Flow Meter Market Report Scope & Overview:

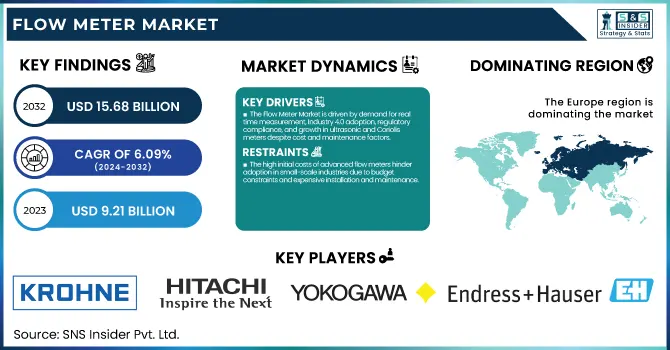

The Flow Meter Market was estimated at USD 9.21 billion in 2023 and is expected to reach USD 15.68 billion by 2032, with a growing CAGR of 6.09% over the forecast period 2024-2032. This report provides an in-depth analysis of flow meter utilization across industries and regions, highlighting operational efficiency trends. It examines maintenance and downtime metrics, offering insights into reliability and performance optimization. The study explores technological adoption trends, emphasizing the rise of smart flow meters and wireless monitoring systems. Additionally, it includes export/import data, tracking global trade flows, and supply chain shifts. A unique aspect is the coverage of real-time monitoring advancements, regulatory compliance trends, and the impact of sustainability initiatives shaping the future of flow measurement technologies.

To Get more information on Flow Meter Market - Request Free Sample Report

The U.S. Flow Meter Market is projected to grow steadily, with a CAGR of 6.16% from 2023 to 2032. The market value is expected to increase from USD 1.21 billion in 2023 to USD 2.07 billion in 2032, driven by rising demand across industries such as oil & gas, water & wastewater, and power generation. The adoption of smart flow meters with IoT and AI integration is accelerating, enhancing real-time monitoring and operational efficiency. Additionally, stringent regulatory policies on environmental compliance and industrial automation advancements are fueling market expansion. The U.S. remains the dominant market in North America, contributing significantly to regional growth.

Flow Meter Market Dynamics

Drivers

-

The Flow Meter Market is driven by demand for real-time measurement, Industry 4.0 adoption, regulatory compliance, and growth in ultrasonic and Coriolis meters despite cost and maintenance factors.

The Flow Meter Market is witnessing significant growth due to the rising demand for accurate and real-time flow measurement across industries such as oil & gas, water & wastewater, and chemicals. These sectors require accurate monitoring to improve process efficiency, minimize consumption, and meet strict regulatory standards. Smart and digital flow meters are becoming increasingly popular via industrial automation and the Internet of Things (IoT)in the new era of "Industry 4.0". Furthermore, a shift towards ultrasonic as well as Coriolis-type flowmeters is gaining more and more hold on account of them having increasingly higher measuring precision. The water and wastewater sector makes a major contribution to market expansion, driven by industry-wide attention to water resource conservation and comprehensive planning. Also, sustainability and green monitoring of the environment create further business opportunities. But, barriers such as high initial investment costs and ongoing maintenance complexity could slow down growth in certain areas.

Restraint

-

The high initial costs of advanced flow meters hinder adoption in small-scale industries due to budget constraints and expensive installation and maintenance.

The high initial costs of advanced flow meters, such as Coriolis, ultrasonic, and electromagnetic types, pose a significant barrier to adoption, especially for small-scale industries. These flow meters offer high accuracy, reliability, and advanced features like IoT integration and real-time monitoring, but their expensive sensors, sophisticated electronics, and calibration requirements drive up costs. Small and medium-sized enterprises (SMEs) operating on limited budgets often struggle to justify these investments, opting instead for lower-cost alternatives like mechanical or turbine flow meters, despite their lower precision. Adding installation and maintenance these days, however, results in a package that's expensive to run. While technological advancements may lead to cost reductions over time, the current price-sensitive nature of small businesses continues to hinder the widespread adoption of high-end flow measurement solutions.

Opportunities

-

The growth of renewable energy projects drives demand for precise flow meters to enhance efficiency, safety, and real-time monitoring.

The expansion of renewable energy projects is driving the demand for accurate flow measurement solutions across various applications, from hydropower to biofuels, geothermal energy to hydrogen production. Precise flow monitoring helps optimize efficiency while minimizing waste and ensuring compliance with regulatory requirements. In hydrogen production, for example, flow meters are used to regulate gas flow rates to increase safety and efficiency. Likewise, solar thermal and even geothermal power plants, where heat transfer fluids need to be handled perfectly, indicate the importance of flow measurement. With tightening clean energy spending by governments everywhere, the demand for pumps and systems will have to include more sophisticated flow meters, including various types of Coriolis, ultrasonic, and magnetic. Moreover, the growing popularity of smart grids and digital surveillance, IoT, and AI-integrated flow meters is catching up as well. They assist in real-time data analysis, remote monitoring, and predictive maintenance, increasing operational efficiency in renewable energy projects. The upcoming developments are anticipated to provide potential opportunities for the flow meter market growth.

