Messaging Security Market Report Scope & Overview:

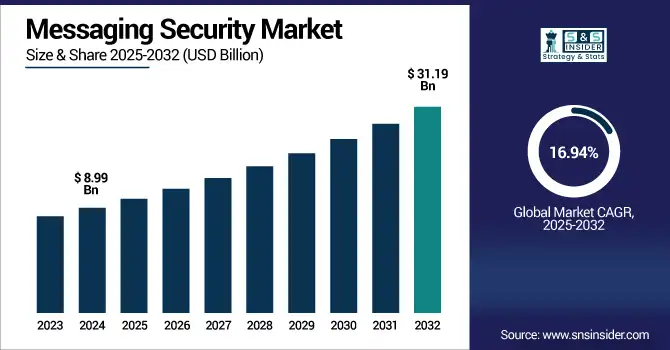

Messaging Security Market size was valued at USD 8.99 billion in 2024 and is expected to reach USD 31.19 billion by 2032, growing at a CAGR of 16.94% over 2025-2032.

To Get more information on Messaging Security Market - Request Free Sample Report

The Messaging Security Market growth is propelled by increasing cyber threats, phishing and ransomware attempting to infiltrate business communications.

-

In 2024, 94% of organizations reported being victims of phishing attacks, with 79% of account takeover incidents starting via phishing emails.

-

The U.S. Cybersecurity and Infrastructure Security Agency (CISA) highlighted that 70% of malicious links or attachments bypass network protections, and 84% of employees engage with them within 10 minutes, yet only 13% report them, indicating significant human vulnerability.

The rise of remote work and trend toward BYOD (Bring Your Device) has only broadened the attack surface, causing systems to be more vulnerable.

-

According to Microsoft's 2024 Digital Defense Report, 90% of organizations are exposed to at least one attack path, and 61% of these involve sensitive user accounts, underlining the growing threat to remote-access credentials.

-

Microsoft also noted that their customers face over 600 million cyberattacks daily, including ransomware, phishing, and identity-based threats.

These threats are forcing organizations to spend on messaging security along with data & regulatory compliance, such as GDPR & HIPAA. Furthermore, with cloud-based messaging platforms becoming more popular, they also need a scalable integrated security solution. The growing trend of integration of machine learning and AI technologies in messaging security tools enables real-time threat detection and automated response to threats, and this factor has played a vital role in boosting the market growth.

The U.S. Messaging Security Market size was valued at USD 2.47 billion in 2024 and is expected to reach USD 8.44 billion by 2032, growing at a CAGR of 16.61% over 2025-2032.

The U.S. Messaging Security Market is driven by the increasing cyberattacks related to enterprise communications, stringent data privacy regulations, and growing adoption of cloud-based messaging. AI-driven threat detection along with secure remote communication tools is in high demand and is further driving the growth of the market across industries.

Market Dynamics:

Drivers:

-

Widespread Cloud Adoption and Remote Work Culture are Driving the Demand for Cloud-Based Messaging Security Platforms Across Industries

With enterprises embracing cloud-hosted tools, such as Microsoft 365, Google Workspace and Slack, the need for integrated cloud-native messaging security is surging. Adding to this complexity, hybrid and remote work models have greatly widened the attack surface, making endpoints and their communications harder to secure. Today, organizations want cloud-native scalable, flexible, and consistent security similar to that of cloud infrastructure. Cloud solutions offer a decentralized approach which protect in real time, can be controlled through a single policy, have automated updates and patches performed so they are best suited for an enterprise trying to minimize the risk and ensure compliance in a decentralized digital world.

-

Google Workspace now has 3 billion active users, with over 8 million paying business customers globally. Google reports its AI-driven Gmail security blocks 99.9% of spam, phishing, and malware detecting twice as much malware as typical antivirus solutions demonstrating the critical role of cloud-native tools in modern messaging protection.

