Real Estate Software Market Report Scope & Overview:

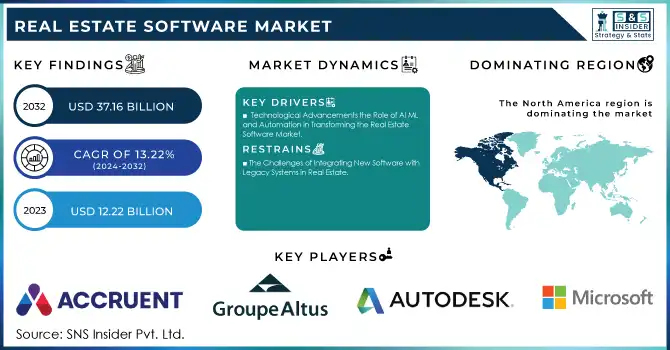

The Real Estate Software Market was valued at USD 12.22 billion in 2023 and is expected to reach USD 37.16 billion by 2032, growing at a CAGR of 13.22% from 2024-2032.

Get More Information on Real Estate Software Market - Request Sample Report

The real estate software industry is witnessing considerable expansion fueled by the rising use of digital tools in managing properties, conducting real estate deals, and development activities. With the increasing need for automation, efficiency, and decisions based on data, software solutions that combine property listing management, virtual tours, client relationship management, and financial analysis are becoming more popular. For example, in September 2024, Planon introduced Real Estate Management for SAP S/4HANA®, improving the integration of real estate and facilities management with ERP systems. This expansion illustrates the overall digital change in industries, as the real estate field utilizes software to optimize processes and improve customer satisfaction.

The need for real estate software is anticipated to increase as urbanization progresses worldwide, fueling the demand for advanced property management and investment solutions. Market participants are progressively concentrating on AI, machine learning, and blockchain integration to deliver advanced solutions that facilitate predictive analytics, fraud prevention, and improved transparency. Moreover, the expansion of smart home technologies and the growth of eco-friendly building initiatives are encouraging software developers to integrate features that support energy efficiency and real-time oversight of building systems.

Looking forward, there are numerous opportunities for real estate software ahead. With the rise of remote work and flexible lifestyles, there is increasing potential for software solutions designed for emerging property types, including co-living arrangements and short-term rental services. Moreover, as environmental, social, and governance issues become more significant, software that aids in managing sustainability, regulatory adherence, and energy efficiency will see increased demand. Emphasizing the speed of innovation, MRI Software's introduction of the advanced CTM eContracts in January 2024 demonstrates how improved tools and intuitive interfaces can simplify real estate transactions. This corresponds with changing customer demands and the industry's drive for flexibility and efficiency. Through ongoing innovation, the real estate software sector is poised for steady expansion and change in the years ahead.

Market Dynamics

Drivers

-

Technological Advancements the Role of AI ML and Automation in Transforming the Real Estate Software Market

The integration of artificial intelligence AI machine learning ML and automation into real estate software is transforming the industry. These technologies enable predictive analytics, allowing real estate professionals to forecast market trends, identify investment opportunities, and optimize pricing strategies with greater accuracy. AI-powered tools enhance property management by automating routine tasks such as tenant communication, maintenance requests, and lease management, significantly improving operational efficiency. Additionally, machine learning algorithms refine customer relationship management CRM systems by providing personalized recommendations and insights, fostering better client relationships. The ability to automate tasks, analyze vast amounts of data, and predict market shifts is propelling the demand for advanced real estate software solutions, driving substantial growth within the industry.

-

The Rise of Virtual and Remote Tools Driving Innovation in the Real Estate Software Market

Virtual tours, augmented reality AR, and remote property management tools have gained significant traction due to shifts in consumer behavior, particularly after the pandemic. These tools allow potential buyers and renters to experience properties remotely, saving time and providing convenience. Virtual tours offer an immersive, interactive experience, enabling users to explore properties without visiting in person. Augmented reality AR enhances these tours by adding digital overlays, helping clients visualize customized designs or furnishings. Remote property management tools further support landlords and property managers by enabling them to handle tasks like maintenance, rent collection, and tenant communication from any location. The increasing preference for online and contactless interactions has made these technologies essential, fueling the demand for advanced real estate software solutions.

