Dispersing Agents Market Analysis & Overview:

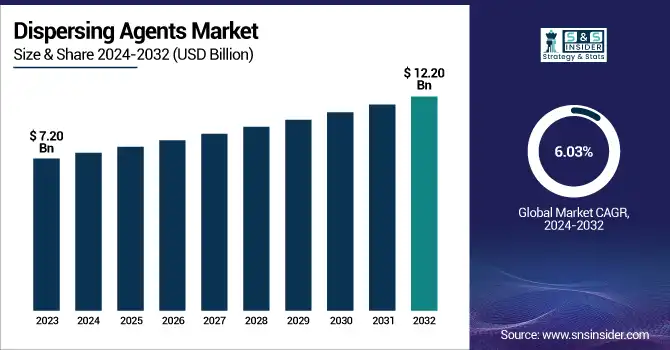

The Dispersing Agents Market size was USD 7.20 billion in 2023 and is expected to reach USD 12.20 billion by 2032 and grow at a CAGR of 6.03% over the forecast period of 2024-2032.

To Get more information on Dispersing Agents Market - Request Free Sample Report

The report provides comprehensive data on production capacity and utilization rates by type and region for 2023, offering visibility into supply chain dynamics. The report includes a detailed analysis of raw material and feedstock pricing trends, highlighting regional fluctuations and cost pressures. It evaluates the regulatory landscape across major markets, assessing its impact on product formulations and industry compliance. Environmental performance is analyzed through emissions data, waste management strategies, and sustainability initiatives undertaken by key players. Innovation trends are captured through insights on R&D investments and product advancements. Additionally, the report explores the adoption of dispersing agent management software and digital tools, with a focus on regional uptake and feature optimization. These insights help stakeholders make informed decisions aligned with market dynamics and regulatory expectations.

The dispersing agents’ market in the United States was valued at USD 1.20 billion in 2023 and is expected to reach USD 2.14 billion by 2032, growing at a CAGR of 6.64% over the forecast period of 2024–2032. The U.S. held the largest market share due to its robust industrial base, particularly in key sectors such as paints & coatings, construction, pharmaceuticals, and oil & gas, where dispersing agents are widely used to improve product stability and performance. High levels of R&D investment, combined with the presence of leading chemical manufacturers and advanced production technologies, have further driven innovation and product diversification in the market. Additionally, stringent environmental regulations have prompted the shift toward eco-friendly and high-efficiency dispersing agents, boosting demand. The country’s strong infrastructure and regulatory clarity also support steady market expansion across diverse end-user industries.

Dispersing Agents Market Dynamics

Drivers

-

Surging demand for high-performance dispersing agents in paints and coatings sector fuels the market growth.

The rising demand for high-performance dispersing agents in the paints and coatings industry is one of the primary drivers of the Dispersing Agents Market. These agents improve pigment stability, enhance color development, and provide uniform distribution in formulations, which is crucial for modern architectural and automotive applications. With the construction and automotive sectors expanding globally—particularly in the U.S., China, and India the demand for quality coatings is surging. According to the American Coatings Association, the U.S. paint and coatings industry alone was valued at over USD 26 billion in 2023. Moreover, consumer preferences are shifting toward durable, environmentally friendly coatings, which require advanced dispersing technologies. This shift is propelling investments in R&D and driving innovation in sustainable dispersing solutions, further strengthening the market outlook.

Restrain

-

Stringent environmental regulations on synthetic chemicals limit dispersing agents market expansion.

Despite its growth potential, the Dispersing Agents Market faces significant restraints due to stringent environmental regulations on synthetic and petroleum-based dispersing chemicals. Government bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have imposed regulations that restrict the use of certain volatile organic compounds (VOCs) and non-biodegradable additives commonly found in dispersing agents. Compliance with these regulations increases production costs, slows down product development, and limits the use of conventional raw materials. Companies are now compelled to invest in costly R&D to develop greener alternatives, which is particularly challenging for small and medium enterprises. These regulations may hamper market growth unless sustainable and compliant dispersing agents become more commercially viable and widely adopted.

Opportunity

-

Emerging applications in bio-based formulations create lucrative growth opportunities for market players.

The increasing focus on sustainability and green chemistry presents a promising opportunity for the Dispersing Agents Market through bio-based formulations. These bio-based dispersants, derived from renewable resources such as plant oils and natural polymers, are gaining traction due to their low environmental impact and biodegradability. As industries such as personal care, food & beverage, and agrochemicals adopt eco-friendly practices, the demand for natural and safe dispersing agents is rapidly growing. According to the U.S. Department of Energy, the bio-based chemicals market is projected to expand significantly, supporting innovation in dispersants. Additionally, government incentives promoting green manufacturing and investments in clean technology are accelerating the development and commercialization of bio-based dispersants, opening new avenues for market participants looking to differentiate through sustainability.

