RF Front-End Market Report Scope & overview

The RF front-end Market size was valued at USD 15.63 billion in 2023 and is expected to grow to USD 34.53 billion by 2032 and grow at a CAGR of 9.21 % over the forecast period of 2024-2032.

Get more information on RF front-end Market - Request Sample Report

The RF Front-End (RFE) market is experiencing significant growth, driven by the rapid expansion of the Internet of Things (IoT) and the increasing number of connected devices across industries such as healthcare, automotive, and smart cities. As IoT applications evolve, the demand for smaller, more efficient RF components is rising to ensure reliable, high-speed communication. A critical enabler of IoT and 5G connectivity is the 5G RF front-end module, designed to support diverse frequency bands, including sub-1 GHz, 1-6 GHz, and millimeter wave frequencies, as per 3GPP Release 15 and beyond. The need for 5G RF modules is expected to continue growing, driven by the higher bandwidth requirements of 5G technologies, which offer a bandwidth of 100 MHz per subcarrier compared to the 20 MHz per subcarrier in LTE. This substantial increase in bandwidth capacity is fueling demand for more advanced RF components. Within the 5G market, three primary RF front-end architectures are gaining traction Integrated Front-End Modules (iFEM), which integrate multiple RF components into a single module for improved size and performance; Discrete Front-End Modules (dFEM), which provide flexibility but are larger and more complex; and System-on-Chip (SoC) solutions that combine RF components, digital processing, and baseband functions on a single chip, optimizing space and power efficiency. As IoT devices integrate RF front-end components, there is a growing need for innovative solutions, particularly in smart cities and autonomous vehicles. Leading companies like Qualcomm and Infineon Technologies are at the forefront of providing cutting-edge wireless connectivity solutions. As IoT and 5G technologies continue to advance, they are expected to revolutionize mobility, create new business models, and drive long-term growth in the RF front-end market, with the proliferation of connected devices further accelerating demand for these technologies.

Market Dynamics

Drivers

-

Driving Growth in the RF Front-End Market through Wireless Technologies and Bluetooth Low Energy Advancements

The rapid expansion of wireless technologies like Wi-Fi 6/6E, Wi-Fi 7, and Bluetooth Low Energy (BLE) is significantly driving the growth of the RF Front-End (RFE) market across various sectors, including consumer electronics, automotive, smart homes, and industrial IoT. As high-speed, low-latency wireless communication becomes more prevalent, there is an increasing need for advanced RF components to ensure optimal connectivity, seamless data transmission, and enhanced power efficiency. With Wi-Fi 6/6E offering faster speeds and greater bandwidth, and Wi-Fi 7 introducing even higher performance capabilities, these technologies demand cutting-edge RF solutions that can support their improved reliability and higher frequency ranges. In particular, Wi-Fi 7 front-end modules are opening up new business opportunities beyond traditional markets, targeting growing fields such as IoT, automotive, and smart home applications. In parallel, the rise of Bluetooth Low Energy (BLE) in IoT devices such as wearables and smart appliances requires RF components that ensure low-power operation while maintaining stable connectivity. Additionally, the automotive sector is rapidly adopting RF front-end modules to enable in-car connectivity, autonomous driving, and vehicle-to-everything (V2X) communication, further pushing the demand for high-performance RF solutions. As these wireless technologies continue to evolve, their integration across consumer electronics, industrial applications, and smart cities is expected to drive sustained growth in the RF front-end market. As a result, the increasing reliance on wireless communication and the continuous advancements in Wi-Fi and BLE technologies will propel the development of innovative RF front-end modules, positioning them as a key enabler in the next generation of connected devices and services.

Restraints

-

High power consumption remains a key restraint in the RF front-end market, particularly for 5G and IoT applications.

