Metal Finishing Chemicals Market Report Scope & Overview:

The Metal Finishing Chemicals Market Size was valued at USD 12.1 billion in 2023, and is expected to reach USD 18.8 billion by 2032, and grow at a CAGR of 5.1% over the forecast period 2024-2032.

Get More Information on Metal Finishing Chemicals Market - Request Sample Report

The Metal Finishing Chemicals Market is experiencing steady growth due to increasing demand from industries such as automotive, aerospace, electronics, and construction. Metal finishing chemicals are essential for improving the durability, appearance, and corrosion resistance of metal products. They are used in various processes such as electroplating, anodizing, and conversion coatings, which enhance the performance of metals in harsh environments. The growing emphasis on high performance and aesthetic appeal in the automotive and electronics sectors has fueled the demand for advanced metal finishing solutions. Additionally, the rising trend towards lightweight materials in aerospace is driving the need for chemical treatments that can strengthen and protect these metals without adding extra weight.

One of the key market dynamics is the increasing environmental regulations governing the use of hazardous chemicals in metal finishing processes. As governments impose stricter guidelines to reduce environmental pollution, companies are focusing on developing eco-friendly alternatives. For example, many manufacturers are shifting towards trivalent chromium plating as a safer alternative to hexavalent chromium, which has been linked to environmental and health concerns. Additionally, there is a growing demand for water-based and solvent-free solutions, particularly in Europe and North America, where environmental standards are more stringent. This shift towards green chemicals is becoming a crucial factor in the market, encouraging innovation among key players.

Recent developments in the market illustrate the competitive strategies and innovation among key industry participants. For instance, in 2023, BASF SE introduced a new line of metal finishing chemicals designed to meet the needs of the automotive sector by improving metal corrosion resistance while maintaining eco-friendly standards. Similarly, Chemetall, a BASF Group company, expanded its product line in early 2024 with a new range of anodizing chemicals that cater to aerospace manufacturers seeking to enhance the durability of aluminum components. These product launches reflect the ongoing efforts by companies to cater to industry-specific needs while adhering to stricter environmental regulations.

Another significant trend shaping the market is the growing investment in research and development to offer customized solutions for various end-use industries. Companies are investing in R&D to create specialized chemicals that enhance the functionality of metal parts used in electronics and electrical components, where precision is crucial. For instance, Element Solutions Inc. in mid-2023 unveiled a set of advanced plating chemicals that improve the conductivity and durability of metal parts used in high-tech electronic devices. This push towards customization and innovation is allowing companies to cater to the specific needs of different industries, thereby strengthening their position in the market.

Metal Finishing Chemicals Market Dynamics:

Drivers:

-

Automotive and aerospace sectors boost metal finishing chemicals market with rising demand for corrosion resistance, durability, and enhanced metal performance

The automotive and aerospace industries are key consumers of metal finishing chemicals, as these sectors rely heavily on metals such as aluminum, steel, and alloys for manufacturing various components. In the automotive industry, the focus is on creating lighter, more fuel-efficient vehicles, which has driven the demand for high-performance metal treatments. Finishing chemicals are essential to enhance the strength, corrosion resistance, and aesthetic appeal of these metal components. For instance, zinc and nickel plating are widely used in automotive parts to improve their resistance to wear and tear, especially in critical parts like engines and transmissions. Similarly, in the aerospace sector, where safety and durability are paramount, advanced anodizing and electroplating processes are employed to protect aircraft parts from extreme conditions, including high altitudes and varying weather conditions. The increasing global production of automobiles and aircraft, along with the need for extended service life of metal parts, is expected to continue driving the demand for metal finishing chemicals in the coming years.

-

Environmental regulations on hazardous chemicals are driving manufacturers to adopt eco-friendly, water-based, and solvent-free metal finishing solutions.

