Biometric Technology Market Report Scope & Overview:

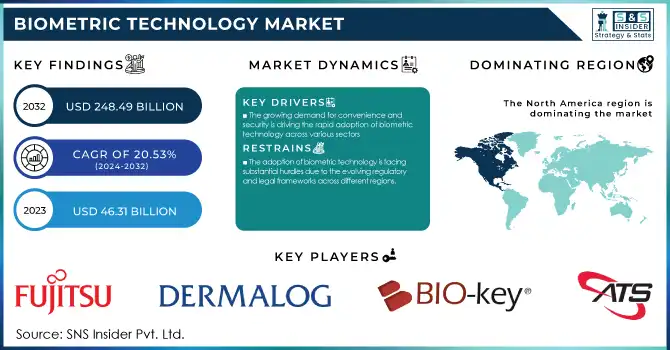

Biometric Technology Market size was valued at USD 55.81 billion in 2024. It is expected to hit USD 248.49 billion by 2032 and grow at a CAGR of 20.53 % over the forecast period of 2025-2032.

Get more information on Biometric Technology Market - Request Sample Report

Biometric Technology Market is rapidly gaining traction due to its ability to enhance security and reliability, providing superior protection against identity theft, fraud, and unauthorized access when compared to traditional methods like passwords and PINs. Biometric data, which is unique to each individual, makes it significantly more difficult to replicate or steal, offering an added layer of protection against unauthorized access. This uniqueness is vital in reducing the risk of identity theft and impersonation. For instance, fingerprint recognition systems boast an error rate as low as one in 50,000, demonstrating their reliability in identity verification. As biometric technology continues to evolve, its integration in sectors such as finance, healthcare, and government is becoming increasingly crucial. Organizations are adopting biometric verification technologies to strengthen security, mitigate risks, and safeguard sensitive data. The financial sector, for example, has seen the implementation of biometric systems like facial and fingerprint recognition to prevent fraud. Additionally, biometrics are becoming integral in air travel, with 238 U.S. airports adopting these technologies, embraced by four out of every five Americans. The continued adoption of biometric authentication systems is not only enhancing security but also ensuring a seamless, efficient experience for users while protecting privacy and ensuring compliance with regulations.

Market Size and Forecast:

-

Market Size in 2024 USD 55.81 Billion

-

Market Size by 2032 USD 248.49 Billion

-

CAGR of 20.53% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Biometric Technology Market Trends:

-

Increasing adoption of biometric authentication in banking, healthcare, and air travel to enhance speed, security, and user convenience.

-

Rising demand for contactless biometric solutions accelerated by global health concerns and consumer preference for touch-free experiences.

-

Expansion of biometric payment systems, including palm recognition, mobile wallets, QR codes, and BNPL methods in retail and financial services.

-

Growing use of biometric identification in airports, with passengers preferring it over traditional passports and boarding passes.

-

Integration of biometric systems helping businesses improve security, reduce costs, and drive digital transformation across industries.

Biometric Technology Market Growth Drivers:

-

The growing demand for convenience and security is driving the rapid adoption of biometric technology across various sectors.

Biometric systems like facial recognition and fingerprint scanning are transforming industries by providing seamless, faster authentication, eliminating the need for traditional methods like passwords and PINs. This shift is particularly evident in sectors such as banking, healthcare, and air travel, where both speed and security are critical. In the financial sector, biometric payment solutions are making transactions quicker and more secure, while in healthcare, they streamline patient identification and enhance care delivery. The rise of contactless biometric solutions has also been accelerated by global health concerns, encouraging the adoption of touch-free systems. Airports, particularly in the U.S., have adopted biometric technology, offering passport-free experiences that reduce wait times and enhance travel convenience. Additionally, retail companies like Whole Foods have embraced palm recognition for payment, showcasing the increasing role of biometrics in everyday transactions. As consumer preferences shift toward faster, secure, and more efficient systems, the biometric technology market is expected to experience significant growth. Innovative payment methods such as biometric authentication, mobile wallets, QR code payments, and Buy Now, Pay Later (BNPL) are becoming more mainstream, with a survey by Square revealing 57% of consumers preferring mobile wallets and 53% using QR codes. Furthermore, 46% of travelers at airports now use biometric identification, with 75% of passengers preferring it over traditional methods like passports and boarding passes. The integration of biometric solutions allows businesses to improve security, reduce operational costs, and enhance the user experience, solidifying biometric technology’s role in driving digital transformation and revolutionizing payment systems across industries.

Biometric Technology Market Restraints:

-

The adoption of biometric technology is facing substantial hurdles due to the evolving regulatory and legal frameworks across different regions.

