DNA Sequencing Market Size & Overview:

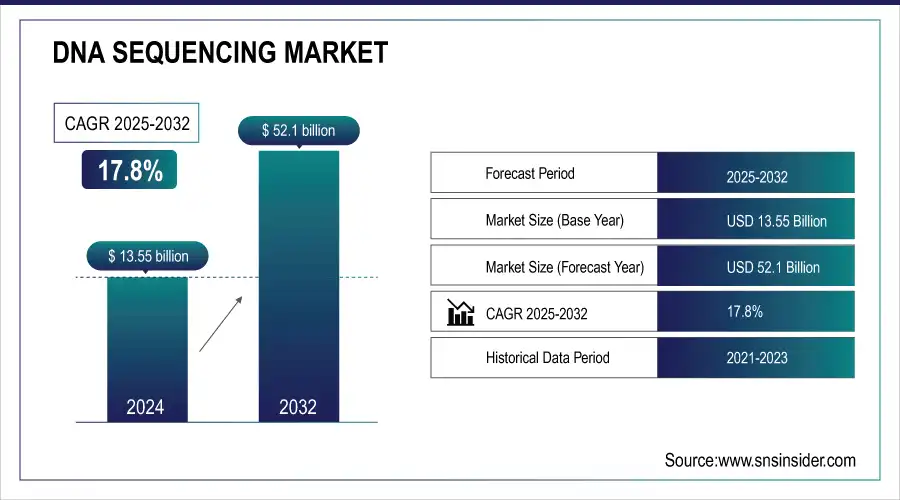

The DNA Sequencing Market Size was valued at USD 13.55 Billion in 2024 and is expected to reach USD 52.1 Billion by 2032, growing at a CAGR of 17.8% over the Forecast Period of 2025-2032.

One of the major forces driving the DNA sequencing market is the significant support from government bodies worldwide, particularly in the field of genomics research. According to the National Institutes of Health, over $3.5 billion was allocated to genomic research in 2024, with a significant part focused on promoting DNA sequencing. This funding allows new sequencing techniques to be developed, which would speed the process and improve the accuracy of mapping the genome. It would also enable larger sequencing of human populations. At the same time, the European Union’s Horizon Europe funded the healthcare sector with €1.1 billion, an investment into the healthcare sector, focusing heavily on DNA sequencing research as well. Such overall increased interest in supporting genome sequencing is largely driven by the growing concern with the need to provide disease prevention and treatment tailored to individual DNA. Furthermore, the National Health Commission of China in 2023 increased its funding allocations to genomic projects by 30% to enhance DNA sequencing for early detection of diseases and the creation of personalized treatments.

Get More Information on DNA Sequencing Market - Request Sample Report

DNA Sequencing Market Size and Forecast:

-

Market Size in 2024: USD 13.55 Billion

-

Market Size by 2032: USD 52.10 Billion

-

CAGR: 17.8% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key DNA Sequencing Market Trends:

-

Advancements in next-generation sequencing (NGS) technologies improve throughput, accuracy, and speed, enabling large-scale genomic studies and personalized medicine.

-

Integration of AI and bioinformatics platforms enhances genomic data analysis, variant interpretation, and predictive insights for research and clinical applications.

-

Adoption of single-cell sequencing techniques supports detailed cellular-level analysis, disease research, and biomarker discovery.

-

Growth in precision medicine and targeted therapies drives demand for sequencing in oncology, rare diseases, and pharmacogenomics.

-

Cloud-based sequencing platforms enable scalable data storage, secure sharing, and remote collaboration among researchers and healthcare providers.

-

Rising investments in genomics research and government-funded initiatives accelerate sequencing adoption in public health, agriculture, and diagnostics.

-

Development of portable and benchtop sequencing devices expands accessibility, supporting point-of-care testing and field-based genomic studies.

-

Automation in sample preparation and library construction reduces errors, lowers costs, and improves workflow efficiency across sequencing laboratories.

