Content Delivery Network Market Size & Overview:

Get More Information on Content Delivery Network Market - Request Sample Report

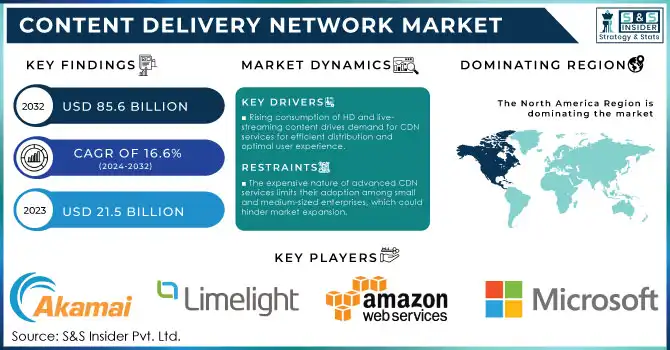

The Content Delivery Network Market Size was valued at USD 21.5 billion in 2023 and is expected to reach USD 85.6 billion by 2032, growing at a CAGR of 16.6% over the forecast period of 2024-2032.

The increasing demand for optimized media delivery has been a major growth driver for the Content Delivery Network (CDN) market. Across the world, governments are increasingly aware of how vital it is to improve digital infrastructure to meet the demands of cloud computing, e-commerce, and increased consumption of online media. The Federal Communications Commission (FCC) revealed U.S. broadband penetration in 2022 stood at 94%, up from 84% in 2019. This increase also goes to show the effort by the government that is targeted towards advancing digital connectivity which in turn helps CDN services responsible for optimal and effective media delivery via the Internet. Furthermore, various nations are pushing for the adoption of 5G technology, which is expected to further amplify the need for content delivery networks that can handle the increased data traffic and provide low-latency solutions.

As part of the EU Digital Decade, Europe has also invested heavily in its high-speed internet infrastructure, ensuring that the region remains a strong contributor to the global CDN market. With the government prioritizing the development of digital infrastructure, the demand for high-quality CDN solutions has spurred the market significantly. Widespread economic trends such as digital transformation, remote work, e-learning, and streaming services are also boding well for the CDN market as they become more and more pivotal to economies around the globe. The key factor contributing to this sudden growth is the government efforts incentivizing digital economy infrastructure and the burgeoning demand for seamless digital experiences around the globe.

Content Delivery Network Market Dynamics

Drivers

-

The increasing consumption of high-definition and live-streaming video content boosts the demand for CDN services, as these platforms need efficient distribution for optimal user experiences.

-

The growing trend of cloud adoption is enhancing CDN efficiency, particularly through the use of cloud content delivery networks, which enable faster content delivery, scalability, and improved performance for businesses across sectors.

The increasing consumption of online content is one of the main factors that drive the growth of the content delivery network market led by the boom in streaming services, gaming, and social media increased rapidly. In recent years, there has been a significant increase in worldwide internet traffic. Video streaming represents over 60% of all internet traffic, with heavyweights like Netflix, YouTube & and Twitch leading the charge. This increasing appetite for video content, particularly at 4K and 8K resolutions, drives content providers to deliver high-speed, seamless delivery of content to users globally.

A pivotal example is the adoption of CDNs by major players like Netflix, which uses a highly optimized CDN infrastructure to serve over 200 million subscribers worldwide, ensuring smooth playback even in regions with lower network capacity. Gaming companies such as Microsoft and Sony also use CDNs for larger game and patch downloads to improve user experiences from online multiplayer. As internet penetration reaches new peaks globally, (faster in developing countries with bolstering mobile internet) the demand for content delivery is even higher. Mobile video traffic in new-age markets such as Southeast Asia and Africa is expected to grow in the range of 40-50% annually, which is expected to further push the adoption of CDN and other technologies to support the growing demand for online content consumption.

Restraints:

-

The expensive nature of advanced CDN services limits their adoption among small and medium-sized enterprises, which could hinder market expansion.

-

Issues like latency and network connectivity in live video streaming present challenges to the CDN market, impacting user experience and content delivery reliability.

CDNs handle massive amounts of data for globally distributed servers, and security and privacy issues are major concerns. CDNs typically cache content at multiple edge servers to improve load times and reduce latency, which increases the potential exposure of sensitive data to cyber threats. Sensitive data, like personal IDs, payment information, and confidential business data traveling through these servers can be compromised as well if the CDN companies do not have effective encrypted data traffic and data access protection policies in place. In addition, regulatory compliance can make things even more complex, as CDNs must ensure that data is stored and transferred in compliance with various data protection laws like GDPR, CCPA, and others, which differ by region. Non-compliance with these norms not only has legal implications but also damages trust between CDN providers and their clients, hence cloud data security and data privacy matter the most.

