Multi-Cloud Networking Market Report Scope & Overview:

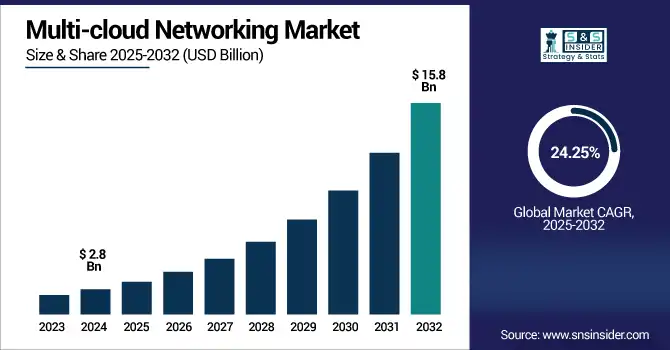

The multi-cloud networking market size was valued at USD 2.8 billion in 2024 and is expected to reach USD 15.8 billion by 2032, growing at a CAGR of 24.25% during 2025-2032.

To Get more information on Multi-cloud Networking Market - Request Free Sample Report

As enterprises widely adopt a hybrid and multi-cloud strategy for agility, vendor independence, and application performance are driving the multi-cloud networking market growth. To connect and communicate better globally, software-defined networking, secure access service edge, and cloud-native networking solutions will deliver innovations in the tight demand fold between cloud providers such as AWS, Azure, and Google Cloud. The increasing demand for centralised visibility, unified policy control, and security of data movement across complex cloud environments is the major driver of growth. Moreover, the growth in the adoption of AI and big data, and the expansion of edge workloads, is driving demand for scalable, resilient, and automated multi-cloud networks. While North America is maintaining its leadership position, several emerging economies are catching up, providing strong momentum globally for the cloud connectivity market.

In the U.S., the Multi-Cloud Networking Market is witnessing strong growth owing to increasing adoption of hybrid cloud, unified security demand, and growing deployment of AI and edge applications. The market was valued at USD 0.8 billion in 2024 and is projected to reach USD 4.4 billion by 2032, growing at a CAGR of 23.99%. A key multi-cloud networking market trend includes the integration of SD-WAN and SASE for scalable and secure multi-cloud connectivity

Multi-Cloud Networking Market Dynamics:

Drivers:

-

Rising Adoption of Hybrid and Multi-Cloud Strategies Drives Demand for Seamless Interconnectivity and Centralized Network Management

Thus, a major force behind the expansion of some of the most significant segments of the multi-cloud networking market is the rise in enterprise adoption of hybrid and multi-cloud strategies. To get optimal cost, performance, and resilience while avoiding vendor lock-in, businesses are increasingly adopting a multi-cloud model using, for example, AWS, Microsoft Azure, and Google Cloud together. The shift requires unprecedented levels of connectivity and unified control over multiple clouds. As such, automated traffic routing, consistent security policies, and real-time visibility across environments are essential components of a successful cloud strategy, which requires multi-cloud networking solutions to achieve. With industries accelerating their digital transformations, enterprises are also looking for networking infrastructure that scales and other architectures that are flexible, and this is leading enterprises across industries to demand the multi-cloud networking technologies that can help them operate efficiently in multiple cloud ecosystems, thereby driving the growth of multi-cloud networking technologies.

For instance, 69% of organizations globally have adopted a hybrid cloud strategy, with 66% stating it delivers the right balance of control and flexibility.

Restraints:

-

Diverse Cloud Architectures and APIs Create Integration Complexity and Operational Challenges for Enterprises

However, although this is advantageous, the increased complexity associated with handling the same across different cloud providers restricts the market growth. Seamless integration is nearly impossible with the unique architectures, APIs, and other service models of each cloud platform. In multi-cloud environments, IT teams may struggle with policy configuration, consistent security enforcement, and performance troubleshooting. Options get complex and thus costly, as they often require high-skilled experts and advanced-level tools. Also, vendor-specific tools might lead to fragmentation of visibility and control. Such issues make it difficult for enterprises to look to multi-cloud networks, specifically small to medium businesses that cannot afford to put in place a strong multi-cloud networking strategy, bringing growth at a slower rate than demand, stunting market adoption.

For instance, 58% of organizations face difficulties aligning security protocols across diverse cloud environments

Opportunities:

-

Increasing Use of AI And Automation Enables Intelligent Traffic Management and Real-Time Network Optimization

The multi-cloud networking market growth opportunities are owing to the potential of AI and machine learning to bring game-changing innovations in the market. Such solutions make use of AI features to anticipate anomalies, automate routing decisions, forecast network congestion, and optimize real-time traffic further in cloud environments. It improves the performance while also minimizing manual effort to make the operations more efficient and more resilient. Predictive analytics allows enterprises to maintain uptime, enhance security posture, and dynamically reconfigure a network on the fly according to application needs. The increasing use of AI for IT infrastructure represents a growing opportunity for vendors to embed intelligent automation with a multi-cloud networking platform and deliver a differentiated market offering while capturing and expanding target enterprise verticals.

