Mobile and wireless backhaul Market Size & Overview:

Get more information on Mobile and Wireless Backhaul Market - Request Sample Report

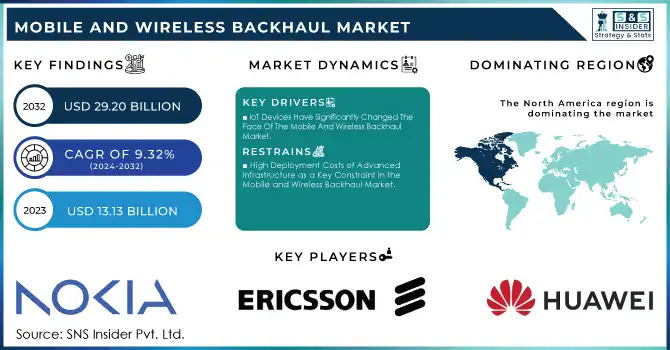

Mobile and Wireless Backhaul Market Size was valued at USD 13.13 Billion in 2023 and is expected to reach USD 29.20 Billion by 2032 and grow at a CAGR of 9.32% over the forecast period 2024-2032.

Mobile and Wireless Backhaul Market is indeed the most important within modern telecommunications, the high speed of connectivity, along with the swift deployment of 5G networks. Therefore, 2023 and 2024 saw advanced backhaul technologies implemented by countries as far flung as the US, China, Japan, France, Germany, and even India. In the United States, the FCC has aided in spectrum allotments to help ensure that seamless deployment of 5G backhaul networks is possible. In China, the MIIT has focused its efforts on improving 5G development such that by mid-2023, it had over 2.9 million 5G base stations across China.

The European government includes France's ARCEP that focuses on fiber optic and microwave technology for backhaul to increase capacities in the networks. In Asia, Japan is now focusing on advanced wireless backhaul solutions to further enhance its smart city projects, while India is pushing forward with the National Broadband Mission to improve rural connectivity. The global surge in electric vehicle sales has also been driving the need for robust backhaul infrastructure to support EV charging networks and real-time data analytics. For instance, Increased EV sales in Germany emphasize the need for reliable communication links between charging stations and grid management systems.

Technological advancements in small cell deployment, millimeter-wave (mmWave) solutions, and satellite-based backhaul are transforming the market. Notably, in 2024, SpaceX's Starlink and similar satellite ventures aim to enhance connectivity in remote regions, presenting significant growth opportunities. Investments in AI-driven traffic management systems and energy-efficient network solutions are also being made in the market, which aligns with the global sustainability goals. The mobile and wireless backhaul market has tremendous scope for future innovation and expansion, given the continuous evolution of IoT and smart devices.

MARKET DYNAMICS

KEY DRIVERS:

- Governments And Operators Worldwide Deploy 5G, Thus Boosting Backhaul Demand.

The major driver for the mobile and wireless backhaul market is the rollout of 5G networks. In 2023, more than 1 billion active 5G connections were observed across the globe in countries like the U.S. and China. This necessitates high-capacity backhaul solutions to handle unprecedented data volumes. Fiber-optic backhaul is considered an essential solution for handling the 10-20 times greater data speeds of 5G compared to 4G. Additionally, the European Union's Digital Decade strategy targets comprehensive 5G coverage by 2030, driving investments in fiber and microwave backhaul. In India, the Department of Telecommunications (DoT) allocated ₹12,195 crore in 2024 to strengthen 5G backhaul, highlighting its critical role in achieving seamless connectivity.

- IoT Devices Have Significantly Changed The Face Of The Mobile And Wireless Backhaul Market.

There are over 15 billion connected IoT devices worldwide, with the number expected to double by 2030. Greater China accounts for more than 5 billion devices, and approximately two-thirds of devices rely on IoT. Such huge amounts will require robust backhaul solutions for connectivity as well as data transfer. Japanese smart home device adoption increased to 28% in 2023, and dependence on scalable backhaul networks for growth was established. The use of EVs also requires IoT for the monitoring process in real-time and needs dependable backhaul links. Further investment in backhaul solutions by Germany for its industrial sectors is underpinned by Industrie 4.0 as IoT implementations drive seamless communication among the devices and systems.