Restraints

-

Lack Of Awareness and Technical Expertise Among Organizations Hampers the Effective Deployment and Utilization of Messaging Security Solutions

Many enterprises, particularly in developing countries, are unaware of this entire spectrum of messaging threats and the importance of dedicated security solutions. Email and chat are important threat vectors where IT teams do not have the same level of focus on protection as they do for endpoint and network protection. This can lead to misconfigured tools or unused tools, which can leave systems vulnerable after they are deployed. Existing security gates are still in use but without adequate training to understand how to best use them and how advanced messaging security solutions are built to stop addressing issues holistically across these organizations.

-

A 2025 KnowBe4 report found that in untrained environments, 33.1% of employees clicked simulated phishing links. Without follow-up training, organizations remain highly exposed.

-

IBM’s 2023 X‑Force and Ponemon Institute analysis shows 95% of breaches involve human error, highlighting that technology alone is not enough.

-

Trend Micro’s 2021 findings reported 84% of organizations had encountered phishing or ransomware, yet 50% admitted they were ineffective at countering these threats; many still focus on endpoints and networks instead.

Opportunities:

-

Integration of Artificial Intelligence and Machine Learning is Enhancing Threat Detection and Opening New Avenues for Intelligent Messaging Security Solutions

AI & ML are revolutionizing messaging security, enabling solution providers to move from traditional rule-based systems to real-time behavior analysis, anomaly detection, and predictive threat modelling. It allows a platform to adapt to an emerging method of attack fast, reduce the time to respond and decrease the number of false positive. It gives a competitive edge to the vendors integrating AI into their security offerings. With increasing sophistication of cyber threats, there is an increasing need for intelligent, adaptable solutions in sectors with high accuracy requirements and immediate threat removal, which is driving high market demand and is expected to open new corridors for innovation.

-

Microsoft Defender for Office 365 now uses purpose-built Large Language Models (LLMs), achieving 99.995% accuracy in detecting attacker intent and blocking 140,000 Business Email Compromise (BEC) emails daily via LLM filtering alone.

-

Microsoft Security Copilot powered by GPT-4 and security-trained AI improves response accuracy by 44%, speeds task completion by 26%, and helps analysts handle incidents 20% faster, while reducing time spent on incident reports by 39%.

-

Security Copilot’s reduction in manual tasks by 60%, combined with a 40% faster incident response, demonstrates how AI integration gives vendors a strong competitive edge.

Challenges

-

Constant Evolution of Cyber Threats Makes it Difficult for Messaging Security Solutions to Stay Ahead and Offer Comprehensive Protection

Cybercriminals are rapidly advancing their techniques utilizing AI generated phishing, deep fake attachments, and zero day exploit attempts to bypass traditional defenses. Not only are messaging threats more targeted, polymorphic, and evasive than ever, they also compel vendors to keep the tools updated with nimble, real-time intel. While low false positives make rapid innovation possible, it is a delicate balancing act for developers. The lack of sharing of threat intelligence across platforms continues to deplete collective defense. As the pace and evolution of threats easily outrun static measures, imbedded messaging security requires continuous innovation in order to effectively protect organizations against the growing sophistication of cyberattacks.

-

Between September 15, 2024 and February 14, 2025, 82.6% of all phishing emails used AI-generated or polymorphic elements, with a 17.3% increase in phishing volume highlighting the rapid evolution of message-based attacks.

-

Cofense reported that in 2024, a malicious email was delivered every 42 seconds, and email scams increased 70% year-over-year.

-

Over 40% of malware-laden attachments were newly emerging variants. Zscaler also noted a 60% rise in AI-driven phishing and vishing globally in 2023, with deepfake audio and voice cloning becoming increasingly prevalent

Segmentation Analysis:

By End-Use

The corporate segment accounted for the largest revenue share of about 77% in 2024 due to the growing reliance on secure digital communication across enterprises. Corporations deal with enormous quantities of sensitive information on a daily basis, attracting phishing, ransomware, and business email compromise attacks. As a result, the hunting and demand for innovative messaging security solutions aimed at safeguarding financial transactions, sensitive communications and meeting regulatory compliance requirements globally has surged.

