Monolithic Microwave IC Market Size & Trends:

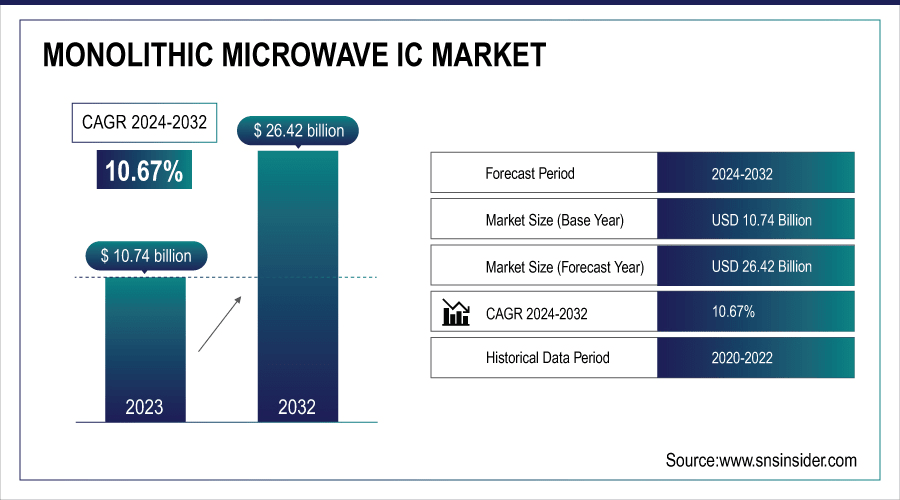

The Monolithic Microwave IC (MMIC) Market was valued at USD 10.74 billion in 2023 and is projected to reach USD 26.42 billion by 2032, growing at a CAGR of 10.67% from 2024 to 2032.

This growth is fuelled by growing demand for high-frequency and high-performance components in 5G network applications, aerospace, defence systems, and satellite communications. The market is also experiencing a fast pace of technological advancements in GaN and GaAs-based MMICs, which are more efficient and have higher bandwidth. Furthermore, growing defence expenditures across the world and the implementation of next-generation communication infrastructure further drive market growth.

To Get More Information On Monolithic Microwave IC (MMIC) Market - Request Free Sample Report

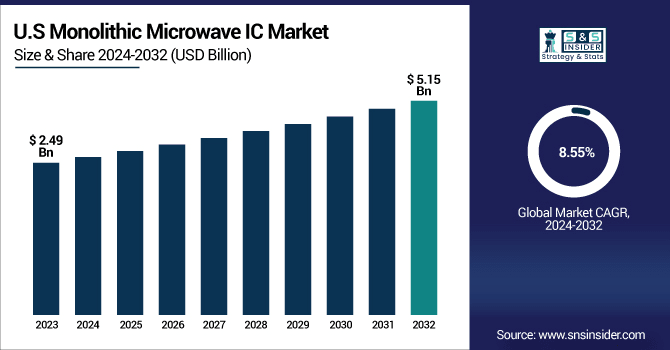

The U.S. Monolithic Microwave IC (MMIC) market was valued at USD 2.49 billion in 2023 and is expected to reach USD 5.15 billion by 2032, growing at a CAGR of 8.55% during the forecast period from 2024 to 2032.

This growth is most influenced by the nation's robust involvement in the aerospace and defense industries, where MMICs find extensive applications in radar, electronic warfare, and satellite communications systems.

Moreover, the speedy development of 5G networks and continuous innovation in military technology is driving further MMIC adoption. The U.S. also has strong R&D activity and major industry players.

Monolithic Microwave IC Market Dynamics

Key Drivers:

-

Rising Integration of MMICs in 5G Infrastructure and Defense Systems Drives The Monolithic Microwave IC Market Growth.

Rise in the implementation of 5G technology and the increase in global defense systems are key stimulants to the Monolithic Microwave IC (MMIC) market. MMICs are essential in high-frequency, high-speed communication systems because they can fit into compact spaces, perform efficiently, and withstand harsh operating conditions. For 5G infrastructure, MMICs contribute to increased data transmission speed, reduced latency, and increased bandwidth, making it a necessity in base stations as well as handheld devices. In defense applications, MMICs are extensively employed in radar systems, electronic warfare, and satellite communication. With the governments and telecommunication operators making huge investments to upgrade communication infrastructure and military technologies, the requirement for advanced MMICs also keeps on escalating, which supports the market to grow continuously throughout the forecast period.

