Edge AI Software Market Report Scope & Overview:

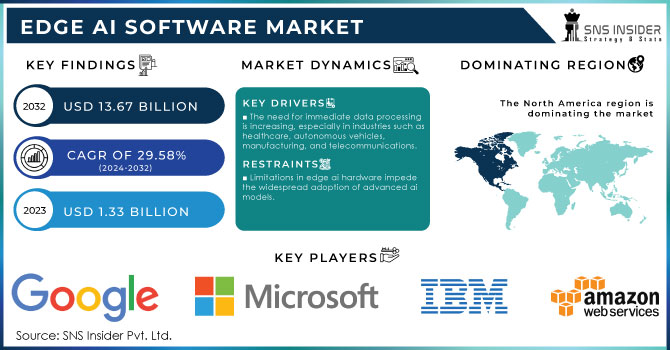

The Edge AI Software Market Size was valued at USD 1.33 Billion in 2023 and is expected to reach USD 13.67 Billion by 2032, growing at a CAGR of 29.58% over the forecast period 2024-2032.

The Edge AI software market is experiencing rapid growth, driven by the increasing demand for real-time data processing and analysis at the edge of networks. This shift enables faster decision-making, reduced latency, and improved efficiency in various applications, making it particularly appealing for industries such as manufacturing, healthcare, and smart cities. Industries such as healthcare, manufacturing, and telecommunications are increasingly adopting edge AI technologies, with 38% of medical providers already utilizing AI in diagnostics and over half of telecommunications organizations employing AI-driven chatbots to enhance productivity. Notably, Netflix alone generates USD 1 billion annually from its AI-driven personalized recommendations. In marketing and sales, AI algorithms are reported to increase leads by 50% while significantly reducing call times and overall costs. In the healthcare industry, real-time data analysis is vital for monitoring patient health and managing equipment. For instance, edge AI can facilitate remote patient monitoring by analyzing data from wearable devices directly on the device itself.

Get more information on Edge AI Software Market - Request Sample Report

The integration of artificial intelligence (AI) in healthcare presents a transformative opportunity to significantly enhance efficiency and reduce costs. By the end of 2023, AI stroke diagnosis technology will be available in every stroke center in the UK, exemplifying the rapid advancements in this field. Notably, in the NHS, 34% of AI applications are dedicated to diagnosis, highlighting its growing role in clinical settings. The financial implications are substantial, with AI projected to save USD 16 billion by minimizing medication dosing errors and contributing to a reduction of healthcare costs by USD 13 billion by 2025. This capability allows healthcare providers to receive immediate alerts about critical changes in a patient’s condition, enabling quicker interventions and better patient outcomes. Moreover, edge AI software can enhance operational efficiencies in hospitals by optimizing the use of medical devices and predicting equipment failures before they occur, thus improving patient care and reducing costs. With its ability to transform industries and improve decision-making processes, the Edge AI software market is poised for significant growth and innovation in the coming years.

Edge AI Software Market Dynamics

Drivers

-

The need for immediate data processing is increasing, especially in industries such as healthcare, autonomous vehicles, manufacturing, and telecommunications.

Edge AI processes data nearer to its origin, decreasing latency significantly in comparison to cloud-based systems. In sectors such as healthcare, fast-response applications are essential for real-time monitoring and diagnosing patient conditions, while in autonomous vehicles, immediate decision-making is crucial for ensuring safety. Edge AI eliminates the need to send data to the cloud for processing, which helps avoid delays in receiving a response. Moreover, this pattern is upheld by the fast growth of the Internet of Things (IoT), in which billions of interconnected devices necessitate quick and effective data processing at the edge rather than depending on centralized cloud infrastructure. The merging of IoT and edge AI presents a chance to enable innovative, quick-to-respond applications, driving growth in this industry.

-

The advancement of 5G technology is greatly enhancing edge AI through facilitating quicker, more dependable, and reduced-latency connectivity.

With the global expansion of 5G infrastructure, it becomes increasingly important to quickly and efficiently process and transmit data at the edge. In edge AI systems, such as autonomous driving, industrial automation, and smart cities, 5G's low-latency capabilities are essential for real-time processing. In autonomous vehicles, 5G can allow immediate communication between vehicles and infrastructure, enabling the sharing of large amounts of data for navigation, safety, and traffic control (known as V2X). Likewise, smart cities depend on edge AI enabled by 5G for traffic control, monitoring energy usage, and improving public safety. The integration of edge AI with 5G is anticipated to generate a variety of innovative applications, greatly propelling market growth.

