Mold Release Agents Market Report Scope & Overview:

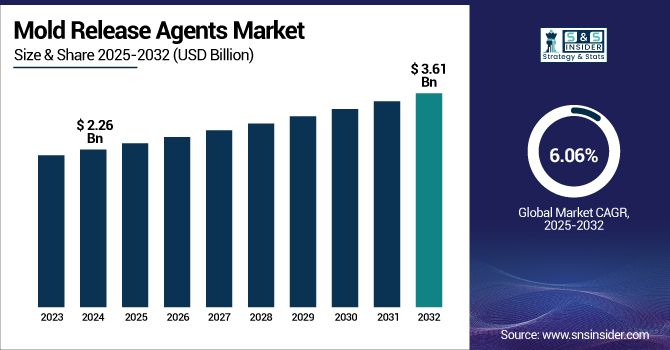

The Mold Release Agents Market size was valued at USD 2.26 billion in 2024 and is expected to reach USD 3.61 billion by 2032, growing at a CAGR of 6.06% over the forecast period of 2025-2032.

To Get more information on Mold Release Agents Market - Request Free Sample Report

The mold release agents market analysis is driven by the stringent regulations established by the U.S. Environmental Protection Agency (2024), wherein many consumers are shifting toward water-based and ecological solutions, providing alternatives. This is stimulating the growth of the mold release agents market, as some developers, such as Chem-Trend and Parker-Hannifin Corporation, are introducing and experimenting with green mold release sprays. Trend in the use of mold release agents, such as advances and developments in precision mold applications, and increasing use of additive manufacturing in aerospace, fuels the growth of the mold release agents market.

-

For instance, in the automotive end-use sector, the usage of composite materials is growing at a rate of ~4% per year (as per the United States Department of Energy,2024), which in turn is projected to create lucrative growth opportunities for the Mold Release Coatings Market in the forecast period.

Market Dynamics:

Drivers:

-

Expanding Automotive and Aerospace Sectors Propel the Global Mold Release Agents Market Growth

Growing production within the automotive and aerospace industries boosts demand for mold release agents. In 2024, global vehicle output climbed up to 92.5 million units, mirroring ongoing auto production growth that has been supported by a huge amount of plastic and composite components. Aerospace is also doing well: Airbus delivered 766 commercial airliners during 2024, and high-performance release coatings are needed for the production of interior components and fuselages. In each of these industries, good release agents provide clean demolding, fewer defects, and excellent mold life. The demand is also enhanced by the rising adoption of electric vehicles and advanced composites in automotive and aeronautic applications. On the other hand, key manufacturers have expanded production capacity, supporting the continued market growth of advanced mold release technologies. Such trends majorly drive market growth for advanced mold release technologies.

-

Advancements in Composite Materials and 3D Printing Bolster Mold Release Agents Market Growth

With the increase in the application, high-performance composites, and additive manufacturing, the mold release agent market is expected to grow. The move from traditional metals to lightweight composites and advanced plastics in automotive, aerospace, and industrial applications is driving complexity in molds. Fiber-reinforced and thermoplastic components can be demolded cleanly with the help of release agents, which are used by manufacturers in this regard. The trend toward electric vehicles in the automotive sector is accelerating the automotive uptake of composites, strengthening release agent demand. Simultaneously, three-dimensional printing provides opportunities to develop tooling and mold designs. New designs are matched with novel release chemistries and application methods from companies. These technological changes strongly support the market growth of such advanced mold release solutions.

Restraints:

-

Stringent Environmental Regulations and VOC Limits Pose Challenges to the Mold Release Agents Market

There is an increasing regulatory pressure on volatile organic compounds (VOCs) and harmful chemicals in the mold release agents industry. For instance, there are regional air quality authorities that have instituted significant VOC reductions from the use of release agents to help improve air quality. In reality, this means that manufacturers have to reformulate or discontinue their solvent and silicone-based products and raise production costs. Production schedules and new product introductions are often postponed due to these compliance requirements. Such regulatory burdens reduce the adoption of traditional release systems, restraining market growth, until greener alternatives are deployed.

