Welding Electrodes Market Report Scope & Overview:

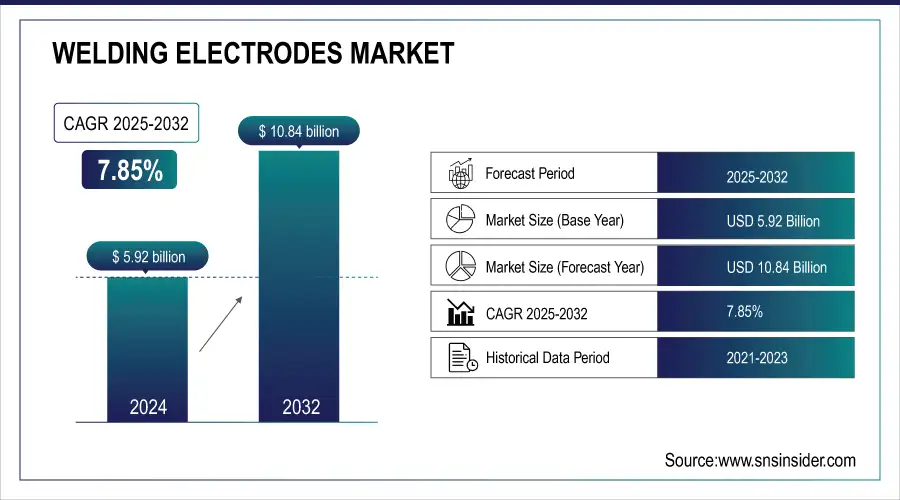

The Welding Electrodes Market size was estimated at USD 5.92 billion in 2024 and is expected to reach USD 10.84 billion By 2032 at a CAGR of 7.85% during the forecast period of 2025-2032. This report provides exclusive standard market trends, insights about changes in the pricing of raw materials in real-time, and how supply chain disruption is impacting electrode production. This covers region-specific regulations impacting electrode formulations, including sustainability mandates, and the resultant push towards low-fume and environmentally friendly coatings. It also delves new electrode technologies including nanostructured coatings, hybrid alloy compositions, and self-shielding electrodes for ultra-extreme industrial service.

Market Size and Forecast:

-

Market Size in 2024 USD 5.92 Billion

-

Market Size by 2032 USD 10.84 Billion

-

CAGR of 7.85% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

To get more information on Welding Electrodes Market - Request Free Sample Report

Welding Electrodes Market Trends:

• Increasing adoption of automation and robotic technology in welding to enhance precision and efficiency.

• Growing use of robotic welding systems in large-scale manufacturing, particularly in automotive and aerospace sectors.

• Rising demand for welding electrodes due to their critical role in automated and robotic welding processes.

• Improved productivity and reduced turnaround time through defect-minimized welds enabled by advanced technologies.

• Enhanced workplace safety by minimizing exposure to hazardous fumes and physical strain during welding operations.

Welding Electrodes Market Growth Drivers:

An increase in automated welding and robotic systems leads to high levels of efficiency, quality, and productivity, which in turn contributes to a rise in demand for welding electrodes.

The rise in automation and robotic technology in welding applications continues to provide a significant increase in the quality and efficiency of the welding process. Welding automation provides a more accurate, repetitive, and swift method of welding which mitigates human error and improves welding projects overall. In particular, due to their ability to operate high-level complex tasks with high repeatability, robotic welding systems are well-suited for large-scale use in an extensive range of manufacturing settings such as the automotive and aerospace sectors. Such innovations are helping manufacturers produce effective welds with a minimum of defects so that the turnaround time is reduced, resulting in improved productivity.

Welding Electrodes Market Restraints:

Variability in the price of raw materials can increase production costs for welding electrodes, negatively impacting the profitability of manufacturers.

Volatile costs of raw materials like steel and nickel represent a major hurdle in the overall welding electrodes industry pose a significant challenge to the welding electrodes market. These materials are essential in the production of welding electrodes, and their prices can be highly volatile due to factors like global supply chain disruptions, geopolitical tensions, and changes in demand. Higher prices of raw materials will lead to increased costs of production for the manufacturers, which can be either transferred to the customers as increased prices or absorbed by the manufacturer, leading to a decline in margins. Such price volatility makes financial planning unpredictable and creates difficulty for manufacturers to ensure pricing stability.

Welding Electrodes Market Opportunities:

-

Development of the renewable energy sector (Wind and Solar) is leading to higher consumption of welding electrodes in infrastructure.

The growth of the renewable energy sector, particularly in wind and solar power, is creating significant demand for welding electrodes. The growth of renewable energy in wind & solar power is fueling demand for welding electrodes. Renewable energy projects have special infrastructure needs, the wind turbine components or solar panel frames need to be riveted and the transmission towers have to be welded for strength. The production of these parts frequently includes challenging welding applications that demand high-quality electrodes to create support, robust welds. The transition to sustainable energy has resulted in numerous wind farms, solar power plants, and energy storage technologies being constructed, thus driving demand for high-performance welding electrodes. Moreover, with the increase in the scale of these projects, the need for welding efficiency and economical solutions is growing, providing opportunities for electrode manufacturers to develop novel ways to serve the ever-evolving requirements of the renewable energy industry. As renewable energy presents a major new focus of global energy strategy, this area represents a key growth opportunity for welding electrode makers.