The increasing use of Next-Generation Sequencing and Whole-Genome Sequencing in clinical diagnostics also amplifies the space of DNA sequencing applications, which propelled the market growth. Moreover, enormous amounts of data generated in genome mappings require enhanced data storage and analysis methods, and the latest advancements in sequencing speed by platforms such as Illumina’s may foreshadow the intensified efficiency in this regard. For instance, in March 2023, Illumina launched Connected Insights, which is a cloud-based clinical NGS data analysis software. Another factor propelling the growth is the increase in interest in genomics and personalized medicine, the progress which is largely driven by innovations broadened by artificial intelligence. For example, in June 2022, Ultima Genomics in partnership with Nvidia announced its AI implementation in genome sequencing, which enhances accuracy and scalability.

DNA Sequencing Market Drivers:

-

Continuous improvements in NGS technologies, such as increased speed, accuracy, and reduced costs, are driving wider adoption in clinical diagnostics, personalized medicine, and genomics research.

-

Growing interest in personalized medicine is fuelling demand for DNA sequencing to tailor treatments based on individual genetic profiles, enabling more effective disease management.

-

The use of AI and machine learning to enhance sequencing accuracy, automate data analysis, and reduce time-to-insight is accelerating market growth. Partnerships like Ultima Genomics and Nvidia highlight the push for AI-driven innovation.

-

DNA sequencing is increasingly being used for cancer research, early detection, and targeted therapies, making it a key driver in the oncology and precision medicine sectors.

The growing focus on personalized medicine is a key driver of the DNA sequencing market, as it allows treatments to be tailored to individual patients based on their genetic profiles. This approach enables more effective disease management, particularly for complex conditions such as cancer, cardiovascular diseases, and rare genetic disorders. Personalized medicine leverages DNA sequencing to identify genetic mutations and variations that may contribute to a patient’s condition, allowing for targeted therapies. For example, in oncology, DNA sequencing can help identify specific genetic markers that make certain cancers more susceptible to particular drugs. A 2023 study from the American Association for Cancer Research (AACR) revealed that over 55% of cancer patients responded more effectively to treatments guided by genetic profiling compared to traditional treatments.

Additionally, advancements in pharmacogenomics, the study of how genes affect a person’s response to drugs, are driving the adoption of DNA sequencing in personalized medicine. It helps in minimizing adverse drug reactions by tailoring prescriptions based on a patient’s genetic makeup. The Clinical Pharmacogenetics Implementation Consortium (CPIC) reported that integrating pharmacogenomics into healthcare could prevent up to 30% of adverse drug reactions, potentially saving thousands of lives annually. Prominent projects like the All of Us Research Program, which aims to collect genomic data from one million Americans, demonstrate the increasing investment in genomics to improve personalized medicine. This focus continues to drive innovation and applications of DNA sequencing in healthcare, with far-reaching benefits for patient outcomes.

DNA Sequencing Market Restraints:

-

Despite falling sequencing costs, the initial capital investment for sequencing equipment remains high, limiting adoption among smaller research labs and healthcare facilities.

-

The massive volume of data generated through sequencing requires complex bioinformatics tools for analysis, posing challenges in interpretation and accessibility for non-specialist users.

-

Stringent regulatory requirements for clinical applications and concerns over data privacy and ethical implications of genetic information pose barriers to widespread adoption.

One of the substantial restraints in the DNA sequencing market is the complexity of data interpretation. Advances in sequencing have accelerated the rate at which raw genetic information can be read and decoded, making the process faster and more affordable. However, the interpretation of such vast amounts of data is complex. There is a wide range of bioinformatics software, high computing infrastructure, and knowledge required to analyze the data produced by sequencing methods, which may not be available for standard healthcare facilities or average researchers. Another key point is the notion of a genetic variant and its clinical significance and capacity to make a clinical scenario revealing relevant patterns. While researchers and bioinformaticians may be familiar with these concepts, clinicians may not be. In this sense, tools that facilitate data interpretation and provide guidelines or alerts can be highly helpful. Additionally, the variability in genetic data interpretation can lead to inconsistent or inconclusive results, complicating clinical decision-making. To address this, improved bioinformatics platforms, automation, and user-friendly tools are essential to streamline data analysis, but the current gap in expertise remains a barrier to widespread adoption in clinical settings.

