Decentralized Finance (DeFi) Market Key Insights:

Get more information on Decentralized Finance (DeFi) Market - Request Sample Report

The Decentralized Finance (DeFi) Market Size was valued at USD 20.76 Billion in 2024 and is expected to reach USD 637.73 Billion by 2032, growing at a CAGR of 53.56% over the forecast period 2025-2032.

Increasing global adoption of blockchain technologies, driven by governmental initiatives to promote financial technology innovation is the key factor driving growth of the Decentralized Finance (DeFi) market. In 2023, the U.S. government reported a 65% year-over-year increase in blockchain-related investments and noted the growing trend of decentralized finance applications offering alternatives to traditional financial systems. Additionally, the European Commission has been actively supporting the blockchain ecosystem through the European Blockchain Services Infrastructure (EBSI), which focuses on enhancing digital financial services.

The World Bank also noted that developing countries where traditional banking infrastructure is scarce have been increasingly turning to blockchain-based financial services. For instance, in 2023, over 32% of financial transactions in certain African nations were conducted through DeFi platforms, marking a substantial shift in the financial landscape. The push for digital currencies, including the Digital Euro and Digital Yuan alongside the investment into DeFi infrastructure by global governments has also driven this narrative in building reliable financial systems. This not only serves to increase financial inclusion but also fosters the adoption of decentralized platforms by decreasing dependence on central intermediaries. Governments are increasingly seeing DeFi as a new way to promote economic growth by lowering transaction costs and increasing efficiency. The latest International Monetary Fund (IMF) report stated that global digital assets inclusive of DeFi could comprise upwards of 12% of the global financial system by 2030.

Market Dynamics

Drivers

-

The growing adoption of blockchain across various industries is boosting the use of DeFi platforms. Blockchain’s ability to provide transparency, immutability, and security has made it an ideal choice for financial services, pushing the expansion of DeFi solutions.

-

DeFi offers access to financial services without traditional intermediaries, catering to underserved populations. This democratization of finance, especially in regions with limited banking infrastructure, is driving demand for decentralized solutions.

-

The rapid development of decentralized applications (dApps) and smart contracts is making financial transactions more automated and efficient, enhancing trust and reducing the need for intermediaries.

Blockchain technology has become increasingly popular, which in turn has led to the rapid expansion of decentralized finance (DeFi) platforms. Blockchain offers a clear, secure, and decentralized infrastructure that does not require any intermediaries such as banks or financial institutions. Moving more towards the decentralization part is very attractive to users who want their assets and financial transactions to be as transparent as possible. The rise of decentralized applications (dApps) and smart contracts highlights this with their ability to radically alter financial systems by automating complex processes without any need for an intermediary. In 2023, the number of decentralized applications (dApps) has recorded an exponential increase with over 4,000 active DeFi projects of Ethereum, which is still the leading blockchain for this ecosystem. This growth is driven by blockchain’s ability to provide tamper-proof, immutable records of financial transactions, increasing trust among users.

In 2023 the total value locked (TVL) of DeFi protocols has grown to over USD 50 billion in 2023, up from just USD 10 billion in 2020, reflecting a belief that blockchain finance will return more benefits to users than conventional finance. Moreover, a Deloitte report found that 76% of global financial institutions are interested in blockchain adoption for improving their functionalities which further corroborates the transformative nature of Blockchain Technology in finance. Prominent examples of blockchain driving DeFi adoption include platforms like Aave and Compound, which leverage Ethereum’s blockchain to enable peer-to-peer lending and borrowing. These platforms provide transparency, eliminate the need for credit checks, and reduce transaction costs, contributing to DeFi’s expanding user base.

Restraints

-

The lack of clear regulatory frameworks for DeFi activities is a significant challenge.

-

DeFi platforms are frequently targeted by hackers due to their open-source nature. Smart contract bugs, rug pulls, and other exploits pose significant risks to users, reducing trust and slowing down the growth of the market.

Regulatory uncertainty is one of the largest restraints in the DeFi market and it will highly affect growth and mainstream adoption of DeFi. DeFi operates in a largely unregulated environment, which poses challenges for both users and regulators. The issue of how to classify and regulate decentralized financial systems is still open for governments and financial authorities all over the world. This lack of clear and consistent regulation creates uncertainty for investors, businesses, and developers, leading to hesitation in participating in the market.