Welding Electrodes Market Segment Analysis:

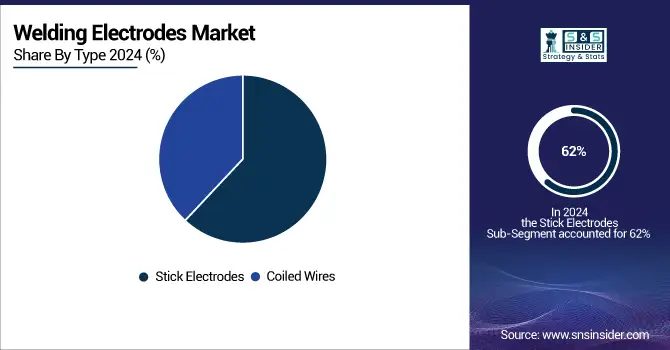

By Type

The Stick Electrodes segment held more than 62% of the market share in 2024. Such electrodes are attractive due to their versatility, simplicity, and low-cost propensities. Stick Electrodes, especially for manual welding processes, can be used for all positions, as well as outdoors with limited protection from the weather and in difficult-to-reach winkles. The fact that they can weld all types of metals, including mild steel and stainless steel, also adds to the appeal. Stick Electrodes are also very fit for heavy applications where reliability and durability are needed. Their appropriate application in industries with regular maintenance and repairs makes it a majority holder in the market.

By End-User

The Construction segment dominated with a market share of over 38% of the market in 2024. This dominance is linked to the high demand for welding applications in various construction projects such as residential and commercial as well as infrastructural developments. Welding is a vital process that is carried out in the manufacturing of steel components, rebars, and other materials that provide stability and durability structures. Demand for reliable, high-performance welding electrodes continues to grow in line with the worldwide expansion of urbanization and associated infrastructure projects. This segment further benefits from unique welding solutions for civil engineering projects such as bridges, roads, and tunnels.

Welding Electrodes Market Regional Analysis:

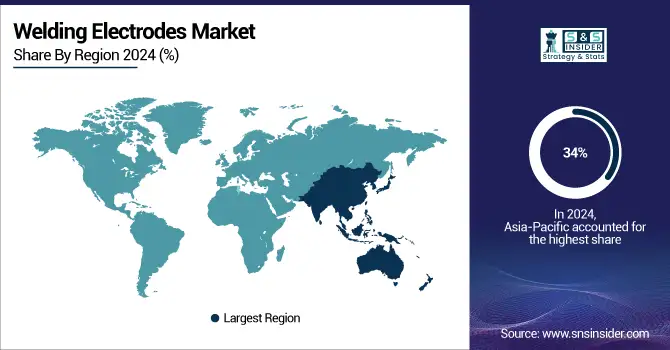

Asia Pacific Welding Electrodes Market Insights

The Asia-Pacific region dominated with a market share of over 34% in 2024. The market is dominated by many key players globally, with China, India, Japan, and South Korea being among the leading countries. The demand for quality welding electrodes is also supported by rapid industrialization infrastructure development, and increasing use of welding technologies. Moreover, Asia-Pacific is the fastest-growing region with increasing industrial activities and investments in industrial and infrastructure & energy sectors. This region is growing rapidly due to the rapid expansion of the construction and automotive sectors as well as the growing number of emerging economies.

Need any customization research on Welding Electrodes Market - Enquiry Now

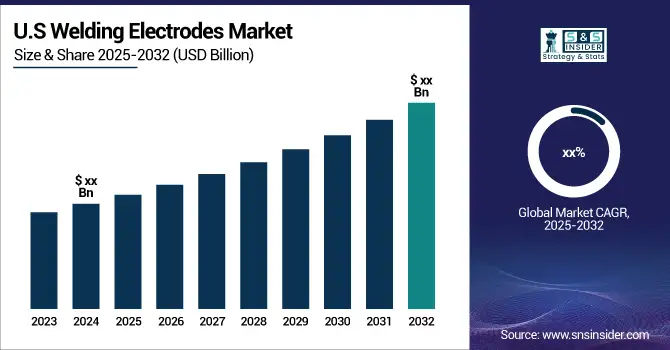

North America Welding Electrodes Market Insights

North America is expected to grow at the significant growth rate from 2025-2032. It is primarily driven by advancements in manufacturing technologies along with a growing demand from major industries. The oil and gas sector, in particular, makes an important contribution, as it demands reliable and durable welding solutions to develop and maintain its infrastructure. Also, infrastructure renewal and modernization improve the demand for welding materials in the construction, automotive, and aerospace sectors. Having a strong industrial base between the U.S. and Canada, there is a constant demand for quality welding electrodes for different applications. All of these contribute toward the growth of North America and its share in the global welding electrodes market.