Environmental regulations have become stricter, particularly in regions like North America and Europe, to mitigate the adverse effects of chemical discharge from industries. Hexavalent chromium, widely used in traditional metal finishing, has been identified as a carcinogen and an environmental hazard, prompting regulatory agencies like the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) to impose stringent restrictions on its use. As a result, manufacturers are being compelled to innovate and develop safer alternatives. Trivalent chromium, for example, is gaining traction as a less toxic alternative, while other companies are exploring water-based and solvent-free chemicals to reduce the environmental footprint of their finishing processes. These eco-friendly alternatives not only comply with the evolving regulatory framework but also align with the growing corporate responsibility toward sustainability. The shift towards greener solutions is not just a regulatory necessity but also a competitive advantage, as many end-users, especially in the automotive and aerospace industries, are increasingly prioritizing suppliers that offer sustainable, eco-friendly products.

Restraint:

-

High costs of eco-friendly metal finishing chemicals limit market growth, particularly for small and medium-sized manufacturers.

One of the major challenges facing the metal finishing chemicals market is the high cost associated with advanced and eco-friendly chemical formulations. The shift towards sustainable practices, while necessary, often involves complex R&D processes to create chemicals that can deliver the same level of performance as traditional products while minimizing environmental harm. For instance, trivalent chromium, though less toxic than hexavalent chromium, requires more sophisticated processing techniques, making it more expensive to produce. Similarly, water-based and solvent-free formulations often come with higher price tags due to the use of more expensive raw materials and production technologies. These high costs can be prohibitive for small and medium-sized enterprises (SMEs) that may lack the financial resources to invest in such alternatives. Moreover, the initial setup costs for adopting new technologies or converting existing processes to accommodate eco-friendly chemicals can be a burden for manufacturers. This has created a gap in adoption rates, with larger companies able to make the switch more readily than smaller players, thereby limiting the overall market growth.

Opportunity:

-

Technological advancements in metal finishing, including nanocoatings and laser-assisted treatments, enhance performance and durability, creating new market opportunities in electronics, healthcare, and energy.

The metal finishing chemicals market is witnessing a surge in technological innovations, which are opening up new avenues for growth across various industries. One of the most promising advancements is the development of nanotechnology-based coatings, which offer superior protection and durability compared to traditional coatings. Nanocoatings can significantly improve the resistance of metal surfaces to corrosion, wear, and chemical damage while maintaining a thinner and more lightweight profile. This is particularly beneficial in industries like electronics, where the trend toward miniaturization demands high-performance coatings that do not add bulk to components. Additionally, laser-assisted surface treatment is another cutting-edge technology gaining traction, offering precise, energy-efficient metal finishing solutions. This technique allows for the targeted modification of metal surfaces, improving their adhesion properties and enhancing their overall performance. As industries like healthcare and renewable energy continue to expand, the demand for these advanced metal-finishing processes is expected to rise, creating lucrative opportunities for market players to invest in R&D and introduce innovative products that cater to the evolving needs of these sectors.

Challenge:

-

Navigating diverse regional regulations in the metal finishing chemicals market complicates standardization and compliance for manufacturers.

The metal finishing chemicals market is subject to a complex web of regulations that differ significantly from one region to another. For instance, the European Union has implemented strict regulations under its REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) framework, which imposes stringent controls on the use of hazardous chemicals, including those commonly used in metal finishing. In contrast, countries in the Asia-Pacific region, such as China and India, have relatively less stringent regulations, although these are gradually becoming more aligned with international standards. For global manufacturers, this fragmented regulatory environment presents a major challenge. Companies must invest heavily in ensuring that their products comply with the varying standards across different markets, which can lead to increased operational costs and delays in product launches. Furthermore, staying updated with the ever-evolving regulations, particularly in environmentally conscious markets like North America and Europe, requires ongoing investment in compliance and testing. Failure to meet these regulatory requirements can result in costly fines, product recalls, and reputational damage, making regulatory compliance one of the biggest hurdles for market players.

