Middle Office Outsourcing Market Report Scope & Overview:

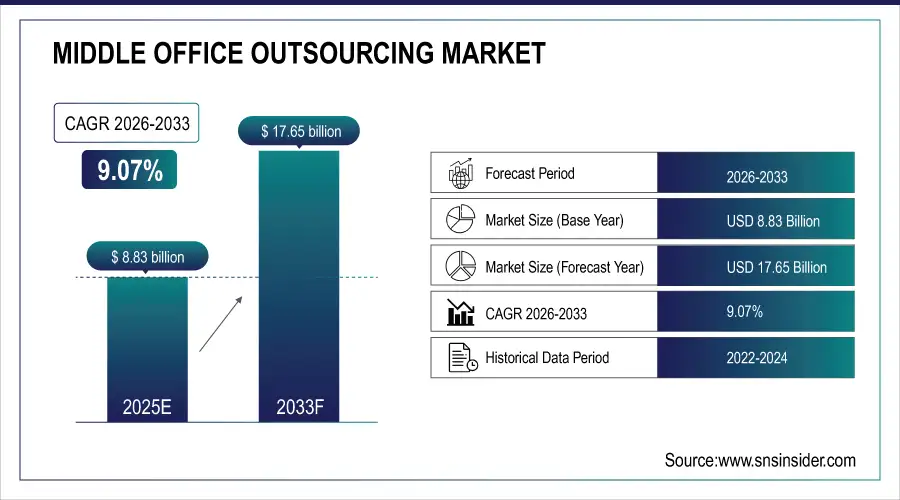

The Middle Office Outsourcing Market Size is valued at USD 8.83 Billion in 2025E and is projected to reach USD 17.65 Billion by 2033, growing at a CAGR of 9.07% during the forecast period 2026–2033.

The Middle Office Outsourcing Market analysis report provides an in-depth assessment of key services, deployment models, and end-user dynamics. Growing complexity in financial operations and demand for cost efficiency are driving adoption of outsourcing solutions, enhancing operational agility and compliance across financial institutions.

Middle office outsourcing contracts reached 1,420 globally in 2025, driven by rising demand for cost efficiency and cloud-based financial operations.

Market Size and Forecast:

-

Market Size in 2025: USD 8.83 Billion

-

Market Size by 2033: USD 17.65 Billion

-

CAGR: 9.07% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Middle Office Outsourcing Market - Request Free Sample Report

Middle Office Outsourcing Market Trends:

-

Firms are increasingly outsourcing middle office functions to enhance operational agility and focus on core investment strategies.

-

Rapid adoption of AI and automation tools is streamlining portfolio reconciliation, risk management, and compliance processes.

-

Cloud-based middle office platforms are gaining traction for scalability, data security, and real-time analytics.

-

Rising regulatory complexity is fueling demand for specialized third-party compliance and reporting services.

-

Strategic partnerships between financial institutions and outsourcing providers are expanding integrated front-to-back-office solutions.

-

Data-driven decision-making and predictive analytics are transforming performance reporting and portfolio optimization.

U.S. Middle Office Outsourcing Market Insights:

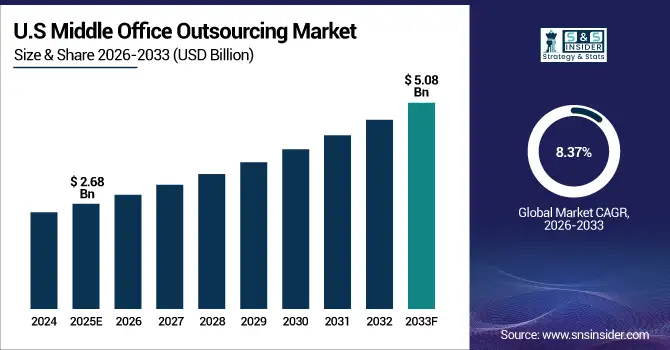

The U.S. Middle Office Outsourcing Market is projected to grow from USD 2.68 Billion in 2025E to USD 5.08 Billion by 2033, at a CAGR of 8.37%. Growth is driven by expanding financial services digitization, rising adoption of AI-based automation, and increasing regulatory compliance demands among leading asset management and investment firms.

Middle Office Outsourcing Market Growth Drivers:

-

Growing complexity of financial operations driving institutions to outsource for enhanced efficiency, compliance, and cost optimization.

