Multi-phase PWM Controller Chip Market Size & Growth:

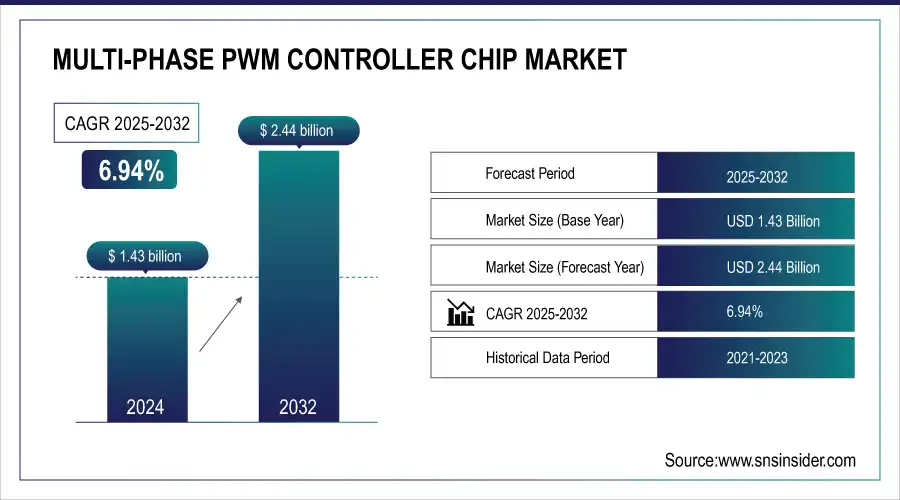

The Multi-phase PWM Controller Chip Market size was valued at USD 1.43 billion in 2024 and is expected to reach USD 2.44 billion by 2032, growing at a CAGR of 6.94% over the forecast period of 2025-2032. Increasing demand to handle high-efficiency power management applications in data centers and electric vehicles that require accurate voltage regulation for advanced processors and high-performance computing components are some key drivers of the multi-phase PWM controller chip market.

To Get more information On Multi-phase PWM Controller Chip Market - Request Free Sample Report

The multi-phase PWM controller chip market trends are increasing demand for efficient power management for various high-performance applications, including data centers, electric vehicles, gaming systems, and 5G infrastructure is a significant trend fueling the multi-phase PWM controller chip market growth during the forecast period. These chips help maintain accurate voltage regulation and thermal management of multi-core processors and GPUs, resulting in lower power usage and longer uptime. Moreover, the transition toward energy-efficient electronics and the aggressive penetration of electric mobility and automation in many sectors are also driving the demand for more sophisticated multi-phase power control solutions.

-

External FET-type PWM controller ICs have been developed by ROHM Semiconductor for use in AC/DC power supplies in industrial applications. Works appropriately in renewable energy systems. With this support, these controllers work with wide variety of power semiconductors which enhance the robustness of applications.

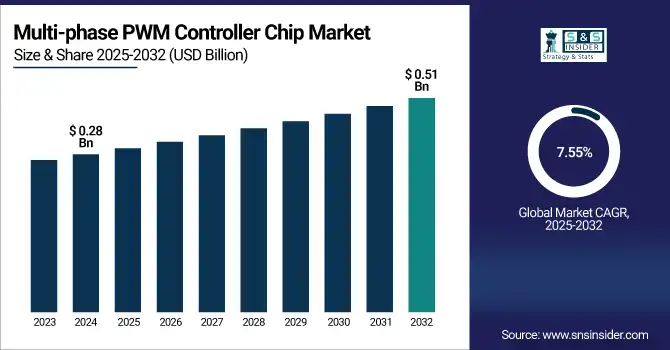

The U.S. multi-phase PWM controller chip market size is estimated to be valued at USD 0.28 billion in 2024 and is projected to grow at a CAGR of 7.55%, reaching USD 0.51 billion by 2032. Factors such as increasing high-performance computing, AI-based applications, and the growing need for energy-efficient power systems in the automotive, aerospace, and telecommunication industries are expected to boost the growth of the U.S. market.

Multi-phase PWM Controller Chip Market Dynamics:

Key Drivers:

-

Surging Need for Advanced Multi Phase PWM Controllers in Evolving High-Performance Technologies

Rising demand for efficient power management in various high-performance applications is the main factor driving the global multi-phase PWM controller chip market. In particular, data centers, electric vehicles (EVs), 5G infrastructure, and industrial automation all require accurate voltage regulation and thermal management. As data centers and edge computing increasingly depend on multi-core processors, GPUs, and AI technologies and innovative power solutions will be needed to provide reliable performance with minimum energy consumption. In addition to this, the shift to EV powertrains is also increasing the market demand for multi-phase PWM controllers, as these are used to improve the delivery of power in battery management systems and motor drives in automotive applications.

