Menstrual Pain Relief Patches Market Report Scope & Overview:

Get More Information on Menstrual Pain Relief Patches Market - Request Sample Report

The Menstrual Pain Relief Patches Market size was valued at USD 1.17 billion in 2023 and is expected to reach USD 1.75 billion by 2032 and grow at a CAGR of 4.61% over the forecast period 2024-2032.

The menstrual pain relief patch market is witnessing significant growth driven by the increasing prevalence of dysmenorrhea or menstrual cramps. Consumers are seeking non-pharmacological, convenient, and effective solutions for managing menstrual pain. Patches that leverage far-infrared (FIR) technology, such as the FIT Lady patch, represent a promising segment within this market.

FIR technology harnesses the body's natural heat to generate therapeutic warmth, improving microcirculation and potentially alleviating pain. The absence of pharmacological ingredients positions these patches as a safe and accessible option. Clinical studies, like the one mentioned, have shown the efficacy of FIR patches in reducing menstrual pain and discomfort, boosting consumer confidence in this category.

Market demand is primarily driven by young to middle-aged women experiencing menstrual pain. The preference for non-invasive and drug-free alternatives is also contributing to market expansion. However, consumer awareness about FIR technology and its benefits remains a key challenge.

The substantial economic burden caused by dysmenorrhea underscores the immense market demand for effective and convenient pain relief solutions. With millions of women experiencing menstrual pain each month, there is a vast untapped potential for menstrual pain relief products.

Dysmenorrhea, or menstrual cramps, poses a significant public health challenge, impacting millions of women worldwide. In the United States alone, it results in a staggering 600 million lost work hours annually, translating to a USD 2 billion economic losses. Despite its prevalence, dysmenorrhea often goes underreported or is self-managed with over-the-counter medications. While traditional heat therapy has been used for centuries, its effectiveness is limited and can lead to acute inflammation.

Market Dynamics

Drivers

-

The Shift Towards Non-pharmacological Pain Relief Solutions

The increasing prevalence of dysmenorrhea among women, coupled with a growing preference for non-pharmacological pain management options, is a primary driver. Consumers are seeking convenient, effective, and drug-free alternatives to traditional oral medications. Additionally, the rising awareness of the potential side effects associated with prolonged use of painkillers is driving demand for safer and more localized pain relief solutions. The desire for discreet and long-lasting pain management, particularly in settings like workplaces or schools, is also contributing to market growth.

Furthermore, technological advancements in patch formulations and delivery systems, such as the development of nanofibrous transdermal patches, are expanding the market's potential. These innovations offer improved drug release profiles, enhanced efficacy, and reduced side effects, making them attractive options for women seeking relief from menstrual pain.

-

Rising Prevalence of Painful Periods

Dysmenorrhea or painful menstruation is a common problem affecting a large portion of the female population. Statistics show most women experience dysmenorrhea during adolescence, and although it may lessen with age, it remains a significant concern for many. This widespread need for pain relief fuels the market for menstrual pain relief patches.

-

Innovation in Patch Technology

Advancements in adhesive technology and drug delivery systems are leading to the development of more effective and longer-lasting menstrual pain relief patches. This ongoing innovation attracts new users and keeps the market dynamic.

Restraints

-

Regulatory, Cost and Consumer Acceptance Issues

Regulatory hurdles pose a significant barrier, as the approval process for therapeutic patches involves extensive testing and documentation to ensure safety and efficacy, leading to potential delays and increased costs. Additionally, market penetration may be limited by low consumer awareness and acceptance, with traditional oral medications remaining prevalent. The cost of advanced technologies, such as nanofibrous transdermal patches, contributes to higher retail prices, potentially restricting accessibility for some users. Moreover, concerns about product efficacy, safety, and the potential for skin reactions need to be addressed to maintain consumer trust. Finally, competition from other non-pharmacological pain management options, like heat therapy and acupuncture, may also influence market adoption.

Key Segmentation

By Product Type

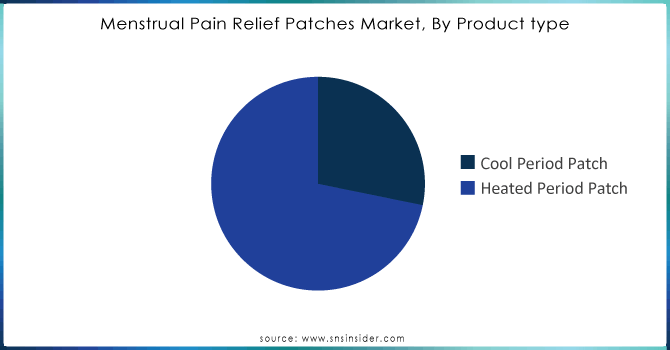

Heated Period Patch was the dominated segment with 72% share in 2023. These patches lead the market due to their effectiveness in providing warmth and alleviating menstrual cramps. Their popularity is driven by their perceived efficacy and widespread consumer preference for heat-based relief.