Metal Finishing Chemicals Market Segmentation Overview

By Product Type

In 2023, Plating Chemicals dominated the Metal Finishing Chemicals Market, holding an estimated market share of 45%. This segment's growth is primarily driven by the increasing demand for electroplating and electroless plating processes across various industries, particularly automotive and electronics. Plating chemicals are essential for enhancing the surface properties of metals, providing benefits such as corrosion resistance, wear resistance, and improved aesthetic appeal. For instance, the automotive sector extensively utilizes nickel and zinc plating to protect critical components from corrosion and wear, ensuring longevity and reliability. Similarly, the electronics industry relies on gold and silver plating for circuit boards and connectors to enhance conductivity and prevent oxidation. As manufacturers strive for higher performance and durability in their products, the demand for plating chemicals continues to rise, solidifying their leading position in the market.

By Process

In 2023, the Electroplating segment dominated the Metal Finishing Chemicals Market, capturing an estimated market share of 40%. This segment's prominence is largely attributed to the widespread adoption of electroplating processes in various industries, including automotive, electronics, and aerospace. Electroplating enhances the surface properties of metals by applying a thin layer of a more noble metal, thereby providing improved corrosion resistance, aesthetic appeal, and electrical conductivity. For example, in the automotive industry, components such as fasteners and decorative trims are often electroplated with chrome or nickel to prevent rust and enhance visual appeal. Similarly, the electronics sector utilizes electroplating for circuit boards and connectors to improve conductivity and protect against oxidation. As the demand for high-performance and visually appealing metal components continues to grow, the electroplating segment is expected to maintain its leading position in the market.

By Material

In 2023, the Nickel segment dominated the Metal Finishing Chemicals Market, holding an estimated market share of 30%. Nickel's widespread use in metal finishing is primarily due to its excellent corrosion resistance, durability, and aesthetic appeal, making it a preferred choice across various industries. For instance, in the automotive industry, nickel plating is commonly applied to components such as wheels, bumpers, and trim to enhance their resistance to wear and environmental damage while providing a shiny, attractive finish. Additionally, the electronics industry relies on nickel for electroplating circuit boards and connectors, where it acts as a barrier to oxidation and enhances conductivity. The versatility and performance characteristics of nickel make it a dominant material in metal finishing applications, contributing significantly to its substantial market share.

By End-Use Industry

In 2023, the Automotive & Transportation segment dominated the Metal Finishing Chemicals Market, capturing an estimated market share of 35%. This segment's dominance is primarily driven by the increasing production of vehicles and the growing demand for high-performance automotive components. Metal finishing plays a crucial role in enhancing the durability, corrosion resistance, and aesthetic appeal of automotive parts. For example, nickel and chrome plating are widely used on exterior trims, bumpers, and wheels to provide a shiny finish while protecting against rust and wear. Additionally, electroplating and other finishing processes are essential for various internal components, such as engine parts and transmission systems, where durability and performance are paramount. As the automotive industry continues to evolve with the advent of electric vehicles and advanced manufacturing techniques, the demand for specialized metal finishing solutions in this sector is expected to remain strong, reinforcing its leading position in the market.

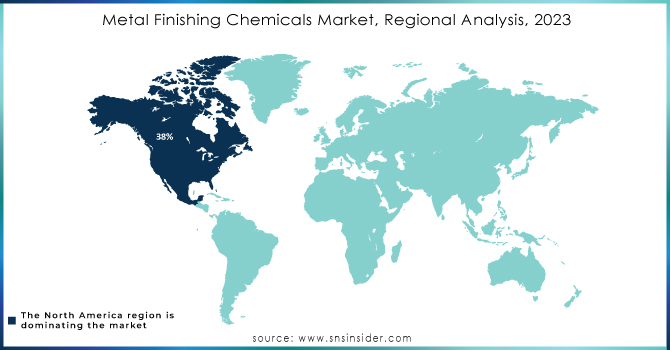

Metal Finishing Chemicals Market Regional Analysis

In 2023, North America dominated the Metal Finishing Chemicals Market, holding an estimated market share of 38%. This region's leadership can be attributed to the robust presence of key industries such as automotive, aerospace, and electronics, all of which significantly utilize metal finishing processes. The U.S. automotive industry, in particular, has been a major driver of demand for metal finishing chemicals, as manufacturers increasingly focus on enhancing the durability and aesthetic appeal of vehicles. Additionally, advancements in manufacturing technologies and strict environmental regulations in North America have led to a rising demand for eco-friendly and high-performance metal finishing solutions, further solidifying the region's dominant position in the market.

