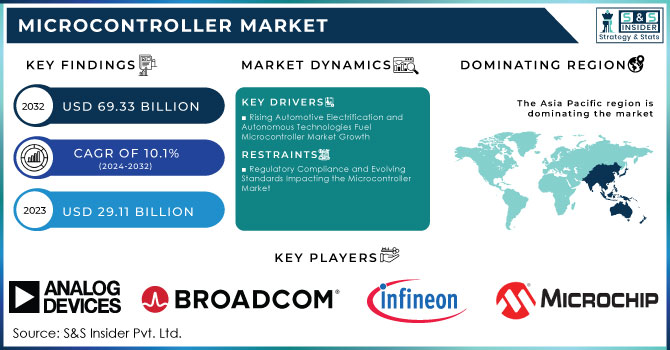

MICROCONTROLLER MARKET KEY INSIGHTS:

To Get More Information on Microcontroller Market - Request Sample Report

The Microcontroller Market Size was valued at USD 29.11 Billion in 2023 and is expected to reach USD 69.33 Billion by 2032 and grow at a CAGR of 10.1% over the forecast period 2024-2032.

This growth in the Microcontroller Market has been fueled by large demand for automation, rapid development in consumer electronics, rapidly increasing adoption of electric vehicles, and continued proliferation of IoT applications. These have become an indispensable component in the use of a very wide array of applications automotive systems to industrial automation, medical devices, and smart home products. In summary, the microcontroller market is projected to grow robustly in the coming years as a result of technological innovations directed toward improved performance as well as cost-cutting.

Automotive is another business sector sustaining the growth of the MCU market as most modern automobiles use MCU extensively in many applications. These applications include ECUs, ADAS, infotainment, and power management, all of which require increasingly complex electronics. In addition, an increasing adoption of EVs and hybrid vehicles increased the demand for high-performance MCUs. For instance, such microcontrollers manage even the electric vehicle's systems such as the battery management system, power distribution, and the regenerative braking system to further optimize energy usage with higher efficiency in the vehicle. The International Energy Agency reported last year that sales of electric and hybrid cars went beyond 10 million units, and selling electric cars is expected to maintain the same speed well into next year. Over 2.3 million electric cars were sold in the first quarter of 2023. Sales rose by 25% over the same period as last year. At the moment, we estimate 14 million in sales for the end of 2023. This would translate into a year-over-year increase of 35% with new purchases accelerating during the second half of this year. Then we might see electric cars reaching 18% of the total car sales across a full calendar year. National policies and incentives will help boost sales, while a return to the significantly high oil prices seen last year will continue to pressure the prospective buyer.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Automotive Electrification and Autonomous Technologies Fuel Microcontroller Market Growth

The automobile industry is considered one of the prime drivers in the MCU market, and more advanced vehicles tend to rely heavily on MCUs for main functionalities such as control of engines, power steering, braking systems, in-car infotainment, and ADAS. Furthermore, advancing automotive technology is also driving demand for higher-end automotive-grade MCUs about the shift toward EVs and autonomous driving. With 14.3 million sales estimated for 2023, up 36% from 2022, and of these 8 million will be BEVs and 2.6 million PHEVs, according to EV-volumes.com, which is a step up from previous years that is caused by government regulations and increased customer demand for 'green' transportation. The boom in the manufacture of EVs has created demand many times over for MCUs controlling power distribution, battery management, and energy optimization.

Further, self-driving and ADAS require high-performance microcontrollers because it need to process real-time data coming from hundreds of sensors, cameras, and radar systems. Increasing stringent safety and emissions laws and regulations imposed by governments worldwide are further promoting the use of high-performance MCUs in automobiles. For instance, The Fit for 55 package contains a proposal for a review of the renewable energy directive. Increase the current EU-level target of at least 32% of renewable energy sources in the overall energy mix by at least 40% in 2030, and introduce or enhance sectorial sub-targets and measures across all sectors with a special focus on sectors where progress with integrating renewables has been slower to date: transport, buildings, and industry.

