Next Generation Biometrics Market Size & Trends:

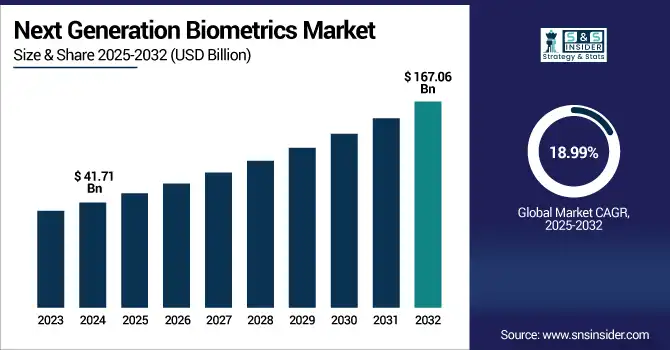

The Next Generation Biometrics Market size was valued at USD 41.71 billion in 2024 and is expected to reach USD 167.06 billion by 2032 and grow at a CAGR of 18.99% over the forecast period 2025-2032. The global market is thoroughly segmented by technology, application, deployment model, end-user, region, and key market dynamics in terms of drivers, restraints, opportunities, and challenges. Ongoing adoption is being fueled by an increasing demand for secure and contactless authentication, and the rising implementation of biometrics in government, defense, and enterprise systems. Continuous technological advancements and technological initiatives for digital identity are also some factors supporting high Next generation biometrics market growth globally.

To Get more information on Next Generation Biometrics Market - Request Free Sample Report

For instance, biometric systems are estimated to reduce identity fraud incidents by over 50% compared to traditional methods.

The U.S. Next Generation Biometrics Market size was USD 9.62 billion in 2024 and is expected to reach USD 37.36 billion by 2032, growing at a CAGR of 18.54% over the forecast period of 2025–2032.

The U.S. market is poised to witness a 12.5% growth fueled by stringent national security mandates, increased deployment of biometric systems for border control and e-governance, and early adoption of advanced technologies. The company already has a substantial tech architecture and expanding demand for secure identity verification in the banking and healthcare sectors also bodes well. The U.S. Biometrics market is fueling novel development of Next Generation Biometrics as continued public & private sector investments on advanced authentication solutions receive significant traction.

For instance, nearly 90% of smartphones in the U.S. support biometric authentication methods, including fingerprint and facial ID.

Next Generation Biometrics Market Key Drivers:

-

Widespread Use of Biometrics in Consumer Devices and Enterprise Authentication for Improved Access Control

Use of biometrics in consumer electronics has become the norm for secure and user-friendly authentication methods in devices such as smartphones, wearables, and laptops. The financial services and fintech sectors are also using both facial and fingerprint biometrics for fraud detection and safer banking. Moreover, enterprises are employing biometric access control systems at critical infrastructure and sites for protection against unauthorized access. The increasing commercial adoption of biometrics, particularly mobile-based authentication, is certainly stimulating volume demand and innovation in embedded biometric sensors and software.

For instance, around 65% of fintech apps globally now offer biometric logins as a primary or optional authentication method.

Next Generation Biometrics Market Restraints:

-

Data Privacy Concerns and Ethical Challenges Associated with the Storage and Use of Biometric Information

Since biometric data cannot be issued again, like a password, its hacking has led to many security and identity stealing issues. As it has become more popular these issues have extended the discussions around consent, surveillance overreach and ownership of data. Privacy blowback It has also caused cases of unconsented facial recognition usage, data leaks, and algorithmic discrimination. Even as the deployment of biometrics accelerates, lack of trust remains a major barrier in regions lacking sound data protection legislation and legal and regulatory uncertainty continues to act as a brake on wider adoption, particularly for civil applications, globally.

Next Generation Biometrics Market Opportunities:

-

Technological Innovations in AI and Multimodal Biometric Systems for More Accurate and Secure Authentication

There is a whole new technological frontier out there for the biometrics market. The recognition of biometrics is getting more accurate, faster, and contextual performance enhancement are all made possible through AI and deep learning algorithms even if you are fairly in the noise or low-light environment. A new multimodal system that combines face, voice, and iris data provides higher authentication reliability and helps reduce false positives. Advancements you will catch a glimpse of in law enforcement, surveillance and enterprise level cybersecurity. High growth niches will be available for vendors developing edge AI-enabled biometric solutions and frictionless authentication systems.

For instance, multimodal biometric systems can reduce false acceptance rates (FAR) by up to 80% compared to unimodal systems.

Next Generation Biometrics Market Challenges:

-

Increasing Spoofing Threats and Rapid Obsolescence of Biometric Systems in an Evolving Security Landscape

The widespread availability of biometric systems is a breeding ground for risks such as spoofing, deepfake manipulation, and cyberattacks on biometric databases. More and more, attackers are finding ways to bypass facial recognition security systems, for example by using mask attacks or fingerprint replication. Most existing deployments do not have real-time liveness and anti-spoofing support. In addition, systems can quickly become obsolete, particularly in areas with delayed procurement cycles, as innovation moves at a rapid pace. This is a relentless pressure to both vendors and end-users to keep upgrading, protecting, and testing these biometric systems for new threats. Next Generation Biometrics Market trends highlight rising demand for anti-spoofing capabilities.

