Air Traffic Control Equipment Market Report Scope & Overview:

Get more information on Air Traffic Control Equipment Market - Request Free Sample Report

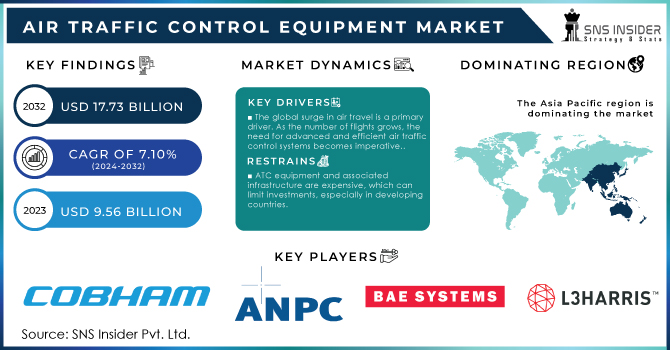

The Air Traffic Control Equipment Market was valued at USD 9.56 billion in 2023, and it is expected to reach USD 17.73 billion by 2032, registering a CAGR of 7.10% from 2024 to 2032.

The air transportation is expected to observe steady growth projections over the next 20 years, increasing safety measures and minimizing expenses on operations appears to be crucial. It is remarkable that governmental entities and airspace customers continue attaching importance to notable investments in innovative air traffic management solutions. The discussed trend can be described by referring to the increased use of novel air traffic control systems and advanced navigation and surveillance tools, as well as air-to-ground communication systems by all stakeholders.

In May 2023: Indra solidified its global leadership in Air Traffic Management (ATM) with the establishment of its subsidiary in the USA, Indra Air Traffic Inc.

A major opportunity for the air traffic control equipment market is brought about by the introduction of advanced high-speed computers and new software. The system is empowered to be more efficient in overall traffic flow management and able to make tactical measures ensuring conflict-free, expeditious, and fuel-efficient flight paths for an individual aircraft. Computers are to be phased, starting with route ATC air traffic control centers, integrated control facilities technologically terminating in terminal areas and a centralized flow control facility for national air traffic system management.

The ATC equipment market opportunity is not limited by safety and capacity gains but also by a degree of automation in ATC, which would have a potential to greatly reduce the workforce needed to handle future traffic loads. This reduction implies advantages in terms of more efficient and cost-effective air traffic control operations and this, consequently, implies major market growth opportunities.

In January 2024: UNO Technology initiated its inaugural project in India, introducing a cutting-edge Air Traffic Control (ATC)Cabin at Noida International Airport.

DRIVERS

The emergence of FAA forecasts refers to the Federal Aviation Administration's development of predictive models to anticipate future trends and demands in air traffic, aviation safety, and airport infrastructure.

There will be a tremendous increase in air traffic over the next 10-20 years. This fact will make the demand on air traffic control services increase. The Federal Aviation Administration has already developed a plan concerning the modernization and expansion of the National Airspace System, which is based on the assumption that the future increase in air traffic should be permitted. Despite the discrepancies between FAA’s forecasts and real demand in the past, when the projections were nearly 50% higher than the real growth, FAA’s assumption of unbounded growth has to be implemented. Thus, the evident lacuna between the predictions based on the number of licensed pilots and the projection of ATC equipment market showed a need for increased investment in state-of-the-art ATC’s facilities and equipment in general.

The global surge in air travel is a primary driver. As the number of flights grows, the need for advanced and efficient air traffic control systems becomes imperative.

There are many reasons for the increased demand for sophisticated systems of air traffic control. This can be explained by the global surge in air travel. Owing to the many relatively new causes of international flights, such as rising disposable income, globalization, increased business trips, and tourism, the world’s entire stay in overcrowded airport runways. In this historical case, the number of flights continues to increase, and the existing system is overwhelmed by it, resulting in logistical problems. As a result, there is a need for more efficient, reliable, and advanced means of controlling the air traffic flows.

Air traffic control systems have to deal with all the difficulties of modern aviation, and advanced systems help it. Such systems allow monitoring the air traffic flow, optimizing routes, reducing delays, and ensuring aircraft safety. All these aspects reduce fuel usage and carbon footprint. Automation, AI, and data analytics that are used in air traffic control systems today transform the industry. They provide real-time data monitoring, predictive analytics, and even bespoke decision-making. New systems help control to foresee and manage potential problems, such as congestion in the air, which allows making the flight smoother. However, such systems are useful not only for passengers. With the development of technologies, air traffic management becomes more sophisticated, especially with the implementation of the satellite-based navigation systems, such as NextGen in the United States and (SESAR) in Europe, which help both airport clients and controllers. Both systems aim at accelerating the modernization of air traffic control systems, ensuring they are fit for purpose and do not decrease the air travel safety.

RESTRAIN

ATC equipment and associated infrastructure are expensive, which can limit investments, especially in developing countries.

High cost of air traffic control equipment and associated infrastructure is a common financial issue that presents significant challenges, especially to developing countries. ATC systems are high-tech and require all types of investment, such as investment into advanced technology, relevant hard- and software, the cost of financing operators and maintaining infrastructure, etc. Strain on limited finance resources can not only obstruct modernization and deployment of new advanced systems but make it impossible. Under these circumstances, developing nations and countries with emerging economies might be unable to ensure safety and secure their airspace control from incidents and security issues.

Integrating new ATC systems with existing infrastructure can be complex and time-consuming.