Global inconsistencies in privacy laws related to biometric data such as data storage, consent, and usage create barriers to widespread adoption, particularly in industries like finance, healthcare, and travel, which handle sensitive personal information. For example, the General Data Protection Regulation (GDPR) in the EU mandates strict user consent and data protection protocols for biometric data collection and processing. Similarly, in the U.S., the Biometric Information Privacy Act (BIPA) in Illinois restricts the collection and use of biometric data, while the Federal Trade Commission (FTC) issued a 2024 policy on biometric data emphasizing the need for transparent and secure practices. These regulatory requirements increase the operational complexity and cost of compliance, potentially hindering scalability. Furthermore, inconsistent global standards impede the smooth implementation of biometric systems across borders. Germany's privacy watchdog has even taken action against Worldcoin for mishandling biometric data, exemplifying the heightened scrutiny of biometric practices. Additionally, the UK's Biometrics Commissioner has voiced concerns about improper biometric usage, signaling potential future regulatory crackdowns. Businesses in biometric authentication face growing legal risks related to data breaches and non-compliance, further complicating the landscape. As studies indicate that 40% of U.S. companies are concerned about legal exposure, organizations are increasingly investing in compliance and cybersecurity measures to mitigate risks. In this challenging regulatory environment, companies must navigate legal risks while balancing the demand for biometric solutions in identity verification and access control. to keep pace with biometric technology advancements, legal and regulatory frameworks must evolve, ensuring privacy is protected without stifling innovation.

Biometric Technology Market Segment Analysis:

By Component

The hardware segment is the dominant component in the biometric technology market, accounting for approximately 59% of the market share in 2024. This segment includes essential devices such as fingerprint scanners, facial recognition cameras, iris scanners, and palm print sensors, which serve as the primary tools for capturing biometric data. The demand for hardware solutions has surged due to their crucial role in identity verification, access control, and security applications across industries like banking, healthcare, and travel. Advancements in hardware technology, such as increased accuracy, speed, and miniaturization, have further fueled market growth. Additionally, the rise in biometric authentication for mobile devices and payment systems has further solidified the hardware segment's dominance. As organizations continue to prioritize security and efficiency, the hardware segment remains a key driver in the biometric technology market.

By offering

The contact-based segment dominates the biometric technology market, holding around 68% of the market share in 2024. This segment includes biometric systems such as fingerprint scanning, palm print recognition, and vein pattern detection, all requiring physical interaction with the user. The widespread adoption of contact-based solutions is driven by their high accuracy, reliability, and cost-effectiveness, making them ideal for sectors like banking, healthcare, and government. Fingerprint recognition, in particular, remains the most common form of biometric authentication due to its ease of integration and precision. Contact-based systems are favored in high-security environments due to their ability to capture precise data, ensuring secure identity verification. Despite the rise of contactless systems, the contact-based segment continues to lead, particularly for applications requiring robust security and data accuracy

Biometric Technology Market Regional Analysis:

North America Biometric Technology Market Insights

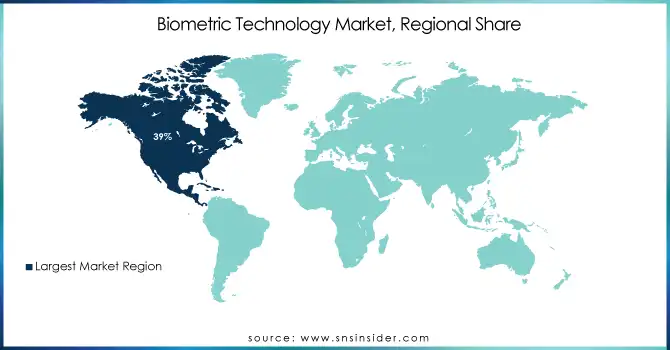

North America, holding around 39% of the biometric technology market in 2024, leads in adoption due to its advanced infrastructure and technological innovations. The United States is at the forefront, with significant investments in biometric solutions across sectors like banking, healthcare, and government. Companies like IDEMIA and BioCatch have propelled the use of facial recognition, fingerprint scanning, and iris recognition, supported by government initiatives focusing on enhancing security and identity verification. Regulations such as the Biometric Information Privacy Act (BIPA) ensure secure handling of biometric data, fostering consumer confidence. Moreover, the region's emphasis on digital transformation, mobile wallets, and contactless biometrics further drives market growth, ensuring North America's continued dominance in the biometric technology market.

Asia Pacific Biometric Technology Market Insights

Asia-Pacific is set to be the fastest-growing region in the biometric technology market from 2025 to 2032, driven by rapid urbanization, growing security concerns, and technological advancements. Countries like China, India, Japan, and South Korea are leading the charge in biometric adoption. In China, government initiatives, such as the "Smart City" program, have significantly boosted biometric use in public safety, banking, and transportation. India’s push for digital identity verification through Aadhaar is another major driver, making biometric systems integral for government services. Japan and South Korea have also embraced biometric technology in banking, mobile payments, and retail. The region’s high smartphone penetration, along with advancements in AI and machine learning, further accelerates the adoption of biometric authentication, particularly in mobile and contactless payment solutions. As security, convenience, and digital innovation continue to rise in Asia-Pacific, biometric technology is expected to thrive.

