Copper Fungicides Market Report Scope & Overview:

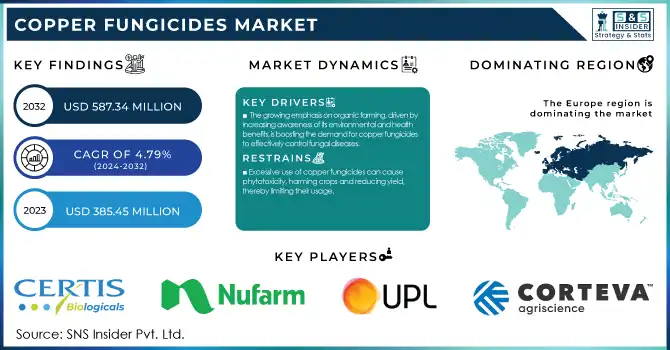

The Copper Fungicides Market size was valued at USD 385.45 million in 2023. It is expected to grow to USD 587.34 million by 2032 and grow at a CAGR of 4.79% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Copper Fungicides Market - Request Sample Report

The Copper Fungicides Market is witnessing significant growth, driven by increasing demand for sustainable agricultural practices and the rising prevalence of fungal diseases in crops. Copper fungicides are widely used in the agricultural industry to control a broad spectrum of fungal and bacterial diseases in fruits, vegetables, grains, and ornamental plants. Their effectiveness, combined with their ability to enhance plant health and yield, makes them an indispensable tool for farmers globally. One of the key trends in the market is the growing adoption of organic farming. With consumers increasingly prioritizing chemical-free and sustainably produced food, organic-certified copper fungicides are gaining traction. Additionally, advancements in formulation technologies, such as the development of nanoparticle-based copper fungicides, are improving efficacy while reducing environmental impact. Another trend is the rise in integrated pest management (IPM) programs, which promote the judicious use of copper fungicides alongside other biological and mechanical methods to minimize residue levels and resistance risks.

The market is also being bolstered by government support and subsidies for agricultural inputs, particularly in developing regions, to improve food security and crop resilience. Furthermore, the increasing awareness about crop protection in regions susceptible to climatic fluctuations, such as Asia-Pacific and Latin America, is driving demand. According to research, global agricultural land under copper fungicide application has increased by over 15% in the last five years, highlighting the growing reliance on these products. Copper-based solutions account for approximately 25% of all fungicides used in fruit cultivation, emphasizing their importance in high-value crops. Leading companies are also investing in R&D to create environmentally friendly formulations that comply with stringent regulatory standards, ensuring continued market growth.

MARKET DYNAMICS

DRIVERS

- The growing emphasis on organic farming, driven by increasing awareness of its environmental and health benefits, is boosting the demand for copper fungicides to effectively control fungal diseases.

The rising demand for organic farming practices is a significant growth driver for the copper fungicides market. With increasing awareness among farmers and consumers about the environmental and health benefits of organic agriculture, there has been a notable shift towards sustainable farming practices. Copper fungicides, widely accepted in organic farming, play a vital role in controlling fungal diseases such as downy mildew and leaf spots, thereby ensuring crop health and productivity. This demand is further bolstered by the growing emphasis on reducing synthetic chemical usage in agriculture due to their adverse effects on human health and the environment.

Key market trends include advancements in formulation technologies, such as nanoparticle-based copper fungicides and slow-release formulations, which improve efficacy while minimizing environmental impact. Additionally, regulatory support for organic farming in regions like Europe and North America has amplified the adoption of copper fungicides. Emerging economies, where agriculture remains a primary industry, are also witnessing increasing usage as farmers adopt organic practices to meet global export standards.

RESTRAINT

- Excessive use of copper fungicides can cause phytotoxicity, harming crops and reducing yield, thereby limiting their usage.

Excessive application of copper fungicides can cause phytotoxicity, a condition where high levels of copper negatively impact plants. This often manifests as leaf discoloration, wilting, or stunted growth, ultimately reducing crop quality and yield. While copper fungicides are effective in controlling fungal diseases, improper dosage or frequent usage can harm sensitive crops, making farmers cautious about their application. The risk of phytotoxicity is particularly high in humid or wet conditions, where copper residue may accumulate on plant surfaces. This limitation not only affects their effectiveness but also deters widespread adoption, especially among farmers unfamiliar with precise application techniques. As a result, balancing efficacy with safety becomes a critical challenge for users. Manufacturers are addressing this concern by developing advanced formulations with controlled release mechanisms, but the issue remains a significant restraint in the adoption of copper fungicides across the agricultural sector.

MARKET SEGMENTATION

By Product

Copper Oxychloride segment dominated with the market share over 30% in 2023. This product is highly valued for its broad-spectrum fungicidal properties, making it effective against a range of fungal diseases that affect crops, particularly in agriculture. Its reliability, affordability, and versatility have led to its widespread adoption by farmers globally. Copper Oxychloride is especially favored for controlling fungal issues in fruits, vegetables, and ornamental plants. Its long history of use and proven efficacy in preventing crop damage contribute significantly to its dominant position in the market.

By Application

Fruit & Vegetables segment dominated with the market share over 40% in 2023. This is primarily due to the essential role copper fungicides play in protecting fruit and vegetable crops from a wide range of fungal diseases, which can significantly impact yield and quality. The increasing global demand for high-quality produce and the need to maintain crop health in diverse environmental conditions have driven widespread adoption of copper-based fungicides. Their effectiveness, affordability, and regulatory acceptance contribute to their extensive use in both conventional and organic farming, making this segment the leading one in the market.

