Database Security Market Size & Overview:

Get more information on Database Security Market - Request Sample Report

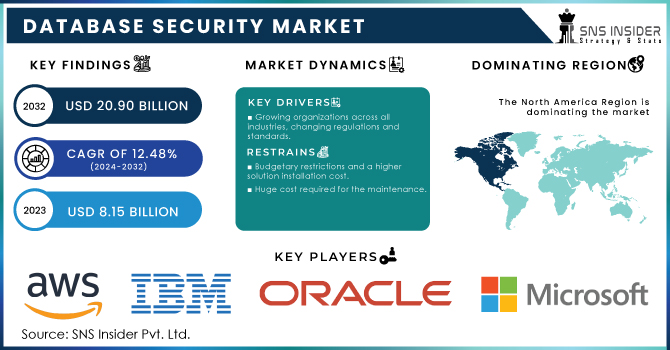

The Database Security Market is anticipated to develop at a CAGR of 12.48% from 2024 to 2032, from an estimated value of USD 8.15 billion in 2023 to USD 20.90 billion in 2032.

The increasing volume of data generated by various industries has led to a significant demand for data protection and management, thereby driving the global database security market. Moreover, the need for effective security solutions for data generated by advanced technologies such as IoT, Big Data, and cloud-based services, along with the imperative to safeguard data from unauthorized access, has further fueled the adoption of database security. These factors, among others, are anticipated to propel the global database security industry forward. Organizations across various sectors, including retail, e-commerce, telecommunications, financial services, healthcare, and insurance, are witnessing a surge in the number of databases they manage. Consequently, safeguarding data has become paramount, further intensifying the need for robust database security solutions in global markets.

The increasing security concerns over data breaches and cyber-attacks have led to the growth of the database security market. The government statistics indicate that the rate of cyber-attacks has been increasing as there was a 20% increase in data breaches in 2023 compared to 2022. Governments throughout the world have moved to enhance cybersecurity frameworks. The U.S. government, through the Cybersecurity and Infrastructure Security Agency, has recently announced an investment of $1.2 billion to enhance the security of databases in both public and private sectors.

In the first quarter of 2023, over 5.92 million data records were compromised globally due to data breaches. This represents a significant increase compared to the previous year, specifically the fourth quarter of 2020, which witnessed the highest number of exposed data records, totaling nearly 125 million data sets. The alarming rise in data breaches highlights the pressing need for enhanced cybersecurity measures across industries. These breaches not only jeopardize the privacy and security of individuals but also pose severe risks to businesses and organizations worldwide.

Market Definition

Database security refers to a set of protocols implemented to ensure the utmost security of a database. Its primary objective is to safeguard the database from potential attacks, prevent unauthorized access, and unlawful usage, and mitigate threats. Within an organizational environment, database security plays a pivotal role in executing various commands that guarantee the protection and privacy of sensitive information. It extends its protective measures to data stored within the database, database management systems, database servers, and other workflow applications. By implementing robust database security measures, organizations can fortify their data assets and maintain a secure operational environment.

Database Security Market Dynamics

Drivers

-

Growing organizations across all industries, changing regulations and standards.

-

The increasing need for advanced data security solutions all contribute to market expansion.

Increasing concerns regarding data privacy have become a major factor driving the demand for database security solutions. Organizations are increasingly worried about the privacy of their data, especially with the widespread use of databases in sectors such as retail, e-commerce, telecommunications, financial services, healthcare, and insurance. As a result, the importance of data protection has grown significantly, leading to a reinforced demand for database security solutions in global markets.

Restrains

-

Huge cost required for the maintenance.

-

Budgetary restrictions and a higher solution installation cost

The integration of top-notch hardware in database security systems entails a substantial upfront investment as well as ongoing maintenance expenses. However, due to financial constraints, small and medium-sized enterprises (SMEs) exhibit reluctance to adopt newer technologies and instead opt for established security software. Moreover, businesses tend to prioritize safeguarding their critical servers, often neglecting the protection of their databases and the valuable data they hold. Consequently, database security professionals face persistent challenges in effectively executing their IT security operations.