Challenge

-

Fluctuating raw material prices and supply chain disruptions pose major operational challenges for manufacturers.

One of the critical challenges faced by manufacturers in the Dispersing Agents Market is the high volatility in raw material prices, coupled with global supply chain disruptions. Dispersing agents often rely on feedstocks such as ethylene oxide, propylene oxide, and various solvents, the prices of which are subject to global oil market fluctuations and geopolitical tensions. According to the U.S. Bureau of Labor Statistics, chemical input costs rose by over 8% in 2023, affecting profit margins across the sector. This unpredictability hampers planning and increases production costs, especially for manufacturers with limited sourcing alternatives or those operating in price-sensitive markets.

Dispersing Agents Market Segmentation Analysis

By Type

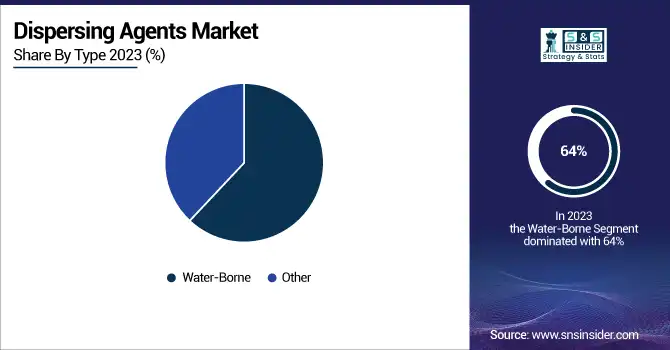

The water-borne segment accounted for the largest share, around 64%, in 2023. The increase in the use of water-borne dispersing agents in industrial applications. These agents, predominantly water-based, drastically minimize VOC emissions and comply strictly with environmental regulations imposed by agencies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA). Sustainable alternatives Water-borne formulations are increasingly replacing solvent-borne formulations in compliance with regulatory requirements and sustainability goals, especially in industries like paints and coatings, textiles, and adhesives. Furthermore, their dispersion efficiency, stability in shelf-life, and adhesion to the substrate are improved by the development of water-borne technology. The ease of application of these biopesticides, combined with cost-effectiveness and lesser toxicity, strengthens their use globally, particularly in developing economies that follow an eco-industrial development pathway. As a result, they dominate the world market.

By Structure

Anionic held the largest market share, around 38%, in 2023. It is due to their better dispersion efficiency, wide compatibility with different systems, and cost-effectiveness, anionic dispersing agents commanded the largest share of the overall dispersing agents’ market. These agents have functional groups with a negative charge and, as such, offer powerful electrostatic repulsion between the particles, reducing aggregation propensity and promoting stable dispersions in aqueous and non-aqueous formulations. They are, therefore, suitable for use in paints and coatings, detergents, ceramics, and building materials. Due to their ease of formulation and stability within high pH environments, they have seen extensive use, particularly in water-borne systems that are becoming popular as environmental regulations are imposed. Additionally, their diverse range of anionic chemistries, such as sulfonates, phosphates, and carboxylates, make them applicable to many industrial uses. The strong efficacy, relative cost-effectiveness, and regulatory pathway keep them a dominant force in the global market.

By End-Use

Paints, Coatings & Inks held the largest market share at around 28% in 2023. They are necessary to avoid pigment agglomeration, thus increasing color strength, gloss, and uniformity in the final application. The worldwide demand for high-performance marine coatings paint has rapidly increased, especially in the countries of emerging economies, due to the rapid development in construction, automotive, packaging, and decorative industries. In addition, efficient dispersing systems are being leveraged to help tackle the rising demand for water-borne and low-VOC formulations as environmental regulations promote this shift. The introduction of novel pigment technologies and a rising inclination toward sustainable as well as long-lasting coatings are further augmenting the dependency on dispersing agents contributing to this application segment being the largest consumer in the global market.

