Metalworking Fluids Market Report Scope & Overview:

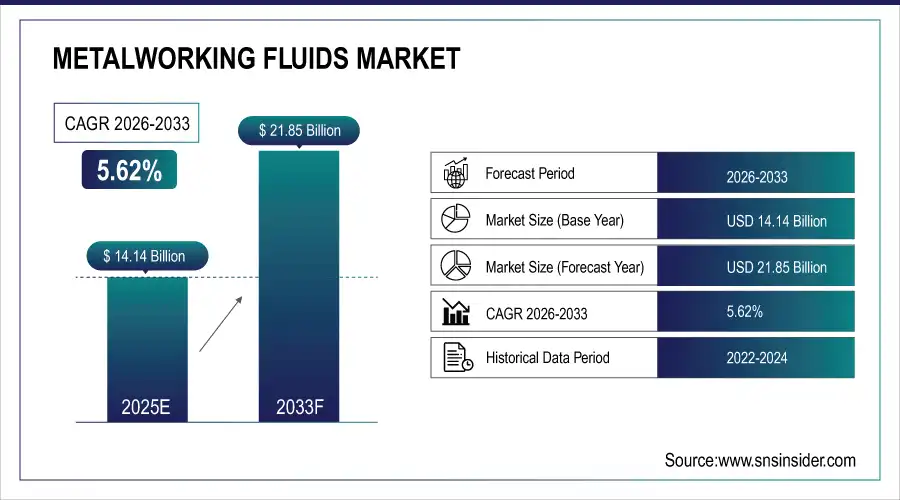

The Metalworking Fluids Market Size is valued at USD 14.14 Billion in 2025E and is projected to reach USD 21.85 Billion by 2033, growing at a CAGR of 5.62% during the forecast period 2026–2033.

The Metalworking Fluids Market analysis report offers an in-depth overview of industry performance, highlighting production volumes, usage patterns, and innovations in fluid formulations. Growing need of precision maintenance and manufacturing in various industries is expected to further augment the demand and growth for metalworking fluids.

Metalworking Fluid consumption reached 2.1 million kiloliters in 2025, driven by rising automotive production and greater use of synthetic formulations for precision machining.

Market Size and Forecast:

-

Market Size in 2025: USD 14.14 Billion

-

Market Size by 2033: USD 21.85 Billion

-

CAGR: 5.62% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Metalworking Fluids Market - Request Free Sample Report

Metalworking Fluids Market Trends:

-

Increasing adoption of synthetic and semi-synthetic fluids is aiding in improving machine performance and cutting down the maintenance downtime for various applications.

-

Growing preference for sustainable and bio-based formulations is expected across the transition to eco-friendly metalworking fluids.

-

Increasing penetration of automation and precision engineering in automotive and aerospace industries is driving demand for high-performance cooling and lubrication systems.

-

Rise in metal fabrication and heavy machinery production in emerging economies is driving big consumption.

-

Booming use of smart monitoring and fluid management systems for improved efficiency, long tool life and effective usage of the fluid is enhancing.

U.S. Metalworking Fluids Market Insights:

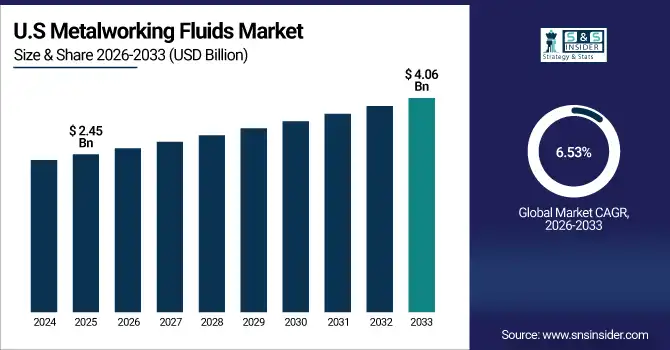

The U.S. Metalworking Fluids Market is projected to grow from USD 2.45 Billion in 2025E to USD 4.06 Billion by 2033, at a CAGR of 6.53%. Growth is led by the development of precision machining, automation and aerospace manufacturing, while steadily rising penetration in such applications as synthetic and environmentally friendly metalworking fluids.

Metalworking Fluids Market Growth Drivers:

-

Rising adoption of precision machining and automated manufacturing, driving demand for high-performance synthetic metalworking fluids.

Rising adoption of precision machining and automated manufacturing is a key driver of Metalworking Fluids Market growth. As the automotive, aerospace and heavy equipment industries progress to high-precision production so does the demand for effective cooling, lubrication and corrosion protection. State-of-the-art synthetic technology provides longer tool life, smoother operation and lower maintenance costs which also promotes consistent productivity. This paradigm shift is still redefining what we consider to be our benchmarks for quality and performance in manufacturing.