DNA Sequencing Market Segmentation Insights:

By Application, Oncology Leads DNA Sequencing Market Driven by Precision Medicine and Government Initiatives

The oncology application segment primarily contributed to the DNA sequencing market, with a revenue share of 24% in 2024. The dominance is primarily due to the increasing demand for precision oncology, where sequencing assists in identifying the specific genetic mutations that cause cancer. The segment growth can also be attributed to government health initiatives that are contributing to ongoing precision medicine. For instance, in 2024, the National Cancer Institute dedicated $1.5 billion to precision medicine, and more than $500 million of the budget was allocated to genomic sequencing in oncology. Sequencing technologies that perform cancer diagnostics and treatment support the ability of clinicians to modulate treatments based on the genetic makeup of individual tumors. For instance, in the U.K., the Genomics England project is continually integrating cancer genomics into routine health service, and with time, they will develop the entire cancer genome to understand the different genomic regions, which vary depending on individuals. The approach will assist in the development of early interventions based on general understanding and reduce the costs of genetic predispositions. Overall, such government-backed initiatives in different countries and regions increase the use of DNA sequencing in oncology and contribute to a substantial market share.

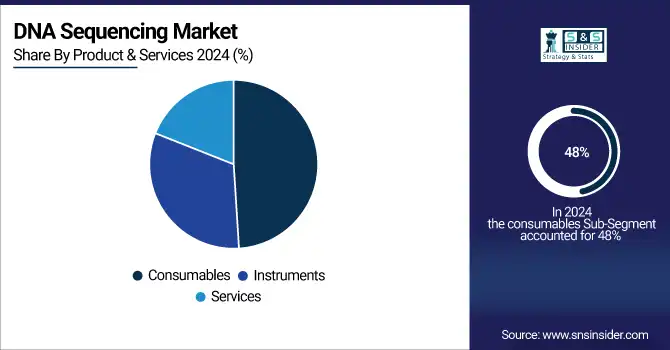

By Product & Service, Consumables Dominate DNA Sequencing Market While Services Segment Experiences Fastest Growth

The consumables segment was the leading DNA sequencing market by product and service, with a revenue share of 48% in 2024. Consumables, such as reagents, sample preparation kits, and sequencing chips, are essential components of sequencing workflows. Moreover, they are used in laboratories and research facilities on a recurrent basis, which ensures consistent demand. A significant factor that contributes to the domination of this segment is the increasing number of genomic research projects worldwide. The initiatives are often supported by the government, which often creates additional funding opportunities. For example, as part of the 2023 budget of the NIH, approximately $2 billion was allocated to enable the purchase of genomic consumables for sequencing projects across the U.S. Another factor that drives this segment’s performance is the advent of innovations that increase device efficiency. For instance, high-throughput sequencing platforms depend extensively on consumables to deliver their unique advantages. Overall, the trend suggests that consumables are and will remain the dominant force in the DNA sequencing market.

The services segment is expected to have the highest CAGR throughout the forecast period. The rise of sequencing technologies created a demand for sequencing services, with outsourced projects becoming particularly popular in clinical research and diagnostics. In addition, governments are acknowledging the benefits of such collaboration with private sequencing service providers, which allows them to expand the range of the population that undergoes genetic testing. For instance, as part of its 2024 precision medicine initiative, the Chinese government announced its plan to partner with sequencing service companies to provide genetic screening programs.

By End-user, the Academic Research Segment Holds the Largest Share; Clinical Research to Witness Rapid Expansion

In 2024, the academic research segment accounted for the largest share of revenue in the DNA sequencing market at 49%. The demand for sequencing technologies is high in academic and research facilities because they are at the forefront of most genomics’ activities. Most governments, especially in the U.S. and Europe, have spent significant amounts of money to build research infrastructure over the years. These efforts have gone a long way in boosting the growth of this segment. The National Institutes of Health (NIH's) 2023 budget, for instance, directed approximately $1.2 billion to genomic research in academic settings, highlighting the crucial role of universities and research institutions in advancing sequencing technologies. The fast-growing popularity of these technologies in researchers and academic institutions is supported by the high level of government funding for universities and research institutions. The importance of academic institutions in the development of sequencing technologies is quite monumental. Most of the new methodologies are usually approved in such research centers before being accepted as clinical or profit-making technologies. The commercial success of this segment is, therefore, ably supported by well-funded government projects. The clinical research segment to experience the fastest growth rate because DNA sequencing is finding increased adoption in various clinical trials especially in the development of targeted therapies. The European Medicines Agency's 2024 report emphasized the growing use of sequencing in clinical trials for new drug development, particularly in cancer and rare genetic diseases. This trend is expected to push the clinical research segment to grow rapidly as DNA sequencing becomes integral to modern clinical practices.

