Molecular Spectroscopy Market Size & Report Overview:

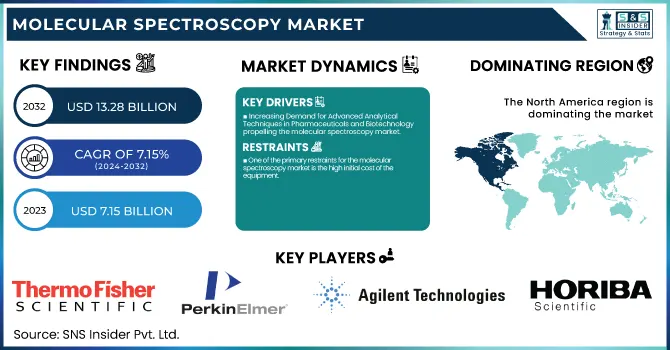

The Molecular Spectroscopy Market size was valued at USD 7.15 billion in 2023 and is expected to reach USD 13.28 billion by 2032, growing at a CAGR of 7.15% from 2024-2032.

To Get more information on Molecular Spectroscopy Market - Request Free Sample Report

Advancements in analytical techniques and higher demand for molecular spectroscopy across industries in pharmaceutical, biotechnology, food & beverages, and environmental testing are expanding the market. As far as accuracy, speed of measurement, sensitivity, and wide scope of the molecule under observation, molecular spectroscopy including the four main spectrometric methods has come up as one of the more relevant tools of analysis.

The pharmaceutical industry is one of the major contributors to this growth because molecular spectroscopy is increasingly being used for drug analysis, formulation development, and quality control. The advantage of these technologies is that they do not destroy the products, which is particularly important in ensuring the safety and efficacy of the products for compliance with regulatory standards. The biotechnology industry also uses molecular spectroscopy for research applications, such as protein analysis and DNA sequencing.

The latest trends boost the market growth. For instance, Bruker Corporation has released new high-resolution solid-state NMR spectroscopy solutions that enable unprecedented studies of large proteins, membrane proteins, and protein aggregates, potentially facilitating significant breakthroughs in both structural biology and drug discovery.

The kind of partnership done in diagnostics between Hitachi High-Tech Corporation and Gencurix, Inc. highlights the increasing integration of molecular spectroscopy with precision medicine. It will be well-positioned to develop advanced cancer molecular diagnostic services by combining Hitachi's experience in digital technology and diagnostic product manufacturing with Gencurix's biomarker discovery capability.

The demand for accurate and effective testing in environmental monitoring, food & beverage safety, and academic research applications will keep driving the molecular spectroscopy market. The growth of these systems with technological advancement and innovation is expected to further propel the market.

Molecular Spectroscopy Market Dynamics

Drivers

-

Increasing Demand for Advanced Analytical Techniques in Pharmaceuticals and Biotechnology propelling the molecular spectroscopy market.

The pharmaceutical and biotechnology industry is a prominent driver of the molecular spectroscopy market. The demand for accurate and fast analytical instruments has risen radically, particularly in drug building, formulation, and high-quality measurement routines. Molecular spectroscopy (e.g., NMR, FTIR, and Raman spectroscopy) provides non-destructive, highly sensitive, and precise molecular structure analysis, making these techniques indispensable in research and manufacturing. These approaches are crucial for evaluating the quality, safety, and efficacy of pharmaceutical products and ensuring compliance with regulatory standards. Additionally, the rise of personalized medicine and biologics is driving the need for advanced molecular analytics that is fueling the adoption of these technologies in the pharmaceutical and biopharmaceutical industries.

-

Rising Demand for Non-Destructive Testing in Environmental and Food Safety Applications

Molecular spectroscopy is progressively being utilized in environmental testing and food safety because of its non-destructive qualities, enabling quick analysis without harming samples. In environmental surveillance, these methods are employed to assess pollutants, toxins, and contaminants in air, water, and soil. In the food and beverage sector, molecular spectroscopy assists in analyzing food composition, identifying contaminants, and ensuring product quality and safety. With increasing worries about environmental sustainability and food safety, the demand for molecular spectroscopy technologies that offer dependable, precise, and non-invasive testing options is rising, thus propelling market growth further.

Restraint

-

One of the primary restraints for the molecular spectroscopy market is the high initial cost of the equipment.

High-end analytical devices like Nuclear Magnetic Resonance (NMR) spectrometers, Fourier Transform Infrared (FTIR) systems, and Raman spectrometers require substantial investment since a considerable sum is allocated for their purchase, installation, and upkeep. The complexity of technology and specialized parts of these devices also contributes to the cost. There are always extra expenses for the trained personnel needed to operate these systems and to understand what the results actually indicate. While there's nothing wrong with being open source, this might become a bottleneck for smaller labs, research institutes, or companies in emerging markets with less deep pockets. The high initial cost may deter the implementation of these technologies, thus hindering their broader-scale application, especially for price-sensitive markets.