The complexity of ATC systems modernization historically always intersects with the problem of integration with some available infrastructure. ATC systems that feature new technology need to be interlinked with various legacy systems of the existing infrastructure, which take time and effort. These systems might be not only out-of-date but also vary in format and be incompatible with a significant number of new technologies. The process of integration is complex and involves a number of phases, such as planning of integration, its testing and PPP implementation. Overall, a complex integration process can take up too much time, slow down the pace of the modernization process and, as a result, increase the final cost of the project.

KEY MARKET SEGMENTATION

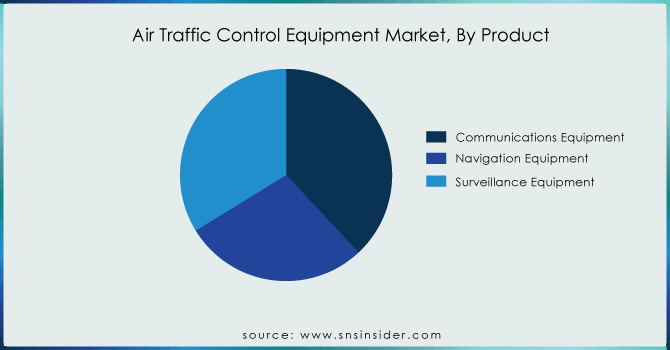

By Product

In 2023, the communication equipment segment held a market share of 38.05%. Air traffic control systems use digital data communication equipment for all communications. The replacement rate of obsolete communications equipment has increased due to the improvement of digital data communication. The sensitive air traffic data is exposed to hackers; this has increased the deployment and upgrade on surveillance and communication equipment.

The surveillance equipment segment is estimated to record a significant CAGR of 7.24% during the forecast period. The rise in the number of airports has increased air travel. The demand for air travel continues to grow, and the number of air travellers is expected to grow exponentially. Surveillance equipment helps in monitoring and processing the air traffic data accurately and safely. Similarly, the modern airports rely on surveillance equipment to manage the number of flights.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

The commercial aircrafts segment held the largest market share of 39.72% in 2023. The increase in the air traffic has elevated the demand for flights across the globe. As the volume of air traffic is increasing, the modernization of air traffic control systems is gaining importance. The modern airports provide the latest and sophisticated air traffic control systems.

The private aircrafts segment is projected to record a significant CAGR of 7.59% during the forecast period. The private aircraft provide convenience and speed that is absent with commercial flights. Business leaders, celebrities, politicians, and other influential people use private aircraft. The applications are attributed to the inability to schedule commercial aircraft flights and access to remote destinations.

REGIONAL ANALYSIS

Asia Pacific accounted for the largest market share of 34.07% in 2023. The Asia-Pacific region has been one of the fastest-growing economic regions in the world. This economic growth has increased business and leisure travel, increasing demand for air travel services. Expanding the middle class in countries across the region has increased disposable income and a greater ability to afford air travel. This has translated into higher passenger numbers for both domestic and international flights.

Asia Pacific has experienced significant economic and aviation growth in recent years. Looking ahead, as the aviation sector rebounds from the global pandemic, the region is poised to exhibit the highest economic growth worldwide over the next two decades. This growth trajectory, propelled by the expanding middle class in several APAC countries, will drive continuous increases in airline passenger volumes, both domestically and internationally. As such, the Asia Pacific region presents lucrative opportunities for the Air Traffic Control (ATC)equipment market, fueled by a commitment to innovation, infrastructure modernization, and sustained economic growth.

In February 2024: Embraer and Mahindra announced their collaboration on the C-390 Millennium Medium Transport Aircraft in India.

Key Players

Some of the major key players in the Air Traffic Control Equipment Market are Cobham Limited, Advanced Navigation and Positioning Corporation, BAE Systems, Endeavor Business Media, LLC., L3Harris Technologies, Inc., Intelcan Technosystems Inc, Lockheed Martin Corporation, Indra, Northrop Grumman, Verdict Media Limited., RTX, Thales, Searidge Technologies and other players.

Recent Developments

In February 2024: Airbus and Total Energies are strategic partners working on sustainable aviation fuels to tackle the issue of decarbonising aviation.

In February 2023: Skye Air, an aviation market participant, made an important achievement in implementing the India’s first-ever drone Traffic Management System daughter as it is noted that the expanded usage of drones for logistics, agriculture, surveillance, and many other purposes results in a steadily growing demand for such.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 9.56 billion |

| Market Size by 2032 | US$ 17.73 Billion |

| CAGR | CAGR of 7.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Communications Equipment, Navigation Equipment, Surveillance Equipment) • By Application (Commercial Aircraft, Private Aircraft, Military Aircraft) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cobham Limited, Advanced Navigation and Positioning Corporation, BAE Systems, Endeavor Business Media, LLC., L3Harris Technologies, Inc., Intelcan Technosystems Inc, Lockheed Martin Corporation, Indra, Northrop Grumman, Verdict Media Limited., RTX, Thales, Searidge Technologies |

| Key Drivers | • The emergence of FAA forecasts refers to the Federal Aviation Administration's development of predictive models to anticipate future trends and demands in air traffic, aviation safety, and airport infrastructure. • The global surge in air travel is a primary driver. As the number of flights grows, the need for advanced and efficient air traffic control systems becomes imperative. |

| RESTRAINTS | • ATC equipment and associated infrastructure are expensive, which can limit investments, especially in developing countries. • Integrating new ATC systems with existing infrastructure can be complex and time-consuming. |