Restraints

-

High Initial Costs Limiting the Adoption of Real Estate Software Market

The development and implementation of advanced real estate software often require substantial investments in technology, training, and infrastructure, posing a significant barrier, especially for small and medium-sized businesses. The high costs associated with purchasing, customizing, and maintaining software solutions can be prohibitive for firms with limited budgets. Additionally, the need for specialized staff to manage and operate these tools adds to the overall financial burden. For many businesses, these expenses may not be justified by the immediate returns, leading to reluctance in adopting new technologies. This financial barrier can prevent smaller real estate companies from leveraging advanced software, ultimately slowing the overall growth of the market. As a result, the high initial costs of real estate software remain a key challenge in expanding its adoption.

-

The Challenges of Integrating New Software with Legacy Systems in Real Estate

Integrating new software with existing legacy systems often presents significant challenges. Compatibility issues frequently arise as modern software may not align seamlessly with older systems, causing disruptions in data flow and operational processes. The time-consuming nature of data migration from legacy systems to newer platforms can lead to data inconsistencies, errors, and potential loss of valuable information. Additionally, the complexity of mapping and updating old workflows to fit the new system can create delays and confusion. Employees, accustomed to traditional methods, may resist adopting new technologies, which can hinder smooth implementation. The time, effort, and potential disruption involved in integration often lead to reluctance from real estate businesses, making it a considerable barrier to widespread adoption of advanced software solutions.

Segment Analysis

By Deployment

In 2023, the Cloud segment dominated the real estate software market, capturing the highest revenue share of approximately 57%. This dominance is driven by the increasing demand for scalable, flexible, and cost-effective solutions. Cloud-based software allows businesses to easily access, store, and analyze data from anywhere, improving operational efficiency. Additionally, its ability to offer real-time updates and seamless integration with various platforms further enhances its appeal, making it the preferred choice for many real estate companies.

The On-premise segment is expected to grow at the fastest CAGR of about 14.17% from 2024 to 2032. This growth is primarily attributed to the rising concerns over data privacy and security, which drive businesses to prefer on-premise solutions that provide full control over their data infrastructure. Furthermore, industries in regulated sectors or with legacy systems favor on-premise deployment for its customization flexibility, which contributes to its rapidly expanding market share in the coming years.

By Application

In 2023, the Residential segment dominated the real estate software market, accounting for approximately 54% of the revenue share. This dominance is driven by the increasing demand for property management solutions, especially with the rapid growth of residential real estate transactions. The shift toward digital tools for managing listings, virtual tours, and customer interactions has significantly streamlined processes for real estate agents and property owners, making the residential sector a key driver of market revenue.

The Commercial segment is projected to grow at the fastest CAGR of about 14.33% from 2024 to 2032. This growth can be attributed to the rising need for advanced software solutions in managing large-scale commercial properties and complex lease agreements. The increasing adoption of technology to streamline operations such as tenant management, leasing, and space utilization, combined with the expansion of global business hubs, positions the commercial real estate sector for rapid growth in the coming years.

By Type

In 2023, the Customer Relationship Management Software segment led the real estate software market, capturing the highest revenue share of approximately 32%. This dominance is attributed to the growing need for real estate companies to manage client relationships effectively and enhance customer satisfaction. CRM software offers a unified platform for tracking leads, managing communication, and automating marketing efforts, all of which are essential for boosting sales and improving client retention in a highly competitive market.

The Contract Software segment is expected to grow at the fastest CAGR of about 17.40% from 2024 to 2032. This growth is driven by the increasing complexity of real estate contracts and the rising demand for automated, streamlined contract management solutions. Real estate businesses are increasingly adopting contract software to improve efficiency, reduce errors, and ensure compliance with regulatory requirements, positioning this segment for rapid expansion in the coming years.

By End-use

In 2023, the Architects & Engineers segment dominated the real estate software market, securing the highest revenue share of approximately 40%. This dominance stems from the increasing reliance on advanced software for design, project management, and building information modeling (BIM). Architects and engineers are adopting sophisticated tools to streamline the design process, optimize construction workflows, and ensure regulatory compliance, making this segment a major contributor to market revenue.

The Real Estate Agents segment is expected to grow at the fastest CAGR of about 14.62% from 2024 to 2032. This growth is driven by the increasing demand for digital tools that help agents manage property listings, engage with clients, and streamline transactions. As real estate agents continue to embrace technology for virtual tours, customer relationship management, and market analysis, the segment is poised for rapid expansion in response to evolving consumer expectations and the shift toward online property buying and selling.

