More Electric Aircraft Market Report Scope & Overview:

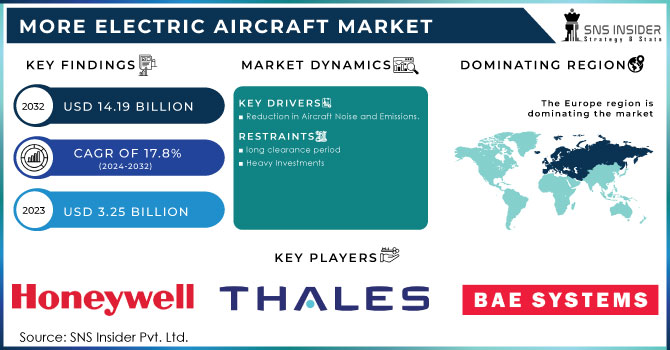

The More Electric Aircraft Market Size was valued at USD 3.25 billion in 2023 and is expected to reach USD 14.19 billion by 2032 with a growing CAGR of 17.8% over the forecast period 2024-2032.

Aircraft are used in the transportation of merchandise and travelers overall relying upon the necessity of different ventures like the travel industry, coordinated factors, and protection businesses. The airplane structure a colossal piece of the speculation of an association, attributable to gigantic upkeep costs and working expenses separated from the monstrous obtainment costs related with an airplane.

To get more information on More Electric Aircraft Market - Request Free Sample Report

Airplane likewise transmit commotion and air toxins like Carbon dioxide CO2, nitrogen oxides, sulfur oxides, and unburnt hydrocarbons, which unfavorably affect the climate. The flying organizations are embracing halfway or generally speaking jolt of airplane capacities to beat the natural difficulties presented by regular stream fuel-based airplane and to consent to the limitations and guidelines forced by the flight controllers internationally. More electric airplane innovation includes the continuous substitution of water driven and pneumatic power with electric power and helps in the decrease of airplane mass, fuel utilization, ozone harming substance discharges, collecting expenses, and upkeep costs.

During the forecast period, the rise in innovations and development of new aircraft technologies is expected to fuel the expansion of the global more electric aircraft market. The electric aircraft industry is growing as aircraft OEMs see the design's potential benefits, such as increased eco-friendliness, lower support costs, and enhanced dependability through the use of modern power electronics and less water-driven pneumatic parts in engine installation. In the coming years, more electric aircraft with short ranges are likely to become practicable for local transportation. More electric aircraft may see military demand in the coming years, owing to the concealment capabilities provided by the quiet activities of these aircraft. The same holds true for military UAVs, which are being obtained for ISR activities.

MARKET DYNAMICS

KEY DRIVERS

-

Reduction in Aircraft Noise and Emissions.

RESTRAINTS

-

long clearance period

-

Heavy Investments

OPPORTUNITIES

-

Enhancement & developing power electronic component

-

Complex embedded digital systems

CHALLENGES

-

Thermal Control in Electrical Systems

-

Generate large amount of heat

IMPACT OF COVID-19

The Coronavirus pandemic has influenced the electric airplane market essentially. Because of the conclusion of lines and air travel limitations around the world, many organizations in the more electric airplane market were constrained to stop producing. This break in business tasks is straightforwardly affecting the income of the more electric airplane market. Despite the fact that a few ventures proceeded with tasks, postpones in natural substance supplies and the restricted stockpile of delivered merchandise covered creation and diminished limit usage rates.

The momentary viewpoint of the aeronautics business will eventually rely on how rapidly legislatures contain the flare-up and how fruitful their endeavors are. Postpones in airplane conveyances and undoing of existing requests have fundamentally affected airplane producers universally. Transitory ends underway exercises debilitated request because of promptly accessible stock, prompting a lopsidedness in the store network. On a more extensive scale, the delayed lockdown has likewise overwhelmed the tasks of different players. Airplane and motor makers probably won't work at the greatest limit present the lockdown due on new friendly removing standards, prompting more slow development of creation and, thusly, less interest for more electric airplane

Non-electric power sources such as pneumatic, mechanical, and hydraulic power are used in conventional aircraft for warming leading-edge wings, elevators for ice protection, compressor spinning for cabin environmental control, and fuel pumping into the engine combustion chamber, as well as hydraulic pump drive for primary flight control actuation. These applications use standard jet fuel, reducing the aircraft's fuel efficiency even further. Electric power sources are increasingly being used by aircraft customers as secondary power systems to power these aircraft components and boost the aircraft's fuel efficiency.

