Modular Uninterruptible Power Supply Market Report Scope & Overview:

Get more information on Modular Uninterruptible Power Supply Market - Request Free Sample Report

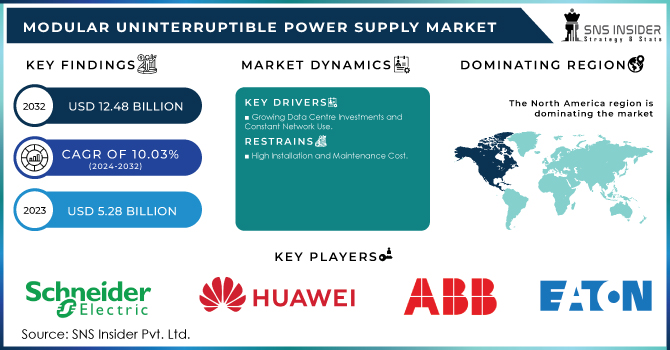

The Modular Uninterruptible Power Supply Market size was valued at USD 5.28 billion in 2023 and is expected to grow to USD 12.48 billion by 2032 and grow at a CAGR of 10.03 % over the forecast period of 2024-2032.

Organisations may easily and affordably increase their UPS power with the help of modular UPS solutions, enhance availability, and take advantage of scalable UPS solutions that can grow in manageable incremental stages as the organisation expands. The most cutting-edge UPS systems in terms of idea and functionality are flexible and scalable. All UPS systems are built to run continuously throughout the duration of the UPS. reducing failure as a result.

The basic rule is that there is more redundancy the more modules that have free and spare capacity. For instance, the final output will be N+2 if the load is 100 KVA and the modular UPS is rated at 120 KVA UPS and filled with a 30 KVA power module. The probability of a complete UPS failure is decreased by increasing redundancy by adding additional modules.

In many cases, establishing a modular UPS might be more economical than setting up a parallel or scalable UPS. For instance, a modular solution will be 120KVA if the demand is for 100KVA with N+1 redundancy.

MARKET DYNAMICS

KEY DRIVERS:

-

Growing Data Centre Investments and Constant Network Use

-

Rising Demand for Dependable and Downtime-Free Power

Businesses across all industries are digitizing, which has increased their reliance on electronic devices to access and gather data on their operational procedures, increasing their need for consistent and dependable electricity supplies. Businesses cannot operate if there is power loss due to a power outage or loss, thus there needs to be a guaranteed and dependable power source to get around those problems. During power outages, a UPS offers continuity and dependability, reducing continuous effort and safeguarding the gear.

RESTRAIN:

-

High Installation and Maintenance Cost

OPPORTUNITY:

-

Demand for hyper scale data centres, cloud computing, and massive colocation facilities present

Businesses in all industries are noticing an increase in demand for massive colocation facilities, hyperscale data centres, and cloud computing. They have already begun utilising digital transformation. For instance, Microsoft stated in May 2020 that it will establish its first data centre in New Zealand to assist businesses in enhancing their digital capabilities. The development of new data centres is anticipated to increase demand in New Zealand for modular UPS systems.

CHALLENGES:

-

Supply chain and logistic disruptions.

IMPACT OF RUSSIAN-UKRAINE WAR

Since the start of the war, China has been purchasing subsidized oil from Russia. Russia lost governments and private companies as buyers for its Ural crude oil as a result of its invasion of Ukraine, which led to a decline in its price. Russia replaced Saudi Arabia as China's main oil supplier this year, displacing it. China purchased 8.342 million tonnes of Russian oil in August. These included supplies pushed through the East Siberia Pacific Ocean pipeline and marine exports from Russian ports in Europe and the Far East. China is now importing less oil from Saudi Arabia, though. The amount of goods imported from Saudi Arabia rose to 8.475 million tonnes last month.