Restrain:

-

Complex Design and High Development Costs of MMICs Hinder The Monolithic Microwave IC Market Expansion

The MMIC market is hindered by the high expense and technical complexity of designing and developing such circuits. It takes precision engineering, costly semiconductor materials such as Gallium Arsenide (GaAs) or Gallium Nitride (GaN), and sophisticated fabrication facilities to produce MMICs. The complicated manufacturing process and the requirement of specialized test equipment considerably increase production costs.

Also, the incorporation of MMICs into current systems may not be easy because of issues of compatibility and optimizing performance. Such impediments tend to dissuade new entrants or small makers from going into the MMIC market, hence slowing down the growth of the market and curtailing innovation, especially within price-sensitive markets and developing economies.

Opportunities:

-

Expanding Application of MMICs in Automotive Radar and Satellite Internet Services Offers New Growth Opportunities

The increasing adoption of MMICs in new applications like automotive radar systems and satellite internet services offers promising growth prospects. With the integration of advanced driver-assistance systems (ADAS) and radar-based safety features by automotive companies into vehicles, the demand for high-frequency performance and compact MMICs is increasing. At the same time, satellite internet companies such as Starlink are launching low-Earth orbit (LEO) satellites based on MMICs for processing high-speed signals and reliable connections. These new applications are creating new revenue opportunities beyond legacy telecom and defense markets. Enterprises that are investing in the production of Multi-Media Multi-Chip Modules (MMICs) for these cutting-edge applications will gain a competitive edge, further increasing the market potential and horizon in the next few years.

Challenges:

-

Supply Chain Disruptions and Material Shortages Pose Persistent Challenges to The Monolithic Microwave IC Market Growth.

The MMIC industry still grapples with massive challenges from the disruptions in the global supply chain and raw material shortages. The manufacture of MMICs depends significantly on exotic and specialized semiconductor materials such as GaAs and GaN that are prone to limited supply and geopolitical tensions. Any supply disruption of these materials can push the production schedule behind and raise the cost of manufacture.

Further, persistent worldwide shortages of chips have affected the on-time supply of MMICs to major sectors like defense, telecommunications, and aerospace. Supply bottlenecks, coupled with logistic hurdles and increasing input costs, can restrain manufacturers' capabilities to respond to increasing market demand and maintain extensive production, slowing down overall market growth.

Monolithic Microwave IC (MMIC) Market Segment Analysis

By Component

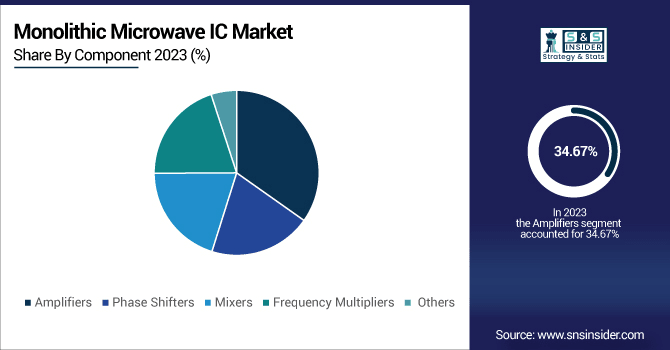

In 2023, the Amplifiers segment led the Monolithic Microwave IC (MMIC) market with 34.67% revenue share due to its vital function in high-frequency communication and defense applications. Amplifiers support signal boost for 5G, satellite, and radar technologies. Qorvo and Analog Devices have spearheaded this segment with developments such as high-efficiency GaN-based MMIC amplifiers. For example, Qorvo's launch of the QPA2933, a wideband MMIC amplifier covering 2–20 GHz, fills next-generation defense and instrumentation requirements. This technical momentum, reinforced by robust global demand for high-performance RF devices, continues to reinforce the amplifier segment's position at the head of the MMIC market environment.

The Phase Shifters segment will develop at the Fastest CAGR of 13.55% during 2024-2032 due to increasing demand for beamforming in next-generation radar and 5G MIMO applications. Phase shifters are critical in electronically steering signal directions in phased array antennas, which is necessary in todays communication and defense applications. Some recent advancements are Analog Devices' X-Band MMIC phase shifters for AESA radar systems that provide precise angle control. Furthermore, players such as MACOM are working on ultra-miniature MMIC phase shifters for 5G infrastructure. All these developments follow growing global investments in adaptive communication systems, fueling the growth of this high-potential MMIC segment.