Europe Biometric Technology Market Insights

Europe’s biometric technology market is expanding due to strict data protection regulations, rising adoption in banking, border control, and healthcare sectors. Governments are implementing large-scale biometric identity programs, while enterprises embrace solutions for secure authentication. Increasing demand for contactless technologies and integration with payment systems further drive market growth, positioning Europe as a key innovator in biometrics.

Latin America (LATAM) and Middle East & Africa (MEA) Biometric Technology Market Insights

The LATAM and MEA biometric technology markets are witnessing steady growth, driven by government-led identity programs, border security initiatives, and financial inclusion efforts. In Latin America, biometrics enhances secure banking and social welfare systems, while Middle Eastern and African countries adopt biometric solutions for national security, airport modernization, and e-governance, fueling broader digital transformation across these regions.

Need any customization research on Biometric Technology Market - Enquiry Now

Biometric Technology Market Key Players:

Some of the Biometric Technology Market Companies are

-

Accu-Time Systems, Inc. (Time and Attendance Solutions, Biometric Time Clocks)

-

AFIX Technologies (Mobile Fingerprint Scanning Solutions)

-

BIO-key International, Inc. (Fingerprint Recognition Software, Biometric Access Control)

-

DERMALOG Identification Systems GmbH (Fingerprint, Iris, and Face Recognition Systems)

-

East Shore Technologies, Inc. (Fingerprint and Face Recognition Systems)

-

EyeVerify, Inc. (Eyeprint ID, Biometric Authentication)

-

Fujitsu Limited (Palm Vein Scanners, Facial Recognition Solutions)

-

Gemalto NV (Smart Cards, Biometric Identification Solutions)

-

HID Global Corporation (Biometric Access Control Systems, Fingerprint Scanners)

-

IDEMIA (Facial Recognition, Fingerprint Biometrics, Identity Solutions)

-

Iris ID, Inc. (Iris Recognition Systems)

-

NEC Corporation (Facial Recognition, Fingerprint Authentication Solutions)

-

Zebra Technologies (Fingerprint Scanners, Biometric Solutions for Healthcare)

-

Microsoft Corporation (Windows Hello, Facial Recognition)

-

Apple Inc. (Face ID, touch ID)

-

SenseTime (AI-based Facial Recognition, Object Detection)

-

Synaptics Incorporated (Fingerprint Sensors, Biometric Solutions for Smartphones)

-

Virdi (Fingerprint, Face, and Iris Recognition Systems)

-

Crossmatch (Fingerprint and Palm Print Biometrics)

-

Suprema Inc. (FaceStation, BioStation, Fingerprint Scanners)

Competitive Landscape for Biometric Technology Market:

Accu-Time Systems (ATS) is a leading provider of biometric time and attendance solutions, specializing in fingerprint and facial recognition technologies. Its biometric time clocks enable accurate workforce management, reducing fraud and enhancing productivity across industries. By integrating secure authentication methods, ATS supports organizations in streamlining operations, ensuring compliance, and advancing digital workforce transformation within the biometric technology market.

-

On October 2024, Accu-Time Systems (ATS) unveiled the stride40 Time Clock on designed for small businesses. It offers versatile clock-in options, including HID ProxPoint badges, barcode scanners, and advanced facial recognition, ensuring secure and accurate time tracking. The stride40’s "Only|You Face" system reduces time theft and buddy punching, streamlining workforce management.

NEC Corporation is a global leader in biometric technology, offering advanced facial recognition, fingerprint authentication, and iris recognition solutions. Its AI-powered biometric systems are widely deployed in border control, public safety, and enterprise security. NEC’s innovations enable fast, accurate, and secure identification, supporting digital transformation initiatives and strengthening its role in driving growth within the biometric technology market.

-

On September 2024, NEC Corporation launched a new facial recognition system that enables authentication of individuals while in motion. Designed for crowded environments like airports, the system can process up to 100 people per minute, reducing congestion and wait times without the need for physical barriers.

| Report Attributes | Details |

| Market Size in 2024 | USD 55.81 Billion |

| Market Size by 2032 | USD 248.49 Billion |

| CAGR | CAGR of 20.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Hardware, and Service) • By Offering (Contactless, Contact, and Hybrid) • By Authentication Type (Single Factor, Two Factor, Three-Factor, Four Factor, and Five-Factor) • By Application (Hand Geometry, Face, Voice, Signature, AFIS, Non-AFIS, Iris, and Others) • By End-use (Banking and Finance, Defense & Security, Healthcare, Government, Consumer Electronics, Transportation & Logistics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Accu-Time Systems, Inc., AFIX Technologies, BIO-key International, Inc., DERMALOG Identification Systems GmbH, East Shore Technologies, Inc., EyeVerify, Inc., Fujitsu Limited, Gemalto NV, HID Global Corporation, IDEMIA, Iris ID, Inc., NEC Corporation, Zebra Technologies, Microsoft Corporation, Apple Inc., SenseTime, Synaptics Incorporated, Virdi, Crossmatch, Suprema Inc. |