Growing complexity of financial operations is a key driver of the Middle Office Outsourcing Market growth. As investment firms face mounting regulatory demands and data management challenges, outsourcing enables enhanced efficiency, accuracy, and compliance. Financial institutions are increasingly leveraging specialized service providers to optimize operations, reduce costs, and focus on core investment activities. This strategic shift toward outsourcing is strengthening agility, risk management, and overall performance across the financial ecosystem.

Middle office outsourcing spending grew 9.2% in 2025, driven by rising regulatory compliance costs and increasing adoption of cloud-based financial management solutions.

Middle Office Outsourcing Market Restraints:

-

Data security concerns, regulatory complexities, and integration challenges with legacy systems are restraining widespread adoption of middle office outsourcing.

Data security concerns, regulatory complexities, and integration challenges with legacy systems are key restraints for the Middle Office Outsourcing Market. Financial institutions handle highly sensitive data, making security breaches or compliance lapses potentially costly and damaging to reputation. Moreover, aligning outsourced solutions with existing legacy infrastructures often involves significant time, customization, and investment. These challenges slow adoption rates and deter smaller firms from outsourcing critical operations, limiting the market’s full growth potential despite rising demand for efficiency.

Middle Office Outsourcing Market Opportunities:

-

Rising adoption of AI, automation, and analytics offers vast opportunities to transform efficiency and decision-making in middle office operations.

Rising adoption of AI, automation, and analytics presents a major opportunity for the Middle Office Outsourcing Market. Financial institutions are leveraging these technologies to streamline data processing, enhance risk assessment, and improve operational transparency. AI-driven automation reduces manual errors and accelerates reconciliation and reporting tasks. Meanwhile, analytics enables predictive insights and smarter investment decisions. Providers offering intelligent, integrated, and scalable technology solutions are well-positioned to capture this digital transformation wave in middle office operations.

AI-driven middle office outsourcing solutions accounted for 32% of new contracts in 2025, driven by rising demand for automation.

Middle Office Outsourcing Market Segmentation Analysis:

-

By Service Type, Trade Management held the largest market share of 27.36% in 2025, while Risk Management is expected to grow at the fastest CAGR of 10.28% during 2026–2033.

-

By Deployment Type, the On-Premise segment dominated with a 46.78% share in 2025, while Cloud-Based deployment is projected to expand at the fastest CAGR of 11.34% during the forecast period.

-

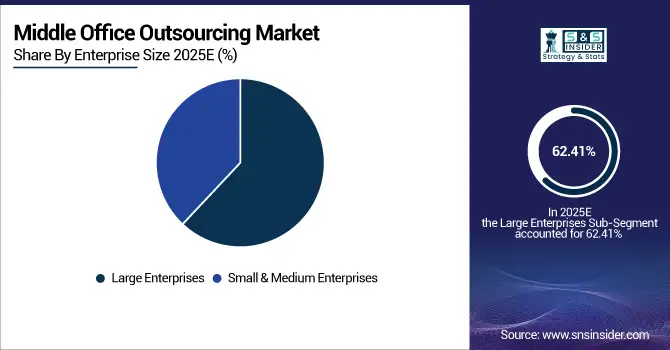

By Enterprise Size, Large Enterprises accounted for the highest market share of 62.41% in 2025, while Small & Medium Enterprises are anticipated to record the fastest CAGR of 10.86% through 2026–2033.

-

By End User, Asset Managers held the largest share of 29.84% in 2025, while Hedge Funds are expected to grow at the fastest CAGR of 10.43% during 2026–2033.

By Enterprise Size, Large Enterprises Dominate While SMEs Accelerate:

Large Enterprises segment dominated the market owing to their vast investment portfolios, operations and demand for high-volume data processing and reconciliation capabilities. These organizations often outsource middle office tasks to optimize efficiency and reduce overhead costs. Small & Medium Enterprises (SMEs) are the fastest growing segment, driven by the affordability of modular outsourcing services. In 2025, more than 210 SMEs partnered with third-party providers to digitize risk and compliance operations.

By Service Type, Trade Management Dominates While Risk Management Expands Rapidly:

Trade Management segment dominated the market due to its critical role in automating trade capture, confirmation, and settlement across complex asset classes. Increasing trading volumes and the need for operational accuracy have made outsourcing this function essential for financial institutions. Risk Management is the fastest growing segment, fueled by rising regulatory pressures and market volatility. In 2025, over 480 new outsourcing contracts focused on risk analytics and compliance monitoring were signed globally.

