Accident Insurance Market Size & Trends

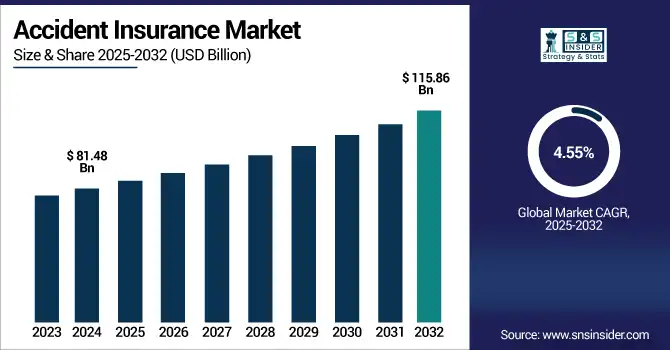

The Accident Insurance Market size was valued at USD 81.48 billion in 2024 and is expected to reach USD 115.86 billion by 2032, growing at a CAGR of 4.55% over the forecast period of 2025-2032.

To Get more information on Accident Insurance Market - Request Free Sample Report

The global accident insurance market is growing significantly as there is increasing awareness related to financial protection owing to accidents, a rise in road and workplace accidents, and an upsurge in global workforce participation, driving the growth of this market. Government safety regulations improve, and the acceptance of digital insurance platforms also accelerates the growth of the market. Similarly, both individuals and corporate customers also seek flexible, short-term, and customizable coverage for accidents. To increase the speed of market competitiveness, insurers are using AI and big data analytics to improve the claim process and provide personalized products.

The U.S. accident insurance market size was valued at USD 23.94 billion in 2024 and is expected to reach USD 33.46 billion by 2032, growing at a CAGR of 4.33% over the forecast period of 2025-2032.

The North American accident insurance market growth is primarily driven by the U.S., as the country possesses a conducive insurance structure with a large population and a mature regulatory structure. As the most advanced market globally, with a broad portfolio of products, the country excels in innovation, digitalisation, and umbrella policy offerings. The presence of bigger insurers, employer-sponsored programs, and a growing knowledge about accident financial protection would still provide grounds for the leadership of the U.S. in the regional scope.

Accident Insurance Market Dynamics

Drivers

-

Rising Road Traffic Accidents and Occupational Hazards are driving the market growth.

The growing incidence of road traffic accidents globally, particularly in urban areas with high population density, together with the prevalence of workplace injuries, especially in construction, manufacturing, and mining, is primarily driving the demand for accident insurance. Accident insurance policies are becoming an increasingly important form of financial protection as more people and organizations look to safeguard themselves from the medical expenses and loss of income that result from an accident. The pattern is particularly acute in creating economies with high fatalities due to mishaps, prompting both individuals and enterprises to invest in protective insurance.

-

The Market Growth is Directed by Some Governmental Initiatives and Regulatory Aid

Many countries' governments have also actively promoted accident insurance by integrating it into the public welfare mechanism and through policy guidance. Policy penetration for a personal accident can be witnessed via the inclusion of personal accident in the Social Security program, or through public health insurance in the Asia Pacific and Latin America. Regulators in developed markets are also prompting employers, particularly in high-risk sectors, to provide compulsory accident coverage to employees. Such institutional support not only strengthens confidence in insurance companies but also broadens the entire accident insurance market customer base.

Restraint

-

High Premium Costs for Comprehensive Coverage are Restraining the Market from Growing

The high cost of premiums for plans that cover accidents, which include accidental death, disability, hospitalization, and critical illness, acts as a major restraint in the accident insurance market. Basic accident plans might be inexpensive, but the stronger plans with more comprehensive financial security features might cost substantially more, effectively deterring low-income individuals, gig workers, and small businesses from accessing the plans. Such a pricing barrier works as a hindrance to mass adoption and market expansion in price-sensitive regions.

Accident Insurance Market Segmentation Analysis

By Type of Accident Insurance

The accident insurance market share was dominated by the personal accident insurance segment in 2024, with a 42.60%, owing to rising awareness about personal safety among the general population, increasing urbanisation, as well as the incidence of loss due to accidental injuries occurring at home, on the road, and in recreational activities. The segment has gained traction for providing flexible coverage options, relatively low premiums, and accessibility through digital channels, and also through the bancassurance model. Moreover, a significant share of personal accident policies are sold along with life or health insurance products, which gives a push to the uptake of such products by individual customers looking to acquire complete financial protection.

The travel accident insurance segment is expected to witness the highest growth during the forecast period, owing to the revival of domestic and international travel, post-pandemic. One of the factors encouraging a boom in these under-penetrated segments is the growth of business and leisure tourism, the rise in international mobility, and stricter visa requirements from many countries for visas involving permanent injury. Additionally, the increasing preference for travel aggregators, coupled with online platforms providing packaged insurance at the time of booking, is also boosting the demand in this segment.