Molecular Spectroscopy Market Segmentation Analysis

By Technology

The nuclear magnetic resonance spectroscopy segment dominated the market with 28% of the market share in 2023, because of its unmatched sensitivity and precision in structural analysis. It provides complete information on the molecular structure and dynamics of complex compounds, such as large biomolecules like proteins and nucleic acids, which has made it indispensable in the pharmaceutical and biotechnology industries. The versatility of NMR applications also extends into a wide range of industries, from drug development, and food safety testing, to environmental testing. Its non-destructive nature also allows for the recycling of valuable samples and thus it is cheaper. High-resolution and solid-state NMR have expanded considerably in the last few years. The requirements of pharmaceutical firms, acceptance of regulations, and continued technological advancement are keeping NMR at the apex as the most sought-after molecular spectroscopy technique.

The raman spectroscopy segment is expected to experience the fastest growth with 13.24% CAGR throughout the forecast period, Owing to its non-invasive nature and quick analysis, along with its expanding use in various sectors. It offers real-time, in situ analysis without sample preparation, making it suitable for pharmaceutical, biotechnology, food safety, and environmental monitoring. In pharmaceuticals, it is used in drug composition analysis and quality control; in healthcare, it has applications in non-invasive diagnostics such as cancer detection and tissue analysis. Technological advances, like portable devices, have made it more accessible for field testing and point-of-care diagnostics. Its cost-effectiveness and ease of use further fuel its growth, as industries increasingly adopt Raman spectroscopy for quality assurance and environmental monitoring, cementing its position as a fast-growing technology.

By Application

The pharmaceutical applications segment dominated the molecular spectroscopy market with 38% of the market share in 2023 since it plays a critical role in drug development, quality control, and regulatory compliance. Molecular spectroscopy techniques, including NMR, FTIR, and Raman spectroscopy, are crucial for the analysis of the molecular structure, interactions, and composition of pharmaceutical compounds. These technologies permit accurate identification and quantification of active pharmaceutical ingredients, impurities, and excipients, hence determining the safety and efficacy of medications.

Advanced spectroscopic techniques are increasingly in demand for studying complex biomolecules due to the added impetus given by biologics and personalized medicine. The rigorous quality testing requirements ushered into the market due to the intercession of the FDA and EMA have driven adoption throughout the pharmaceutical industry. Since this technology is integral to each step of drug development, this market segment will be in the lead.

Biotechnology and biopharmaceutical applications segment constitute the fastest-growing segment in the molecular spectroscopy market with 11.01% CAGR, mainly driven by an increase in the demand for advanced analytical tools used in biologics development and manufacturing of biosimilars and cell-based therapies. In all these applications described, the precise characterization of the complex biomolecules involved, including proteins, antibodies, and nucleic acids, determines their structural quality, purity, and ultimately quality.

Molecular Spectroscopy Market Regional Insights

North America dominated the market with a 37% market share of the molecular spectroscopy market. Due to developed research and development infrastructure, mainly in the pharmaceutical, biotechnology, and healthcare sectors. Some of the leading players such as Thermo Fisher Scientific, Agilent Technologies, and Bruker Corporation constantly innovates technologies in molecular spectroscopy in the United States. All these companies work in different fields of drug discovery from diagnostics to quality control, ensuring the ever-growing need for high-end spectroscopic systems. In addition, North America is a well-established healthcare system where there is a requirement for accurate analytical equipment for clinical applications, environmental testing, and regulatory issues. Government funding for scientific research is another factor that would add to the technological advantage of molecular spectroscopy across the region, thereby contributing to being the leading region in the global market.

The Asia Pacific is expected to experience the fastest growth in the molecular spectroscopy market with a 10.43% CAGR from 2024-2032. Due to the increasing investment in R&D and rapid industrialization. In terms of pharmaceutical, biotechnology, and the environment, collectively creating a demand for advanced analytical tools like molecular spectroscopy. Rising awareness about food safety and environmental concerns in the region further supplements the adoption of such technologies for testing and quality assurance. In addition, spectroscopic technologies are becoming more accessible for use across various applications due to their lower cost and availability in developing countries. The Asia Pacific region is a key driver of global markets, is anticipated to experience significant growth while following previous trends, as governmental organizations continue to invest heavily in scientific infrastructure and research facilities, positioning it as a prime area for market expansion in the years ahead.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Molecular Spectroscopy Market

-

Thermo Fisher Scientific (Nicolet iS50 FTIR Spectrometer, Q Exactive Plus Orbitrap Mass Spectrometer)

-

PerkinElmer (LAMBDA 265 UV-Vis Spectrophotometer, Frontier FTIR Spectrometer)

-

Agilent Technologies (Cary 3500 UV-Vis Spectrophotometer, 7000 Series Triple Quadrupole GC-MS)