Europe Welding Electrodes Market Insights

The European welding electrodes market is driven by the region’s strong manufacturing and automotive sectors, alongside growing adoption of advanced welding technologies such as robotic and automated welding systems. Stringent quality standards and environmental regulations are encouraging the use of high-performance electrodes, while rising demand from aerospace, shipbuilding, and infrastructure projects further supports market growth. Continuous technological innovations, coupled with the focus on productivity and safety in welding operations, are expected to sustain steady market expansion across Europe in the coming years.

Latin America (LATAM) and Middle East & Africa (MEA) Welding Electrodes Market Insights

The LATAM and MEA welding electrodes markets are experiencing growth due to increasing industrialization, infrastructure development, and expansion of the automotive and construction sectors. Adoption of modern welding techniques, including flux-cored and automated welding processes, is enhancing production efficiency. Governments’ investments in energy, oil, and gas projects, along with rising safety and quality requirements, are fueling demand for high-performance electrodes. Market growth is also supported by rising manufacturing capabilities and increasing emphasis on reducing operational costs and improving weld quality.

Welding Electrodes Market Key Players:

-

Lincoln Electric (Mild Steel Electrodes, Stainless Steel Electrodes, Aluminum Electrodes)

-

KOBE STEEL, LTD. (Mild Steel Electrodes, Stainless Steel Electrodes)

-

ESAB (Stick Electrodes, Flux-Cored Electrodes)

-

ZULFI (Mild Steel Electrodes, Stainless Steel Electrodes)

-

KISWEL CO., LTD. (Mild Steel Electrodes, Stainless Steel Electrodes)

-

CS HOLDINGS CO., LTD. (Welding Electrodes, Flux-Cored Welding Wire)

-

RME MIDDLE EAST (Welding Electrodes, MIG Welding Wire)

-

voestalpine BOHLER Edelstahl GmbH (Welding Electrodes, Flux-Cored Wires)

-

Capilla (Welding Electrodes for Steel, Cast Iron Electrodes)

-

Tianjin Golden Bridge Welding Materials Group Co., Ltd. (Mild Steel Electrodes, Stainless Steel Electrodes)

-

Ador Welding Limited (Mild Steel Electrodes, Stainless Steel Electrodes)

-

Kobe Welding (Flux-Cored Electrodes, Stainless Steel Electrodes)

-

Weldbond (Mild Steel Electrodes, Flux-Cored Electrodes)

-

Sunstone Welders (TIG Welding Electrodes, MIG Welding Electrodes)

-

Miller Electric (MIG and Stick Electrodes, Flux-Cored Electrodes)

-

ArcelorMittal (Welding Electrodes, Submerged Arc Electrodes)

-

ITW Welding (Stick Electrodes, MIG & Flux-Cored Wires)

-

Thermadyne (Welding Electrodes, Consumables for TIG, MIG)

-

Fronius International GmbH (Welding Electrodes, Filler Materials)

-

Harris Products Group (Mild Steel Electrodes, Flux-Cored Wires)

Competitive Landscape for Welding Electrodes Market:

Lincoln Electric is a global leader in welding solutions, offering a wide range of electrodes, welding equipment, and automation technologies. The company focuses on enhancing productivity, precision, and safety in industrial welding applications, serving key sectors such as automotive, construction, and manufacturing with high-performance and reliable welding products.

In July 31, 2024: Lincoln Electric has acquired Vanair Manufacturing, a global leader in mobile power solutions for the U.S. service truck market. The acquisition enhances Lincoln Electric's portfolio with equipment like compressors, generators, welders, hydraulics, and welding solutions, positioning the company for accelerated growth and long-term value creation. Vanair contributes approximately USD 100 million in annual revenue.

ESAB is a leading provider of welding and cutting solutions, specializing in stick electrodes, flux-cored electrodes, and advanced welding equipment. The company serves diverse industries, including automotive, construction, and shipbuilding, focusing on innovation, quality, and efficiency to support automated and manual welding processes while ensuring safety and consistent performance.

In May 23, 2024: ESAB showcased its latest welding materials and equipment at the Welding and Cutting 2024 exhibition in Minsk, including high-performance welding inverters like the ESAB Transmig 500 DP and ESAB Rogue EMP 210 PRO, as well as advanced personal protective equipment such as the Sentinel A60 mask with improved filter technology. These innovations highlight ESAB's commitment to providing reliable solutions for diverse industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.92 Billion |

| Market Size by 2032 | USD 10.84 Billion |

| CAGR | CAGR of 7.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Stick Electrodes, Coiled Wires) • By End User (Automotive, Construction, Oil & Gas, Shipbuilding, Aerospace & Defence, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Lincoln Electric, KOBE STEEL, LTD., ESAB, ZULFI, KISWEL CO., LTD., CS HOLDINGS CO., LTD., RME MIDDLE EAST, voestalpine BOHLER Edelstahl GmbH, Capilla, Tianjin Golden Bridge Welding Materials Group Co., Ltd., Ador Welding Limited, Kobe Welding, Weldbond, Sunstone Welders, Miller Electric, ArcelorMittal, ITW Welding, Thermadyne, Fronius International GmbH, Harris Products Group. |