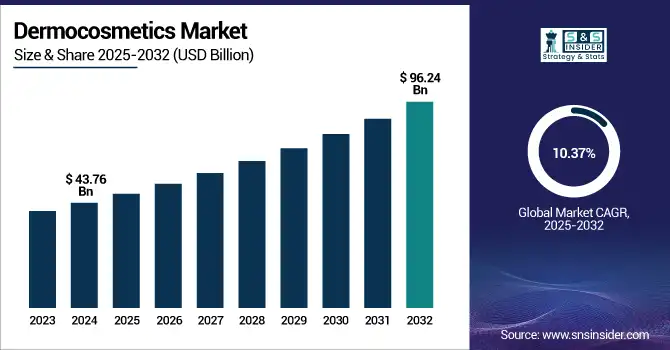

Dermocosmetics Market Size Analysis:

The Dermocosmetics Market size was valued at USD 43.76 billion in 2024 and is expected to reach USD 96.24 billion by 2032, growing at a CAGR of 10.37% over the forecast period of 2025-2032.

Increasing awareness regarding skin health, mounting cases of chronic skin problems, including eczema, acne, and rosacea, and preference for clinical skincare solutions among consumers are leading to the high dermocosmetics market growth. As per AAD, the annual rate of Americans who see a dermatologist is around one in four, and there are more than 85 million Americans affected by skin diseases, which is leading to the growth of the dermocosmetics skin care products market. With the aging population, according to AARP reports, the number of skin conditions increases after the 70s, and lifestyle components like pollution and exposure to the sun moving forward, a surge in the need for specialized dermatological care has ensued.

To Get more information on Dermocosmetics Market - Request Free Sample Report

A report in JAAD (2024) gives importance to the superior benefits of combined dermocosmetic and drug treatment for acne, consolidating the blurring of the lines between skincare and treatment, indispensable to the advancement of the global dermocosmetics space.

Consumers are looking for natural ingredients. 76% of Americans say organic plays a role in personal care (NSF). At the same time, investment in R&D is taking place, dermocosmetic breakthroughs such as Aptar’s Micro Airless packaging for the latest product from SVR underscore the evolution of the industry. Regulations, such as the FDA guidelines related to cosmetic product registration, also strengthen the credentials of the product. Expansion of the dermocosmetics market can be attributed to rising expenditure on skincare, substantiated by BLS (Bureau of Labor Statistics) data and the growth of esthetician certification (NCEA). Progress in molecular dermatology, financed by research supported by the NIH, keeps driving the analysis and innovation of the dermocosmetics market. AI is being applied in testing formulations, and marketers are embracing products with a focus on the microbiome to cater to this increasing demand.

In March 2024, SVR Laboratories introduced a new dermocosmetic line using Aptar’s "Micro Airless" technology for perfect delivery of active ingredients, free from contamination. This advancement reflects consumer demand for safe, hygienic and clinically effective skincare products, contributed to growing demand for preservative-free skincare products which is accelerating trends in the dermocosmetics market.

Dermocosmetics Market Dynamics:

Drivers:

-

Rising Demand, Innovation, and Regulatory Backing Fueling Market Growth

The dermocosmetics industry is propelled by surging consumer consciousness towards skin health, mounting incidences of skin diseases, and surging uptake of scientifically-backed skincare solutions. Per a JAAD study (2023), more than 50% of the worldwide population suffers from some form of skin problems every year, driving consumers to look for solutions endorsed by dermatologists. Lifestyle-related diseases caused by pollution, stress, and bad diets have fueled demand for premium skincare.

Growth of hybrid skincare-cosmetic products. A proliferation in aesthetic concerns, particularly among millennials and Gen Z, is driving growth in hybrid skincare-cosmetic products. Supply-side, businesses continue to invest in R&D – L’Oréal has just invested more than USD 1.08 billion in dermatology and skincare innovations. In addition, greater FDA control over cosmetic labeling and manufacturing under the MoCRA has raised consumer confidence in attested products. A growing number of dermatology-centered start-ups and partnerships between skincare companies and pharmaceutical companies are also influencing the growth of the dermocosmetics market.

