Modular Robotics Market Report Scope & Overview:

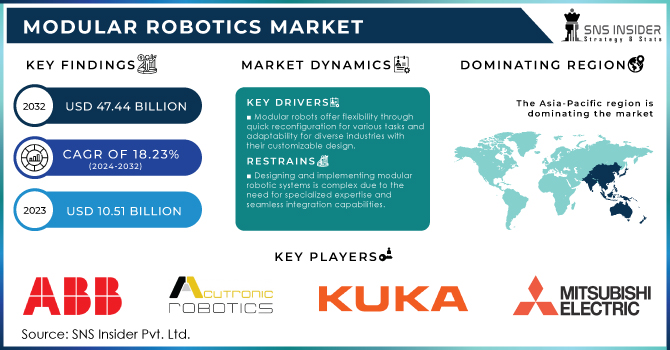

The Modular Robotics Market size was estimated at USD 10.51 billion in 2023 and is expected to reach USD 47.44 billion by 2032 at a CAGR of 18.23% during the forecast period of 2024-2032.

Get more information on Modular Robotics Market - Request Free Sample Report

Modular robotics is one of the major breakthroughs transforming the field of robotics. Central to the development is a use of sets of small, often identical, modules that are capable of reconfiguring autonomously. The functionality helps modular robots to perform a wide range of task from assembly in manufacturing to search and rescue operations in hazardous conditions. Moreover, unlike traditional one-piece robots, modular robots demonstrate superiority in a number of areas, including adaptability, scalability, and redundancy. The modules constituting a robot often include actuators, sensors, and control units, and the system is reconfigurable as a whole. Such a setup provides advantages in applications where a high degree of flexibility and skill is required. For example, in space, systems need to be able to react to the environment they are facing, as the terrains and obstacles are diverse and frequently unpredictable. The development of the field takes advantage of the progress in artificial intelligence and machine learning, which, when applied to robots, allows to make reconfigurable systems learn the most efficient way to complete certain tasks. In 2023, in the United State, the number of new robots installed grew by more than 15 percent. The automotive industry was a leader in the number of installations, with over 9,783 new robot units. Another driver of the field’s growth is the development of new, lightweight, and durable materials the robots can be made of, which allow to use them in applications such as healthcare, agriculture, and logistics.

Corporation unveiled the MOTOMAN-GP300R, a multifunctional modular robot with a payload capacity of 300 kg and a maximum reach of 3,220 mm. The MOTOMAN-GP300R will be put to use in applications for moving body parts along a vehicle manufacturing line.

The modular robotics is vast and continually expanding. In manufacturing, modular robots are revolutionizing assembly lines by enabling a tailor-made process of production while reducing downtime through quick reconfiguration. In agriculture, they can perform different tasks and adapt to different crops, thus slightly improving productivity and reducing labor costs. In the defense industry, modular robotics may be applied in the form of adaptable and resilient robotic systems used for reconnaissance and demining. In broad terms, though, as the augmenting automation of all types of industry demands their operations to be highly flexible, easy to scale and robust at the same time, there seems to be no stopping the growing popularity of modular robotics. The increased demand for this type of robotics may innovate further applications and new models on the market.

MARKET DYNAMICS

DRIVER

Modular robots offer flexibility by allowing quick reconfiguration for diverse tasks, and they provide adaptability by being suitable for a wide range of industries due to their customizable nature.

The modular robot design is its flexibility and adaptability in terms of quickly reconfiguring the pieces to perform multiple tasks in diverse industries. The new robots’ ability is derived from their construction, where every piece or module that is part of it can be easily interchanged for another that will better suit the desired application. In manufacturing, modular robots may perform various assembly procedures, whether it is a minute task with the use of small circuits or robust machinery assembly. They can meet any manufacturing plant’s needs in the automotive industry, performing welding, painting, or assembling different parts, in accordance with the specific production line. Additionally, as proven by the sources, because they can integrate with different tools and sensors, modular robots can be useful for other applications outside an industrial setting. For instance, in healthcare for performing nuanced surgeries and aiding the human workforce in guaranteeing a high degree of precision and for logistics companies in terms of highly functional modules capable of handling different types of materials. Thus, companies can design new tasks for their robots’ performance, or when it comes to more dynamic industries, they can avoid the need for substantial overhauls or investments into new equipment. The modular design also provides these robots with an advantage in terms of not making the new tasks adaptation process more streamlined, as well as an added value because of an extended use period when clients often modify or update the robots based on their new needs, desires or technological advances. In conclusion, due to the highly valuable flexibility and adaptability, modular robots become a useful tool for a high variety of industries and offer efficient solutions for various approaches.