Lack of regulation will cause fraud, money laundering, and consumer protection problems. Moreover, stringent regulations could be introduced in the future, potentially limiting the scope of DeFi platforms. The lack of clarity on regulation creates the inability to have institutional players enter with confidence, given that it is unclear what compliance and legal risks they are assuming. Since then, regulatory uncertainty has strangled the full potential of DeFi and preventing it from achieving wider acceptance and integration with traditional financial systems.

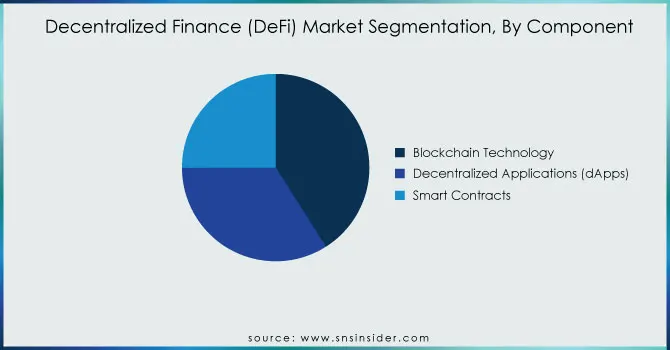

By Component

In 2023, the Decentralized Finance (DeFi) market was dominated by the blockchain technology segment with a major revenue share of over 40.0%. The large share of this segment is because it provides a safe, transparent and decentralized infrastructure for DeFi applications to run on. All the decentralized platforms work on blockchain. It is a technology that Bitcoin and many other cryptocurrencies are based on, It makes sure that transactions cannot be modified and are fully trustless without requiring intermediaries like banks or traditional financial institutions. The government helped a lot in creating the environment for blockchain technology to grow, and in 2023 U.S. Department of Commerce has shown that there is a rise of around 42% in blockchain patents filed around the world now as compared to previous years. Such high levels of endorsement and push for blockchain by the government itself have led to widespread adoption across multiple sectors including DeFi. In addition, regulatory institutions like the European Securities and Markets Authority (ESMA) identified blockchain as a means of boosting transparent financial systems, which drives the growth of this segment.

By Application

The data and analytics segment dominated the market in 2023, accounting for 19% of global revenue. The prominence of the data and analytics segment is due to their ability to leverage the excessive amount of transactional data produced by the DeFi platforms, executing advanced risk assessments, fraud detection, and market predictions. This boom has been accelerated by proximity and government-backed initiatives including the EU's Data Act in 2023 that encourage open access to financial data.

On the other side, the payments segment is projected to grow fastest over the forecast period. we expect the payments business to grow quickly due to the increased need for seamless cross-border payments at lower cost and higher speed with DeFi platforms than traditional ones. In fact, we had seen 60% low cost of cross-border payment due to the DeFi solution in the year 2023 according to the Bank for International Settlements (BIS) which surely makes this a very attractive application segment for global commerce.