RESTRAIN:

-

Regulatory Compliance and Evolving Standards Impacting the Microcontroller Market

This requirement to meet regulation will, therefore influence the major areas which are automotive, healthcare, and industrial automation. Automotive the standard ISO 26262, covers road vehicles functional safety by the automotive industry. Strict requirements for functional safety are especially critical, as EVs are expected to constitute nearly 18% of global car sales by 2030, according to the International Energy Agency. In 2023, about 60% of all newly registered electric cars were produced in the People's Republic of China, while a quarter were registered in Europe and 10 % in the United States corresponding to almost 95% of electric car sales worldwide combined. The concentration of electric car sales also leads to an increasingly concentrated global electric car stock. This means that the microcontrollers in use in medical devices should be FDA-approved in the United States and CE-marked in Europe for them to be deployed in health applications.

In healthcare, microcontrollers used in medical devices must meet regulatory standards such as FDA approval in the U.S. and CE marking in Europe. Thus, market growth will leave more burden on the MCU manufacturer's end for following the safety standards. The IEC 61508 Industrial safety standards are now mandatory for a lot of industrial applications such as pumps, switches programmable logic controllers, etc. This microchip has a 32-bit microcontroller, and it comes with a Certified SIL 2/3 library with the possibility to attain the desired safety level for the end application. Higher safety levels can also be attained through redundancy, such as SIL 3 with a dual-channel system (two MCUs).

KEY SEGMENTATION ANALYSIS

BY APPLICATION TYPE

Consumer Electronics & Telecom was the dominant market segment of MCU in 2023, generating 24% of the market share. It has contributed largely to this fast growth in smart devices, wearables, and telecommunications infrastructure, which require much more sophisticated MCUs for even efficient processing, connectivity, and energy management. High-performance microcontrollers continue to stay on the high-end demand list, with increasing consumer demand for advanced features in their smartphones, tablets, and smart home devices. It is also due to the Rising Deployment Of 5G, with investment in infrastructure upgradation by telecom providers relying on MCUs for network management and ensuring reliable communication. The survey indicates a good level of progression toward making affordable 5G data plans and devices more accessible.

The Automotive Microcontroller Market size will likely grow at a CAGR of 12.73% during the forecast period. Microcontrollers are electronic elements that are applied widely in the automotive industry, among others, as a means of managing and controlling various systems within vehicles. They refer to compact low-power integrated circuits, often used for direct real-time data processing and control in embedded systems. Automotive applications of microcontrollers include Advanced Driver Assistance Systems, Anti-lock Braking Systems, airbag control, entertainment systems, and control of gearbox.

BY INSTRUCTION SET TYPE

The RISC segment dominated this microcontroller market with a revenue share of 72% in 2023. RISC architecture employs a reduced and optimized set of instructions for which it is best suited to high-end applications such as image and video processing and telecommunications. For Instance, the ARM released its Cortex-M85 microcontroller in 2023 with enhanced processing and security capabilities.

The Complex Instruction Set Computer (CISC) segment is anticipated to experience the largest CAGR during the forecast period. It reduces programming complexity as many complex instructions are offered by CISC architecture, making it apt for applications that require rich instruction sets, such as high-performance and advanced computing systems. For example, Intel introduced its Core i9-13900K in 2023 which was a CISC microprocessor at its most powerful, run with high-performance tasks. On the other hand, AMD has announced its Ryzen 7000 series, which will also rely on CISC architecture that would improve multi-core performance and energy efficiency.

REGIONAL ANALYSIS

Asia Pacific was the market dominated in 2023, primarily led by the increasing investments in consumer electronics and automotive applications across the region. For instance, in 2023, NXP Semiconductors launched its S32K microcontroller series with specific features designed for automotive applications, emphasizing advanced safety and connectivity features. This launch aligns with the increasing regional demand for vehicle electrification and smart technologies. Another one is the industrial application microcontroller by Renesas Electronics called the RX72N microcontroller with its performance increased to 50% based on the foregoing model. Per the Asian Development Bank, "the semiconductor market is expected to reach USD 300 billion by 2025". In addition, different governments' policies, such as Japan's government's Semiconductor Strategy, boost domestic semiconductor production. Simultaneously, this encourages foreign investment to make Asia Pacific's position strong in the growth and development of the global microcontroller market.

