Mobile Gamma Cameras Market Report Scope & Overview:

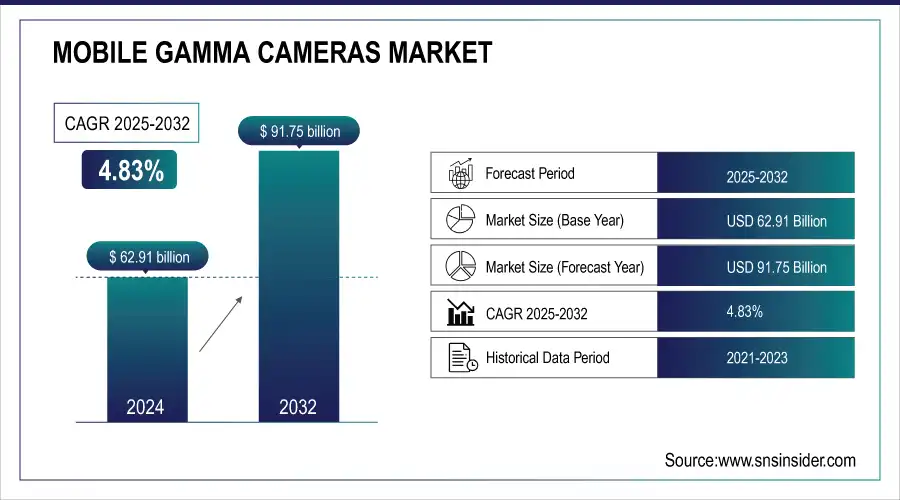

The Mobile Gamma Cameras Market was valued at USD 62.91 billion in 2024 and is expected to reach USD 91.75 billion by 2032, growing at a CAGR of 4.83% from 2025-2032.

Get more information on Mobile Gamma Cameras Market - Request Free Sample Report

The mobile gamma cameras market is witnessing significant growth due to advanced imaging capabilities and rising demand for precise diagnostics. Driven by increasing chronic diseases and cancer prevalence, these devices enable rapid, accurate examinations in clinical settings. In the U.S., over 600,000 cancer deaths occurred in 2022, with 1.9 million new cases expected by 2025, highlighting the critical need for efficient diagnostic tools. Partnerships between healthcare providers and manufacturers ensure accessibility and quality. Technological advancements in gamma cameras offer higher sensitivity, improved resolution, and reduced radiation exposure, enhancing safety and effectiveness for both patients and medical professionals.

Market Size and Forecast

-

Mobile Gamma Cameras Market Size in 2024: USD 62.91 Billion

-

Mobile Gamma Cameras Market Size by 2032: USD 91.75 Billion

-

CAGR: 4.83% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Mobile Gamma Cameras Market Trends

-

Rising demand for portable imaging solutions in hospitals and clinics is driving mobile gamma camera adoption.

-

Integration with advanced detectors and software is enhancing image resolution and diagnostic accuracy.

-

Growing prevalence of cancer and cardiac diseases is boosting market growth.

-

Adoption of SPECT and hybrid imaging systems is expanding clinical applications.

-

Increasing focus on point-of-care diagnostics and bedside imaging is enhancing convenience and workflow efficiency.

-

Technological advancements in compact, lightweight, and battery-operated cameras are improving mobility.

-

Collaborations between medical device manufacturers, healthcare providers, and research institutions are fostering innovation and wider adoption.

Mobile Gamma Cameras Market Growth Drivers:

-

Rising prevalence of chronic diseases and cancers significantly boosts mobile gamma cameras demand.

The growing prevalence of chronic diseases and cancers is a primary driver for the mobile gamma cameras market. These conditions require timely and accurate diagnostics for effective treatment planning. Mobile gamma cameras provide clinicians with high-quality imaging for precise detection, staging, and monitoring of diseases, especially in oncology. The increase in cancer incidence, cardiovascular disorders, and other chronic illnesses has escalated the need for accessible and efficient imaging solutions. Healthcare facilities are adopting mobile gamma cameras to enhance diagnostic accuracy, improve patient outcomes, and streamline clinical workflows, contributing significantly to market growth.

Mobile Gamma Cameras Market Restraints:

-

High costs of mobile gamma camera systems limit adoption, especially among smaller healthcare providers.