Opportunities

-

An increase in the amount of business data

-

Database security is increasingly used to protect databases.

-

In the developing IT and telecom business, the rising use of cloud-based services is anticipated to lead to profitable prospects.

Database Security Market Segment Analysis

By Component

Software is the dominant segment in the database security market as the demand for automated and scalable solutions is increasing. Over the years, the use of advanced software solutions to secure databases has been growing. In 2023, according to government data, 72% of the organizations invested in advanced database security software which is up from 61% in 2022. The software segment includes database firewalls, encryption, and auditing tools which have become popular for providing effective solutions to a variety of security concerns.

The services segment is projected to grow with a significant CAGR during the forecast period, which includes consulting, training, and managed security services. The service segment is far behind the software segment due to its limitations. The software segment is capable of providing real-time threat detection and protection at scale. 85% of all database security measures in the U.S. Department of Defence were software solutions that protected against cyber espionage and insider threats.

By Vertical

Banking, Financial Services, and Insurance are the largest verticals in the DB security market. This dominance is attributed to the sensitive nature of the data handled within this industry, including personal financial information, transaction histories, and credit card details. According to a 2023 report by the U.S. Federal Reserve, the financial sector experienced the highest volume of cyber-attacks, with 35% of all reported breaches targeting financial institutions. In response, regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the U.S. have implemented stricter data security regulations, forcing financial institutions to invest heavily in database security solutions. The global banking sector saw a 28% increase in security spending in 2023, with a significant portion allocated to database protection measures. Additionally, government-backed cybersecurity programs, such as the European Central Bank's TIBER-EU framework, further underline the importance of database security in the BFSI sector, making it the largest contributor to the overall market.

By Deployment Mode

The on-premise deployment mode held the largest market share 64% in the database security market. This growth was attributed to the increasing adoption of cloud by organizations of different sizes. In 2023, 58% of such enterprises were using cloud-based database solutions. The flexibility of cloud-based databases is one of the main factors contributing to the market growth of such solutions. According to the National Institute of Standards and Technology, cloud-based database security tools provide a high level of encryption, which makes them attractive for enterprises. Real-time monitoring of such tools also positively reflects on their market share for organizations. Though on-premises solutions still play a significant role in highly regulated industries, such as government and defense, they are slowly going into oblivion, while new options for deploying cloud-native apps become available.

Regional Analysis

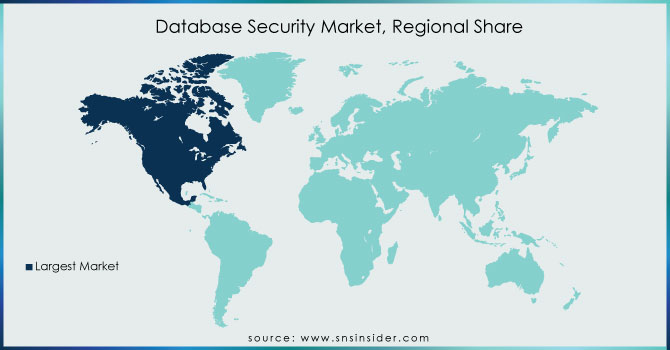

In 2023, North America dominated the database security market with a 35% market share. The reason for this was the region’s superior level of technological infrastructure, high adoption of cloud-based solutions, and strong regulatory framework. In the USA, for example, the government advances the development of this technology in both private and governmental sectors. For this state, Cybersecurity Maturity Model Certification CMMC was established by the Department of Defence to push the adoption of advanced database security. Canada has also seen increased investments in database security, driven by the country's updated Personal Information Protection and Electronic Documents Act (PIPEDA). Furthermore, this dominance is fuelled by the presence of key market players, such as IBM, Oracle, and Microsoft, which have heavily invested in developing innovative database security solutions. North America's advanced cybersecurity ecosystem, supported by robust government regulations and funding, ensures its leadership in the global database security market. Additionally, the rise in cyber events has increased the demand for data security solutions in the banking and financial sectors. 37.52% of the population is from the North American region, and 27.1%, 22.6% in Europe and Asia Pacific is a breakdown of database security by region.