By Technology

In 2023, the High Electron Mobility Transistor (HEMT) segment dominated the Monolithic Microwave IC (MMIC) market with a 34.12% revenue share, owing to its high efficiency and high-frequency operation. HEMTs are critical for use in radar systems, 5G base stations, and satellite communications. Major players like Mitsubishi Electric and Wolfspeed have driven this segment with GaN-on-SiC HEMT advancements. For instance, Wolfspeed's high-power HEMT MMICs are specifically designed for military and aerospace applications with increased thermal conductivity and power density. The advancements underscore HEMT's contribution to increasing MMIC adoption in high-performance markets, solidifying its leading position in the global MMIC market.

The Pseudomorphic High Electron Mobility Transistor (pHEMT) market is projected to the fastest CAGR of 12.18% between 2024 and 2032 due to increasing need for small, low-noise, and high-linearity components in RF applications. pHEMT technology provides better gain and efficiency and is particularly suited for mobile communication, broadband, and space systems. Players such as Skyworks and Qorvo are in the process of developing sophisticated pHEMT-based MMICs—Skyworks' pHEMT LNAs, for example, are widely used in GPS and IoT applications. This swift product development and increasing demand for energy-efficient RF front ends are driving the growth of the pHEMT segment, contributing substantially to the growth of the MMIC market.

By Material Type

In 2023, the Gallium Arsenide (GaAs) segment dominated the largest revenue of 39.63% in the Monolithic Microwave IC (MMIC) market due to its extensive application in high-frequency and low-noise applications like mobile phones, satellite communications, and radar systems. GaAs possesses higher electron mobility and saturation velocity compared to other materials and is best suited for MMICs that need high performance and accuracy. Firms such as Broadcom and WIN Semiconductors are actively making investments in GaAs-based MMICs Broadcom, for example, recently added to its GaAs MMIC portfolio for RF front-end modules. Such a robust industry investment in GaAs technology still underpins its supremacy in the MMIC material space.

The Gallium Nitride (GaN) segment is anticipated to expand at the fastest CAGR of 12.91% during 2024-2032 due to its high power density, thermal stability, and efficiency in high-frequency applications. GaN MMICs play a significant role in defense radar, 5G infrastructure, and satellite systems. Market leaders like Qorvo and Cree Wolfspeed are at the forefront of GaN innovations Qorvo has recently introduced high-power GaN MMIC amplifiers for X-band radar and aerospace systems. These technologies are allowing for more efficient, smaller, and more powerful MMICs, making GaN a revolutionary material for next-generation RF systems and a primary growth driver in the MMIC market.

By Application

In 2023, the Wireless Communication Infrastructure segment held a 34.78% revenue share of the Monolithic Microwave IC (MMIC) market, as spurred by the worldwide expansion of 5G networks and rising demand for fast mobile connectivity. MMICs are crucial for providing high-frequency signal transmission in wireless base stations, small cells, and backhaul networks. Other players such as Analog Devices and NXP Semiconductors have launched higher-order MMIC solutions to drive 5G infrastructure Analog Devices' latest RF transceivers include MMICs to improve next-generation base stations' performance. This Telecom revolution is picking up pace with respect to driving the adoption of MMIC, bolstering wireless communications segment supremacy over the international MMIC scenario.

The Automotive segment is also expected to expand at the fastest CAGR of 12.95% during the forecast period of 2024-2032, driven by increasing adoption of advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communication, and radar-based safety features. MMICs facilitate accurate, high-frequency radar sensing essential for applications such as adaptive cruise control and collision avoidance. Firms like Texas Instruments and Infineon Technologies are leading the way Infineon, for instance, unveiled a 77 GHz MMIC radar chipset that is designed to fit in high-resolution, compact automotive radar systems. Such advances are growing the application of MMIC in current cars, positioning the automotive market as a rapidly developing growth trend in the wider MMIC marketplace.