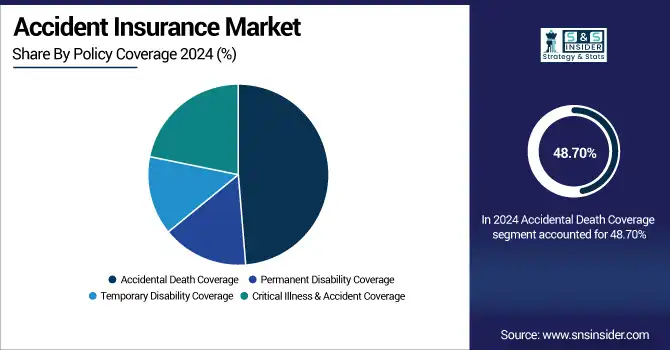

By Policy Coverage

The accidental death coverage segment occupied the largest share in the accident insurance market with around 48.70% in 2024, as it provides coverage to the beneficiary in case of the death of the policyholder due to an accident. Such coverage is very popular for both individual and corporate policies as it is offered as a lump return sum and will help families cope with sudden pressures such as unpaid loans and debts, regular bills, kids' education, etc. The relatively low premium compared to larger policies, as well as the fact that it is included in most base insurance, has made it a consumer favourite.

Owing to the growing number of cases of chronic and lifestyle-related diseases, including heart attacks and strokes, usually induced by or aggravated by accidents, the critical illness & accident coverage segment is anticipated to grow at the highest rate over the forecast period. The growing demand from consumers for single policies covering both accidental death and critical illness, increasing awareness about health issues, and the treatment costs for advanced medical technology are compelling insurers to introduce a hybrid plan. Employers and group insurers are also trying to provide more rounded protection for their employee benefit programmes, which is contributing to this trend.

By Customer Type

In 2024, the accident insurance market was dominated by the individual customers segment with a 43.25% market share, with factors such as enhancing personal risk perception, rising out-of-pocket expenditure on healthcare, as well as growing financial literacy. As a result, more and more people are preferring independent accident insurance plans to not only secure their own lives but also the lives of their family members from financial distress arising out of accidental injuries, disabilities, or even death. The ability to customize cover as per individual requirement and income levels, combined with hassle-free purchase of policy through digital platforms and agents, has changed the way individual accident insurance is perceived among a larger population across age groups.

The young adults segment is likely to be the fastest-growing segment in the forecast years, owing to growing preference for early financial planning coupled with high exposure to workplace- and travel-associated risks. As evidenced by many young professionals, particularly those who live in cities where they are active and participate in gigs and freelancing that don't have employer-sponsored benefits, are becoming more aware of personal safety nets. With cheap, simple, tech-enabled policies, insurers are also targeting this demographic.

By Policy Duration

In the year 2024, the accident insurance market was led by the annual policy renewals segment, reflecting the enduring inclination of both consumers and insurance providers to opt for uninterrupted insurance coverage along with the administrative ease of annual renewals. Due to a stable view and premium management, and the possibility to bundle accident insurance with other long-term products, annual policies also appeal to individuals and families, and even corporate clients. Insurers have higher customer retention and better risk assessment with these annual renewals, infusing this practice.

Short-term accident Insurance is projected to be the fastest-growing segment of short-term disability insurance over the forecast period, owing to its flexibility and demand among travel insurance, seasonal workers, and individuals participating in short-term activities like adventure sports or event-specific coverage needs. The rise of gig economy participants who are looking for perhaps no more than temporary protection that is also sufficient increases the demand. In another example of insurance companies taking advantage of the trend, insurers are dispensing short-duration policies to consumers that feature easy-to-purchase, app-based, and event-driven policies that respond to changing lifestyles.

Accident Insurance Market Regional Insights

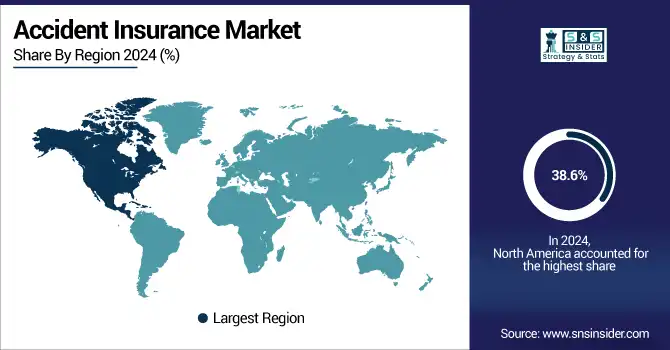

The accident insurance market trend in North America is dominated by 38.6% market share owing to its mature insurance ecosystem, high awareness levels, and wide variety of accident insurance plans. The region offers robust regulatory environments, high disposable income, and an established healthcare reimbursement landscape. Furthermore, government and employer-sponsored programs provide additional incentives for accident insurance among multiple consumer segments. North America is also the leading market because it is driven by the presence of top global insurance companies, along with continuous innovations in product offerings.