Challenges

-

Supply chain disruptions in the Flow Meter Market have led to raw material shortages, increased costs, and production delays, impacting global supply and pricing.

Supply chain disruptions have significantly impacted the Flow Meter Market, affecting both raw material availability and production cycles. Key materials like stainless steel, aluminum, or electronic elements that are used to manufacture flow meters in recent times have been impacted by the ongoing geopolitical issues, trade restrictions, and certain logistics bottlenecks. In particular, semiconductor shortages have hampered the growth of smart and digital flowmeters, and as a result, equipment lead times have lengthened for end-users' foremen at the back end of the chain. Meanwhile, higher transportation costs and labor shortfalls have squeezed supply chains worldwide, leading producers to hike prices or postpone shipments. Now companies are adapting by working on localized sourcing, trading with diverse suppliers , and best inventory management to mitigate risks. But extend those disruptions and markets may suffer, particularly in regions that are sensitive to prices. Overcoming these challenges would require long-term strategic planning, digital transformation, and strengthening of supply chains to sustain production and timely delivery.

Flow Meter Market Segmentation Analysis

By Product

The Magnetic segment dominated with a market share of over 32% in 2023, due to its extensive application in industries such as water & wastewater, chemicals, and food & beverage. Electromagnetic types of flow meters are popular due to their accuracy, long life, and low maintenance. Magnetic flow meters have no moving parts, unlike mechanical alternatives, which means no wear and tear and a longer operational lifetime. They are perfect for applications where flow conditions change frequently due to their capability to measure conductive fluids in an unobstructed way. Moreover, strict regulations enforced by the regulatory authorities in water management and process industries for accurate flow measurement contribute to the high market share of magnetic flow meters globally.

By Type

The battery-powered segment dominated with a market share of over 48% in 2023, owing to their widespread application in major end-user industries, including oil & gas, water & wastewater, and chemical processing. They are popular because of their excellent reliability, long life, and operation without external power. These flow meters are especially beneficial in remote areas without access to a continuous power supply, as they guarantee continuous flow measurement without interruptions, which is useful for fluid measurement. Further, the development of battery technology has made them more efficient, requiring less maintenance and higher penetration into different sectors. This, coupled with their versatility and working in different rough environments, further strengthens their foothold in the market , making them the ideal and most sought-after type of flow meter in industries and commercial applications.

By Application

The power generation segment dominated with a market share of over 34% in 2023, due to its critical role in monitoring and optimizing fluid flow in power plants. For efficient energy generation, accurate control of steam, water, and fuel consumption is key, since that can only be accomplished when steam/water/fuel flow is measured exactly. Flow meters, in turn, are used in thermal, nuclear, hydro, and renewable power plants to improve operational efficiencies, reduce energy losses, and meet strict environmental regulations. This growth is driven by the growing electricity demand and the need for an advanced monitoring system in power plants, resulting in the dominance of this segment. Moreover, the ever-progressing technology, for instance, ultrasonic and Coriolis flow meters, ensures enhanced precision and reliability, which makes them crucial for global power generation applications.

By Size

The 2-inch pipe size segment dominated with a market share of over 43% in 2023, due to its extensive use across key industries such as water & wastewater, oil & gas, and chemicals. This segment accounts for the majority share owing to its use in various industrial and commercial applications where moderate flow measurement is required. The 2-inch is the most popular size, as it is economical, versatile, and easy to install for process monitoring, fluid control, and energy management applications. The increasing infrastructure is also one of the factors driving the adoption of the market, along with regulations on the fluid measurement accuracy and the need for effective management of resources. This is largely due to continuing industrial growth and upgrades to pipeline infrastructure in multiple sectors.

Flow Meter Market Regional Outlook

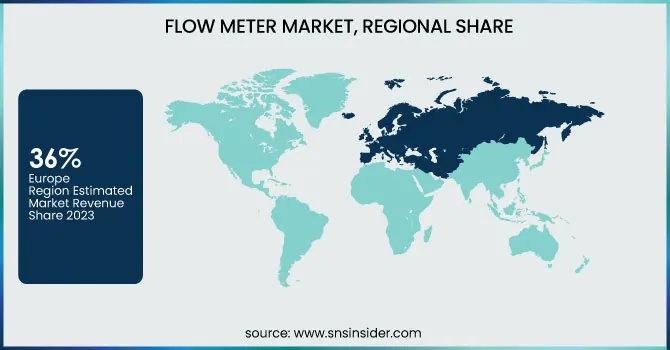

The Europe region dominated with a market share of over 36% in 2023, mainly because of stringent environmental regulations in the region and the increasing demand for high-precision and smart flow meters for monitoring and compliance. Demand has also been boosted further due to the presence of industries such as water & wastewater, among others, rather than more oil & gas & chemicals, as the region possesses an industrial automation-oriented nature. European manufacturers are also equipped with sophisticated production expertise, which results in lucrative benefits in providing new-generation flow meters that involve high-efficiency and energy-efficient aspects. Moreover, the availability of the leading market players keeps bringing innovation in the digitalization and IoT-based flow measurement solutions. However, steady patent policies promoting optimization of resource usage are further endorsing Europe as the world leader in the Flow Meter Market.

