E-learning Market Report Scope & Overview:

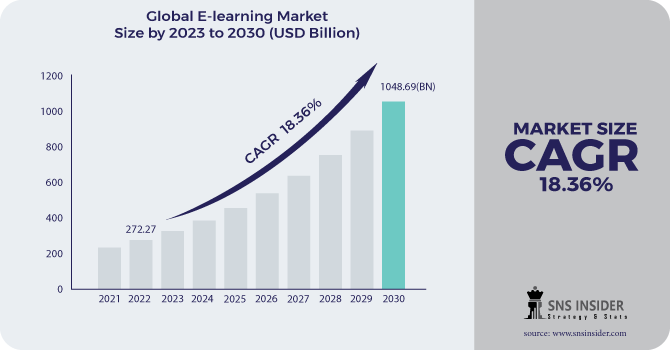

The E-learning Market was valued at USD 308.1 Billion in 2023 and is expected to reach USD 1378.6 Billion by 2032, growing at a CAGR of 18.14% from 2024-2032. The e-learning market evolved in 2023 with innovations in AI-based personalization, gamification, and AR/VR integration improving user engagement. Integration with LMS and productivity tools made it easy for schools and organizations to adopt in the K-12 and corporate training space, enabling growth. Advanced analytics driven by artificial intelligence-enabled better data-driven decision-making, powering personalized learning journeys for learners. The report consists of adaptive learning, blockchain-based credentialing, and VR-driven simulations for skill development.

Get more information on E-learning Market - Request Sample Report

E-learning Market Dynamics

Drivers

-

AI-driven personalization, virtual tutors, and real-time analytics enhance learning experiences and improve engagement.

AI and machine learning are gradually becoming an integrated part of e-learning platforms and revolutionizing personalized education by changing content according to each learner’s learning style. They increase participation and retention of information through AI-driven chatbots, virtual tutors, and real-time feedback mechanisms. Now, universities and companies are using AI-enabled analytics to take a look at how well the learners are progressing and on the other hand, to adjust and optimize their training modules. AI also makes it easier for everyone to come across content in multiple languages and through assistance in reading. With education moving towards hybrid and digital-first models, AI-based personalization remains one of the drivers of e-learning, providing plenty of solutions to offer personalized, speedy, and scalable learning for learners, professionals, and enterprises in different sectors.

Restraints

-

Poor internet infrastructure and high device costs in rural areas hinder e-learning adoption and accessibility.

While e-learning continues to expand significantly, internet connectivity and digital infrastructure in developing countries is limited. Many rural areas do not have stable broadband, which makes it hard for students and workers to access high-end learning materials. Moreover, the expenses involved in digital devices are limiting in terms of adoption. To counter this challenge, governments and organizations are building the digital infrastructure and introducing e-learning solutions that work offline. However, the potential of e-learning cannot be fully tapped until the depth of access to the internet is enhanced, and that prevents e-learning from extensively reaching out to the world at large, especially far-flung and impoverished communities.

Opportunities

-

Rising demand for digital workforce training and AI-powered LMS solutions is driving corporate e-learning growth.

With the increasing adoption of remote and hybrid work models, there is tremendous investment in corporate e-learning and employee upskilling programs. Most organizations are using digital learning platforms for workforce skills development, compliance training, and leadership development. Learning Management systems are using AI-driven personalized training recommendations and gamification to improve engagement. In response, organizations are looking for scale, cost-effective e-learning solutions as workers, senior management, and executives alike increasingly emphasize continuous learning and, by extension, upskilling and personal development. The growing preference for tailored training programs is attributed to various partnerships being developed between educational institutions and enterprises paving the way for new growth prospects in corporate e-learning.

Challenges

-

Limited instructor interaction and unstructured content lead to reduced motivation and higher course abandonment rates.

High dropout rates are an issue in the e-learning market, usually the result of a lack of engagement and motivation. Online courses do not have immediate interaction with instructors like a classroom and thus could lower the commitment of the learner. The students drop off from the courses because the courses are not structured, there is no feedback and no real interaction. In response, platforms are incorporating gamification, interactive simulations, and AI-powered engagement tools to maintain learner motivation. While the level of engagement can be higher than that in traditional classrooms, the challenge is maintaining that level of engagement through innovative course design, real-time support in general from instructors, and effective community-built learning experiences.