By Deployment Type, On-Premise Leads While Cloud-Based Soars:

On-Premise segment dominated the market as large financial firms prioritize control, data sovereignty, and compliance over operational flexibility. Legacy systems remain deeply embedded, driving continued reliance on in-house managed infrastructure. Cloud-Based are the fastest growing segment as institutions seek scalability and lower IT costs. With increasing adoption of hybrid and SaaS-based middle office platforms, over 58% of new outsourcing deals in 2025 incorporated at least one cloud-based component.

By End User, Asset Managers Dominate While Hedge Funds Expand Swiftly:

Asset Managers segment dominated the market as they handle diverse portfolios requiring precise performance reporting, compliance tracking, and reconciliation. Their focus on operational transparency and investor trust continues to fuel outsourcing adoption. Hedge Funds are the fastest growing segment, leveraging outsourcing to scale quickly and maintain lean operational structures. In 2025, 190 hedge fund firms transitioned to outsourced middle office solutions to enhance agility and reduce manual processing.

Middle Office Outsourcing Market Regional Analysis:

North America Middle Office Outsourcing Market Insights:

The North America Middle Office Outsourcing Market dominated with a 38.67% share in 2025, attributed to its highly developed financial infrastructure and strong base of asset management and investment firms. The U.S. and Canada lead in adopting advanced automation, AI, and cloud-based outsourcing solutions. Growing regulatory scrutiny, complex portfolio operations, and the push for cost-efficient yet compliant services continue to reinforce North America’s dominant position in the middle office outsourcing landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Middle Office Outsourcing Market Insights:

The U.S. Middle Office Outsourcing Market is driven by rising demand for automation, risk analytics, and digital transformation across financial institutions. Growing reliance on AI-powered reconciliation and compliance tools is enhancing efficiency. Strategic partnerships between outsourcing providers and banks are reshaping operations, while cloud adoption continues to accelerate modernization in the U.S. market.

Asia-Pacific Middle Office Outsourcing Market Insights:

The Asia-Pacific Middle Office Outsourcing Market is the fastest-growing region, projected to expand at a CAGR of 10.72% during 2026–2033. Growth is fueled by rapid financial digitalization, expanding investment management activities, and rising adoption of cloud-based outsourcing across China, India, Japan, and Singapore. Increasing fintech innovation, regulatory modernization, and demand for cost-efficient, scalable solutions are transforming regional operations, making Asia-Pacific a hub for next-generation middle office service providers and technology-driven outsourcing partnerships.

China Middle Office Outsourcing Market Insights:

China Middle Office Outsourcing Market is driven by rapid financial sector modernization, digital transformation, and increasing adoption of AI-enabled risk and compliance tools. Expanding asset management activities and government support for fintech innovation are fueling demand. China’s strong technology ecosystem and large financial institutions make it a key growth hub in Asia-Pacific.

Europe Middle Office Outsourcing Market Insights:

The Europe Middle Office Outsourcing Market held a significant position with strong demand from established financial centers such as the U.K., Germany, France, and Switzerland. The region’s mature asset management ecosystem, stringent regulatory frameworks, and focus on operational transparency are driving outsourcing adoption. Increasing use of automation, data analytics, and compliance services is enhancing efficiency. Europe’s deep-rooted financial sophistication and cross-border investment activity continue to reinforce its pivotal role in the middle office outsourcing landscape.

U.K. Middle Office Outsourcing Market Insights:

The U.K. Middle Office Outsourcing Market is driven by London’s position as a financial hub and growing demand for efficient, technology-driven operations. Increasing regulatory complexity, adoption of AI and automation tools, and the rise of cloud-based outsourcing models are enhancing agility, risk management, and operational resilience across U.K. financial institutions.

Latin America Middle Office Outsourcing Market Insights:

The Latin America Middle Office Outsourcing Market is expanding steadily, supported by financial modernization and increasing adoption of digital solutions in Brazil, Mexico, and Chile. Rising foreign investments, regulatory reforms, and demand for cost-efficient operations are encouraging banks and asset managers to outsource. Growing fintech ecosystems and cloud integration further strengthen regional market momentum.