DNA Sequencing Market Regional Insights

North America Dominates DNA Sequencing Market in 2024

North America holds an estimated 42% market share in 2024, driven by substantial government funding for genomics research, precision medicine initiatives, and advanced healthcare infrastructure. This causes widespread adoption of DNA sequencing technologies in clinical, academic, and research settings, accelerating innovation and market growth.

Need any customization research on DNA Sequencing Market - Enquiry Now

-

United States Leads North America’s DNA Sequencing Market

The U.S. dominates due to its strong healthcare infrastructure, leading biotechnology companies, and significant federal funding for genomics research. Initiatives such as the NIH’s precision medicine programs and cancer genomics projects promote advanced sequencing adoption in hospitals, research institutions, and academic laboratories. The presence of major sequencing technology providers like Illumina, Thermo Fisher Scientific, and Pacific Biosciences further strengthens market growth. Coupled with a high focus on personalized medicine and early disease diagnostics, the U.S. remains the largest contributor to North America’s DNA sequencing leadership.

Asia Pacific is the Fastest-Growing Region in DNA Sequencing Market in 2024

The region is expected to grow at a CAGR of 16.8% from 2025–2032, driven by expanding government genomics initiatives, rising healthcare investments, and increasing adoption of precision medicine. This causes healthcare providers and research institutions to implement DNA sequencing solutions to improve diagnostics, treatment planning, and research capabilities.

-

China Leads Asia Pacific’s DNA Sequencing Market

China dominates due to its large-scale investment in genomics research, government-backed precision medicine programs, and increasing healthcare infrastructure development. National initiatives such as the China Precision Medicine Initiative and substantial funding for genomic projects encourage hospitals, research institutes, and universities to adopt advanced DNA sequencing platforms. With a growing biotech ecosystem, partnerships with global sequencing technology providers, and rising demand for personalized healthcare, China has become the primary driver of DNA sequencing adoption in Asia Pacific. This positions the country as the key market leader in the region.

Europe DNA Sequencing Market Insights, 2024

Europe is witnessing significant growth in DNA sequencing, fueled by rising government funding for genomic research, increasing adoption of precision medicine, and strong academic infrastructure. The UK’s investment in genomic initiatives and precision medicine enhances research capabilities, causing accelerated adoption of DNA sequencing technologies across Europe.

-

United Kingdom Leads Europe’s DNA Sequencing Market

The U.K. dominates due to initiatives like Genomics England, which integrates genome sequencing into healthcare systems to improve diagnostics and research. High government support, advanced research infrastructure, and strong collaboration between public institutions and private biotech companies boost sequencing adoption. The country’s emphasis on personalized medicine and large-scale genomic projects ensures it remains the central hub for DNA sequencing growth across Europe.

Middle East & Africa and Latin America DNA Sequencing Market Insights, 2024

The DNA sequencing market in these regions is expanding steadily, driven by growing healthcare infrastructure, increasing government funding for genomics research, and rising awareness of precision medicine. Countries such as Saudi Arabia, the UAE, Brazil, and Mexico are investing in next-generation sequencing technologies, establishing genomics research centers, and promoting personalized healthcare initiatives. Collaborations with global biotechnology firms and adoption of modern sequencing platforms accelerate market growth. Growing emphasis on healthcare innovation, disease diagnostics, and research capabilities continues to drive demand for DNA sequencing solutions across both regions.

Competitive Landscape for the DNA Sequencing Market:

Illumina, Inc.