Content Delivery Network Market Segment Analysis

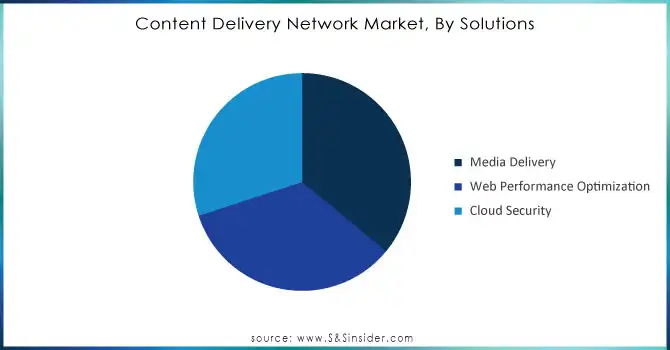

By Solutions

The media delivery segment of the Content Delivery Network Market accounted for a revenue share of over 36% in 2023. The large share of the market is driven by the increasing requirements for high-quality video streaming services, online gaming, and digital media consumption on a wide range of devices and platforms. The media delivery segment grew due to government-backed initiatives for broadband penetration and digital transformation driving growth in broadband connectivity and equipment. The US Federal Communications Commission (FCC), for example, has noted that usage of online video platforms has increased by 40% over the past three years, leading to a higher demand for high-performance CDNs needed to deliver video content without delays.

This segment has mainly flourished due to the increasing usage of over-the-top (OTT) services like Netflix, Hulu, and Disney+, among others. Also in many regions, governments are investing heavily in infrastructure upgrades that accommodate growing capacities of streaming traffic including fiber-optic networks and low-latency solutions that directly benefit CDN performance for media delivery. As cited in the Digital Economy and Society Index (DESI) 2023, the European Commission notes that enhancing regional access to high-speed internet has been crucial for Europe in fostering the streamlined dissemination of content across the region. Growing demand for HD and 4K video and the rise of live streaming events drive continued CDN growth for smooth and buffer-free delivery of content. As governments, service providers, and content creators now focus on the expansion and enhancement of digital media infrastructure, media delivery will continue to be one of the main contributors to this trend, thereby driving the growth of the CDN market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Service Provider

The Content Delivery Network market was dominated in 2023 by the traditional commercial CDN segment, which accounted for over 44% of the revenue share. This domination is said to be because of the long-established tradition of using commercial CDN providers that have enormous infrastructure to facilitate large-scale media delivery operations. Leading CDN service providers such as Akamai Technologies, Cloudflare, Amazon, etc. continue to keep up their market share by offereing a broad range of CDN services for diverse customer needs. Moreover, the digitization of this segment has only been possible because the government has assisted in the development of the digital infrastructure required. For example, the U.S. Department of Commerce has been instrumental in promoting the development of cloud computing services and content delivery solutions to support the digital economy.

The BEAD program continues to improve the underlying infrastructure for CDNs, effectively benefiting traditional CDN providers, while in 2023 the U.S. government considerably boosted the funding for these types of projects. Enterprises, media and entertainment companies, and e-commerce businesses with stringent requirements for high-performance, secure, and reliable content delivery solutions continue to use commercial CDNs. Moreover, the widespread adoption of e-commerce platforms, online media, and mobile applications across industries has made traditional commercial CDN services a staple for businesses seeking to provide a seamless customer experience. According to the International Telecommunication Union (ITU), by 2023, global mobile broadband subscriptions will reach over 80% of the global population, underscoring the growing importance of efficient CDN services to support mobile and web-based content delivery. With the expanding digital economy, traditional commercial CDN providers are well-positioned to maintain their market dominance through continued innovation and investment in scalable, global infrastructure.

By End-Use

In 2023, the media & entertainment segment had a highest market share over 39% in the Content Delivery Network Market. This segment has the highest CAGR as this increase is fueled by the rise in consumption of digital content, not just video streaming but also gaming and live broadcast events. With many governments around the world recognizing the economic and cultural value of the media & entertainment sector, there have been stepped-up support for the development of digital media infrastructure. According to a U.S. Bureau of Labor Statistics (BLS) report, the U.S. media and entertainment industry is estimated to grow at an 8% yearly growth rate until 2027, ultimately resulting from the increasing demand of digital media services.

The governments in the Asia-Pacific region have been investing huge amounts of money in telecommunications infrastructure, with China and India continuing to grow their 4G and 5G networks and significantly improving the media delivery experience for viewers. The demand for high-quality video content, fueled by streaming platforms such as YouTube, Netflix, and TikTok, is pushing CDN providers to deliver large video files quickly and seamlessly. Media & entertainment continues to be the major contributor to CDN market, while government initiatives are providing the essential backup for a digital economy addressing local content producers and distributors to reach global audiences efficiently. Given the continuous growth in digital media consumption, the media & entertainment industry is expected to maintain a dominant position in the CDN market for the foreseeable future.