Moreover, the Asia-Pacific region emerged as the fastest-growing region in the Metal Finishing Chemicals Market in 2023, with an estimated CAGR of 6.5%. This rapid growth is primarily driven by the expanding automotive and electronics sectors in countries like China, India, and Japan. As these economies continue to industrialize, the demand for metal finishing chemicals is increasing significantly. For instance, China, being the largest automobile manufacturer in the world, is seeing a surge in vehicle production, which in turn drives the need for high-quality metal finishing solutions. Moreover, the growing focus on infrastructure development and urbanization in India is further fueling the demand for metal finishing chemicals across various applications, contributing to the Asia-Pacific region's strong growth trajectory.

Need any customization research on Metal Finishing Chemicals Market - Enquiry Now

Key Players in Metal Finishing Chemicals Market

-

A Brite Company (Brightener, Cleaner)

-

Advanced Chemical Company (Electrolytes, Surface Cleaners)

-

Atotech Deutschland GmbH (Plating Chemicals, Process Chemicals)

-

BASF SE (Plating Solutions, Surface Treatment Agents)

-

Chemetall (BASF Group) (Alodine, Oxsilan)

-

Element Solutions Inc. (Electroplating Solutions, Chemical Mechanical Polishing)

-

Houghton International Inc. (Metalworking Fluids, Cleaning Agents)

-

MacDermid Enthone (Electroplating Products, Surface Finishing Solutions)

-

Platform Specialty Products Corporation (Surface Treatment Chemicals, Plating Solutions)

-

Quaker Chemical Corporation (Metalworking Fluids, Coating Solutions)

-

Royal DSM (Surface Finishing Products, Adhesives)

-

Sakata INX Corporation (Metal Coatings, Cleaning Solutions)

-

Shandong Yanggu Huatai Chemical (Electroplating Chemicals, Surface Treatment Agents)

-

Sipchem (Chemical Solutions for Metal Finishing, Lubricants)

-

Standard Chemical & Supply Company (Cleaning Chemicals, Metal Finishing Solutions)

-

Surtec International (Surface Treatment Chemicals, Cleaning Products)

-

Tanaka Chemical Corporation (Electroplating Solutions, Cleaning Agents)

-

The Dow Chemical Company (Surface Finishing Chemicals, Cleaning Products)

-

Toyo Koatsu Co., Ltd. (Surface Treatment Chemicals, Electroplating Agents)

-

Umicore (Plating Products, Surface Finishing Chemicals)

Recent Developments

-

January 2024: MacDermid Enthone acquired surface finishing and cleaning chemical solutions from All-Star Chemical Company to enhance its offerings in the automotive and electric vehicle sectors. Glen Breault, Vice President of North America, noted the potential to integrate All-Star's proprietary solutions to improve customer service and partnerships in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.1 Billion |

| Market Size by 2032 | US$ 18.8 Billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Plating Chemicals, Cleaning Chemicals, Conversion Coating Chemicals, Others) •By Process (Pre-treatment, Electroplating, De-greasing, Polishing, Etching, Cleaning, Others) •By Material (Aluminium, Chromium, Nickel, Zinc, Gold, Silver, Copper, Others) •By End-Use Industry (Electrical & Electronics, Automotive & Transportation, Industrial Machinery, Building & Construction, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atotech Deutschland GmbH, BASF SE, Element Solutions Inc., The Dow Chemical Company, Advanced Chemical Company, Chemetall (BASF Group), Platform Specialty Products Corporation, A Brite Company, Houghton International Inc., Quaker Chemical Corporation and other key players |

| Key Drivers | • Automotive and aerospace sectors boost metal finishing chemicals market with rising demand for corrosion resistance, durability, and enhanced metal performance • Environmental regulations on hazardous chemicals are driving manufacturers to adopt eco-friendly, water-based, and solvent-free metal finishing solutions. |

| RESTRAINTS | • High costs of eco-friendly metal finishing chemicals limit market growth, particularly for small and medium-sized manufacturers. |