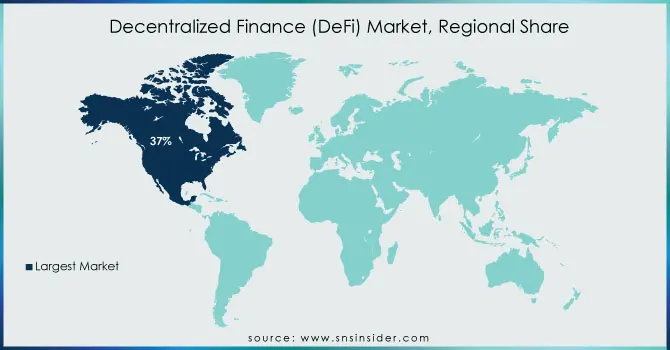

Regional Insights

North America held a 37% revenue share of the world DeFi market in 2023. With its improved regulatory frameworks, high blockchain technology investment rates, and robust startup ecosystem, the United States has been one of the global leaders in DeFi adoption. As per the U.S. Department of Treasury, more than $15 billion has been invested into DeFi start-ups in 2023 so far, consolidating the dominance of the region. In addition, the regulating DeFi space by the Securities and Exchange Commission (SEC) adds some more clarity and can potentially attract institutional investors into the market. Regulatory bodies in North America are working with industry players to create a framework that fosters innovation while ensuring financial stability. The U.S. is a key player in the DeFi market, supported by a robust ecosystem of blockchain engineers, investors, and entrepreneurs. Its advanced technology infrastructure and significant investment are driving the rapid growth of DeFi applications. Organizations like the CFTC aim to balance innovation with consumer protection by collaborating with industry participants. As a major hub for DeFi, the U.S. attracts global interest and investment. For example, in April 2024, Repple announced plans to introduce a Stablecoin fully backed by U.S. dollar deposits and pegged to the dollar on a 1:1 basis.

On the other hand, the Asia-Pacific (APAC) region will register the fastest CAGR during the forecast period. This growth is particularly driven by Singapore, Japan, and South Korea. The growth was a result of various programs launched by the Monetary Authority of Singapore (MAS), including one such blockchain innovation program initiated in early 2023 to promote scalable DeFi applications. This rapid growth is also propelled by the support of blockchain technology in China, as well as the growing volume of venture capital investments in decentralized platforms.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments:

-

The U.S. Federal Reserve recently announced plans for a pilot program to incorporate blockchain-based payment systems into the traditional banking sector in Aug 2023 This represents the next crucial link between DeFi and traditional financial players.

-

June 2023: The European Central Bank (ECB) released a report discussing the relevance of blockchain technology in financial services. DeFi was highlighted in the report for its potential to lower transaction costs by approximately 20% across the European Union over the next five years.

-

April 2023: The Monetary Authority of Singapore (MAS) introduced the "DeFi Sandbox," a regulatory framework that allows blockchain startups to test their decentralized applications in a controlled environment. This initiative has attracted major global players to set up operations in Singapore, contributing to the region’s rapid growth in the DeFi market.

Key Players

Service Providers / Manufacturers:

-

Uniswap Labs (Uniswap v3, Auto Router)

-

MakerDAO (Dai, Oasis)

-

Aave (Aave Protocol, Aave Arc)

-

Compound Labs (Compound Protocol, Compound Treasury)

-

Curve Finance (Curve Pool, CurveDAO)

-

SushiSwap (SushiSwap Exchange, BentoBox)

-

Chainlink Labs (Chainlink Price Feeds, Chainlink VRF)

-

Yearn Finance (Yearn Vaults, Yearn Strategies)

-

Balancer Labs (Balancer Pool, Balancer Smart Pools)

-

Polygon (Polygon zkEVM, Polygon POS)

Key Users of Services and Products:

-

Tesla, Inc.

-

Microsoft Corporation

-

Visa, Inc.

-

Goldman Sachs

-

PayPal Holdings, Inc.

-

Meta Platforms, Inc.

-

Shopify

-

Amazon Web Services (AWS)

-

JPMorgan Chase & Co.

-

Apple Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 20.76 Billion |

| Market Size by 2032 | USD 637.73 Billion |

| CAGR | CAGR of 53.56% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts) • By Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction Industry, Stablecoins, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Uniswap Labs, MakerDAO, Aave, Compound Labs, Curve Finance, SushiSwap, Chainlink Labs, Yearn Finance, Balancer Labs, Polygon |

| Key Drivers | • The growing adoption of blockchain across various industries is boosting the use of DeFi platforms. Blockchain’s ability to provide transparency, immutability, and security has made it an ideal choice for financial services, pushing the expansion of DeFi solutions. • DeFi offers access to financial services without traditional intermediaries, catering to underserved populations. This democratization of finance, especially in regions with limited banking infrastructure, is driving demand for decentralized solutions. |

| Restraints | • The lack of clear regulatory frameworks for DeFi activities is a significant challenge. • DeFi platforms are frequently targeted by hackers due to their open-source nature. Smart contract bugs, rug pulls, and other exploits pose significant risks to users, reducing trust and slowing down the growth of the market. |