-

Emerging Alternative Coatings and Technologies Limit Traditional Mold Release Agents Usage

Modern non-stick coating technologies and process solutions are reducing the need for traditional mold release agents. Such as nano-based and in-mold release coatings, which are becoming more suitable to replace traditional agents by providing friction-reducing surfaces that last longer. Even more sophisticated surface treatments and smart molding systems, such as an embedded sensor coating, will further reduce the requirement for sacrificial release products. Moreover, some additive processes have parts, finished directly with no need for a mold, anywhere. Such fresh alternatives can restrict the demand for traditional release agents. This, in turn, hinders the growth of traditional mold release markets due to the availability of replacement technologies.

Segmentation Analysis:

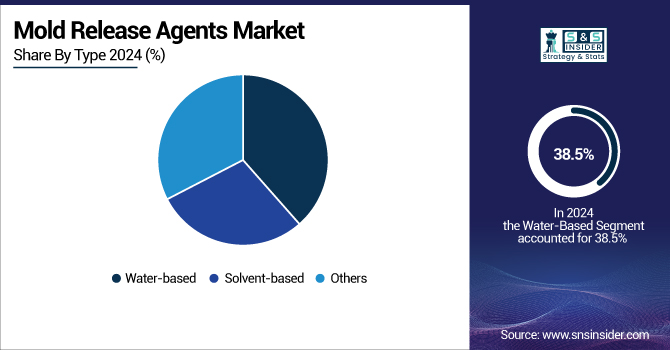

By Type

Water-based mold release agents occupy a maximum of 38.5% of the market. The reason behind their popularity is their eco-friendly composition and non-toxic nature. Regulatory pressure for green alternatives across many sectors, such as automotive and aerospace, has led to the increasing usage of water-based mold release agents over solvent-based mold release agents, as water-based methods are a more sustainable process. Due to this, these agents are particularly popular in areas with strict environmental laws, including the European Union and North America. The increased nature of this trend is supported by environmental regulations & sustainable manufacturing processes worldwide.

Solvent-based mold release agents are the fastest-growing segment with a 6.6% CAGR. This is especially important in fields such as aerospace and heavy manufacturing, where their performance in high-temperature applications is also unmatched. The growing demand for solvent-based products due to their ability to give a smoother finish and provide excellent lubrication under extreme conditions is fuelling their market growth. Emerging demand for solvent-based mold release agents, particularly in high-end applications, as industries continue to drive toward higher efficiency and better mold finish suitability.

By Application

The composite molding dominated the market, accounting for a total share of 25.4%. This growth is primarily due to the increasing usage of composites in aerospace, automotive, construction, and other industries. Composites are lightweight, high-strength materials to which special mold release agents are required to form precise mold shapes, while maintaining the product's integrity. The use of advanced composites in electric vehicles and aircraft production is also reinforcing the growth of the segment. The trend is supported by leading global manufacturers such as Airbus and Tesla, which use mold release agents in the manufacture of lightweight prepreg components.

The die casting application segment in the mold release agents market is projected to grow at the highest CAGR of 7.25% during the forecast period. The growing requirement for high precision components, particularly in automotive and electronics, has led to an increase in die casting processes, which rely on effective mold releasing agents. Die casting mold release agents are critical to enabling die-casting molds to be separated well without damage to the molds and to ensure that the produced parts are easily released. This segment is likely to experience significant market growth due to ongoing industrial improvements and growing adoption of die-casting technology.

By End-User Industry

The automotive segment dominated and accounted for the largest market share of 46.2% in 2024. Growth is fueled by the migration of the automotive industry toward lightweight materials, such as composites and high-performance plastics, and the need for more specialized types of mold release agents for unique and newly evolving molding and forming processes. Demand for innovative mold release agents is even bolstered by the growing adoption of electric vehicles, which require a higher number of interior and structural components due to the characteristics of their platforms. For this sector, companies including BASF, Chem-Trend have continued developing solutions in the sector, cementing automotive in the market.