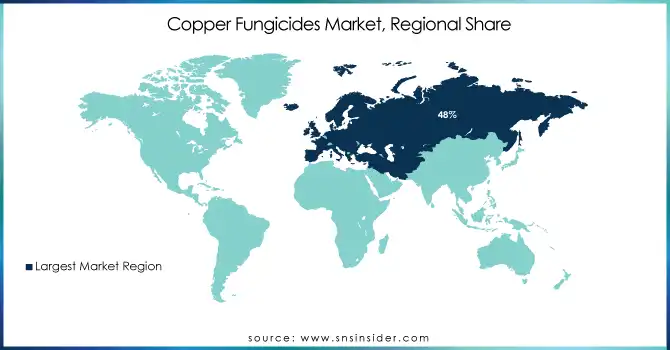

KEY REGIONAL ANALYSIS

Europe region dominated with the market share over 48% in 2023, due to its well-established and highly productive agricultural sector. The region benefits from advanced farming techniques, which require effective crop protection solutions. Copper fungicides are widely used to manage plant diseases in a variety of crops, contributing to higher agricultural yields. The presence of key market players in Europe also strengthens its position, as these companies have developed and commercialized copper-based fungicides that adhere to strict regulatory standards. Furthermore, European governments support the use of copper fungicides as part of integrated pest management programs, promoting sustainable agriculture practices. The European Union’s regulatory framework ensures that copper-based products are used responsibly, balancing environmental concerns with the need for crop protection.

The Asia-Pacific region is experiencing the fastest growth in the copper fungicides market, primarily driven by the rising demand for crop protection solutions. Modern farming practices are increasingly being adopted, particularly in countries like China and India, where agricultural activities are expanding rapidly. This growth is further fueled by the need for effective pest and disease management to ensure higher crop yields. Additionally, the region's industrialization and increasing awareness of sustainable agricultural practices are boosting the usage of copper fungicides.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players of the Copper Fungicides Market

- Corteva (Kocide 3000, Kocide 2000)

- UPL Ltd. India (Cuprofix, Unizeb)

- Nufarm (Champ DP, Cuprofix Ultra 40)

- Certis USA LLC (Cueva Fungicide Concentrate, Basic Copper 53)

- Albaugh LLC (MasterCop, Copper-Count-N)

- Bayer AG (Flint, Copper Shield)

- Isagro S.p.A. (CUPROXAT SC, PESTICUP)

- ADAMA (Cuproxat, Nordox 75 WG)

- Quimetal (Nordox 75 WG, Copper Nordox Super)

- Cosaco (Cupravit, Cuproxat)

- Cinkarna Celje d.d. (Copper-based fungicides)

- Nordox AS (Nordox 75 WG, Nordox Super 50)

- FMC Corporation (Copper Fungicide 53% WP, Rovral)

- BASF SE (Cueva Liquid Copper Fungicide, Polyram DF)

- Sumitomo Chemical (Copper-based solutions like Bordeaux Mix)

- Syngenta AG (Bravo Weather Stik, Ridomil Gold Copper)

- American Vanguard Corporation (Cuprofix Disperss, Liquid Copper Fungicide)

- Gowan Company (Badge SC, ManKocide)

- Limin Chemical Co. Ltd. (Copper Hydroxide WP, Copper Oxychloride WP)

- Sharda Cropchem Limited (Copper Sulphate Fungicide, Copper Oxychloride Fungicide)

Suppliers for (Advanced crop protection and seed technology) on Copper Fungicides Market

- BASF SE

- Syngenta AG

- FMC Corporation

- UPL Limited

- Bayer AG

- Monsanto Company

- Adama Agricultural Solutions

- Sumitomo Chemical Co., Ltd.

- Nufarm Limited

- Coromandel International Limited

RECENT DEVELOPMENT

14 November 2024: Corteva Agriscience Launches Two New Preemergence Soybean Herbicides for 2025, Corteva Agriscience introduces Kyber Pro and Sonic Boom herbicides, designed to offer multiple modes of action and extended residual activity. These products will help soybean growers combat resistant weeds like waterhemp and Palmer amaranth, ensuring optimal growth and yield potential.

In March 2023: Corteva Agriscience revealed the commercial launch of Adavel Active, an innovative fungicide that has recently been granted product registrations in Australia, Canada, and South Korea. Adavel Active is notable for its unique mode of action, offering protection against a wide range of diseases that can have a major impact on crop yields.

19 March 2024: Certis Biologicals acquired the Howler and Theia fungicides from AgBiome, enhancing its portfolio of biological pest control solutions. These products provide effective and sustainable options for high-value crops, further complementing Certis' current range of biofungicides.

| Report Attributes | Details |

| Market Size in 2023 | USD 385.45 million |

| Market Size by 2032 | USD 587.34 million |

| CAGR | CAGR of 4.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chemistry (Copper Hydroxide, Copper Oxychloride, Copper Sulphate, Cuprous Oxide, and Others) • By Application (Fruits & Vegetables, Oilseeds & Pulses, Cereals & Grains, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Corteva, UPL Ltd. India, Nufarm, Certis USA LLC, Albaugh LLC, Bayer AG, Isagro S.p.A., ADAMA, Quimetal, Cosaco, Cinkarna Celje d.d., Nordox AS, FMC Corporation, BASF SE, Sumitomo Chemical, Syngenta AG, American Vanguard Corporation, Gowan Company, Limin Chemical Co. Ltd., Sharda Cropchem Limited. |

| Key Drivers | • The growing emphasis on organic farming, driven by increasing awareness of its environmental and health benefits, is boosting the demand for copper fungicides to effectively control fungal diseases. |

| RESTRAINTS | • Excessive use of copper fungicides can cause phytotoxicity, harming crops and reducing yield, thereby limiting their usage. |