Synthetic metalworking fluid sales grew 6.8% in 2025, driven by expanding precision machining and rising automation in automotive and aerospace manufacturing.

Metalworking Fluids Market Restraints:

-

Stringent environmental regulations, disposal challenges, and rising raw material costs are constraining large-scale growth of the Metalworking Fluids Market.

Stringent environmental regulations, disposal challenges, and rising raw material costs are major restraints for the Metalworking Fluids Market. There is a daunting array of compliance for manufacturers from waste treatment, emissions to chemical use which limits production flexibility. Rising base oils and additives are also squeezing margins still higher. Furthermore, the turn to bio-based formulations may lead to an increase in production costs which in turn hinders scalability while leading industries toward a trade-off between environmental care and economic efficiency.

Metalworking Fluids Market Opportunities:

-

Growing demand for bio-based and sustainable metalworking fluids offers opportunities for innovation in formulation and performance enhancement.

Growing demand for bio-based and sustainable metalworking fluids presents a major opportunity for market expansion. The increasing demand for biodegradable, low-toxicity and high-performance formulations is on the rise even as manufacturers move toward eco-friendly operations and compliance with regulatory bodies. And producers are spending on cutting-edge additives and renewable base oils that add to the life of tools and improve cooling. This shift toward sustainability and performance enhancement enhances brand value, enables long-term partnerships, and fosters competitive differentiation in the Metalworking Fluids Market.

Bio-based metalworking fluids accounted for 24% of new product launches in 2025, driven by demand for eco-friendly formulations.

Metalworking Fluids Market Segmentation Analysis:

-

By Product Type, Soluble Oils held the largest market share of 34.72% in 2025, while Synthetic Fluids are expected to grow at the fastest CAGR of 6.43% during 2026–2033.

-

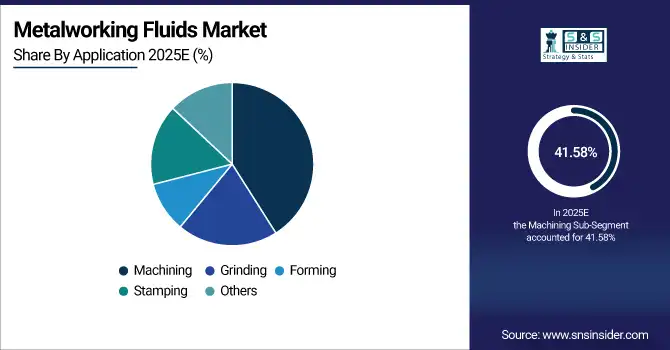

By Application, Machining dominated with a 41.58% share in 2025, while Grinding is projected to expand at the fastest CAGR of 6.12% during the forecast period.

-

By Function, Lubrication accounted for the highest market share of 37.89% in 2025, while Cooling is anticipated to record the fastest CAGR of 5.94% through 2026-2033.

-

By End-Use Industry, Automotive held the largest share of 42.36% in 2025, while Aerospace is expected to grow at the fastest CAGR of 6.57% during 2026–2033.

By Product Type, Soluble Oils Dominate While Synthetic Fluids Expand Rapidly:

The Soluble Oils segment dominated the market as they are versatile, offer cost-effective and have strong lubricating properties that are compatible with a variety of machining applications. In terms of effective cooling and rust protection, you can rely on them for both automotive work and general metal fabrication. Synthetic oils are the fastest growing segment, mainly due to their cleaner operations, longer service life and less waste. In 2025, synthetic formulations were used in over 45% of new high-precision CNC systems, highlighting their growing industrial adoption.

By Application, Machining Leads While Grinding Grows Swiftly:

Machining segment dominated the market, as it is widely utilised in cutting, drilling and milling applications in manufacturing industries. Meanwhile, the demands of high speed and high precision continue to drive the consumption of metal working fluids for cooling and lubrication performance. Grinding is the fastest growing segment yet as demand for fine and tight-tolerance finishes increase hungrier than ever in aerospace and medical parts. In 2025, grinding applications accounted for nearly 30% of total metalworking fluid R&D investments, reflecting its rising technological focus.

By Function, Lubrication Dominates While Cooling Expands Quickly:

Lubrication segment dominated the market as the products perform an essential function to lower down friction, wear and heat generation during metal cutting and forming. It results in smoother running, longer tool life and a better surface finish. Cooling is the fastest growing segment, primarily due to technological developments in high-speed milling and use of light alloys producing higher thermal loads. In 2025, cooling functions contributed to over 35% of new performance fluid innovations, emphasizing their growing industrial significance.