Despite technological advancements, many RF front-end modules continue to consume substantial power, posing challenges for battery-operated devices and limiting efficiency in portable applications. The high-power demands of 5G systems, which require multi-band and high frequency operations, exacerbate the issue, as these designs often lead to energy-intensive modules. While innovations in RF technology strive to reduce power usage, the complexity of meeting both performance and low-power requirements remains a hurdle. IoT devices, which rely on long battery life, are particularly affected by this issue, as the need for constant connectivity and high-speed data transfer drives the demand for power-heavy solutions. RF front-end designs that incorporate advanced features such as multi-band support, beamforming, and millimeter-wave frequencies are inherently power-hungry, making it difficult to achieve energy efficiency without sacrificing performance. While some companies are focusing on low-power solutions like CMOS-based technologies, there is still a significant gap between achieving optimal performance and minimizing power consumption. The challenge is further compounded in industrial and automotive applications, where the operational environment demands both high performance and reliability over extended periods. As the demand for smarter and more efficient devices grows, addressing the power consumption issue will be critical in the development of next-generation RF front-end modules.

Segment Analysis

By Type

In 2023, the RF Filters segment dominated the RF front-end market, holding approximately 40% of the market share. RF filters are critical components in managing signal integrity and preventing interference across different frequency bands in wireless communication. Their role in isolating specific frequency ranges and ensuring smooth transmission in 5G, IoT, and automotive applications makes them indispensable. With the growing demand for advanced connectivity solutions, particularly in 5G networks and IoT devices, RF filters have become vital for optimizing the performance of RF front-end systems. The continuous advancement of filter technologies, such as miniaturization and higher frequency capabilities, contributes to the increasing market share of RF filters in 2023, as they support the growing need for high-bandwidth, multi-frequency communication.

By End-use Industry

In 2023, the Consumer Electronics segment held a dominant share of approximately 40% in the RF front-end market. This segment’s growth is primarily driven by the increasing demand for advanced connectivity features in smartphones, tablets, wearables, and other personal devices. RF front-end modules are essential for enabling high-speed wireless communication, including 5G, Wi-Fi, and Bluetooth, in consumer electronics. The surge in mobile data usage, along with the rapid adoption of 5G technology, has significantly contributed to the demand for efficient and compact RF solutions. As consumer electronics become more integrated with IoT and smart technologies, the need for robust, low-power RF front-end components will continue to rise. Additionally, advancements in miniaturization and multi-band support for a diverse range of devices further boost the market's growth within this segment.

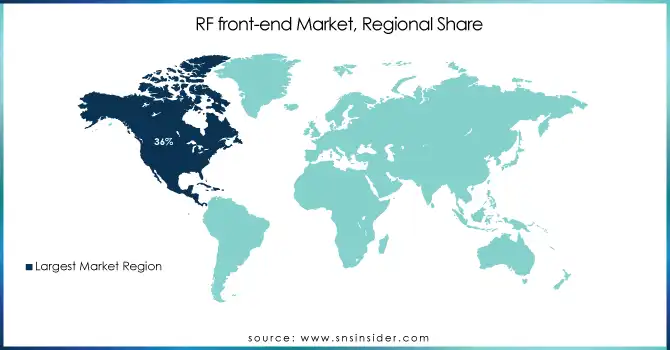

Regional Analysis

In 2023, North America held a dominant share of around 36% in the RF front-end market, driven by the region's advanced technological infrastructure and rapid adoption of 5G and IoT devices. The U.S., in particular, plays a pivotal role due to its strong presence of leading technology companies, including major telecom providers, semiconductor manufacturers, and consumer electronics firms. The growing demand for high-performance RF solutions in consumer electronics, automotive, and healthcare industries contributes to the region's market leadership. Additionally, ongoing investments in 5G network rollouts and the development of next-generation wireless technologies fuel the demand for innovative RF components. The increasing focus on smart cities and connected devices further strengthens North America's position as a key player in the global RF front-end market.

Asia-Pacific is expected to be the fastest-growing region in the RF front-end market from 2024 to 2032, driven by the rapid adoption of 5G technology, IoT applications, and a booming consumer electronics sector. Countries like China, Japan, South Korea, and India are major contributors, with China leading in manufacturing and technological advancements. The region's growing investments in telecommunications infrastructure, along with the expanding automotive and healthcare industries, further bolster the demand for advanced RF solutions. Additionally, the rise of smart cities, autonomous vehicles, and connected devices in this region is creating significant opportunities for RF front-end technologies. The increasing focus on cost-efficient, high-performance solutions positions Asia-Pacific as a key growth driver in the global RF front-end market

Need any customization research on RF front-end Market - Enquiry Now

Key Players

Some of the major players in RF Front-End Market along with product:

-

STMicroelectronics (RF Power Amplifiers, RF Switches, RF Filters, Integrated Circuits)

-

Texas Instruments (RF Amplifiers, RF Switches, Voltage-Controlled Oscillators, Power Management ICs)

-

Skyworks Solutions (RF Power Amplifiers, RF Switches, Filters, Front-End Modules, Low Noise Amplifiers)

-

Qualcomm (RF Front-End Modules, RF Power Amplifiers, Baseband Processors, 5G Solutions)

-

Infineon Technologies (RF Power Amplifiers, Power Management ICs, Radar Sensors, 5G RF Components)

-

Macom Technology Solutions (RF Power Amplifiers, RF Switches, Attenuators, Frequency Converters)

-

Cree (GaN-Based RF Power Devices, RF Amplifiers, Power Transistors)

-

RF Micro Devices (now part of Qorvo) (Power Amplifiers, Switches, Filters, Low Noise Amplifiers)

-

Analog Devices (RF Amplifiers, Mixers, Attenuators, Low Noise Amplifiers, Frequency Synthesizers)

-

NXP Semiconductors (RF Power Amplifiers, RF Switches, Integrated RF Systems, 5G Solutions)

-

Qorvo (RF Power Amplifiers, RF Switches, Filters, Front-End Modules, 5G Solutions)

-

Broadcom (RF Amplifiers, RF Switches, 5G and Wi-Fi Solutions, Bluetooth Chips)

-

Marvell Technology (Wireless Solutions, Wi-Fi Chips, Bluetooth ICs, RF Power Amplifiers)

-

Renesas Electronics (RF Power Amplifiers, Low Noise Amplifiers, RF Modules, Switching Regulators)

-

Microchip Technology (RF Amplifiers, Microwave Components, Filters, Oscillators)

-

Qualcomm (Mobile SoCs, RF Front-End Solutions, 5G Technologies)

-

ON Semiconductor (Power Management ICs, RF Amplifiers, Sensors)

-

Nokia (Wireless Network Equipment, RF Modules, Base Stations)

-

Huawei (Telecom Infrastructure, RF Power Amplifiers, 5G Solutions)

-

Laird Connectivity (RF Modules, Antennas, Wireless Communication Components)

List of Suppliers that provide raw materials and components for the RF Front-End (RFE) market:

-

Skyworks Solutions, Inc.

-

Qualcomm Technologies, Inc.

-

Broadcom Inc.

-

Infineon Technologies

-

Murata Manufacturing Co., Ltd.

-

Qorvo, Inc.

-

NXP Semiconductors

-

Texas Instruments

-

STMicroelectronics

-

WIN Semiconductors

Recent Development

-

Dec 2024, Quobly has partnered with STMicroelectronics to scale quantum processor manufacturing using ST's 28nm FD-SOI technology. The collaboration aims to make large-scale quantum computing cost-effective, with commercial products expected by 2027 for applications in materials development and systems modeling.

-

Mar 2024, Qualcomm unveiled its Snapdragon X80 5G Modem-RF Platform at Mobile World Congress, incorporating AI to enhance 5G performance. As Moore's Law slows, Qualcomm’s use of AI in its heterogeneous compute architecture aims to maintain performance gains, marking a significant step forward in 5G technology.

| Report Attributes | Details |

| Market Size in 2023 | USD 15.63 Billion |

| Market Size by 2032 | USD 34.53 Billion |

| CAGR | CAGR of 9.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (RF Filters, RF Power Amplifiers, RF Switches, Others) • By End-use Industry (Consumer Electronics, Automotive Systems, Wireless Networks, Military, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | STMicroelectronics, Texas Instruments, Skyworks Solutions, Qualcomm, Infineon Technologies, Macom Technology Solutions, Cree, RF Micro Devices (now part of Qorvo), Analog Devices, NXP Semiconductors, Qorvo, Broadcom, Marvell Technology, Renesas Electronics, Microchip Technology, ON Semiconductor, Nokia, Huawei, and Laird Connectivity. |

| Key Drivers | • Driving Growth in the RF Front-End Market through Wireless Technologies and Bluetooth Low Energy Advancements |

| Restraints | • High power consumption remains a key restraint in the RF front-end market, particularly for 5G and IoT applications |