The Asia Pacific market is anticipated to register the fastest CAGR throughout the projection period due to the developing regulatory environment in the region. For instance, China started a global data security initiative outlining recommended practices for anything from personal information to espionage. One of China's eight key concepts is to avoid using technology to harm other nations' critical infrastructure or steal their data. Another is to prevent service providers from installing backdoors into their systems and stealing consumer data.

Need any customization research on Database Security Market - Enquiry Now

Key Players

-

IBM Corporation (Guardium, Security QRadar)

-

Oracle Corporation (Oracle Database Vault, Oracle Advanced Security)

-

Microsoft Corporation (Azure SQL Database Security, SQL Server Security)

-

McAfee, LLC (McAfee Database Activity Monitoring, McAfee Total Protection for Data)

-

Symantec Corporation (Symantec Data Loss Prevention, Symantec Encryption)

-

Trend Micro Inc. (Deep Security, Cloud One - Conformity)

-

Fortinet, Inc. (FortiDB, FortiWeb)

-

Imperva, Inc. (Imperva Data Security, SecureSphere)

-

Thales Group (CipherTrust Database Encryption, Vormetric Data Security)

-

Micro Focus (Data Security Voltage, SecureData)

-

Check Point Software Technologies (CloudGuard, Check Point Data Loss Prevention)

-

Trustwave Holdings, Inc. (Trustwave DbProtect, Trustwave Secure Email Gateway)

-

Sophos Group (Sophos XG Firewall, Sophos Intercept X)

-

Oracle Corporation (Oracle Key Vault, Oracle Audit Vault)

-

Idera, Inc. (SQL Secure, SQL Compliance Manager)

-

Dell Technologies (Dell Data Protection, Secureworks)

-

Varonis Systems, Inc. (Varonis DatAdvantage, Varonis DataAlert)

-

Netwrix Corporation (Netwrix Auditor, Netwrix Data Discovery and Classification)

-

SolarWinds Corporation (Database Performance Analyzer, Access Rights Manager)

-

Huawei Technologies Co., Ltd. (GaussDB, CloudDB Security) and others.

Latest News in Database Security Market

-

The US Department of Homeland Security announced a new cybersecurity grant, designed to help enhance database security across all critical national infrastructures. With a special focus on protecting enterprises from ransomware and data breaches, the $500 million grant will be allocated over the period of three years. As a result, enterprises will be encouraged to enhance their database security infrastructure.

-

The EU has faced a considerable increase in the rates of cyber-attacks, being the reason for the adoption of the Network and Information Security NIS2 Directive. The newly adopted law has started taking effect in March 2023; with it, higher requirements for the level of security in the database sector have been put. Additional demand in the field of database security software has therefore increased.

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.15 Bn |

| Market Size by 2032 | US$ 20.90 Bn |

| CAGR | CAGR of 12.48 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment Mode (Cloud-Based, On-Premises) • By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises) • By Business Function (Marketing, Sales, Finance, Operations, Others) • By Vertical (Banking, Financial Services, And Insurance, Telecommunication and IT, Government and Defense, Manufacturing, Healthcare and life sciences, Retail and E-commerce, Energy and Utilities, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

IBM Corporation, Oracle Corporation, Microsoft Corporation, McAfee, LLC , Symantec Corporation, Trend Micro Inc., Fortinet, Inc., Imperva, Inc., Thales Group, Micro Focus, Check Point Software Technologies, Trustwave Holdings, Inc., Sophos Group, Oracle Corporation |

| Key Drivers | • Growing organizations across all industries, changing regulations and standards, • The increasing need for advanced data security solutions all contribute to market expansion. |

| Market Restraints | • Huge cost required for the maintenance. • Budgetary restrictions and a higher solution installation cost |