Asia-Pacific is the fastest-growing region in the Flow Meter Market, due to rapid industrialization, urbanization, and government initiatives to meet increased energy efficiency demands from industries and utilities to reduce wastage, along with the increasing demand for smart flow meters in key economies, including China, India, and Japan. This is being driven by the growing oil & gas, water & wastewater, and power generation industries. Continued infrastructural projects by governments in the region and their investment in advanced water management systems are expected to further drive the need for precise and efficient flow measurement solutions. Moreover, high adoption of smart manufacturing and IoT-based flow meters is driving their industrial applicability in making operational processes smoother. Asia-Pacific represents the most dynamic region in terms of future growth as industries gradually switch to advanced flow metering technologies, thanks to stringent environmental regulations and a greater emphasis on sustainability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Krohne Messtechnik GmbH (Magnetic, Ultrasonic, Coriolis, Vortex)

-

Hitachi High-Tech Corporation (Ultrasonic, Coriolis, Magnetic)

-

Yokogawa Electric Corporation (Differential Pressure, Coriolis, Magnetic, Vortex)

-

General Electric (GE) (Ultrasonic, Turbine, Coriolis)

-

HÖNTZSCH GMBH & CO. KG (Vortex, Ultrasonic, Turbine)

-

Emerson Electric Corporation (Coriolis, Magnetic, Ultrasonic, Differential Pressure)

-

Endress+Hausar AG (Coriolis, Magnetic, Vortex, Ultrasonic)

-

Siemens (Magnetic, Ultrasonic, Differential Pressure)

-

ABB Ltd. (Coriolis, Magnetic, Vortex, Ultrasonic)

-

Honeywell International Inc. (Differential Pressure, Ultrasonic, Coriolis)

-

em-tec GmbH (Ultrasonic, Non-invasive Flow Meters)

-

Badger Meter, Inc. (Positive Displacement, Magnetic, Ultrasonic)

-

Bronkhorst High-Tech B.V. (Coriolis, Thermal Mass Flow Meters)

-

Schneider Electric (Magnetic, Ultrasonic, Vortex)

-

OMEGA Engineering, Inc. (Turbine, Vortex, Magnetic)

-

SICK AG (Ultrasonic, Vortex, Coriolis)

-

Fuji Electric Co., Ltd. (Ultrasonic, Magnetic, Vortex)

-

Azbil Corporation (Differential Pressure, Vortex, Ultrasonic)

-

McCrometer, Inc. (Magnetic, Vortex, Propeller Flow Meters)

-

Toshiba Corporation (Magnetic, Ultrasonic, Vortex)

Suppliers for (High-precision electromagnetic and Coriolis flow meters) on the Flow Meter Market

-

ABB Ltd.

-

Emerson Electric Corporation

-

Endress+Hauser AG

-

Siemens

-

Yokogawa Electric Corporation

-

Honeywell International Inc.

-

Krohne Messtechnik GmbH

-

HÖNTZSCH GMBH & CO. KG

-

Badger Meter, Inc.

-

Fuji Electric Co., Ltd.

Recent Development

-

In 2024, ABB launched the AquaMaster4 Mobile, a battery-powered electromagnetic flow meter designed for remote water distribution monitoring. This innovation provides utilities with greater flexibility in measuring flow rates across their networks.

-

In 2024, Endress+Hauser and Siemens partnered to develop smart flow measurement solutions for the process industry. By combining flow measurement expertise with automation and digitalization, they aim to create advanced flow meters with improved connectivity and data analytics. These innovations will enhance efficiency, real-time monitoring, and data-driven decision-making for Industry 4.0 applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.21 Billion |

| Market Size by 2032 | USD 15.68 Billion |

| CAGR | CAGR of 6.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Differential Pressure (DP), Positive Displacement (PD), Magnetic (Wired, Wireless), Ultrasonic, Coriolis, Turbine, Vortex, Others) • By Type (Electric, Solar, Battery Powered) • By Application (Water & Wastewater, Oil & Gas, Chemicals, Power Generation, Pulp & Paper, Food & Beverage, Others) • By Size (Pipe Size (2 inches, 4 inches, 6 inches, More than 6 inches)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Krohne Messtechnik GmbH, Hitachi High-Tech Corporation, Yokogawa Electric Corporation, General Electric, HÖNTZSCH GMBH & CO. KG, Emerson Electric Corporation, Endress+Hausar AG, Siemens, ABB Ltd., Honeywell International Inc., em-tec GmbH, Badger Meter, Inc., Bronkhorst High-Tech B.V., Schneider Electric, OMEGA Engineering, Inc., SICK AG, Fuji Electric Co., Ltd., Azbil Corporation, McCrometer, Inc., Toshiba Corporation. |