Next Generation Biometrics Market Segmentation Analysis:

By Type of Biometric Technology

Fingerprint Recognition dominated the Next Generation Biometrics Market share by 34.20% in 2024. Fingerprint Recognition has become widely used in a large number of mobile devices and government ID programs as well as access control systems. Companies such as IDEMIA can be found in large-scale fingerprinting solution available for law enforcement and border control agencies. It is a reliable, easy-to-use, and cost-effective tool that is suitable for large-scale implementation. Billions of smartphones come embedded with fingerprint scanners; they are also used for ATMs, the office and border control.

Facial Recognition is projected to have the highest CAGR of 20.21% during the forecast period of 2024 to 2032. One of the most preferred biometric characteristics due to its contactless and fast verification speed, which is utilized more in surveillance, airports and mobile authentication. NEC Corporation has been instrumental in implementing facial recognition systems in international airports and police agencies around the world. Its rapid market expansion is driven by increasing adoption in the public safety, banking and retail industries along with smart city applications.

By Application

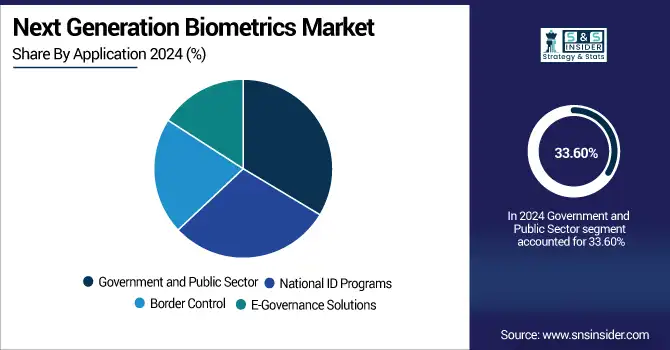

In 2024, Government and Public Sector had the largest revenue share of 33.60% of the market as it includes large-scale deployments as national security, law enforcement civil administration and public welfare distribution. Secure identity and surveillance systems from Thales Group assist various marriage programs through the government. In countries with large and constantly changing populations, such as those in Asia and Africa, biometric systems can make sectors like defense, immigration, and public benefits more transparent, reduce fraud, and help in service delivery.

The National ID Programs segment is expected to be the fastest growing segment with a CAGR of 20.59% during 2024–2032. Biometric national ID programs are being rolled out in parts of Asia, Africa and Latin America by governments looking to promote digital identity, rationalize citizen services and facilitate financial inclusion. MorphoTrust USA, a division of IDEMIA, which has participated in national ID and driving license programs. These programs are key to building a greater governed and more universal access to livelihoods.

By Deployment Model

On-Premise deployment dominated the Next Generation Biometrics Market in 2024, which led the way with a share of 24.60%; this is due to the continued preference for on-premise deployment in secure and regulated environments. On-premise is likely favored by defense, government, and critical infrastructure sectors which would prefer to keep their data in-house. Organizations such as Bio-key International implement on-premise biometric authentication for law enforcement and enterprise networks. Deployments like this will always be around sensitive, personal data where maximum data protection and compliance through localized processing is required.

Cloud-Based is projected to rise with the fastest CAGR of 21.95% during 2024 to 2032. Cloud-based biometrics are scalable, remote, and economical. Companies such as Aware, Inc., are providing biometric-as-a-service platforms which are pushing cloud adoption across the banking, travel, and telecom industries. The accelerating spread of mobile onboarding, eKYC, and digital services is transforming cloud infrastructure into an essential facilitator of biometric segmentation throughout the world economy. Next Generation Biometrics Market analysis shows rising demand for cloud scalability.

By End-User

Defense sector was accounted for 28.30% revenue share in 2024, which is significantly higher than the other market and owing to high scale application of biometrics in surveillance, access control, and national security. Accurate high-speed recognition system is essential for military and intelligence agencies. BAE Systems has sophisticated biometric solutions designed for combat and military identification. Biometric technology ruggedization/anti-tamper requirements driven in this direction are reflected in continuing strong market leadership in defense investment and volume.

The education segment is projected to expand at the highest CAGR of 21.27% during 2024 to 2032. From secure attendance taking, to identity verification and entry points to facilities, schools and universities have adopted biometrics at an increasing rate. The biometric attendance system is used in education institutes internationally and ZKTeco is one of the key providers of this technology. Biometric platforms that are convenient to use and secure for both students and schools have increased as we move beyond COVID lockdowns and shift towards safer, more seamless access to and services within our campuses.