Cool Period Patch, although less dominant, cool period patches are seeing rapid growth as consumers seek alternative, cooling relief options. Their appeal lies in their drug-free approach and soothing effect.

Need any customization research on Menstrual Pain Relief Patches Market - Enquiry Now

By Price Range

Below USD 20 price range held the largest market share with 55% in 2023, appealing to cost-conscious consumers seeking affordable pain relief solutions.

USD 30 - USD 40 segment is expanding quickly as consumers are willing to spend more for premium features and higher quality, driving growth in this mid-to-high price range.

By Sales Channel

Pharmacy/Drug Stores captured a significant portion of the market i.e. 42% in 2023, due to their accessibility and consumer trust. They offer convenience and a reliable place for purchasing menstrual pain relief patches.

Online Retailers are experiencing the most rapid growth. Their convenience, competitive pricing, and wide product range are attracting increasing numbers of consumers, making them the fastest-growing sales channel.

Regional Analysis

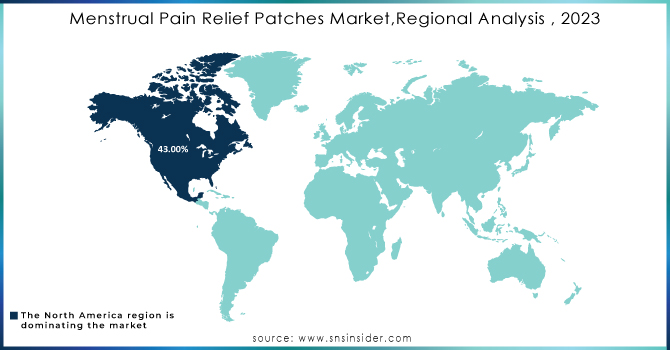

North America, led by the United States, dominated with 43% share in 2023 due to advanced healthcare infrastructure, high disposable incomes, and early adoption of innovative products. Europe follows, with increasing awareness of menstrual health and a preference for non-invasive treatments driving growth. The Asia Pacific region, especially India and China, presents substantial untapped potential due to large female populations. However, varying levels of menstrual health awareness and economic disparities influence market penetration.

Key Players

The Major Players are Sparsha Pharma International Pvt Ltd, BeYou, Unexo Life Sciences Pvt. Ltd., Medi Heally Philippines, Cora, Sirona hygiene private limited, La Mend Inc. dba The Good Patch, BeBodywise, Care Me Inc., Rael, LILAS WELLNESS, Nua Lagom Labs Private Limited, Popband Ltd., and other Players

Recent Developments

February 2024: PainRelief Solutions expanded its FlexiPatch reach through a partnership with a major pharmacy chain, increasing product availability nationwide.

April 2024: HealWell Pharmaceuticals partnered with an online health retailer to broaden the distribution of its TheraPatch line, targeting tech-savvy consumers.

August 2023: PainAway Inc. introduced the UltraFlex Pain Relief Patch, featuring advanced technology for extended comfort and effective chronic pain management.

November 2023: ReliefRx launched SootheEase Patches, combining natural ingredients with flexible design for versatile muscle and joint pain relief.

Women's health company Nua launched an innovative self-heating patch in 2020. Designed to provide up to eight hours of continuous warmth, the patch offers targeted relief from period pain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.17 billion |

| Market Size by 2032 | US$ 1.75 Billion |

| CAGR | CAGR of 4.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2022-2030 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Cool Period Patch, Heated Period Patch) • By Price Range (Below USD 20, USD 20- USD 30, USD 30- USD 40, Above USD 40) • By Sales Channel (Direct Sales, Specialty Stores, Pharmacy / Drug Stores, Departmental Stores, Online Retailers, Other Sales Channel) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sparsha Pharma International Pvt Ltd, BeYou, Unexo Life Sciences Pvt. Ltd., Medi Heally Philippines, Cora, Sirona hygiene private limited, La Mend Inc. dba The Good Patch, BeBodywise, Care Me Inc., Rael, LILAS WELLNESS, Nua Lagom Labs Private Limited, Popband Ltd., and others. |

| Key Drivers | • The Shift Towards Non-pharmacological Pain Relief Solutions |

| Restraints | • Regulatory, Cost and Consumer Acceptance Issues |