Illumina, Inc. is a U.S.-based global leader in DNA sequencing and genomic solutions, providing advanced sequencing platforms, reagents, and software. The company specializes in next-generation sequencing (NGS), microarrays, and genomic analysis tools for applications in oncology, reproductive health, agriculture, and research. Illumina’s solutions enable precise detection of genetic variations, supporting personalized medicine, diagnostics, and research breakthroughs. Its role in the DNA sequencing market is pivotal, as it drives innovation, accuracy, and scalability, empowering academic, clinical, and commercial institutions to accelerate genomic discoveries and enhance patient outcomes.

-

In 2024, Illumina expanded its NGS portfolio with high-throughput sequencing systems, increasing sample processing speed, reducing costs, and enhancing data accuracy for large-scale genomics projects.

Thermo Fisher Scientific

Thermo Fisher Scientific is a U.S.-based biotechnology and life sciences company, offering comprehensive DNA sequencing platforms, reagents, consumables, and software solutions. The company provides NGS instruments, Sanger sequencing services, and bioinformatics tools, enabling research, clinical diagnostics, and pharmaceutical development. Its role in the DNA sequencing market is significant, as it supports large-scale genomic initiatives, enhances workflow efficiency, and facilitates precision medicine adoption across laboratories, hospitals, and research institutions worldwide.

-

In 2024, Thermo Fisher Scientific introduced integrated sequencing solutions combining automated sample preparation and advanced analytics, accelerating genomic research and clinical testing workflows.

Pacific Biosciences

Pacific Biosciences, U.S.-based, specializes in long-read DNA sequencing technologies that deliver highly accurate and comprehensive genomic data. Its platforms, including the Sequel II system, are widely used in research, clinical genomics, and advanced diagnostics. The company’s role in the DNA sequencing market is critical, offering high-fidelity sequencing for complex genomic regions, structural variation analysis, and transcriptomics, enabling discoveries that were previously challenging with short-read technologies.

-

In 2024, Pacific Biosciences launched upgrades to its long-read sequencing systems, enhancing throughput, accuracy, and adoption for clinical and academic genomics applications.

Oxford Nanopore Technologies

Oxford Nanopore Technologies is a U.K.-based pioneer in portable and real-time DNA/RNA sequencing solutions. The company develops nanopore-based platforms that allow ultra-long reads, real-time analysis, and flexible scalability for research, diagnostics, and field applications. Its role in the DNA sequencing market is transformative, enabling rapid genomic insights, mobile sequencing, and accessibility in diverse settings from laboratories to remote locations.

In 2024, Oxford Nanopore Technologies introduced enhanced nanopore sequencing devices with improved accuracy and faster data processing, expanding applications in clinical diagnostics and environmental genomics.

DNA Sequencing Market Key Players:

-

Oxford Nanopore Technologies

-

BGI Group

-

Roche Sequencing Solutions

-

QIAGEN N.V.

-

Agilent Technologies

-

Zymo Research Corporation

-

Macrogen, Inc.

-

Genomatix

-

Bio-Rad Laboratories

-

Element Biosciences

-

Singlera Genomics

-

PerkinElmer, Inc.

-

F. Hoffmann-La Roche AG

-

Novogene

-

Syndrome Genomics

-

Molecular Devices

-

Illumina Clinical Services Laboratory

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 13.55 Billion |

| Market Size by 2032 | US$ 52.1 USD Billion |

| CAGR | CAGR of 17.8% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product & Services (Consumables, Instruments, Services) • by Workflow (Pre-sequencing, Sequencing, Data Analysis) • by Technology (Sanger Sequencing, Next-Generation Sequencing {Whole Genome Sequencing (WGS), Whole Exome Sequencing (WES), Targeted Sequencing & Resequencing}, Third Generation DNA Sequencing {Single-Molecule Real-Time Sequencing (SMRT), Nanopore Sequencing}) • by Application (Oncology, Reproductive Health, Clinical Investigation, Agrigenomics & Forensics, HLA Typing/Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Consumer Genomics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Inc., Thermo Fisher Scientific, Pacific Biosciences, Oxford Nanopore Technologies, BGI Group, Roche Sequencing Solutions, Agilent Technologies, Zymo Research Corporation, Macrogen, Inc., Bio-Rad Laboratories, Element Biosciences , Singlera Genomics. |