Regional Analysis

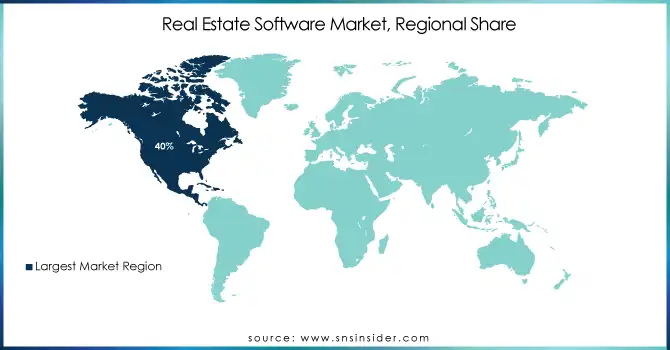

In 2023, North America dominated the real estate software market, accounting for approximately 40% of the revenue share. This dominance is driven by the region's early adoption of advanced technologies, robust infrastructure, and the presence of numerous key players in the real estate sector. The growing demand for efficient property management, customer relationship management, and data-driven decision-making has led to widespread implementation of software solutions, solidifying North America's position as the market leader.

The Asia Pacific region is expected to grow at the fastest CAGR of about 14.79% from 2024 to 2032. This rapid growth can be attributed to the region's expanding real estate markets, urbanization, and increasing technological adoption. As developing economies invest in infrastructure and digital transformation, the demand for real estate software to streamline operations, manage large-scale developments, and improve customer experiences is expected to rise significantly, driving market expansion in the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Accruent (Maintenance Connection, Angus Anywhere)

-

Altus Group Ltd. (Argus Enterprise, Altus Analytics)

-

Autodesk Inc. (AutoCAD, Revit)

-

CoStar Realty Information Inc. (CoStar, LoopNet)

-

Microsoft Corporation (Azure, Dynamics 365)

-

MRI Software LLC (MRI Real Estate Manager, MRI Property Management)

-

Oracle Corporation (Oracle Primavera, Oracle Cloud Infrastructure)

-

RealPage Inc. (RealPage Property Management, RealPage Marketing)

-

SAP SE (SAP S/4HANA, SAP Cloud Platform)

-

SMR Group (SMR Management Software, SMR Cloud)

-

Trimble Inc. (Trimble Real Estate, Tekla Structures)

-

Yardi Systems Inc. (Yardi Voyager, Yardi Matrix)

-

Fiserv Inc. (Fiserv Payments, Fiserv LoanServ)

-

Procore Technologies, Inc. (Procore Construction Management, Procore Project Management)

-

AppFolio, Inc. (AppFolio Property Manager, AppFolio Investment Management)

-

Zillow Group, Inc. (Zillow Premier Agent, Zillow Rentals)

-

Rentlytics (Rentlytics Analytics, Rentlytics Insights)

-

Cresa (Cresa Workplace Solutions, Cresa Lease Advisory)

-

ResMan (ResMan Property Management, ResMan Leasing)

-

Brokermint (Brokermint Transaction Management, Brokermint Commission Management)

-

RealEstateMall (RealEstateMall CRM, RealEstateMall Marketing)

-

VTS (VTS Rise, VTS Market)

-

TenantCloud (TenantCloud Property Management, TenantCloud Accounting)

-

SpaceIQ (SpaceIQ Workspace Management, SpaceIQ Workplace Solutions)

Recent Developments:

-

In June 2024, House730, a Hong Kong-based property search platform, became the first to integrate Microsoft Azure OpenAI Service's natural language processing, significantly improving search accuracy and user experience. This innovation caters to more complex property queries, enhancing results by 4%.

-

In September 2024, Hyatt selected Oracle OPERA Cloud as its global property management system, aiming to centralize data and improve operational efficiency across its portfolio of over 1,000 hotels. This shift enhances guest experience by offering personalized insights and streamlining property management.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 12.22 Billion |

|

Market Size by 2032 |

USD 37.16 Billion |

|

CAGR |

CAGR of 13.22% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Customer Relationship Management Software, Enterprise Resource Planning Software, Property Management Software, Contract Software, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Accruent, Altus Group Ltd., Autodesk Inc., CoStar Realty Information Inc., Microsoft Corporation, MRI Software LLC, Oracle Corporation, RealPage Inc., SAP SE, SMR Group, Trimble Inc., Yardi Systems Inc., Fiserv Inc., Procore Technologies Inc., AppFolio Inc., Zillow Group Inc., Rentlytics, Cresa, ResMan, Brokermint, RealEstateMall, VTS, TenantCloud, SpaceIQ |

|

Key Drivers |

• Technological Advancements the Role of AI ML and Automation in Transforming the Real Estate Software Market |

|

RESTRAINTS |

• High Initial Costs Limiting the Adoption of Real Estate Software Market |