Companies such as La Roche-Posay and Bioderma are also using AI-powered diagnostic tools to tailor skin treatments, suggesting robust tech-driven momentum. The growing awareness of eco-friendly consumers has also inspired dermocosmetic companies to introduce sustainable formulations and skin microbiome-friendly products, which in turn broadens the demand for the global dermocosmetics market.

Restraints:

-

High Cost, Limited Access, and Regulatory Hurdles Hamper the Market Expansion

Dermocosmetic products tend to carry high prices because of targeted ingredients, sophisticated delivery systems, and clinical support that preclude affordability for low-income groups. Dermatological treatments cost more than USD 600 out-of-pocket in a year, discouraging regular use, the National Eczema Association estimates. Distribution imbalances also produce supply-chain gaps, particularly in developing countries where few dermatological facilities or pharmacies carry dermocosmetics.

Regulatory systems such as the FDA's MoCRA increase the safety of the product but create high compliance requirements that can penalize smaller players and slow the launches of smaller manufacturers. Moreover, fragmentation between global standards (such as divergent ingredient approval between the U.S., EU, and Asia) makes dermocosmetics' global distribution problematic. Gaps in aesthetician education and certifications, emphasized by initiatives of NCEA, also make professional consensus more difficult.

Dermocosmetics Market Segmentation Analysis:

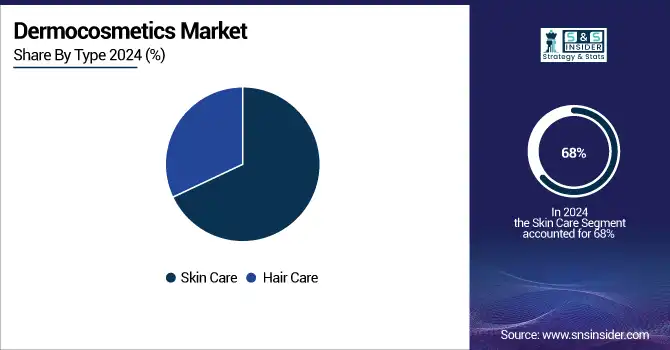

By Type

In terms of the product type, the skincare segment is the largest shareholder of the global dermocosmetics market in 2024, which was responsible for 68% share of the total market. This market superiority is largely attributed to increasing consumer awareness regarding skin health, increasing skin-associated disorders such as acne, eczema, and hyperpigmentation, and increasing geriatric population across the globe. This lead was particularly driven by the sub-segment of anti-aging, as demand for products that boost collagen and reduce wrinkles has continued to rise among both older and younger consumers looking to preventatively address the signs of aging. With advances not just for aging skin, but with nanotechnology for enhanced penetration of ingredients and AI technology to diagnose skin conditions, we are more likely to trust scientific claims around skincare. In addition, a large amount of money is invested by major dermocosmetics companies in research and developing skincare lines with a dermatologically tested stamp has consolidated their leading position in the market.

Hair care is expected to be the fastest-growing category in the global dermocosmetics market due to rising concerns about scalp health and hair thinning and loss caused by stress, hormonal imbalances, and environmental factors. Customers are looking for therapeutic and medically developed hair care products for seborrheic dermatitis, dandruff, and androgenic alopecia. Scalp serums, pH-balanced shampoos, and probiotic-infused hair care are gaining popularity as the focus moves to overall scalp and follicle health.