Modular robots typically require a lower initial investment and incur reduced operational costs compared to traditional industrial robots, making them a more cost-effective option.

The modular robots are an effective alternative to the traditional industrial robots because of their lower initial investment and operational costs. Traditional robots are immobile, meaning that the expenditure might be high, in case they are in need of some repair or upgrade. However, modular robots are designed in a way, allowing for quick and scaled repairing. As long as the design is standardized, the repair or upgrade will also not necessarily require comprehensive precision engineering. The initial investment into modular robots is around 30% less, as the same amount invested into the traditional industrial robots will require further operational costs and other frequent investments into custom precision engineering.

This reduction in operational costs with respect to conventional robots is not less than 20-25% as far the modular robot. This cost reduction is largely thanks to the fact that they can be maintained more easily and replace or upgrade individual modules rather than an entire system. This means that should a module fail, the hit is limited to replacing just the one maybe faulty component rather than multiple ones, reducing time and money send fixing times. In addition, modulatory robots are based on the principle of saving resources and energy. Modular robots, can be as much as 15% more energy-efficient than their older counterparts; that adds up to electricity savings over time. The former low capex and lower opex due to modular robot deployment make it an interesting proposition for users looking to improve the automation processes at a cost-effective solution.

RESTRAIN

Designing and implementing modular robotic systems is complex due to the need for specialized expertise and seamless integration capabilities.

Designing and implementing modular robotic systems poses a considerable amount of complexity due to the need to have specialized proficiency and impeccable integration. Modular robotic systems are composed of interoperating components, or, in other words, relatively independent modules, each specifically designed to perform certain functions. For those modules, created by separate engineers or engineer groups to run together on the same system, highly specific knowledge of robotics, automation, and system integration should be demonstrated. Mechanical and systems engineers are often tasked with solving the problem, leveraging their knowledge to ensure compatibility between different components, create advanced control algorithms, and manage communication protocols. Furthermore, the solution should be scalable and flexible to fit various possible scenario requirements or future improvements. It can be seen that such a hill of complexity would require an advanced knowledge and proficiency in such fields of engineering as mechanical engineering, electronics, software development and systems engineering, in addition to a crucial understanding of how those components should cooperate in a final efficient seamless system product. The key to the creation of modular robotics is effective planning and rigorous implementation of the system that can guarantee the optimal operation of the above-mentioned components in the unclear yet vibrantly changing operational scenario.

High initial investment in modular robotics can be a significant barrier for businesses due to the considerable upfront costs, potentially deterring adoption.

Modular robotics with a high initial investment are a big barrier. This robot, facilitating flexible and customized operation, often requires relatively substantial costs both for hardware and software systems’ implementation. The high cost makes the implementation of the technology a significant barrier for a variety of businesses. It is primarily connected to the costs that affect the capital expenditure and the return that has to be made in the future. As for the capital expenditure, it is the initial expenses and investments. Therefore, in the short term, the development could be limited due to the high costs of purchasing the modular robotics. The financial factor could result in businesses not being able to afford implementing this type of robotics. As a result, the high initial investment required would slow the innovation and implementation of the technology in a variety of industries.

Need any customization research on Modular Robotics Market - Enquiry Now

KEY SEGMENTATION ANALYSIS

By Robot Type

The Articulated Modular segment held the largest market share in 2023 of more than 34.04%, mainly owing to high adoption rate from automotive industry for proper handling large size automatize parts and metal & machinery industry, where it is used for adequate management heavyweight sheets as well components Increased adoption of articulated modular robots in food & beverages, plastics and rubber, chemicals industry to automated processing is one the major driving factor which expected to boost this market.