By End-Use Industry, Automotive Dominates While Aerospace Accelerates Rapidly:

Automotive segment dominated the market due to heavy demand for high-quality machined and finished engine parts, gears, and structural components being produced in bulk. Ongoing movement toward electric vehicle (EV) production ensures robust demand for materials that are lightweight and easily processed. Aerospace segment is the fastest-growing segment, fueled by increasing aircraft components production & advanced materials' machining requirement. In 2025, aerospace applications utilized over 18% more synthetic fluids compared to 2024, signalling accelerated growth and specialization.

Metalworking Fluids Market Regional Analysis:

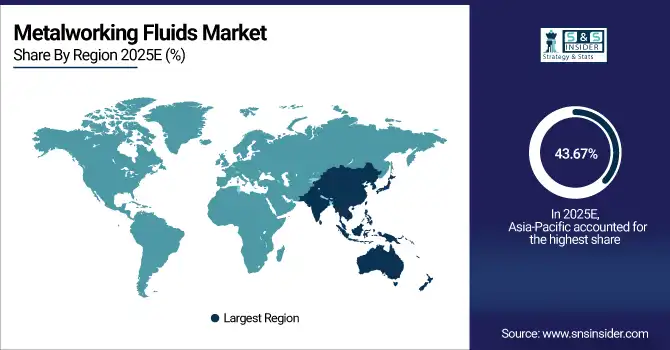

Asia-Pacific Metalworking Fluids Market Insights:

The Asia-Pacific Metalworking Fluids Market dominates globally with a 43.67% market share in 2025, driven by rapid industrialization and large-scale manufacturing in China, India, Japan, and South Korea. Rising automotive and construction activity, and growing heavy machineries industry drive fluids demand. Rising investment in precision engineering and automation drives demand for high-end synthetic and semi-synthetic fluids. Growing infrastructure construction and export-based manufacturing, are further cementing Asia Pacific’s dominance in the metalworking fluids market.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Metalworking Fluids Market Insights:

China Metalworking Fluids Market is driven by expanding automotive and manufacturing industries, rapid industrial automation, and growing precision engineering activities. Increasing investments in high-performance synthetic fluids and sustainable formulations support efficiency and compliance. Strong infrastructure growth and export-oriented production make China a key contributor to Asia-Pacific’s leading metalworking fluids market.

North America Metalworking Fluids Market Insights:

North America is the fastest-growing region in the Metalworking Fluids Market, projected to expand at a CAGR of 6.66% during 2026–2033. The growth is due to the increasing adoption of advanced machining, automation and aerospace manufacturing. Growing demand for synthetic and bio-based fluids promote sustainability and performance of the equipment. A dedication to heavy investment in industrial modernization, combined with high vehicle production and advancements in fluid handling systems are further solidifying North America’s position and reputation on the market.

U.S. Metalworking Fluids Market Insights:

U.S. Metalworking Fluids Market growth is stimulated by growing automotive and aerospace production, increasing automation, and escalating demand for bio-based and synthetic fluids. Demand for high-performance, environmentally friendly products and precision machining technologies is driving growth, while innovation takes fluid management and maintenance efficiency to the next level in this crowded industrial field in the country.

Europe Metalworking Fluids Market Insights:

The Europe Metalworking Fluids Market is showing a positive trend of growth owing to rise in the automotive, aerospace and various industrial manufacturing industries. There is stronger focus on sustainability, worker safety and formulations that are environmentally compliant, which is driving the change in product development. Germany, UK, France and Italy are some of the major contributors owing to growing penetration in synthetic and water-based fluids which facilitates production efficiency along with precision machining for energy saving across modernized manufacturing set-ups.

Germany Metalworking Fluids Market Insights:

Germany is one of the key markets for Metalworking Fluids, and is backed by robust automotive, machinery and engineering sector. Growth is based on increasing precision manufacturing, sustainability efforts and the transition to synthetic and bio-based fluids. Innovation, productivity and modern machine technologies further cement Germany’s leadership in industrial production within Europe.

Latin America Metalworking Fluids Market Insights:

The Latin America Metalworking Fluids Market is growing with expanding automotive, construction, and manufacturing industries. Demand is driven by increasing levels of industrialization, infrastructure construction, and local production in Brazil, Mexico, and Argentina. Rising utilization of synthetic and semi-synthetic fluids, along with efforts to enhance productivity and sustainability will drive the regional market trends.