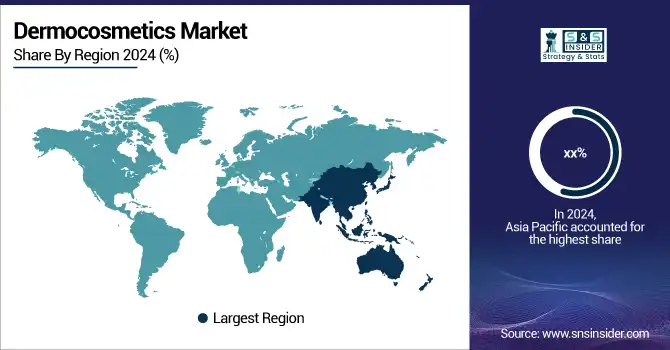

Regional Insights:

Asia Pacific was the leading region in the global dermocosmetics market in 2024 on account of an increasing population base, skin health awareness, coupled with an increase in disposable income. It is the largest market that holds the commanding share, driven by countries such as China, Japan, and South Korea, where skincare is an essential approach towards culture and lifestyle. In China, as growth is generated by rising consumer interest in anti-aging and brightening products, supported by heavy e-commerce penetration, it is the largest beauty market in the region. South Korea, as part of its K-beauty powerhouse, has also played a huge part in the region’s rise due to its innovative skincare formulation. In addition, findings from government-sponsored cosmetics R&D and the fast development of local brands are driving innovation. India is becoming a strong growth centre as increased urbanization and a growing middle class are increasingly interested in dermatologist-recommended solutions. Increasing penetration of cost-effective dermocosmetic products and rising digital adoption have also rapidly driven the growth of the market in the region.

Europe is expected to be the fastest-growing region for dermocosmetics, stimulated by stringent regulatory compliance, rising consumer focus on therapeutic skincare, and the strong presence of leading dermocosmetic companies globally. France, where industry heavyweights, L’Oréal and Pierre Fabre, control the sector, is the most powerful country in the region, with an established tradition of pharmaceutical-grade cosmetics and strong consumer confidence in skin care products sold in pharmacies. More than 60% of dermocosmetics in Europe are sold in pharmacies (EU industry figures), which strengthens the clinical image of this channel. Germany and the U.K. also emerged as significant contributors with increased sales of anti-aging and sensitive skin products.

The dermocosmetics market is expected to experience modest growth in North America, primarily in the U.S., owing to well-established healthcare infrastructure, high diagnostic/dermatological awareness, and strong consumer buying power. The U.S. dermocosmetics market size was valued at USD 5.95 billion in 2024 and is expected to reach USD 10.71 billion by 2032, growing at a CAGR of 7.67% over the forecast period of 2025-2032. The U.S. market is dominated by clinical skincare that is recommended by dermatologists and has overflowed from traditional cosmetics. Major players such as Johnson & Johnson and Colgate-Palmolive are boldly rolling out doctor-approved skincare lines. More than 85 million Americans are affected by skin diseases each year, creating the need for targeted, evidence-based dermocosmetic solutions, according to the American Academy of Dermatology.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading dermocosmetics companies operating in the market include L’Oréal, Pierre Fabre Group, Johnson & Johnson Services, Inc., Unilever, Procter & Gamble, Colgate-Palmolive Company, Beiersdorf AG, Coty Inc., Galderma, and Shiseido.

Recent Developments in the Dermocosmetics Market:

-

In May 2025, Teoxane, a brand renowned for its dermal fillers, expanded into the U.S. skincare market by launching its Swiss-made dermocosmetics line for online purchase, aiming to provide clinical-grade skincare directly to consumers.

-

In April 2024, Sisley debuted its first-ever dermocosmetic solution tailored for sensitive skin, blending luxury with dermatological efficacy as it stepped into the science-backed skincare space.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 43.76 Billion |

| Market Size by 2032 | USD 96.24 Billion |

| CAGR | CAGR of 10.37% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Skin Care (Anti-Aging, Skin Whitening, Sun Protection, Acne Treatment, and Others), Hair Care (Anti-Hairfall, Anti-Dandruff, Others) • By Distribution Channel (Pharmacies/ Drug Stores, Online Stores, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | L’Oréal, Pierre Fabre Group, Johnson & Johnson Services, Inc., Unilever, Procter & Gamble, Colgate-Palmolive Company, Beiersdorf AG, Coty Inc., Galderma, and Shiseido. |