-

In 2023, the U.S. data centers consumed approximately 17 gigawatts (GW) of power, with projections indicating a rise to 35 GW by 2030. This surge is largely attributed to the increasing deployment of AI-ready racks, which require 40–60 kW per rack, compared to the traditional 10–14 kW.

Restraints:

-

Design Complexity and Thermal Challenges Intensify in Multi-Phase PWM Controller High Power Systems

It is essential to ensure accurate current sharing for voltage regulation, which presents another major challenge of design complexity, as multi-phase PWM controllers need to be synchronized and share accurate current balance for high-performance applications. Such complexity usually requires expensive engineering and advanced development tools. High-power, multi-phase systems produce a considerable amount of heat as a consequence of operating with many parallelized power cells. Effective thermal management, advanced cooling mechanisms, and layout have to be addressed to ensure that performance is not degraded and that prolonged structural and functional integrity and reliability of multiple components are not compromised.

Opportunities:

-

Expanding Opportunities for Multi-Phase PWM Controllers in Renewable Energy and Electric Mobility Markets

Growing market opportunities are in use for renewable energy sources, such as solar and wind power, with PWM controllers assisting in effective power conversion. Also, new electric mobility trends including autonomous vehicles and new generation batteries have an opportunity for multi-phase controllers. With energy efficiency and sustainability becoming key targets for industries, the potential for these advanced power management solutions will continue to see high demand.

-

In 2024, China's installed solar power capacity increased by 45.2%, reaching 890 million kilowatts, while wind power capacity grew by 18% to 520 million kilowatts. This rapid expansion underscores the critical role of PWM controllers in managing efficient power delivery from renewable sources.

Challenges:

-

Challenges in Compatibility Standardization and Supply Chain Disruptions Hinder Multi Phase PWM Controller Adoption

One of the biggest holdbacks is compatibility with changing system architectures, as they are moving rapidly over to new processor designs, AI accelerators, and advanced battery technologies. It thus often requires an update of the specification of the controller. Another challenge is the relatively low standardization across industries, which makes it difficult to use these controllers in different applications efficiently and seamlessly. Finally, the high-quality availability of controller chips can be affected by supply chain disruptions due to delays in semiconductor fabrication (often due to geopolitical tensions), resulting in inconsistency in project timelines.

Multi-phase PWM Controller Chip Market Segmentation Analysis:

By Type

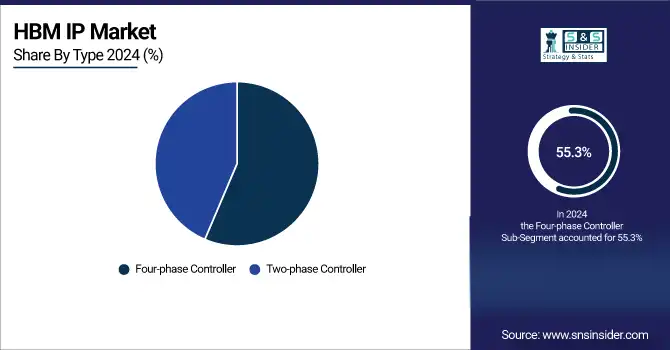

The four-phase controller segment led the market in 2024, accounting for over 55.3% of the global market share, and is expected to hold the largest market share by 2032, as it is projected to record the highest CAGR over 2025-2032. The growth is driven by its improved power handling and efficiency of high-current applications, making it excellent for data centers, gaming systems, and electric vehicles. Four-phase controllers typically provide the best of both worlds, which is almost always wanted for FF sites for many of our sophisticated processors and GPUs these days. The remaining four reasons are due to more complex electronics and their focus on high-performance computing.

By Application

Consumer electronics, which included high-performance consumer products, such as smartphones, laptops, gaming consoles, and smart home systems, continued to boost the rapid adoption of this technology, accounting for a 33.7% share of the market in 2024. Such devices demand compact and efficient power management solutions, and thus, multi-phase PWM controller chips play an important role in delivering stable voltages and making the overall system run more efficiently. Along with these, the growth in this segment is driven by AI-based features and highly multiprocessor speeds in consumer devices.

The highest CAGR during 2025-2032 is expected to come from Automotive Electronics. As the industry swiftly embraces electric vehicles (EVs), advanced driver assistance systems (ADAS), and autonomous technologies, it drives demand for reliable, high-efficiency, and high-performance power management systems. Multi-phase PWM controllers are key in controlling complicated electronic systems found in EVs, such as battery management and electric powertrains, indicating well potential future growth for this segment.