The high acquisition and maintenance costs of mobile gamma camera systems restrict market growth. Advanced imaging technology, precision sensors, and integration with software platforms make these systems expensive for healthcare providers, especially small clinics and emerging markets. Budget constraints in hospitals can delay or limit procurement, reducing widespread adoption. Additionally, costs associated with staff training, calibration, and maintenance add to the financial burden. This price sensitivity hinders penetration in cost-conscious regions and affects the scalability of mobile gamma cameras in routine diagnostics, restraining the market despite their clinical advantages.

Mobile Gamma Cameras Market Opportunities:

-

Innovations in imaging technology enhance diagnostic accuracy, efficiency, and clinical applicability, creating market growth.

Ongoing technological advancements in imaging provide lucrative growth opportunities for the mobile gamma cameras market. Developments such as higher-resolution detectors, enhanced sensitivity, compact designs, and software integration improve diagnostic accuracy and operational efficiency. Innovations like real-time imaging, hybrid modalities, and AI-assisted interpretation expand clinical applications, enabling earlier disease detection and precise monitoring. These advancements reduce radiation exposure and improve patient comfort, increasing adoption among hospitals and diagnostic centers. As healthcare providers seek cutting-edge solutions for improved outcomes, continuous innovation positions mobile gamma cameras as essential tools, driving long-term market growth.

Mobile Gamma Cameras Market Segment Analysis

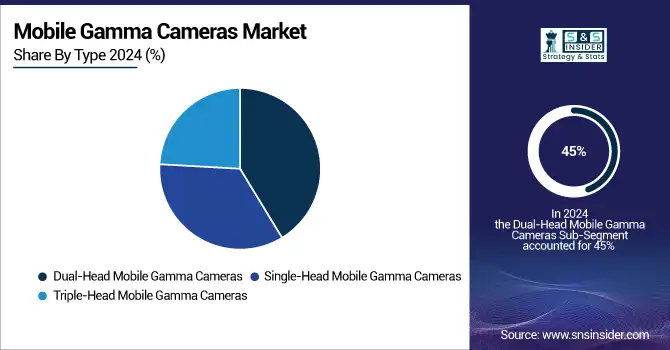

By Type, Dual-Head Mobile Gamma Cameras dominate the market

Among the types, the largest segment is represented by Dual-Head Mobile Gamma Cameras, and it currently has a market share of 45% in 2024. The likely reason for the popularity of dual-head systems is their optimal balance of performance and cost. While Single-Head models satisfy the needs of many organizations or institutions, they are inherently limited due to their design, and as a result, their use is typically confined to a relatively limited range of applications. In contrast, the Dual-Head system offers many improvements that make it suitable for the majority of diagnostic and other imaging applications.

As per the information sourced from the National Institutes of Health, dual-head cameras are popular in a clinical setting because they are capable of producing high-quality images in a relatively short timeframe, allowing healthcare providers to manage the patients and provide an accurate diagnosis. Dual-Head cameras themselves are also a suitable middle ground between the Single-Head cameras and the Triple-Head systems, incurring a considerable boost in two types of performance, the image quality, and the operation speed, without suffering the associated increase in costs.

By End-User, Hospitals dominate the Mobile Gamma Cameras market

Regarding the end-users, hospitals dominated the mobile gamma cameras market and accounted for a significant share of 50% in 2024. This trend can be explained by the fact that the application of the discussed device is highly widespread in this type of setting. The American Hospital Association reports about the increased investments of hospitals in sophisticated imaging technologies and this device in particular. Furthermore, this sector demonstrates particularly high applicability of the cameras for multiple diagnostic procedures related to cancer detection and cardiac imaging.

In addition, a high volume of diagnostic procedures is performed in hospitals, and some institutions can adopt advanced medical equipment into their workflows. Additionally, this type of setting can benefit significantly from the use of mobile gamma cameras because it is more flexible and efficient since it can be applied for multiple purposes and departments. It also indicates an improved level of patient care, and that is why this type of setting accounts for the dominant share regarding the application of this device.