Restraints

-

Limitations in edge ai hardware impede the widespread adoption of advanced ai models.

Even though AI-specific hardware has enhanced the computational abilities of edge devices, they still has restrictions when compared to centralized cloud-based systems. Devices at the edge, like sensors and mobile phones, frequently face restrictions in power, memory, and storage capacities, which poses challenges for running extensive AI models. Despite advancements in enhancing energy efficiency, AI chips still face a discrepancy between the capabilities of edge devices and the processing power of the cloud. Utilizing complex deep learning models or conducting extensive neural network training on edge devices remains unattainable for most. Moreover, there is still worry about energy usage, especially for electrical devices such as drones or self-operating robots, as utilizing AI algorithms may cause batteries to run out quickly. These constraints on processing power limit the range of AI models that can be utilized at the edge, impeding the wider adoption of Edge AI software.

Edge AI Software Market Segmentation Overview

By Offering

The Solutions led the market in 2023 with over 79% market share, mainly because it offers companies cutting-edge software frameworks, tools, and platforms for enabling real-time AI processing on edge devices. These solutions assist businesses in implementing AI algorithms at the point where data is created, resulting in decreased latency and enhanced operational productivity. For instance, companies such as NVIDIA provide their Jetson AI platform, enabling developers to incorporate AI capabilities on edge devices in sectors like automotive, healthcare, and retail.

The Services segment is accounted to become the fastest-growing segment during 2024-2032, fueled by the growing demand for consultation, integration, and maintenance of edge AI deployments. Businesses need skilled services to successfully incorporate, troubleshoot, and enhance their AI systems as they work towards integrating AI into their operations. For instance, Microsoft Azure offers AI Edge services for assisting companies in deploying AI models on edge devices with seamless integration, while IBM provides support services for optimizing AI workloads on edge devices in industries such as manufacturing and logistics.

By Data Type

Video and Image Recognition dominated the market in 2023 with a 32% market share, primarily because of its extensive use in various industries including security, healthcare, and retail. The need for real-time solutions in image analysis, object detection, and facial recognition has greatly increased. Amazon (AWS DeepLens) and Google (Google Cloud's Vision AI) are using video and image recognition to improve customer experiences and operational efficiency. For example, in self-driving cars, companies such as Tesla depend greatly on this technology to analyze visual information for driving and security purposes.

The audio data segment is anticipated to have the fastest CAGR during 2024-2032, due to the rising popularity of voice-controlled devices such as Amazon Alexa and Google Assistant, with Audio Data being the fastest-growing segment. The increasing need for hands-free technology in consumer electronics, automotive, and healthcare industries is driving the growth of this sector. Companies like Nuance Communications and similar companies offer AI-based audio solutions for instant speech recognition in the healthcare and automotive sectors.

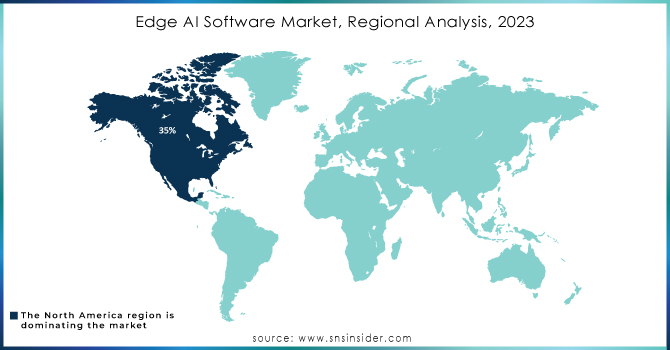

Edge AI Software Market Regional Analysis

North America dominated in 2023 with a 35% market share. The leadership of the area is influenced by the quick integration of AI technologies, solid IT infrastructure, and substantial funding from major tech companies such as IBM, Google, and Microsoft. The high level of industries like automotive, healthcare, and manufacturing boosts the need for edge AI software. Tesla uses edge AI for its autonomous vehicles, while GE Healthcare applies AI for predictive diagnostics at the edge. Moreover, efforts by the government to enhance AI integration, like the U.S. National AI Initiative, further solidify the region's leadership in this sector.

Asia-Pacific region is projected to grow at the fastest CAGR during 2024-2032, due to increased digitalization, higher use of IoT, and rising investments in smart cities, with a focus on countries such as China, Japan, and South Korea. Huawei and Samsung are working on edge AI solutions for areas like telecommunications and consumer electronics. The increasing use of edge AI in manufacturing automation and retail, especially in China, continues to drive growth in the APAC region.