Multi-phase PWM Controller Chip Market Regional Overview:

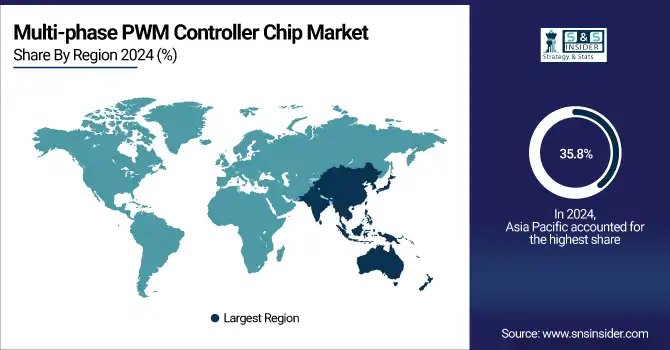

The Asia Pacific had the largest 35.8% of multi-phase PWM controller chip market share in 2024 as a result of rapid technological advancement and the high demand for electronic devices, electric vehicles (EVs), and 5G infrastructure projects. The region is a global centre for semiconductor manufacturing and innovation due to its strong manufacturing base, in particular China, Japan, and South Korea. The growing demand for efficient power management solutions is also driven by the rising integration of renewable energy and smart technologies across the Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

In the Asia Pacific region, China is the largest multi-phase PWM controller chip market, owing to its comparatively large electronics manufacturing base, heavy investments in the manufacturing of electric vehicles (EVS), and specialized deployment of renewable energy.

Multi-phase PWM controller chip market in North America is the fastest growing region through the forecast period, and is expected to grow at a CAGR of 7.6% over the period of 2025 - 2032. The surge is fueled by the swift uptake of next-gen technologies across data center, EV, and 5G infrastructure sectors. Growing demand for high-efficiency power management solutions, along with massive investments in AI, cloud computing, and autonomous systems, which are also amongst the fastest-growing areas for advanced power components, will drive the industry growth in all regions.

The U.S. is the front-runner among North America in the multi-phase PWM controller Chip market due to technological advancements, and high need in North America for data centers, electric vehicles, and 5G infrastructure, and extensive investments in AI, autonomous systems, and renewable energy.

The multi-phase PWM controller chip market in Europe has principally benefited from the rising trend toward energy-efficient solutions for various applications, such as automotive electronics, industrial automation, and renewable energy. With growing sustainability efforts in the region, joined with fast-paced advancements in electric vehicles and smart grid technologies, Europe has become significant for power management, as these developments are increasing the need for energy-efficient solutions.

Germany is dominating the European multi-phase PWM controller chip market owing to its healthy automotive sector, high automotive EVs, and authority over industrial automation. So as a large part of the nation is emphasis on advanced manufacturing of sustainability and technology, it is the need of the time that they get supply of power management solutions in an efficient manner.

Latin America and the Middle East & and Africa can prove to be a potential market for multi-phase PWM controller chips in the coming years proliferating of funds in infrastructure, renewable energy initiatives, and automotive industry. With the increasing demand for power-efficient products, next-gen power management solutions are seeing increased adoption across industrial automation, electric mobility, and telecom end-user verticals. These regions also have engaged in increasing their infrastructure and industrial, which also has a rising demand of needing for voltage regulation and thermal management.

Key Players in the Multi-phase PWM Controller Chip Market are:

Some of the major multi-phase PWM controller chip companies are Texas Instruments, Analog Devices, Infineon Technologies, ON Semiconductor, Microchip Technology, Maxim Integrated, NXP Semiconductors, STMicroelectronics, Renesas Electronics, and Vishay Intertechnology.

Recent Developments:

-

In March 2025, Texas Instruments launched new power management chips, including the TPS1685, the industry’s first 48V hot-swap eFuse and GaN power stages for high-efficiency data center applications. These innovations enhance power density and protection.

-

In March 2025, Infineon introduced its OptiMOS™ TDM2454xx quad-phase power modules with industry-leading 2 A/mm² current density. These modules boost vertical power delivery for high-performance AI data centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.43 Billion |

| Market Size by 2032 | USD 2.44 Billion |

| CAGR | CAGR of 6.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Two-phase Controller and Four-phase Controller) • By Application (Automotive Electronics, Consumer Electronics, Communications, Industrial Control, Military, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Texas Instruments, Analog Devices, Infineon Technologies, ON Semiconductor, Microchip Technology, Maxim Integrated, NXP Semiconductors, STMicroelectronics, Renesas Electronics, and Vishay Intertechnology. |