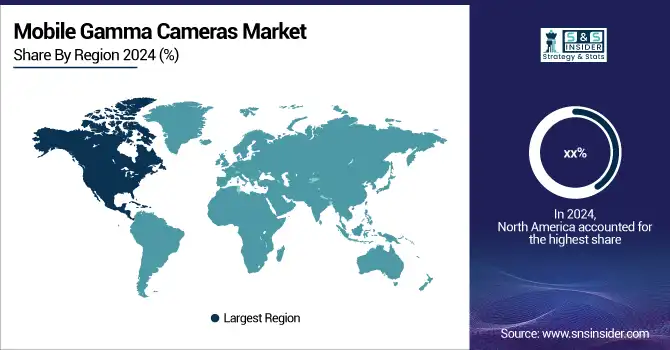

Mobile Gamma Cameras Market Regional Analysis

North America Mobile Gamma Cameras Market Insights

North America dominated the Mobile Gamma Cameras Market in 2024 due to advanced healthcare infrastructure, high adoption of cutting-edge imaging technologies, and strong presence of key medical device manufacturers. The region benefits from substantial healthcare investments, well-established clinical networks, and rising prevalence of chronic diseases and cancers, driving demand for precise diagnostic tools. Continuous technological innovations, regulatory support, and collaborations between hospitals and manufacturers further strengthen North America’s leadership in the global mobile gamma cameras market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Mobile Gamma Cameras Market Insights

In 2024, Asia Pacific is emerging as a key region in the Mobile Gamma Cameras Market, driven by rising healthcare infrastructure, increasing prevalence of chronic diseases and cancers, and growing investments in advanced diagnostic imaging technologies. Expanding medical facilities, rising patient awareness, and government initiatives to improve healthcare accessibility are fueling market adoption. Countries like China, India, and Japan are leading in clinical implementation, supporting regional growth and technological advancement.

Europe Mobile Gamma Cameras Market Insights

In 2024, Europe holds a significant position in the Mobile Gamma Cameras Market, supported by advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, and strong government support for cancer care and chronic disease management. The presence of leading medical device manufacturers, well-established research facilities, and increasing investments in personalized medicine and nuclear imaging further drive market growth. Countries such as Germany, France, and the UK are at the forefront of adopting mobile gamma camera systems, enhancing diagnostic efficiency and improving patient outcomes across the region.

Middle East & Africa and Latin America Mobile Gamma Cameras Market Insights

The Middle East & Africa and Latin America Mobile Gamma Cameras Markets are witnessing steady growth, driven by expanding healthcare infrastructure, rising prevalence of chronic diseases and cancers, and increased government initiatives for improved diagnostics. Limited local manufacturing has led to reliance on imports, while partnerships with global medical device companies enhance accessibility. Investments in advanced imaging technologies, training for healthcare professionals, and rising awareness of early disease detection are fueling adoption, creating opportunities for market expansion in these regions, particularly in urban centers and emerging medical hubs.

Mobile Gamma Cameras Market Competitive Landscape:

Siemens Healthineers

Siemens Healthineers Expanded its mobile gamma camera offerings with the latest Symbia Intevo Bold system, providing high-resolution SPECT/CT imaging, faster scan times, and lower radiation exposure. Designed for hospitals and diagnostic centers, the system improves workflow efficiency, diagnostic accuracy, and patient safety. Siemens Healthineers focuses on integrating AI-driven analysis and advanced detector technology to enhance nuclear medicine procedures, supporting oncology, cardiology, and other clinical applications.

-

2024: Siemens Healthineers Installed a Symbia Evo Excel gamma camera in Lanka Hospitals, Sri Lanka enhancing nuclear medicine diagnostics across oncology by enabling precise tumor staging, follow-up, and therapy monitoring.

KEY PLAYERS:

Some of the Mobile Gamma Cameras Market Companies

-

DDD Diagnostic

-

Digirad Corporation

-

Spectrum Dynamics

-

GAEDE Medizinsysteme GmbH

-

Dilon Technologies

-

Gamma Medica

-

MiE GmbH

-

MEDX

-

Siemens Healthineers

-

GE Healthcare

-

Philips Healthcare

-

Canon Medical Systems Corporation

-

Hitachi Medical Corporation

-

Carestream Health

-

Fujifilm Holdings Corporation

-

Mediso Ltd.

-

Neusoft Medical Systems

-

Shimadzu Corporation

-

Hologic, Inc.

-

Trimed, Inc.

-

Eczacibasi-Monrol Nuclear

-

Siemens Healthineers

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 62.91 Billion |

| Market Size by 2032 | US$ 91.75 Billion |

| CAGR | CAGR of 4.83% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Single-Head, Dual-Head, Triple-Head) •By Application (Cardiology, Oncology, Endocrinology, Orthopedics, Neurology, Others •By End-User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Specialty Clinics). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DDD Diagnostic, Digirad Corporation, Spectrum Dynamics, GAEDE Medizinsysteme GmbH, Dilon Technologies, Gamma Medica, MiE GmbH, MEDX, Inc. and Other players |