The residence segment is expected to register the fastest CAGR of about 19.35% over 2025-2032, owing to the growing usage of personal e-mail, messaging applications, and smart devices. With PowerPoint and e-commerce in more households than ever before, remote work, and online bank accounts, researchers say, virtually every home is now vulnerable to these virtual threats. With consumers now more aware of the risks from identity theft and malware, there is a greater demand for messaging security tools designed to be easy to use and more affordable for the residential market.

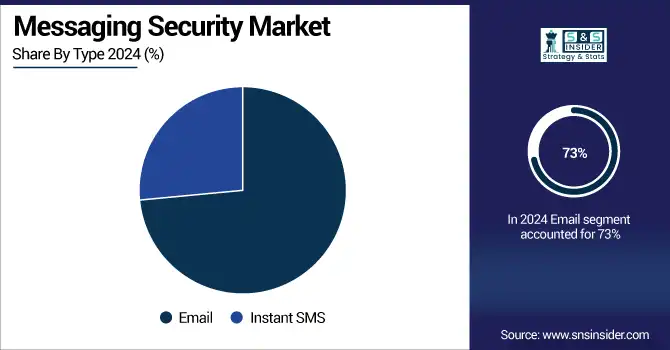

By Type

The email segment dominated the messaging security market share of about 73% in 2024, primarily due to being the most prominent communication channel for conducting cyberattacks. As email remains a crucial channel of business for the enterprise, it will continue to be the top target for phishing, spam, malware, and ransomware. As a result of this persistent threat landscape, there has been significant global investment in email-specific security infrastructure and services through the years.

The instant SMS segment is projected to grow at the fastest CAGR of about 18.85% over 2025-2032, owing to the rapid growth of mobile-based communications in e-commerce, banking, and customer service interactions. As more SMS is being used for 2FA, alerts and marketing, it opens to smishing and spoofing attacks. With the growing awareness about threats to mobile communication, enterprises have adapted the latest in SMS security, safeguarding the end-user experience, and trust.

By Deployment

The cloud segment held the largest revenue share of about 63% in 2024 and is projected to grow at the fastest CAGR of 17.63% over 2025-2032. This dominance and rapid growth are due to the accelerated adoption of cloud-based communication platforms by enterprise customers which offer scalable, flexible and lower-cost deployment options. With remote work and hybrid business models on the rise, the security provided by cloud-based messaging has become increasingly popular over on-premise methods, being cited for its real-time protection, effortless integration and centralized policy management capabilities which secure dynamic communication landscapes across various locations and devices.

By Product

The email protection segment captured the highest revenue share of about 48% in 2024 and is also anticipated to grow at the fastest CAGR of 18.34% over 2025-2032. This growth is primarily driven by the continued prevalence of email is the most common medium for phishing, malware and ransomware attacks. Due to the need to secure sensitive information, ensure business continuity, and to comply with regulatory requirements, organizations have placed a significant emphasis on email security. The pace at which AI threats are evolving, coupled with the greater emphasis on cloud-based email platforms, will only further drive the need for more adaptive and advanced email protection tools, thereby reinforcing its leading market position and a greater growth curve.

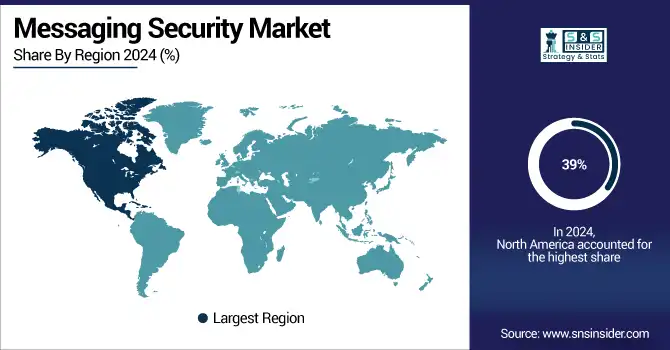

Regional Analysis

North America

In 2024, North America accounted for around 39% of messaging security revenue owing to advanced IT infrastructure, high cybersecurity awareness, and the extensive use of digital communication tools. Demand across industry verticals was driven by regulatory mandates (HIPAA and GDPR), the presence of key players, and widespread investments in enterprise security.