The global increase in air and noise pollution has prompted regulatory agencies and manufacturers all over the world to adopt environmentally friendly policies and technologies. The rise in demand for sustainable technologies, such as more electric aircraft technology for pollution reduction, can be ascribed to global government initiatives.

The global increase in air and noise pollution has prompted regulatory agencies and manufacturers all over the world to adopt environmentally friendly policies and technologies. The rise in demand for sustainable technologies, such as more electric aircraft technology for pollution reduction, can be ascribed to global government initiatives.

The more electric aircraft market is divided into civil and military segments based on end user. The civil segment is expected to account for a greater share in 2022 than the military section. Some of the issues in the civil aviation market are carbon and nitrogen oxide emissions, excessive fuel consumption, and high maintenance expenses.

The more electric aircraft market is divided into two parts- propulsion system and airframe system. The electrification of various propulsion and airframe systems allows aircraft to cut carbon emissions as well as overall operating costs. During the projection period, the propulsion system segment is likely to be driven by the increasing attention of key OEMs such as Airbus on the development of electric propulsion systems.

The more electric aircraft market is further subdivided into fixed-wing and rotary-wing aircraft. The development of more dependable and efficient auxiliary power supply systems to drive fixed-wing aircraft needs. Recent technological improvements in the realm of power electronics and flight control system operations for rotary-wing aircraft, on the other hand, are expected to fuel the segment's expansion.

KEY MARKET SEGMENTATION

By Aircraft Type

-

Fixed Wing

-

Rotary Wing

By Application

-

Power Generation

-

Power Distribution

-

Power Conversion

-

Energy Storage

By End User

-

Civil

-

Military

By Aircraft System

-

Airframe System

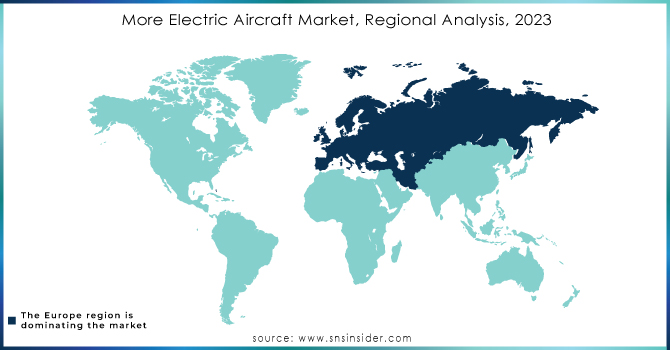

REGIONAL ANALYSIS

The market for more electric Aeroplan’s has been researched in North America, Europe, Asia Pacific, the Middle East and Africa, and Africa. Europe is expected to have the greatest share of the global market. The market in Europe is expanding at a rapid pace, mostly due to increased air passenger travel. The Asia Pacific market is expected to rising fastest due to significant investments in airport modernization and the construction of new regional airports.

Need any customization research on More Electric Aircraft Market - Enquiry Now

REGIONAL COVEREGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are GE Aviation, Honeywell International Inc, Thales Group, AMETEK Inc, BAE Systems plc, Bombardier Inc., Raytheon Technologies Corporation, Rolls-Royce Holdings plc, Safran, Elbit system Ltd, and Other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.25 Billion |

| Market Size by 2032 | US$ 14.19 Billion |

| CAGR | CAGR of 17.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Aircraft Type (Fixed Wing, Rotary Wing) • By Application (Power Generation, Power Distribution, Power Conversion, Energy Storage) • By End User (Civil, Military) • By Aircraft System (Propulsion System and Airframe System) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GE Aviation, Honeywell International Inc, Thales Group, AMETEK Inc, BAE Systems plc, Bombardier Inc., Raytheon Technologies Corporation, Rolls-Royce Holdings plc, Safran, Elbit system Ltd, and Other players. |

| DRIVERS | • Reduction in Aircraft Noise and Emissions. |

| RESTRAINTS | • long clearance period • Heavy Investments |