RESTRAIN:

- High Deployment Costs of Advanced Infrastructure as a Key Constraint in the Mobile and Wireless Backhaul Market

One of the most significant constraints in mobile and wireless backhaul is related to the very high deployment cost associated with the advanced infrastructure, such as fibre optic networks and satellite based solutions. According to research, fibre optic installation for backhaul can cost between $27,000 and $60,000 per mile in urban areas. In developing countries such as India and Brazil, the cost of backhaul upgrades across the entire country is too high to be afforded, thus limiting the expansion of networks to rural and underdeveloped areas.

Additionally, satellite-based backhaul solutions, although promising for remote connectivity, are expensive to launch and maintain, with per-satellite costs often running over $300 million. These financial barriers limit the equitable growth of backhaul networks around the world, especially in areas where ROI on such investments is uncertain. Such cost-related issues will be dealt with by public-private partnerships and innovative financing models. This is very important for the growth of the market.

KEY MARKET SEGMENTS

BY EQUIPMENT

Microwave equipment segment continues to be a dominant participant, having held the lead and taken away 38.94% of market share in 2023 driven by wide deployment in cities and towns for high capacity links backhaul. Microwave still will remain one of the cheapest yet reliable choices with big quantities of data transported over longer distances for operators. Conversely, millimeter wave technologies have been widely adopting and are going to gain its peak performance as it has wide deployment in the 5G small cell backhaul segment.

Sub-6 GHz would grow the fastest CAGR at 10.40% during the forecast period between 2024 and 2032 in order to offer solution toward coverage difficulties in rural as well as rural areas. The penetration of sub-6 GHz through walls and trees ensures reliable connectivity, hence further supporting the adoption of the technology. This diversity in equipment offerings reflects the market's adaptability to various network demands and geographic requirements, thereby making segmentation by equipment a critical factor in the backhaul industry's evolution.

BY COMPONENT

In 2023, equipment dominated the market with 63.57% of market share, driven by increasing demand for advanced hardware solutions that would support 5G deployments and high-capacity data transport. Equipment such as routers, antennas, and transmitters are essential for the scalability and efficiency of networks, especially in light of the increasing mobile data consumption.

Services are expected to witness the fastest CAGR of 9.87% from 2024 to 2032. This is due to the fact that there is more reliance on the specialized service providers for the design, optimization, and deployment of a network. Consulting services are particularly important for the operators to work through the intricacies of 5G and IoT integration, while deployment services help to ensure smooth implementation of backhaul solutions. The two-component segmentation of this market highlights the balance between innovation in hardware and the expertise necessary to operationalize next-generation networks.

REGIONAL ANALYSIS

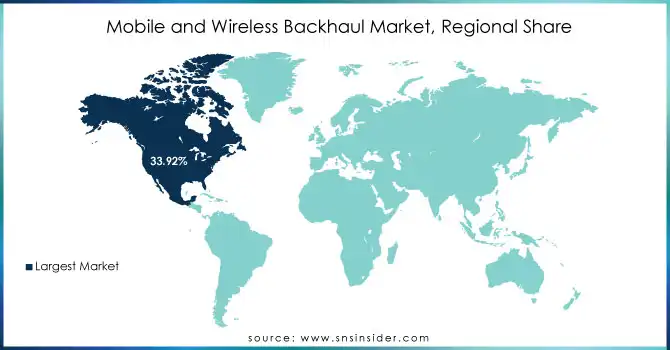

North America led the mobile and wireless backhaul market in 2023, with 33.92% market share. This leadership is supported by early adoption of 5G technologies, strong investments in advanced backhaul solutions, and the supportive initiatives of the government such as FCC's Rural Digital Opportunity Fund. The strong focus of the region on urban connectivity and IoT applications further strengthens its market position.

Asia Pacific is expected to grow at the highest CAGR of 9.80% from 2024 to 2032, mainly due to the rapid rollouts of 5G in countries such as China, India, and Japan. For example, China alone accounted for more than 60% of the world's 5G base stations in 2023, requiring vast backhaul infrastructure. Government programs, like India's National Broadband Mission and Japan's Smart Cities initiatives, are accelerating investments in backhaul networks, leading to robust growth across the region. This dynamic regional landscape underlines the global significance of mobile and wireless backhaul technologies.