-

The HIPAA Security Rule, upheld by the U.S. Department of Health and Human Services (HHS), mandates encryption and access safeguards for electronic protected health information (e-PHI) transmitted via messaging platforms.

-

According to NIST SP 800-66 (February 2024), all HIPAA-regulated entities covering millions of providers and insurers nationwide must implement structured risk management, encryption, and audit controls to protect sensitive health data, making secure messaging a regulatory necessity.

The U.S. is dominating the messaging security market due to its strong cybersecurity infrastructure, high enterprise adoption, regulatory compliance needs, and presence of major technology providers.

Asia Pacific

Asia Pacific is projected to grow at the fastest CAGR of about 18.91% over 2025-2032, attributed to rapid digital transformation, high smartphone penetration, along with high Internet connectivity.

-

As of end‑2023, 1.8 billion people in Asia Pacific (63% of the population) subscribed to mobile services, with 51% using mobile internet up to nearly threefold from a decade ago.

The increase in cyberattack incidents in emerging economies, robust cloud adoption in the corporate space, coupled with growing awareness with respect to data privacy compliance is signifying the need for organizations to adopt secure messaging systems. In Asia Pacific, governments have issued or refreshed national cybersecurity strategies that include secure cloud messaging in national critical infrastructure protections.

-

In 2024, China published its first National Cybersecurity Strategy, emphasizing protection of critical systems including messaging and communication networks and reinforcing cyber sovereignty.

China is dominating the messaging security market in Asia Pacific due to its massive digital user base, rapid cloud adoption, and increasing focus on national cybersecurity and data protection regulations.

Europe

Europe is witnessing steady growth in the messaging security market owing to strict data privacy regulations, such as GDP, growing cyber threats coupled with the increase of secure communication tools adoption by sectors including finance, Heathcords, and government organizations.

The U.K. is dominating the messaging security market in Europe, driven by strong digital adoption, cybersecurity investments, and stringent data protection regulations across public and private sectors.

-

GDPR enforcement fines totaled USD 1.30 billion in 2024, with 2,245 penalties issued across Europe by March 2025 underscoring strong regulatory pressure for compliant messaging protections.

-

Public awareness remains high as 72% of EU citizens are familiar with GDPR rights, driving organizational demand for secure communication tools.

Middle East & Africa and Latin America

The Messaging Security Market trends in Middle East & Africa and Latin America indicate strong growth as countries increasingly adopt digital services, heightening the need for secure communication tools across banking, telecom, and government sectors. While demand for these services is high, challenges such as limited infrastructure, constrained budgets, and slower human adaptation may hinder localized adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Messaging Security Market companies are Barracuda Networks, Inc., BlackBerry Limited, Cisco Systems, Inc., Clearswift, Enea, Forcepoint LLC, LeapXpert, McAfee, LLC, Mimecast Email Protection Limited, Panda Security, Proofpoint, Inc., SlashNext, Inc., Sophos Ltd., Symantec Corp., and Trend Micro Inc.

Recent Developments:

-

In 2025, Barracuda XDR now integrates Cisco Secure Endpoint via API, enabling unified endpoint data visibility in the Barracuda XDR dashboard for enhanced threat detection and response

-

In 2023, Cisco Systems, Inc. unveiled its new XDR solution and enhanced Duo MFA at RSA Conference to rapidly detect advanced cyber threats and automate response across IT systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.99 Billion |

| Market Size by 2032 | USD 31.19 Billion |

| CAGR | CAGR of 16.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Anti-virus, Email Protection, Messaging Gateway) • By Deployment (Cloud, On-premises) • By Type (Email, Instant SMS) • By End Use (Corporate, Residence) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Barracuda Networks, Inc., BlackBerry Limited, Cisco Systems, Inc., Clearswift, Enea, Forcepoint LLC, LeapXpert, McAfee, LLC, Mimecast Email Protection Limited, Panda Security, Proofpoint, Inc., SlashNext, Inc., Sophos Ltd., Symantec Corp., Trend Micro Inc. |