Middle East and Africa Middle Office Outsourcing Market Insights:

The Middle East & Africa Middle Office Outsourcing Market is witnessing steady growth driven by financial sector modernization, digital transformation, and rising investment activities. Countries such as Saudi Arabia, the UAE, and South Africa are leading adoption of cloud-based and AI-driven outsourcing solutions, enhancing operational efficiency and compliance across regional banking and asset management sectors.

Middle Office Outsourcing Market Competitive Landscape:

Accenture plc, headquartered in Dublin, Ireland, is a leader in professional services, specializing in digital transformation, technology, and operations outsourcing. The company dominates the Middle Office Outsourcing Market through its advanced automation, AI integration, and cloud-based financial management solutions. Accenture’s deep industry expertise, delivery network, and end-to-end operational capabilities enable financial institutions to enhance efficiency, compliance, and scalability which solidifying its leadership in providing cutting-edge middle office solutions.

-

In March 2025, Accenture expanded its AI Refinery platform by launching a new AI Agent Builder that empowers business users to build and customize advanced AI agents without coding. This strengthens its leadership in enterprise automation and operational transformation.

State Street Corporation, based in Boston, Massachusetts, is one of the world’s largest asset management and custody banking institutions. The company dominates the Middle Office Outsourcing Market through its comprehensive investment servicing, risk analytics, and data management solutions. With decades of experience and advanced technologies including the State Street Alpha platform, it provides seamless front-to-back integration, enabling clients to optimize operations, enhance transparency, and achieve regulatory compliance, making it a trusted leader in financial outsourcing.

-

In September 2025, State Street introduced Enterprise Performance, powered by Opturo, a cloud-based performance calculation engine seamlessly integrated with its Alpha platform, enhancing workflow automation, real-time insights, and advanced analytics capabilities for investment managers.

JPMorgan Chase & Co., headquartered in New York City, United States, is a financial powerhouse offering investment banking, asset management, and outsourcing services. The company dominates the Middle Office Outsourcing Market by leveraging its robust financial infrastructure, cutting-edge digital tools, and expertise in risk and performance management. Through data-driven analytics and automation, JPMorgan helps institutional clients streamline middle office functions, reduce operational costs, and maintain compliance, reinforcing its leadership across the financial ecosystem.

-

In July 2025, JPMorgan Payments launched a cutting-edge Supply Chain Finance solution, integrated with Oracle Corporation Cloud ERP, enabling clients such as FedEx Corporation to streamline vendor payments, optimize working capital management, and enhance liquidity efficiency across supply chain networks.

Middle Office Outsourcing Market Key Players:

Some of the Middle Office Outsourcing Market Companies are:

-

Accenture plc

-

State Street Corporation

-

JPMorgan Chase & Co.

-

The Bank of New York Mellon Corporation

-

Citigroup Inc.

-

BNP Paribas S.A.

-

Northern Trust Corporation

-

SS&C Technologies Holdings, Inc.

-

CACEIS Bank S.A.

-

Apex Group Ltd.

-

Genpact Limited

-

Linedata Services S.A.

-

Empaxis Data Management India Private Limited

-

Indus Valley Partners

-

Brown Brothers Harriman & Co.

-

Capgemini SE

-

Cognizant Technology Solutions Corporation

-

Tata Consultancy Services Limited

-

Wipro Limited

-

HSBC Holdings plc

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 8.83 Billion |

| Market Size by 2033 | USD 17.65 Billion |

| CAGR | CAGR of 9.07% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Trade Management, Portfolio Performance Reporting, Risk Management, Compliance & Regulatory Support, Reconciliation, Others) • By Deployment Type (On-Premise, Cloud-Based, Hybrid) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By End User (Asset Managers, Hedge Funds, Banks, Broker-Dealers, Insurance Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Accenture plc, State Street Corporation, JPMorgan Chase & Co., The Bank of New York Mellon Corporation, Citigroup Inc., BNP Paribas S.A., Northern Trust Corporation, SS&C Technologies Holdings, Inc., CACEIS Bank S.A., Apex Group Ltd., Genpact Limited, Linedata Services S.A., Empaxis Data Management India Private Limited, Indus Valley Partners, Brown Brothers Harriman & Co., Capgemini SE, Cognizant Technology Solutions Corporation, Tata Consultancy Services Limited, Wipro Limited, HSBC Holdings plc |