According to a study, by 2026, 30% of enterprises will automate more than half of their network activities, up from under 10% in mid-2023, through AI-driven analytics and intelligent automation

Challenges:

-

Varying Security and Compliance Standards Across Cloud Providers Hinder Consistent Policy Enforcement and Regulatory Adherence

Maintaining security and compliance across heterogeneous cloud environments are main challenge in the multi-cloud networking market. Due to each cloud service provider's unique security protocols, data governance policies, and compliance standards, organizations find it nearly impossible to create unified control. This means orchestrated access controls, unified, centrally-managed threat detection, and easy-to-set-up and manage encryption policies to protect data both in transit. Without the need for consistency failure, it opens itself to vulnerabilities, compliance gaps, and data breaches. With more stringent regulations, including GDPR, HIPAA, and CCPA, organizations are under immense pressure to prove compliance on every layer of the cloud stack. These security and regulatory hurdles must be overcome to facilitate widespread multi-cloud adoption and thus further growth in the multi-cloud market.

Multi-Cloud Networking Market Segmentation Analysis:

By Component:

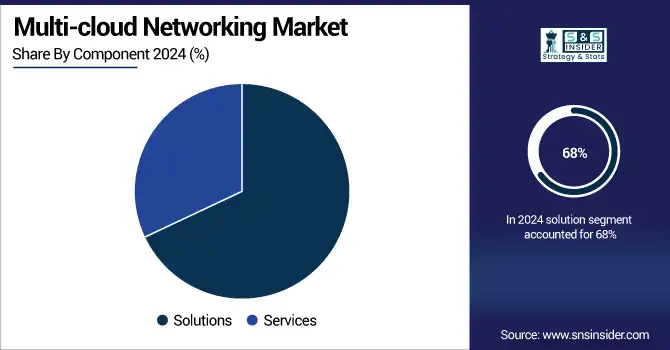

The solution segment leads the market in 2024 and accounted for 68% of the multi-cloud networking market share, attributed to the growing need by enterprises for unified control over multiple clouds, smart traffic routing capabilities, and secure interconnect between different clouds from vendor to vendor. Integrated SD-WAN, SASE, and cloud-native networking tools are gaining traction as businesses leverage hybrid and multi-cloud strategies. And this segment will remain the leader, as the scale continues to push, and automation and performance improvements roll out.

In January 2025, Aviatrix released a strategic outlook titled "Cloud Networking 2025", highlighting the surge in solution-based architectures for multicloud environments. Key focus areas include cybersecurity integration, AI-driven orchestration, and platform-unified traffic management, indicating a solution-first approach in the market.

The services segment is expected to witness the fastest growth during the forecast period, as enterprises are turning explicitly to the need for managed services, consulting, and support because of multi-cloud implementations that are becoming more complex. The increasing need for vendor-neutral orchestration, migration help, and around-the-clock monitoring is driving service uptake. Skill gap and demand for integration expertise, and tailored networking patterns for enterprises, are driving rapid growth in the segment.

By Deployment:

The public cloud segment dominated the multi-cloud networking market in 2024 and accounted for a significant revenue share. Due to its cost-effectiveness, flexibility, and worldwide accessibility of cloud services. Public cloud is the choice for enterprises looking for rapid deployment and flexible infrastructure across the likes of AWS and Azure. Part of this growth will continue to be fed by a migration of workloads to the public domain on the part of countless organizations looking for the innovation speed and capital outlay that comes with public platforms.

In May 2025, Equinix announced a major update, simplifying multicloud networking across public environments via 24+ metro regions connected with Google Cloud and 32+ high-speed virtual interconnects (20/50 Gbps), delivering optimized performance and cost reduction for public cloud workloads

The hybrid cloud segment is poised for the fastest growth as organizations try to strike a balance between the private cloud control and the agility of the public cloud. This is fueled by heightened regulatory compliance requirements, the need for data sovereignty, and the desire for portability of workloads across on-premises and the public cloud. Growth in this segment is driven by the increasing digital transformation initiatives and the demand for integrated multi-cloud networking solutions.

By Enterprise Size:

Large enterprises segment dominated the multi-cloud networking market in 2024 and accounted for 71% of revenue share, owing to the IT complexity in large enterprises, higher cloud budget, and the need for security, along with compliance requirements. They are investing in cloud, which drives demand for scalable networking solutions due to an early adoption of hybrid and multi-cloud strategies. This space will continue to dominate as enterprises invest further in AI, automation, and centralized network control for maximum performance and resilience.

The SME segment is expected to grow at the fastest pace, as more SMEs move to the cloud to enhance agility while reducing infrastructure costs. The new era of simplified multi-cloud architectures and managed services is making advanced networking easier and closer to everybody. The future growth is expected to be driven by increasing digital transformation among the SMEs and the need for cost-effective, scalable, and easy-to-deploy multi-cloud networking tools.