MMIC Market Regional Outlook

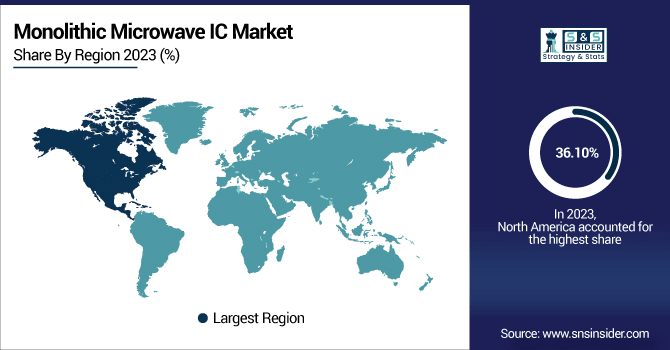

In 2023, North America accounted for the highest revenue share of 36.10% in the Monolithic Microwave IC (MMIC) market due to the high demand from defense, aerospace, and 5G communications industries. The region is facilitated by industry giants such as Analog Devices, Qorvo, and MACOM, which are heavily investing in product innovation and R&D. For instance, Qorvo has recently released a portfolio of GaN MMIC power amplifiers for space and radar applications, solidifying the region's technological superiority.

Also,strong government spending on military electronics and quick deployment of 5G infrastructure are pushing the adoption of MMIC further, cementing North America's leading role in the world MMIC market.

The Asia Pacific region is also expected to expand at the Fastest CAGR of 12.45% in the forecast period on the back of fast industrialization, growing 5G networks, and rising defense spending in countries such as China, Japan, and South Korea. The availability of semiconductor industry leaders like WIN Semiconductors and Sumitomo Electric is improving regional manufacturing capability. WIN Semiconductors, for instance, continues to develop GaAs and GaN MMIC technologies to enable increasing telecom needs. Moreover, government programs in smart cities and autonomous vehicles are driving MMIC applications in communications and automotive markets, making Asia Pacific the fastest-growing market in the worldwide MMIC market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Key Companies Listed in the Monolithic Microwave IC Market Report are:

-

WIN Semiconductors – (WLP3065 Low Noise Amplifier MMIC, WHP5048 Power Amplifier MMIC)

-

United Monolithic Semiconductors (UMS) – (CHA2069-98F Wideband LNA MMIC, CHA7465-QDG GaN Power Amplifier MMIC)

-

Custom MMIC Design Services, Inc. – (CMD292C3 Double-Balanced Mixer, CMD243 18–45 GHz Amplifier MMIC)

-

Microarray Technologies – (RF Microarray MMIC Sensor Chips, Multi-Channel MMIC Readout Chips)

-

Vectrawave – (VMA1129 Wideband Amplifier MMIC, VMD2061 Ka-band Driver Amplifier)

-

Berex – (BA25-06 MMIC Gain Block Amplifier, BA30-04 MMIC LNA)

-

Arralis – (TEQ-12W-BD05 94 GHz Transmitter MMIC, TPX-W-BD03 94 GHz Receiver MMIC)

-

Elite Microwave Electronics Co., Ltd. – (EME-PMA Series Power Amplifier MMIC, EME-LNA Series Low Noise Amplifier MMIC)

-

Northrop Grumman – (APEX GaN MMIC Power Amplifier, Ka-band Beamforming MMICRecent Trends)

-

OMMIC – (CGY2655UH Ka-Band Power Amplifier MMIC, CGY2174UH Low Noise Amplifier MMIC)

Recent Developments:

-

March 2023, Northrop Grumman Developed the world's highest power single-chip Ka-band GaN MMIC amplifier, achieving 40W peak power at 27 GHz with a compact 13.5 mm² footprint, setting a new industry standard.

-

April 2024, United Monolithic Semiconductors Introduced the CHA6354-QQA, a GaN power amplifier delivering 4W output in the 27.5–30 GHz range, tailored for SATCOM uplink and 5G communication applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.74 Billion |

| Market Size by 2032 | USD 26.42 Billion |

| CAGR | CAGR of 10.67 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component - (Amplifiers, Phase Shifters, Mixers, Frequency Multipliers, Others) •By Material Type –(Gallium Arsenide, Indium Phosphide, Silicon Germanium, Gallium Nitride, Indium Gallium Phosphide) •By Technology - (Metal Semiconductor Field-Effect Transistor, High Electron Mobility Transistor, Pseudomorphic High Electron Mobility Transistor,Others) •By Application – (Wireless Communication Infrastructure, Automotive , Aerospace and Defense, CATV and Wired Broadband ,Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Win Semiconductors, United Monolithic Semiconductors (UMS), Custom MMIC Design Services, Inc.,Microarray Technologies ,Vectrawave ,Berex, Arralis , Microarray Technologies ,Elite Microwave Electronics Co., Ltd. ,Northrop Grumman |