-

Bruker Corporation (Tensor 27 FTIR Spectrometer, Ultraflextreme MALDI-TOF Mass Spectrometer)

-

Horiba Scientific (Scientific Raman Spectrometers - LabRAM HR Evolution, UV-Vis-NIR Spectrophotometer - U-3900i)

-

JASCO Corporation (V-750 UV-Visible Spectrophotometer, FT/IR-4600 Series FT-IR Spectrometer)

-

Shimadzu Corporation (UV-2600 UV-Visible Spectrophotometer, IRSpirit FTIR Spectrometer)

-

Bio-Rad Laboratories (Bio-Plex 200 System, ChemiDoc MP Imaging System)

-

Malvern Panalytical (Morphologi 4-ID Particle Imaging System, Zetasizer Ultra)

-

Hitachi High-Tech Corporation (U-5100 UV-Vis Spectrophotometer, FTIR-8400S Fourier Transform Infrared Spectrometer)

-

Oxford Instruments (XploRA PLUS Raman Microscope, INCA X-ray Spectrometer)

-

Renishaw (InVia Raman Microscope, Raman Imaging Systems)

-

Enwave Optronics (UV-Vis-NIR Spectrometer, MicroNIR 1700 Handheld Spectrometer)

-

Newport Corporation (Oriel Instruments Fiber Optic Spectrometer, Oriel 77250 Raman Spectrometer)

-

Witec (alpha300 R Confocal Raman Microscope, spm 3000 AFM Spectrometer)

-

SPECTRO Analytical Instruments (SPECTRO iQ 8000 X-ray Fluorescence Spectrometer, SPECTRO ARCOS ICP-OES Spectrometer)

-

Carl Zeiss (Axio Observer Microscope, LSM 880 Confocal Laser Scanning Microscope)

-

Analytical Systems Keco (AC-1500 FT-IR Spectrometer, HT-5000 High-Throughput NIR Analyzer)

-

Edinburgh Instruments (FS5 Fluorescence Spectrometer, FLS1000 Spectrometer)

Key suppliers

These suppliers provide critical components and technology to enhance the performance and capabilities of molecular spectroscopy instruments manufactured by companies like Thermo Fisher, PerkinElmer, Agilent Technologies, and others.

-

Hamamatsu Photonics Suppliers

-

Mettler Toledo Suppliers

-

Lightwave Logic Suppliers

-

Edmund Optics Suppliers

-

Oxford Instruments Superconducting Magnet Technology Suppliers

-

Ocean Insight Suppliers

-

Thorlabs Suppliers

-

Horiba Scientific Suppliers

-

Agilent Technologies Suppliers

-

PI (Physik Instrumente) Suppliers

Recent Developments in Molecular Spectroscopy Market

-

April 2024 - Bruker Corporation a leader in nuclear magnetic resonance (NMR) spectroscopy solutions, has unveiled advanced high-resolution solid-state NMR capabilities. These innovations are set to drive groundbreaking discoveries in structural biology, particularly for large proteins, membrane proteins, and protein aggregates.

-

August 28, 2024 - Hitachi High-Tech Corporation ("Hitachi High-Tech") and Gencurix, Inc. have formed a strategic partnership in the field of cancer molecular diagnostics. This collaboration combines Hitachi High-Tech's expertise in R&D and manufacturing of in vitro diagnostic products with Gencurix's proficiency in biomarker discovery and molecular testing services, aiming to develop an advanced cancer molecular diagnostic testing service.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.15 Billion |

| Market Size by 2032 | US$ 13.28 Billion |

| CAGR | CAGR of 7.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Nuclear Magnetic Resonance Spectroscopy, UV-Visible Spectroscopy, Infrared Spectroscopy, Near-Infrared Spectroscopy, Color Measurement Spectroscopy, Raman Spectroscopy, Other Technologies) • By Application (Pharmaceutical Applications, Food & Beverage Testing, Biotechnology & Biopharmaceutical Applications, Environmental Testing, Academic Research, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, PerkinElmer, Agilent Technologies, Bruker Corporation, Horiba Scientific, JASCO Corporation, Shimadzu Corporation, Bio-Rad Laboratories, Malvern Panalytical, Hitachi High-Tech Corporation, Oxford Instruments, Renishaw, Enwave Optronics, Newport Corporation, Witec, SPECTRO Analytical Instruments, Carl Zeiss, Analytical Systems Keco, Edinburgh Instruments, and other players. |

| Key Drivers | •Increasing Demand for Advanced Analytical Techniques in Pharmaceuticals and Biotechnology propelling the molecular spectroscopy market. •Rising Demand for Non-Destructive Testing in Environmental and Food Safety Applications |

| Restraints | •One of the primary restraints for the molecular spectroscopy market is the high initial cost of the equipment. |