Need any customization research/data on Edge AI Software Market - Enquiry Now

Key Players in Edge AI Software Market

The major key players in the Edge AI Software Market are:

-

NVIDIA Corporation (NVIDIA Jetson, DeepStream SDK)

-

Intel Corporation (OpenVINO, Movidius VPU)

-

Qualcomm Technologies (Snapdragon Neural Processing Engine, Qualcomm AI Stack)

-

Google LLC (TensorFlow Lite, Edge TPU)

-

Microsoft Corporation (Azure IoT Edge, Custom Vision AI)

-

Amazon Web Services (AWS) (AWS IoT Greengrass, AWS SageMaker Edge)

-

Xilinx, Inc. (Vitis AI, Zynq UltraScale+ MPSoC)

-

Huawei Technologies Co., Ltd. (Ascend AI Processors, MindSpore)

-

Arm Holdings (Arm Cortex-M, Arm NN SDK)

-

Texas Instruments Incorporated (TDA4VM Processors, Edge AI Studio)

-

IBM Corporation (IBM Watson IoT, IBM Maximo Visual Inspection)

-

Cisco Systems, Inc. (Cisco Edge Intelligence, Cisco Kinetic)

-

Siemens AG (MindSphere, Industrial Edge)

-

Edge Impulse, Inc. (Edge Impulse Studio, EON Tuner)

-

Rockwell Automation (FactoryTalk, Connected Services)

-

Samsung Electronics (Samsung ARTIK, SmartThings Cloud)

-

Fujitsu Limited (Fujitsu Edge AI, Fujitsu Human Centric AI Zinrai)

-

SAP SE (SAP Leonardo, SAP Edge Services)

-

Palo Alto Networks (Cortex XSOAR, Prisma Cloud)

-

C3.ai (C3 AI Suite, C3 AI Ex Machina)

Suppliers in the Edge AI Software Market:

-

Advantech Co., Ltd.

-

FogHorn Systems

-

Lantronix, Inc.

-

Edge Impulse, Inc.

-

Axiomtek Co., Ltd.

-

Azion Technologies

-

Samsara Inc.

-

Octonion SA

-

Imagimob AB

-

Kontron AG

Recent Development

-

July 2024: NVIDIA introduced its AI Workbench to simplify the process of building, testing, and deploying generative AI models across edge devices. This solution helps developers run AI models on various platforms, enabling a seamless transition from development to edge deployment.

-

March 2024: Qualcomm launched its Snapdragon Smart Platforms, which leverage AI to enhance edge computing capabilities for industries like automotive, IoT, and healthcare. The platform includes enhanced AI-based inference capabilities, designed to bring advanced Edge AI solutions to a range of devices.

-

November 2023: AWS released IoT Greengrass 3.0, an upgrade to its edge AI software for IoT devices. The new version supports enhanced machine learning models and better integration with cloud AI services, providing real-time intelligence on edge devices for industries like manufacturing and logistics.

-

February 2024: Microsoft launched an updated version of its Azure Percept platform, designed to streamline the deployment of AI models to edge devices. The update provides improved computer vision and voice recognition models, with built-in support for Azure Cognitive Services at the edge.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.33 Billion |

| Market Size by 2032 | USD 13.67 Billion |

| CAGR | CAGR of 29.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solutions, Services) • By Data Type (Audio Data, Mobile Data, Sensor Data, Biometric Data, Speech Recognition, Video and Image Recognition, Others) • By Vertical (BFSI, Government & Public Sector, Healthcare & Life Sciences, IT & Telecommunications, Energy & Utilities, Manufacturing, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Google LLC, Microsoft Corporation, Amazon Web Services (AWS), Xilinx, Inc., Huawei Technologies Co., Ltd., Arm Holdings, Texas Instruments Incorporated, IBM Corporation, Cisco Systems, Inc., Siemens AG, Edge Impulse, Inc., Rockwell Automation, Samsung Electronics, Fujitsu Limited, SAP SE, Palo Alto Networks, C3.ai |

| Key Drivers | • The need for immediate data processing is increasing, especially in industries such as healthcare, autonomous vehicles, manufacturing, and telecommunications. • The advancement of 5G technology is greatly enhancing edge AI through facilitating quicker, more dependable, and reduced-latency connectivity. |

| RESTRAINTS | • Limitations in edge ai hardware impede the widespread adoption of advanced ai models. |