Among applications, the fastest growing segment is the medical sector, which is expected to register a CAGR of 7.27%. The expansion is mainly driven by the rising demand for personalized medical machinery, including diagnostic instruments, implants, and drug delivery systems, which involves the need for accurate molding processes. Medical manufacturers striving for clean demolding and quality in their applications are relying on high-performance and biocompatible materials with mold release agents. Despite this, the medical device industry experienced considerable investment from the U.S. Food and Drug Administration in 2024, driving further growth of the medical device release agent sector globally.

Regional Analysis:

North America emerged as the fastest-growing region in the mold release agents market, with a 27.6% share of the market. This has led to a rise in investments in the automotive segment, especially in the U.S., with the demand for electric vehicles continuing to rise, driving the industry even further with environment-friendly solutions. The evolving environmental regulations lead to the launch of products from companies, such as Chem-Trend and Michelman. Further supporting the market are the U.S. Environmental Protection Agency's emission standards and Mexico's automotive hub. As a result, North America has been considered an important region in the mold release agents market.

Europe accounts for a 22.3% share in the mold release agents market, attributed to the sustainable manufacturing process. Eco-friendly products and biobased release coatings are expected to gain traction in countries such as Germany and France, especially in the automotive and aerospace industries. Mold release agents companies have stepped up their game, driving innovation following the European Union's implementation of stringent environmental regulations. This is due to the robust automotive sector in Germany and the aerospace industry in France. Motorization in Europe is also changing, with a stronger drive toward emission reduction, which is increasing the frequency of usage of specialized mold release formulations.

Asia Pacific led the mold release agents market and accounted for 39.9%. This growth is mainly in the automotive, electronics, and construction industries from countries such as China, Japan, and India. As the leading automotive component manufacturer globally, China dominates the demand share for mold release agents. The market is also witnessing growth due to Japan being a hub of energy-efficient innovations and India emerging as an automotive manufacturing country. Due to the rapid improvements in manufacturing capacity and sustainable production techniques, the region is likely to continue dominating the market.

The Latin America had a substantial growth with a market share of 5.3% in 2024 in the mold release agents market, with Brazil leading the region. Growth in Brazil primarily is being driven by the automotive and electronics industries, with demand for mold release agents rising as local industry continues to expand. Its automotive industry develops, modern manufacturing technology is invested in. This is anticipated to have a positive impact on the demand for mold release agents, especially with sustainable and high-performance solutions. Growing industrialization in Brazil makes it an important driver of the mold release agents market in the region.

The Middle East & Africa has a 4.9% market share in the mold release agents industry and is expected to witness development trends as automotive and construction industries emerge. Saudi Arabia and UAE are developing the manufacturing and construction industry, which in turn propels the demand for mold release agents. Demand is also likely to be driven by investments into domestic automotive assembly plants and industrial projects. The growth in the use of mold release agents in the oil & gas and industrial sectors is also likely to provide a scope for innovation and new product developments in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major competitors in the mold release agents market include Chem-Trend L.P., Michelman Inc., Miller-Stephenson Inc., Axel Plastics Research Laboratories, Moresco Corporation, Cresset Chemical, McGee Industries, Inc., Polytek Development Corp., Tag Chemicals GmbH, and Peri SE.

Recent Developments:

-

March 2025: Chem-Trend introduced SL-10187, a mold release agent designed for high-pressure aluminum casting, improving surface finish and productivity.

-

May 2024: Kao launched LUNAFLOW, a water-based mold release agent for high-temperature and pressure applications, enhancing product efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.26 billion |

| Market Size by 2032 | USD 3.61 billion |

| CAGR | CAGR of 6.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Water-based, Solvent-based, Others) •By Application (Die Casting, PU Molding, Rubber Molding, Composite Molding, Plastic Molding, Wood Composite & Panel Pressing, Concrete, Others) •By End-User Industry (Aerospace, Automotive, Electronics, Medical, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Chem-Trend L.P., Michelman Inc., Miller-Stephenson Inc., Axel Plastics Research Laboratories, Moresco Corporation, Cresset Chemical, McGee Industries, Inc., Polytek Development Corp., Tag Chemicals GmbH, Peri SE |