KEY MARKET SEGMENTATION

By Component

-

Solution

-

50 kVA and Below

-

51-100 kVA

-

101-250 kVA

-

251-500 kVA

-

501 KVA and Above

-

-

Services

-

Training, education, and consulting

-

Integration and Implementation

-

Support and Maintenance

-

By organization size

-

Large Enterprises

-

Small and Medium-sized Enterprises

By verticals

-

BFSI

-

Cloud Service and Colocation Providers

-

Telecom

-

Manufacturing

-

Healthcare

-

Energy and Utilities

-

Government and Public Sector

-

Others (include education and retail)

REGIONAL ANALYSIS

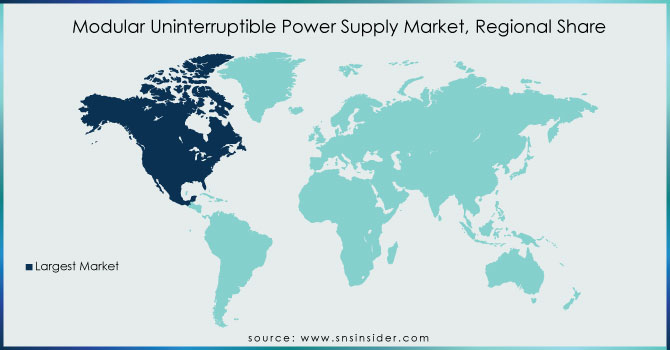

North America is anticipated to have the biggest market share for modular uninterruptible power supplies because of the region's colocation and data centre infrastructure, as well as the presence of technologically sophisticated nations like the U.S. and Canada. According to the Executive Briefings on Data Centres Around the World published by the U.S. International Trade Commission in May 2021, the U.S. was in first place with around 33% of the world's data centres, which contributed significantly to the need for data from a variety of industries.

The modular UPS market is dominated by Asia Pacific. In this area, the data centre industry is dominated by China and India. Over 87 colocation data centres are located throughout China's 28 regions. Over 95% of the nation's total IT power capacity is now operated by 126 colocation and hyperscale third-party data centres in India. The data centre business in India has drawn close to $944 million in private equity and strategic investments, of which more than 45% were made in the period from January to September of 2022.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Major Platers are Schneider Electric, Huawei, ABB, Eaton, Emerson, Legrand, Vertiv, Rittal, Delta Electronics, Toshiba, HPE, AEG Power Solutions, and other players

RECENT DEVELOPMENT

-

In June 2022, Schneider Electric unveiled APC Smart-UPS modular ultra, the industry's smallest, lightest, and most potent modular 5-20kW UPS using lithium-ion technology. It is one of the most environmentally friendly modular single-phase UPS of its kind. 50% smaller in size and 60% lighter in weight.

-

The Smart-UPS Modular Ultra is the industry's smallest, lightest, and most potent uninterruptible power supply, with 2.5x more power density than comparable UPSs. In September 2021, International Information Technology Co. LLC (IITC), an OHI Group firm in Oman, established a collaboration with Delta. On planned data center and IT infrastructure projects in Oman and the Middle East, IITC and Delta will work closely together. Aside from that, IITC will distribute Delta's backup power supply cooling systems that are perfect for the expanding number of data centers and operators in the area.

-

Eaton paid $1.65 billion to purchase Tripp Lite in March 2021. Tripp is one of the top suppliers of connection products and services to the industrial, medical, and communication data center sectors in the Americas enclosures. The Electrical Americas and Global business sector include Tripp Lite.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.28 billion |

| Market Size by 2032 | US$ 12.48 billion |

| CAGR | CAGR of 10.03 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Solution, Services) • By organization size (Large Enterprises, Small and Medium-sized Enterprises) • By verticals (BFSI, Cloud Service and Colocation Providers, Telecom, Manufacturing, Healthcare, Energy and Utilities, Government and Public Sector, Others (include education and retail)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Schneider Electric (France), Huawei (China), ABB (Switzerland), Eaton (Ireland), Emerson (US), Legrand (France), Vertiv (US), Rittal (Germany), Delta Electronics (Taiwan), Toshiba (Japan), HPE (US), AEG Power Solutions (Netherlands), and other players are listed in a final report. |

| Key Drivers | • Growing Data Centre Investments and Constant Network Use • Rising Demand for Dependable and Downtime-Free Power |

| Market Restraints | • High Installation and Maintenance Cost |