The accident insurance market analysis in Asia Pacific is poised to be the fastest-growing region due to rapid Asian economic progress, increasing middle-class populations, and increased awareness about financial protection from risk. With the internet gaining traction, more people seem to be getting their hands on accident insurance policies due to rising urbanization and the larger reach of digital platforms. Governments in countries such as India, China, and other Southeast Asian countries are encouraging health and safety insurance with public-private partnerships and awareness campaigns in the region, which is expediting the market penetration of these sectors.

The accident insurance market in Europe is projected to become a key financial market due to strong regulatory frameworks and increased demand for personal protection policies. In countries such as Germany, the UK, and France, there is a growing trend for both compulsory and optional accident coverage with social welfare systems that strongly stress workplace and travel coverage. Better digital transformation in insurance, such as online and telematics-based offerings, has driven higher access and better experience, which are driving higher demand for accident insurance across both personal and corporate customer segments.

Moderate growth is observed in the accident insurance market in Latin America and the Middle East & Africa (MEA). In places such as Brazil, Mexico, and Argentina, accident protection is gradually becoming more popular, particularly in cities and among businesses. Nonetheless, growth opportunities remain constrained as a result of low insurance penetration, affordability obstacles, and fragmented regulatory landscapes. Demand in MEA is experiencing steady growth owing to growing workplace safety rates, increasing commuting hazards, coupled with the development of travel accident protection. But adoption is slow due to a lack of infrastructure, country-to-country economic variances, and limited disposable income. Growth itself is steady—particularly in South Africa, UAE, and Saudi Arabia—but moderate relative to other, more mature geographies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Accident Insurance Market Key Players

The accident insurance market companies are Allianz, Assicurazioni Generali, China Life Insurance, MetLife, Ping An Insurance, AXA, Sumitomo Life Insurance, Aegon, Dai‑ichi Mutual Life Insurance, CPIC (China Pacific Insurance), Aviva, Munich Re Group, Zurich Insurance Services, Nippon Life Insurance, Gerber Life Insurance, AIG (American International Group), Chubb Limited, Prudential Financial, The Travelers Companies, and Berkshire Hathaway/GEICO, and other players.

Recent Developments in the Accident Insurance Market

-

October 2024 – At its 12th Allianz Motor Day conference in Munich, Allianz SE called upon policymakers, automobile manufacturers, and fleet managers to strengthen measures for urban pedestrians and cyclists. The insurer pointed out that about 70% of urban road deaths concern vulnerable road users, and estimated that a third of truck-related accidents can be prevented through available safety technologies like blind-spot detection and automatic emergency braking systems. Allianz referred to these advancements as a "new seat belt" strategy, the same as the EU's Vision Zero long-term objective.

-

January 2025 During its Investor Day on January 30, 2025, Assicurazioni Generali formally unveiled its new three‑year business plan, Lifetime Partner 27: Driving Excellence. The strategy includes ambitious financial goals—such as an 8–10% EPS CAGR, more than €11 billion of aggregate net holding cash flow, and €7 billion+ in dividend payments—backed by continued cash generation and no less than €1.5 billion of share buybacks programmed up to 2027.

Accident Insurance Market Report Scope:

Report Attributes Details Market Size in 2024 USD 81.48 Billion Market Size by 2032 USD 115.86 Billion CAGR CAGR of 4.55% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Type of Accident Insurance (Personal Accident Insurance, Workplace Accident Insurance, Travel Accident Insurance, Auto Accident Insurance)

• By Policy Coverage (Accidental Death Coverage, Permanent Disability Coverage, Temporary Disability Coverage, Critical Illness & Accident Coverage)

• By Customer Type (Individual Customers, Young Adults, Families, Senior Citizens, Corporate Customers, Small Enterprises, Medium-Sized Enterprises, Large Corporations)

• By Policy Duration (Short-Term Accident Insurance, Long-Term Accident Insurance, Annual Policy Renewals)

• By Distribution Channel (Direct Sales, Insurance Agents/Brokers, Online Platforms, Employer-Sponsored Programs)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles The accident insurance market companies are Allianz, Assicurazioni Generali, China Life Insurance, MetLife, Ping An Insurance, AXA, Sumitomo Life Insurance, Aegon, Dai ichi Mutual Life Insurance, CPIC (China Pacific Insurance), Aviva, Munich Re Group, Zurich Insurance Services, Nippon Life Insurance, Gerber Life Insurance, AIG (American International Group), Chubb Limited, Prudential Financial, The Travelers Companies, and Berkshire Hathaway/GEICO, and other players.