Next Generation Biometrics Market Regional Insights:

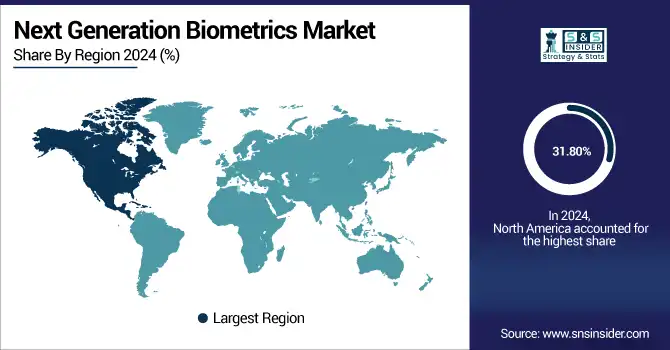

The North America market led the global industry in 2024, as it accounted for the largest revenue share of 31.80%. The growth in Asia Pacific is attributed to early adoption of advanced biometric technologies, high government expenditure, and a well-established security infrastructure. High demand, especially in the fields of defense, border control, financial services, and healthcare fuels continuous market growth. In the U.S. and Canada, the ubiquity of leading biometric technology providers and robust data protection regulations further enables widespread deployment in both public and private sector use cases.

-

The U.S. dominates the North American biometrics market due to strong government investment in homeland security, widespread deployment in border control, and rapid adoption across banking, healthcare, and consumer electronics, supported by advanced infrastructure and key biometric technology providers.

Asia Pacific region is anticipated to be the fastest growing CAGR of 19.92% during the period of 2024 to 2032. Good demand driven by rapid digital transformation, high population density and growing government identity programs. Biometric authentication for financial services, citizen ID, and public benefits are being launched in countries including India, China, Indonesia, and the Philippines; Strong mobile penetration across the region organized smart city projects and rising security concerns will drive adoption in all verticals across the region.

-

China leads the Asia Pacific biometrics market owing to large-scale government surveillance programs, widespread facial recognition deployment, integration in fintech and smartphones, and massive public sector initiatives, driven by strong domestic companies and favorable regulatory frameworks supporting technology implementation.

Europe is a significant region in the Next Generation Biometrics Market, due to rising demand for secure identity verification in border control, banking, and healthcare. Regulations are the driving forces to create the enabling environments for trusted biometric adoptions like EU push for digital ID frameworks and data privacy regulation like GDPR. Germany, the UK, and France are pouring millions into government sector biometrics systems.

-

Germany leads the European biometrics market due to strong government initiatives, advanced industrial infrastructure, and widespread use in border control and digital ID programs. Its focus on data protection and early adoption of AI-powered biometric systems further drives its dominance.

Middle East & Africa is led by the UAE, owing to its highly developed digital identity programs, smart city projects, and biometric-based immigration and border security systems. Brazil is at the forefront of wide-scale biometric adoption in voting, banking and law enforcement in Latin America, powered by government support and the full implementation of digital transformation initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Next Generation Biometrics Companies are:

Major Key Players in Next Generation Biometrics Market are Thales Group, IDEMIA, NEC Corporation, ASSA ABLOY, Fujitsu Limited, Suprema Inc., Bio-Key International Inc., Cognitec Systems GmbH, Aware Inc., HID Global (an ASSA ABLOY brand), Synaptics Incorporated, Precise Biometrics, Dermalog Identification Systems GmbH, Fingerprint Cards AB, ZKTeco Co. Ltd., Gemalto N.V. (a Thales company), ImageWare Systems Inc., IriTech Inc., Daon Inc. and Secunet Security Networks AG and others.

Recent Developments:

-

In January 2025, IDEMIA launched its F.CODE Biometric Payment Card Enrollment Device, a USB‑C dongle that enables fingerprint enrollment directly via a user’s smartphone (iOS or Android), facilitating seamless onboarding and eliminating PIN entry during contactless payments.

-

In February 2025, NEC unveiled digital signature technology that performs facial biometric authentication without storing facial images by generating cryptographic keys from fluctuating facial data, enhancing privacy and reducing risk of data leakage.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 41.71 Billion |

| Market Size by 2032 | USD 167.06 Billion |

| CAGR | CAGR of 18.99% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Biometric Technology (Fingerprint Recognition, Facial Recognition, Iris Recognition, Voice Recognition, Vein Recognition and Gait Recognition) • By Application (Government and Public Sector, National ID Programs, Border Control and E-Governance Solutions) • By Deployment Model (On-Premise, Hardware Solutions, Software Solutions, Cloud-Based, Hybrid Solutions and Fully Managed Services) • By End-User (Telecommunications, Automotive, Education, Manufacturing and Defense) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thales Group, IDEMIA, NEC Corporation, ASSA ABLOY, Fujitsu Limited, Suprema Inc., Bio-Key International Inc., Cognitec Systems GmbH, Aware Inc., HID Global (an ASSA ABLOY brand), Synaptics Incorporated, Precise Biometrics, Dermalog Identification Systems GmbH, Fingerprint Cards AB, ZKTeco Co. Ltd., Gemalto N.V. (a Thales company), ImageWare Systems Inc., IriTech Inc., Daon Inc. and Secunet Security Networks AG. |