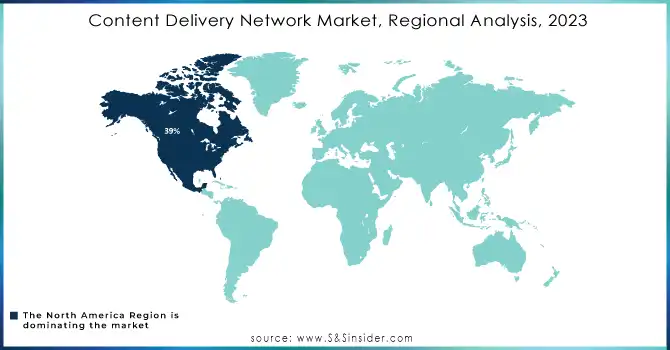

Content Delivery Network Market Regional Insights

North America held a significant share of about 39% of the global Content Delivery Network Market in 2023. This dominance is mainly due to well-developed digital infrastructure, high internet penetration rates, and leading CDN service providers in the region. The U.S. government’s efforts to enhance broadband infrastructure through programs such as the BEAD initiative have significantly contributed to the growth of CDN services. Additionally, North America’s high demand for video streaming services, gaming, and e-commerce has fueled the region's CDN market.

On the other hand, an impressive growth rate is projected for the Asia-Pacific (APAC) with the fastest CAGR due to increasing internet penetration, mobile usage, and rising government-supported investments in digital infrastructure. The Asia-Pacific Tele community (APT) reported a steady increase in the APAC Internet penetration rate from 53.1% in 2018 to 61.4% in 2022, with further growth expected. The growing number of mobile-first and over-the-top (OTT) services in countries such as India, China, and Japan will drive CDN demand. Heavier investments by regional governments to roll out 5G and expand fiber-optic networks will only intensify the demand for effective content-delivery networks. With the growing digital content consumption and an ever-increasing demand for low-latency services, the CDN market in the APAC region is bound to be growing. The CDN market in APAC is a key market in the world and it is largely supported by the public infrastructure, and the governments are at the forefront of building this infrastructure.

Recent Developments in the Content Delivery Network Market

-

In September 2024, Akamai Technologies announced the launch of its next-generation CDN platform aimed at reducing latency and increasing streaming performance for global customers. This new platform is designed to provide faster, more secure, and more scalable content delivery solutions.

-

In September 2023, Akamai Technologies, Inc. expanded its global cloud network by launching new core compute regions in Amsterdam, Jakarta, Los Angeles, Miami, Milan, Osaka, and São Paulo, advancing its decentralized cloud strategy across Asia, Europe, North America, and Latin America.

Key Players

Service Providers / Manufacturers:

-

Akamai Technologies, Inc. (Akamai Edge, Akamai Adaptive Media Delivery)

-

Cloudflare, Inc. (Cloudflare CDN, Cloudflare Stream)

-

Amazon Web Services (AWS) (Amazon CloudFront, AWS Elemental MediaStore)

-

Google LLC (Google Cloud CDN, Google Media CDN)

-

Microsoft Corporation (Azure CDN, Azure Front Door)

-

Limelight Networks, Inc. (EdgeFunctions, Limelight Realtime Streaming)

-

Fastly, Inc. (Fastly Compute@Edge, Fastly Image Optimization)

-

CDNetworks (Cloud Security CDN, Cloud Web Acceleration)

-

Alibaba Cloud (Alibaba Global Accelerator, Alibaba CDN)

-

Imperva, Inc. (Imperva CDN, Imperva Cloud Application Protection)

Key Users of CDN Services and Products:

-

Netflix, Inc.

-

YouTube (Google LLC)

-

Amazon Prime Video (Amazon.com, Inc.)

-

Facebook, Inc. (Meta Platforms)

-

Disney+ (The Walt Disney Company)

-

Hulu, LLC

-

TikTok (ByteDance Ltd.)

-

Spotify Technology S.A.

-

Sony Interactive Entertainment (PlayStation Network)

-

Microsoft Xbox Live (Microsoft Corporation)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 21.5 billion |

| Market Size by 2032 | US$ 85.6 billion |

| CAGR | CAGR of 16.6 % from 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Offering (Solutions, Services)

• By Service (Standard CDN, Video CDN) • By Service Provider (Traditional Commercial CDN, Cloud CDN, Peer-to-Peer CDN, Telecom CDN) • By Solutions (Web Performance Optimization, Media Delivery, Cloud Security) • By End-use (Advertising, E-commerce, Media & Entertainment, Gaming, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Akamai Technologies, Inc., Cloudflare, Inc., Amazon Web Services (AWS), Google LLC, Microsoft Corporation, Limelight Networks, Inc., Fastly, Inc., CDNetworks, Alibaba Cloud, Imperva, Inc. |

| Key Drivers | • The increasing consumption of high-definition and live-streaming video content boosts the demand for CDN services, as these platforms need efficient distribution for optimal user experiences. • The growing trend of cloud adoption is enhancing CDN efficiency, particularly through the use of cloud content delivery networks, which enable faster content delivery, scalability, and improved performance for businesses across sectors. |

| Restraints | • The expensive nature of advanced CDN services limits their adoption among small and medium-sized enterprises, which could hinder market expansion. • Issues like latency and network connectivity in live video streaming present challenges to the CDN market, impacting user experience and content delivery reliability. |