E-learning Market Segment Analysis

By Delivery Mode

The self-paced E-Learning segment dominated the market and represented a significant revenue share of more than 45% in 2023, as it is highly flexible and well-suited for learners who want to learn at their own pace. Self-paced courses offer students the ability to join to learn on their schedule and their download, broadening the learning appeal to a diversity of learners ranging from professionals. Given the advancements in technology, this mode will likely remain the predominant delivery method for the next several years.

The live online e-learning segment is expected to register the fastest CAGR during the forecast period, especially in academic institutions and corporate training. Live online classes Instantly interact with your instructors and peers while simulating real-life engagement to drive a deeper, more immersive, and engaging learning experience. This segment is anticipated to experience the highest growth rates during the forecast period due to the expanded implementation of virtual classrooms and greater demand for remote learning methods.

By Learning Type

The academic e-learning segment dominated the market and accounted for revenue share of more than 47% in 2023, as schools and universities are rapidly adopting an online platform to provide students with a diverse array of materials and flexible, at-home learning options. This segment is estimated to witness continued growth due to the transition towards digital classrooms and virtual learning environments.

The corporate e-learning segment is growing at the highest rate and increasing upskilling and reskilling of the workforce is the primary driving factor. With the increasing need of remote work and the digital transformation office, businesses are accelerating the adoption of e-learning platforms to provide cost-effective, scalable, and highly engaging training programs. This trend will only increase over the forecast period.

By Technology

The LMS segment dominated the e-learning market and represented a significant revenue share in 2023, the LMS allows for efficient management, tracking, and delivery of training material, and other resources, for learning. This is a mainstream option for most academic institutions and businesses alike, and growth will remain stable.

The Mobile E-Learning segment is expected to register the fastest CAGR during the forecast period, as more people use mobile devices such as smartphones and tablets for educational activities, mobile e-learning is becoming increasingly popular. Mobile devices will allow learners to learn while on the go, and this segment is forecast to witness major growth; with emerging markets leading the way.

Regional Landscape

North America dominated the market and accounted for a revenue share of more than 36% in 2023, simply as a result of its advanced infrastructure and the high property of online studying platforms in educational and company sectors. It is poised to retain its position at the forefront of digital learning solutions through continuous innovation and investments in exponential technology.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period as it is witnessing an increasing internet penetration, mobile Learning adoption, and many government initiatives promoting e-learning. E-learning platforms are booming in the region catering to both educational institutions and businesses.

.png)

Need any customization research on E-learning Market - Enquiry Now

Key Players

The major key companies of E-learning are

-

Coursera – Coursera for Business

-

Udemy – Udemy for Business

-

LinkedIn Learning – LinkedIn Learning Courses

-

Duolingo – Duolingo Language Learning App

-

Skillshare – Skillshare Classes

-

Edmodo – Edmodo Classroom

-

Khan Academy – Khan Academy Learning Platform

-

Pluralsight – Pluralsight Skills

-

FutureLearn – FutureLearn Online Courses

-

Teachable – Teachable Course Creation Platform

-

Moodle – Moodle Learning Management System (LMS)

-

Blackboard – Blackboard Learn LMS

-

Lynda.com – Lynda.com Online Learning Platform

-

Rosetta Stone – Rosetta Stone Language Learning Software

-

Canvas – Canvas Learning Management System

Recent Developments

December 2024: Duolingo introduced AI-powered features, including a Video Call with an AI character named Lily, enhancing interactive language learning.

December 2024: Learning Technologies Group (LTG) agreed to be acquired by U.S. private equity firm General Atlantic for £802.4 million, aiming to adapt to AI-driven changes in corporate training.

October 2024: Coursera adjusted its revenue forecast to $690 million to $694 million, citing changing consumer spending patterns and a 10% workforce reduction to focus on long-term growth.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.1 Billion |

| Market Size by 2032 | USD 6.3 Billion |

| CAGR | CAGR of 21.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (UV-A, UV-B, UV-C) By Power Output (Less than 1W, 1W -5W, More than 5W) • By Application (UV curing, Medical light therapy, Disinfection & sterilization, Counterfeit detection, Optical sensing & instrumentation, Others) • By End - Use (Industrial, Commercial, Residential, Agriculture, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nichia Corporation, Osram Opto Semiconductors, Seoul Viosys, Crystal IS, LG Innotek, Lumileds, Stanley Electric Co., Ltd., Honle UV America Inc., Bolb Inc., Nitride Semiconductors Co., Ltd., Epitop Optoelectronic Co., Ltd., Photon Wave Co., Ltd., Dowa Electronics Materials Co., Ltd., Sensor Electronic Technology, Inc. (SETi), Qingdao Jason Electric Co., Ltd. |