By End-Use:

The BFSI segment dominated the multi-cloud networking market and accounted for a significant revenue share in 2024, as this sector requires high data security and compliance, and the need for continuous service delivery through multi-cloud environments. Multi-cloud networking is used by financial institutions for secure transactions, disaster recovery, and high availability. This vertical will remain highly demanding for robust and centralized networking solutions direction, as digital banking expands further, fintechs get integrated at a mass scale, and regulatory compliance requirements remain predominant.

The manufacturing segment is expected to register the fastest CAGR, driven by faster adoption of Industry 4.0 with the need for real-time data exchange across distributed sites, the manufacturing segment is expected to record the fastest CAGR IoT integration, predictive maintenance, and supply chain optimization is all assisted by multi-cloud networking. Smart factory initiatives, automation, and the requirement for low-latency, secure connectivity across hybrid cloud infrastructures in global operations support future growth.

Multi-Cloud Networking Market Regional Outlook:

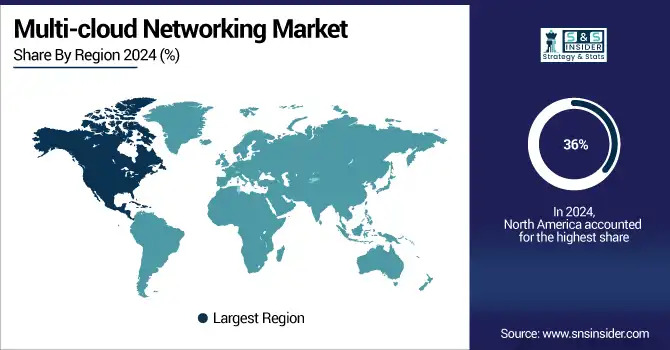

North America dominated the multi-cloud networking market in 2024 and accounted for 36% of revenue share, owing to early cloud adoption, solid digital backbone, and physical presence of several key cloud service providers. The large spending in AI, automation, and cybersecurity further enhances demand for sophisticated multi-cloud networking solutions. It will continue to be led by the region, driven by enterprise cloud modernization projects and an accelerated dependency on hybrid and public cloud solutions.

For instance, 60% of enterprises in North America have adopted multi-cloud strategies, with strong integration of SDN to optimize inter-cloud connectivity

According to a multi-cloud networking market analysis, Asia-Pacific is expected to register the fastest CAGR during the forecast period, due to regional digital transformation, increasing cloud investments, and growing IT infrastructure, specifically in India, China, and Southeast Asia, according to a multi-cloud networking market study. The growth of the market is accelerated by factors such as government data supporting the cloud-native development and increasing cloud adoption among SMEs. Future growth in the region will be propelled by the driving demand for economical, efficient, scalable, and secure networking solutions.

In 2024, 93% of APAC organizations planned to increase public cloud storage, with 96% in India and South Korea specifically boosting public-cloud budgets

Europe’s growth is driven by the accelerating cloud-native transformation, stringent data sovereignty regulations (GDPR), and a growing need for a secure multi-cloud networking solution. As enterprises place their focus on interoperability, compliance, and hybrid cloud resilience across segments including BFSI, government, and manufacturing, the market will keep on growing.

The UK leads Europe’s multi-cloud networking market, Due to early cloud adoption, rich fintech ecosystem and matured regulatory frameworks. Steady investments in public sector digitalization and AI-enabled infrastructure will continue to propel growth, more so in BFSI, healthcare and defense cloud integration projects.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major key multi-cloud networking market companies are VMware, Cisco Systems, Juniper Networks, Microsoft Corporation, IBM Corporation, Oracle Corporation, Hewlett Packard Enterprise (HPE), F5 Inc., Nutanix, Aviatrix Systems, Google LLC, Amazon Web Services (AWS), Arista Networks Inc., Alibaba Cloud, Extreme Networks Inc., Citrix Systems Inc., Dell Technologies Inc., Cloudflare Inc., Megaport Limited, Fortinet Inc. and others.

Recent Developments:

-

In July 2025, HPE finalized its $14 billion acquisition of Juniper Networks, significantly expanding its footprint in AI-native and multi-cloud networking. The merger enables HPE to deliver integrated solutions across hybrid cloud environments, combining Juniper’s SDN expertise with HPE’s edge-to-cloud platform capabilities.

-

In May 2025, Aviatrix introduced an AI-powered Secure Network Supervisor Agent, integrating Microsoft Security Copilot to automate VPN diagnostics and reduce downtime. Earlier, in November 2024, it launched Aviatrix PaaS, a managed cloud network security platform tailored for multi-cloud enterprises.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2024 |

USD 2.8 Billion |

|

Market Size by 2032 |

USD 15.8 Billion |

|

CAGR |

CAGR of 24.25% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solutions, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

VMware, Cisco Systems, Juniper Networks, Microsoft Corporation, IBM Corporation, Oracle Corporation, Hewlett Packard Enterprise (HPE), F5 Inc., Nutanix, Aviatrix Systems and others in the report |