Middle East and Africa Metalworking Fluids Market Insights:

The Middle East & Africa Metalworking Fluids Market is expanding with growth in automotive, construction, and oil & gas industries. Rising industrial projects, infrastructure investments, and manufacturing diversification drive demand. Increasing adoption of synthetic fluids, technological upgrades, and sustainability initiatives are further supporting market development across key economies such as Saudi Arabia, UAE, and South Africa.

Metalworking Fluids Market Competitive Landscape:

Exxon Mobil Corporation, headquartered in the U.S., is a leader in lubricants and metalworking fluids production. Underpinned by extensive refining capacity, cutting-edge R&D and a formidable international marketing & logistics network. The company Mobilcut and Mobilmet ranges deliver superior performance, extended tool and component life, ease of use and low oil mist propensity for all machining operations. With this commitment to synthetic fluids innovation, sustainability and partnerships with industrial manufacturers, ExxonMobil is positioning itself as a leader in the metalworking fluids sector for decades to come.

-

In September 2025, Exxon Mobil unveiled its new line of synthetic metalworking fluids designed for high-speed machining operations. These fluids deliver enhanced cooling and lubrication performance, catering to the growing demand for advanced metal removal applications.

Quaker Houghton Corporation, based in the U.S., stands as a powerhouse in industrial process fluids and metalworking solutions. Created by the combination of Quaker Chemical and Houghton International, the company boasts a unique expertise and suite of innovative analytical tools with cutting-edge chemistry. Its leadership is driven by inventive fluid chemistry, customised service models and digital monitoring capabilities. The strong presence in automotive, aerospace and heavy industrial manufacturing further affirms Quaker Houghton as a reliable partner for performance and sustainability.

-

In April 2025, Quaker Houghton launched QH FLUID INTELLIGENCE™ 2.0, featuring AI-driven analytics for real-time fluid monitoring and sustainability tracking. The upgrade boosts productivity, minimizes waste, and reinforces the company’s leadership in smart metalworking fluid management.

Fuchs SE, headquartered in Mannheim, Germany, is Europe’s largest independent lubricant manufacturer with a leading role in metalworking fluids. Its core competences are tailored formulations, a wide range of products and reactivity to local market requirements. By means of its Fuchs2025 strategy, the company is focusing on sustainability, digitalization and innovation. Customer focused R&D, manufacturing base and a commitment to greener technologies ensure the continued dominance of Fuchs SE in the world’s metalworking fluids market place, synonymous with accuracy and reliability.

-

In August 2025, Fuchs introduced the RENOLIN FECC 10 SYN immersion cooling fluid, certified under UL 2417 and engineered for data-centres and digital infrastructure applications, marking its expansion from traditional machining fluids into new industrial cooling domains.

Metalworking Fluids Market Key Players:

Some of the Metalworking Fluids Market Companies are:

-

Exxon Mobil Corporation

-

Quaker Houghton Corporation

-

Fuchs SE

-

TotalEnergies SE

-

BP p.l.c.

-

The Lubrizol Corporation

-

Henkel AG & Co. KGaA

-

Chevron Corporation

-

Idemitsu Kosan Co., Ltd.

-

PJSC LUKOIL

-

China Petroleum & Chemical Corporation

-

Blaser Swisslube AG

-

Master Fluid Solutions

-

CIMCOOL Fluid Technology LLC

-

Kuwait Petroleum Corporation

-

Italmatch Chemicals S.p.A.

-

Apar Industries Ltd.

-

Yushiro Chemical Industry Co., Ltd.

-

MORESCO Corporation

-

Petrofer Chemie

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 14.14 Billion |

| Market Size by 2033 | USD 21.85 Billion |

| CAGR | CAGR of 5.62% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Straight Oils, Soluble Oils, Semi-Synthetic Fluids, Synthetic Fluids, Others) • By Application (Machining, Grinding, Forming, Stamping, Others) • By Function (Cooling, Lubrication, Corrosion Protection, Chip Removal, Others) • By End-Use Industry (Automotive, Aerospace, Metal Fabrication, Heavy Equipment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Exxon Mobil Corporation, Quaker Houghton Corporation, Fuchs SE, TotalEnergies SE, BP p.l.c., The Lubrizol Corporation, Henkel AG & Co. KGaA, Chevron Corporation, Idemitsu Kosan Co., Ltd., PJSC LUKOIL, China Petroleum & Chemical Corporation, Blaser Swisslube AG, Master Fluid Solutions, CIMCOOL Fluid Technology LLC, Kuwait Petroleum Corporation, Italmatch Chemicals S.p.A., Apar Industries Ltd., Yushiro Chemical Industry Co., Ltd., MORESCO Corporation, Petrofer Chemie. |