Need any custom research on Mobile and Wireless Backhaul Market - Enquiry Now

KEY PLAYERS

Some of the major players in the Mobile and Wireless Backhaul Market are

-

Nokia (Microwave radios, Network routers)

-

Ericsson (Microwave transport solutions, Backhaul management software)

-

Huawei (5G backhaul solutions, Fiber-optic systems)

-

ZTE Corporation (Microwave solutions, Optical transport systems)

-

Cisco Systems (Network switches, Mobile backhaul routers)

-

NEC Corporation (Millimeter-wave radios, Microwave systems)

-

Ceragon Networks (High-capacity wireless backhaul, Multi-core solutions)

-

Fujitsu (Transport network solutions, Packet optical networking)

-

Samsung Electronics (5G backhaul, Small cell solutions)

-

CommScope (Fiber backhaul solutions, Wireless transport systems)

-

Juniper Networks (Edge routers, Network security solutions)

-

Alcatel-Lucent Enterprise (Wireless backhaul, Cloud solutions)

-

Cambium Networks (Point-to-point wireless, Sub-6 GHz solutions)

-

Siklu (Millimeter-wave systems, 5G fixed wireless)

-

Infinera (Intelligent transport networks, Optical solutions)

-

E-Band Communications (Millimeter-wave radios, Backhaul components)

-

Mavenir (Cloud-native software, Open RAN solutions)

-

Proxim Wireless (Point-to-multipoint radios, Wireless broadband)

-

Aviat Networks (Microwave solutions, Multi-band radios)

-

DragonWave-X (Packet microwave radios, Hybrid backhaul systems)

MAJOR SUPPLIERS (Components, Technologies)

-

Corning Incorporated (Fiber-optic cables, Optical components)

-

Broadcom Inc. (Chipsets, Network processors)

-

Qualcomm (Wireless chipsets, 5G modems)

-

Texas Instruments (Analog ICs, RF components)

-

Infineon Technologies (Semiconductors, Wireless modules)

-

Skyworks Solutions (RF solutions, Antennas)

-

Analog Devices Inc. (Data converters, Signal processors)

-

Maxim Integrated (Integrated circuits, Signal processing solutions)

-

TE Connectivity (Connectors, Interconnect systems)

-

Molex (Fiber connectors, Cable assemblies)

MAJOR CLIENTS

-

Verizon Communications

-

AT&T Inc.

-

China Mobile

-

Vodafone Group

-

T-Mobile US

-

Deutsche Telekom

-

Reliance Jio

-

Bharti Airtel

-

Orange S.A.

-

Telefónica

RECENT TRENDS

-

June 2024: Nokia has unveiled a new portfolio of cell site solutions including small cells, Massive MIMO radio units, backhaul microwave units, and upgrades to its Airscale basedband during its Midsummer event held in Finland. The launches were announced as Nokia said its focus was on providing performant and optimized solutions that future-proof operator cell site investments and underpin monetization opportunities for operators.

-

July 2024: Ericsson and Turkcell will collaborate to research new spectrum solutions that will provide increased capacity for mobile backhaul for emerging technologies like 5G and 6G. As part of this cooperation, Ericsson and Turkcell trialed a W-Band solution successfully, which not only supports the existing E-band but further increases the spectrum by 1.5 times.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 13.13 Billion |

|

Market Size by 2032 |

US$ 29.20 Billion |

|

CAGR |

CAGR of 9.32 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Equipment and Services [Designing & Consulting, Integration & Deployment]), |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Nokia, Ericsson, Huawei, ZTE Corporation, Cisco Systems, NEC Corporation, Ceragon Networks, Fujitsu, Samsung Electronics, CommScope, Juniper Networks, Alcatel-Lucent Enterprise, Cambium Networks, Siklu, Infinera, E-Band Communications, Mavenir, Proxim Wireless, Aviat Networks, DragonWave-X. |

|

Key Drivers |

• Governments And Operators Worldwide Deploy 5G, Thus Boosting Backhaul Demand. |

|

Restraints |

• High Deployment Costs of Advanced Infrastructure as a Key Constraint in the Mobile and Wireless Backhaul Market |