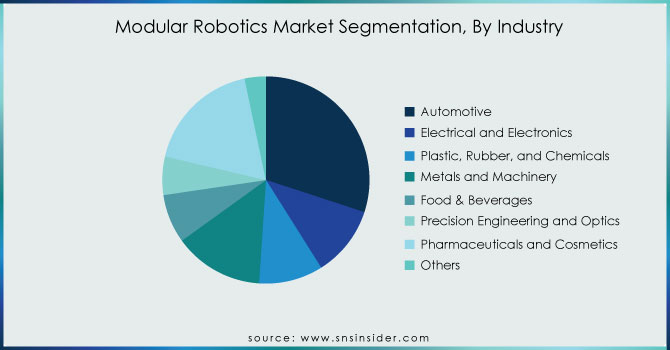

By Industry

The automotive industry dominated with a market share of over 30.04% in 2023. Modular robotics enabled new capabilities to be able to address manufacturing demands in a more efficient and cost-effective manner. Furthermore, manufacturing capabilities have reached new levels of speed, accuracy, precision, flexibility, and agility as a result of the implementation of modular robotics, thus facilitating increased manufacturing competitiveness, quality, and productivity. The increasing demand for vehicles, particularly in the developing countries has enticed the automotive manufacturing companies along with the OEMs to adopt automation in manufacturing in both the vehicle production and parts manufacturing, in a scaled-up approach to cater to the present market demand.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

The Asia-Pacific dominated the market with more than 38% in 2023. Countries such as China, Japan, and South Korea have become manufacturing powerhouses which requires high demand for automation technology to improve precision and productivity in industries of manufacturing consumer electronics devices and automotive components. These countries are at the forefront of using robotics as part of the manufacturing process to emphasize flexibility and automation scalability. Additionally, APAC governments’ aid in funding research and development and subsidizing automation projects, have set an enabling environment for the growth of the robotics industry in the APAC region.

North America is the fastest-growing region in the forecast period in the modular robotics market. The rapidly growing demand in the region can be attributed to the widening focus on automation across multiple sectors. In addition to this, enterprises throughout border, the United States invested heavily in robots with the aim of enhancing operational efficiency and improving productivity. Also, North America is a leader in the research and development of robotics which has led to various modular robot solutions that provide local industrialists with comprehensive solutions to complex challenges in the industry.

KEY PLAYERS

The major key players are ABB Ltd., Acutronic Robotics, KUKA AG, Mitsubishi Electric Corp., FANUC Corporation, Kawasaki Heavy Industries Ltd., Yaskawa Electric Corporation, Denso Corporation, Universal Robots, Nachi-Fujikoshi Corp., Rethink Robotics, and others.

Acutronic Robotics-Company Financial Analysis

RECENT DEVELOPMENT

In February 2024: OMRON introduced fresh autonomous mobile robot (AMR) options, including lifter and roller modules from ROEQ. Companies aiming to use AMRs in their space often find that an AMR without a top module is similar to a robot arm without a gripper.

In December 2023: QYSEA Technology revealed its latest underwater tool, the FIFISH E-GO. This new device has a modular structure and better power and imaging. It can carry multiple loads and comes with AI capabilities. These features make it the most advanced underwater robot from QYSEA so far.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.51 Bn |

| Market Size by 2032 | US$ 47.44 Bn |

| CAGR | CAGR of 18.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robot Type (Articulated modular robots, Cartesian modular robots, SCARA modular robots, Parallel modular robots, Collaborative modular robots, Others) • By Industry (Automotive, Electrical and Electronics, Plastic, Rubber, and Chemicals, Metals and Machinery, Food & Beverages, Precision Engineering and Optics, Pharmaceuticals and Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ABB Ltd., Acutronic Robotics, KUKA AG, Mitsubishi Electric Corp., FANUC Corporation, Kawasaki Heavy Industries Ltd., Yaskawa Electric Corporation, Denso Corporation, Universal Robots, Nachi-Fujikoshi Corp., Rethink Robotics |

| Key Drivers | • Modular robots offer flexibility by allowing quick reconfiguration for diverse tasks, and they provide adaptability by being suitable for a wide range of industries due to their customizable nature.

• Modular robots typically require a lower initial investment and incur reduced operational costs compared to traditional industrial robots, making them a more cost-effective option. |

| Market Restrain | • Designing and implementing modular robotic systems is complex due to the need for specialized expertise and seamless integration capabilities.

• High initial investment in modular robotics can be a significant barrier for businesses due to the considerable upfront costs, potentially deterring adoption. |