North America is the second largest market and is expected to grow at a significant CAGR in the forecast period. The main driver of this growth, however, is the increasing demand for intelligent and connected devices. This region is a leader in IoT technology development, where everyday devices are connected to the Internet for them to communicate with and share data. In other words, this trend is fueling the growth of the IoT microcontroller market as day by day the requirement for a more feature-rich microcontroller in tandem with sensing and low-power modes is growing.

Do You Need any Customization Research on Microcontroller Market - Inquire Now

Key Players

Some of the major players in the Microcontroller Market are:

-

Analog Devices Inc. (ADuC7026, ADuCM360)

-

Broadcom Inc. (BCM2837, BCM4908)

-

Infineon Technologies AG (AURIX TC3xx, XMC1000)

-

Intel Corporation (Intel Quark SE, Intel Atom E3900 Series)

-

Microchip Technology Inc. (PIC16F877A, SAM D21)

-

NXP Semiconductors N.V. (LPC1768, Kinetis K64)

-

Onsemi (RSL10, NCP81239)

-

ROHM Co., Ltd. (BD5xxx Series, BH1750FVI)

-

Texas Instruments Incorporated (MSP430G2553, Tiva C Series TM4C123G)

-

Toshiba Corporation (TMPM3H Series, TLCS-900 Series)

-

Fujitsu (MB9BFxx Series, FR Series)

-

Renesas Electronics Corporation (RX72N, RL78/G1D)

-

STMicroelectronics (STM32F4 Series, STM8S Series)

-

TE Connectivity (TEMPERATURE Sensor ICs, Microcontroller Interface Modules)

-

Yamaichi Electronics Co., Ltd. (Y-Circular Connector Series, Y-Spring Connector Series)

-

Zilog, Inc. (Z8 Encore, eZ8 Microcontrollers)

-

Cypress Semiconductor Corporation (PSoC 4, PSoC 6)

-

Maxim Integrated (MAX32630, MAXQ3100)

-

Nuvoton Technology Corporation (N76E003AT20, M051 Series)

-

Silicon Labs (EFM32 Gecko, EFR32 Mighty Gecko)

RECENT TRENDS

-

In May 2024, Infineon Technologies issued a high-voltage microcontroller PSoC 4 HVPA 144K specifically designed for battery management systems for electric vehicles (EVs). With this newcomer to the family of their PSoC microcontrollers, high voltage above 400V, as well as low voltage 12V/48V battery systems, can be monitored and managed. The development appears consistent with growing demand from the EV segment for efficient battery management solutions.

-

In May 2023, STMicroelectronics introduced a second-generation STM32 MPU, an improved architecture within an existing ecosystem intended to advance the needed elevated performance and security for industrial and IoT edge applications. Key features of the STM32MP2 Series devices included 64-bit Arm Cortex-A35 cores operating at 1.5GHz and a 400MHz Cortex-M33 embedded core for real-time processing, thus providing a powerful and efficient solution.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 29.11 Billion |

| Market Size by 2032 | US$ 69.33 Billion |

| CAGR | CAGR of 10.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application Type (Automotive, Consumer Electronics & Telecom, Industrial, Embedded Systems (Hardware, Software) Medical Devices, Aerospace & Defence, Others) • By Product type (8-Bit, 16-Bit, 32-Bit, 64-Bit) • By Type (Peripheral Interface Controller (PIC), ARM, 8051, TriCore, Others) • By Architecture Type (Harvard Architecture, Von Neumann Architecture, and Others) • By Instruction Set Type (Reduced Instruction Set Computer (RISC), Complex Instruction Set Computer (CISC)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Analog Devices Inc., Broadcom Inc., Infineon Technologies AG, Intel Corporation, Microchip Technology Inc., NXP Semiconductors N.V., Onsemi, ROHM Co., Ltd., Texas Instruments Incorporated, Toshiba Corporation, Fujitsu, Renesas Electronics Corporation, STMicroelectronics, TE Connectivity, Yamaichi Electronics Co., Ltd., Zilog, Inc., Cypress Semiconductor Corporation, Maxim Integrated, Nuvoton Technology Corporation, Silicon Labs |

| Key Drivers | • Rising Automotive Electrification and Autonomous Technologies Fuel Microcontroller Market Growth |

| Restraints | • Regulatory Compliance and Evolving Standards Impacting the Microcontroller Market |