Dispersing Agents Market Regional Outlook

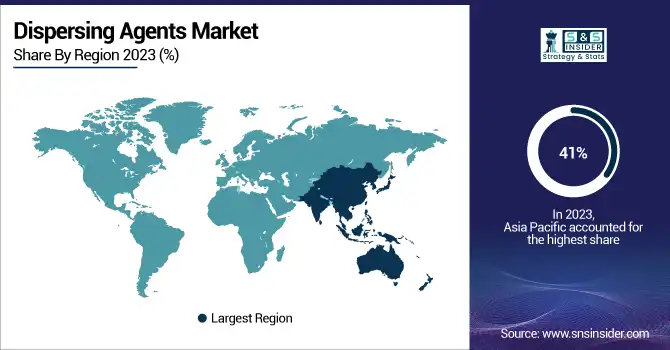

Asia Pacific held the largest market share, around 41%, in 2023. The region is rapidly industrializing and urbanizing and is widely growing in demand from key end-use industries such as construction, automotive, textiles, and paints & coatings. Rapid infrastructure development, expanded manufacturing, and industrial production happening in countries such as China, India, Japan, and South Korea are expected to further bolster demand for dispersing agents in numerous formulations. Furthermore, the increased number of middle-class individuals and increasing consumer purchases of housing and automotive merchandise have accelerated the call for excessive overall performance coatings and adhesives. Additionally, the region has a favorable regulatory environment for manufacturing, a strong chemical production base, and lower production costs. These reasons, along with the growing acceptance of water-borne and green dispersing technologies, have established Asia Pacific’s dominance in the global market.

North America held a significant market share. It is owing to manufacturing base in the region, especially in paints & coatings, automotive and construction industries. Major manufacturers and R D hubs in the U.S. and Canada are solidly entrenched in developing advanced dispersing technologies to meet tougher environmental regulations and stringent performance specifications. The rising demand for efficient dispersing agents has been driven by the U.S. Environmental Protection Agency (EPA) and other regulatory authorities strongly encouraging the adoption of water-borne and low-VOC formulations in automotive and other end-use industries. Additionally, the region has a track record of technological innovation, a skilled workforce, and robust investments in green chemistry and sustainable manufacturing. Coupled with higher demand for high-quality products from both commercial and residential construction activities, these factors make North America a dominant force in the global dispersing agent market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Dispex Ultra PX 4290, Efka PX 4310)

-

Clariant AG (Genapol PF 40, Hostaperm Pink E)

-

Arkema S.A. (Rheotech 2000, Ethacryl 783)

-

Ashland Global Holdings Inc. (Drewplus L-475, Advantage 4910)

-

Dow Inc. (Acumer 3100, Primal AC-261)

-

Elementis plc (Nuosperse FX 908, Bentone EW)

-

Evonik Industries AG (TEGO Dispers 656, TEGO Wet 280)

-

Lubrizol Corporation (Solthix T10, Carboset 525)

-

Croda International Plc (Coltide Radiance, Synperonic A7)

-

Stepan Company (Stepwet DOS 70, Makon NF-12)

-

Altana AG (BYK-9076, BYK-110)

-

Lanxess AG (Baypure DS 100, Naphtolite S)

-

Huntsman Corporation (Surfonic N-60, T-Mulz 734)

-

Solvay S.A. (Rhodoline DF 642, Soprophor FLK)

-

Wacker Chemie AG (GENIOSIL GF 960, VINNAPAS 5518 H)

-

Kao Corporation (Emal AD-25, Levenol H&B)

-

King Industries Inc. (Disparlon DA-325, K-Stay 501)

-

Air Products and Chemicals, Inc. (Surfynol 104, ZetaSperse 3800)

-

Synthron (Syntran 2802, Synadd 8411)

-

Venator Materials PLC (Tioxide TR28, Dispex CX 4320)

Recent Development:

-

In 2024, Elementis plc Introduced Nuosperse FX 908, an advanced rheology‑modifier/dispersant hybrid designed for industrial coatings, enhancing sag resistance and maintaining superior pigment suspension in high‑build applications.

-

In 2024, Evonik Industries AG expanded the TEGO Dispers 656 line with a bio‑based variant, reducing its carbon footprint by 30% while preserving high dispersion efficiency in pigment concentrates.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.20 Billion |

| Market Size by 2032 | USD 12.20 Billion |

| CAGR | CAGR of 6.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Water-borne, Others) •By Structure (Anionic, Non-ionic, Hydrophilic, Amphoteric, Other), •By End-Use (Paints, Coatings & Inks, Adhesives & Sealants, Personal Care & Cosmetics, Agriculture, Construction, Household and Industrial/Institutional Cleaning, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Clariant AG, Arkema S.A., Ashland Global Holdings Inc., Dow Inc., Elementis plc, Evonik Industries AG, Lubrizol Corporation, Croda International Plc, Stepan Company, Altana AG, Lanxess AG, Huntsman Corporation, Solvay S.A., Wacker Chemie AG, Kao Corporation, King Industries Inc., Air Products and Chemicals, Inc., Synthron, Venator Materials PLC |