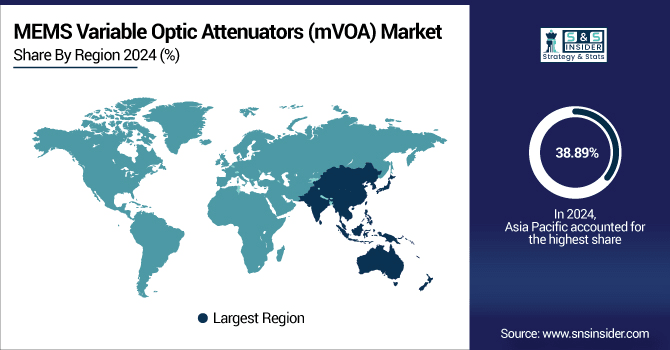

Asia Pacific dominated the MEMS Variable Optic Attenuators (mVOA) Market with the highest revenue share of about 38.89% in 2024. This is driven by rapid growth in telecom sector, ongoing fiber optic deployment and huge presence of electronics manufacturing in countries such as China, Japan and South Korea. Governments in the area are in the process of heavy investment in the next-generation network infrastructure, based on 5G and optical broadband. Moreover a large pool of skilled labor and cost effective production environment gives a further leg up to Asia Pacific in the global mVOA market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

China leads the Asia Pacific MEMS Variable Optic Attenuators (mVOA) market due to its strong telecommunications infrastructure, vast 5G roll-out, strong government backing, and the existence of leading manufacturers of optical components to scale up production and provide faster technology uptake.

North America is projected to witness the fastest CAGR of 8.31% from 2025 to 2032, fueled by its sophisticated technology environment and accelerated pace of digital adoption. Increasing data center expansion, and increasing deployment of 5G networks and government investments in secure communication systems are driving the demand for mVOA. The U.S. has many of the world’s top manufacturers of optical components and R&D centers, encouraging innovation and performance capable solutions. Strategic alignments and defence communications requirements also enhance the region's potential for long-term growth.

-

US dominance in North America MEMS Variable Optic Attenuators market is attributed to advanced technology infrastructure, extensive fiber optic networks and high government investments in the secure communication. Its development centers and large industry parties promote the development and application of advanced optical solutions and serve as an engine for the growth of the market.

Europe is a major market for the MEMS Variable Optic Attenuators (mVOA), due to the rising investments in telecom infrastructure and smart city programs. Robust emphasis on innovation, favorable government initiatives and increasing penetration of fiber optic networks across nations such as Germany, France and UK stimulate demand. These characteristics of the region also help to pave the way for the growth of the market, due to their focus on energy-saving and high-performance optical devices.

-

Germany has the highest market share in the European MEMS Variable Optic Attenuators (mVOA) market with its well-developed telecom infrastructure and huge amount of R&D funding. Early implementation of fiber optic networks and emphasis on innovation are boosting the demand for high-performance optical components in a wide range of industries.

The Middle East & Africa MEMS Variable Optic Attenuators is being aided by the growing telecom infrastructure in UAE and Saudi Arabia and backed by smart city projects. In Latin America, Brazil is leading and expanding the adoption with broadband networks, with investments to upgrade optical communications technology packages in countries like Argentina and other countries to cope with increasing data demand.

MEMS Variable Optic Attenuators Companies are:

Major Key Players in MEMS Variable Optic Attenuators (mVOA) Market are Lumentum Holdings Inc., II-VI Incorporated (Coherent Inc.), Finisar Corporation, Furukawa Electric Co., Ltd., Oplink Communications, Gould Fiber Optics, Micron Optics (Luna Innovations), Aurrion, Inc. (Juniper Networks), Avago Technologies (Broadcom Inc.), NeoPhotonics Corporation and others.

Recent Development:

-

June 2024, Accelink Technologies: Launched Low-Insertion-Loss MEMS VOAs tailored for data centers, improving optical attenuation precision, reducing signal loss, and supporting the expanding demand for faster, reliable high-speed telecom network infrastructure.

-

August 2023, EMCORE Corporation: Introduced Advanced MEMS Optical Modulators and VOAs to enhance telecom network performance by improving signal quality, dynamic range, and enabling efficient optical power control in fiber optic systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 139.25 Million |

| Market Size by 2032 | USD 232.95 Million |

| CAGR | CAGR of 6.71% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mechanical MEMS VOAs, Optical MEMS VOAs, Electro-Optic MEMS VOAs) • By Application (Telecommunications, Data Centers, Cable Television, Military and Aerospace, Medical Devices) • By End-Use Industry (Telecommunications Service Providers, Government and Defense, CATV service providers, Enterprise Networks) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lumentum Holdings Inc., II-VI Incorporated (Coherent Inc.), Finisar Corporation, Furukawa Electric Co., Ltd., Oplink Communications, Gould Fiber Optics, Micron Optics (Luna Innovations), Aurrion, Inc. (Juniper Networks), Avago Technologies (Broadcom Inc.), NeoPhotonics Corporation. |