Non-opioid Pain Patches Market Size Analysis

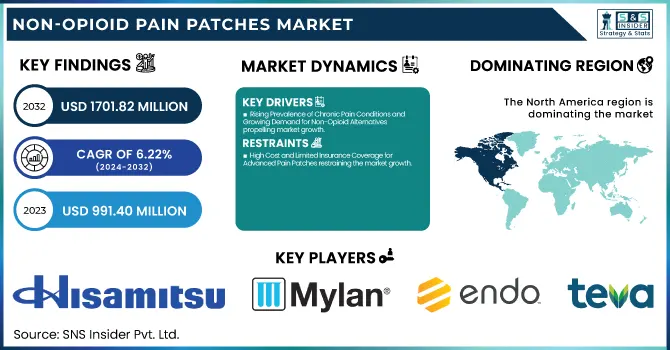

The Non-opioid Pain Patches Market size was estimated at USD 991.40 million in 2023 and is projected to reach USD 1701.82 million by 2032, growing at a CAGR of 6.22% from 2024-2032.

The global non-opioid pain patches market report provides statistical data, such as the prevalence and incidence of chronic and acute pain conditions in 2023, broken down by major demographics and regions. We also provide comprehensive prescription trends for non-opioid pain patches, comparing regional differences based on healthcare policies and reimbursement structures. A unique feature of our analysis is the complete segmentation of healthcare expenditure on pain management therapies by sources of funds (government, commercial, private, and out-of-pocket), providing information regarding market affordability and accessibility. These unique data points provide a more in-depth analysis of market trends beyond common growth patterns.

To Get more information on Non-opioid Pain Patches Market - Request Free Sample Report

Non-opioid Pain Patches Market Dynamics

Drivers

-

Rising Prevalence of Chronic Pain Conditions and Growing Demand for Non-Opioid Alternatives propelling market growth.

The rise in the number of chronic pain diseases like arthritis, neuropathy, and musculoskeletal diseases is a prime growth driver for the Non-opioid Pain Patches Market. The CDC states that about 51.6 million U.S. adults have chronic pain, and more than 17.1 million have high-impact pain, which restricts daily activities. The increasing worries about opioid addiction and the opioid epidemic have driven patients and healthcare professionals toward safer options such as non-opioid pain patches. The recent approvals, including the FDA approval of capsaicin-containing Qutenza patches for neuropathic pain in 2023, demonstrate the increased popularity of non-opioid treatments. In addition, the inclusion of lidocaine and diclofenac patches in worldwide pain management protocols has further contributed to market demand, facilitating their use in clinics and over-the-counter (OTC) sales.

-

Regulatory Support and Favorable Reimbursement Policies for Non-Opioid Pain Management accelerating the market.

Regulatory agencies across the world are increasingly encouraging non-opioid pain management options to combat opioid abuse. In 2022, the U.S. FDA launched new labeling and prescribing recommendations promoting the use of non-opioid therapies as initial treatment for acute and chronic pain. Further, the Centers for Medicare & Medicaid Services (CMS) increased reimbursement for non-opioid pain management options such as lidocaine and diclofenac patches in outpatient and post-surgery care plans. All these policy adjustments are causing more accessibility and affordability for the patients. European nations such as Germany and the U.K. also updated their pain management programs in 2023, introducing non-opioid patches as a better substitute. This regulatory change, coupled with increasing R&D spending on new transdermal technologies, will drive market penetration and speed the uptake of advanced pain relief technologies.

Restraint

-

High Cost and Limited Insurance Coverage for Advanced Pain Patches restraining the market growth.

One of the major constraints in the Non-opioid Pain Patches Market is the exorbitant price of sophisticated formulations and the limited insurance coverage for some non-opioid pain relief patches. Although conventional ones such as lidocaine and diclofenac patches are easily accessible, newer and more potent patches such as high-concentration capsaicin (Qutenza) or ketoprofen patches tend to be pricey. For example, one patch application of the Qutenza patch costs more than USD 800 per treatment and is not an option for many patients in the absence of broad insurance. In addition, insurers place limitations on reimbursement, assigning non-opioid pain patches as secondary alternatives to pain control instead of a primary solution to pain management. This economic limitation discourages acceptance, particularly from older and poor patients, effectively slowing down the growth of the market in the face of heightened demand for alternative opioids.

Opportunities

-

Expansion into Emerging Markets and Aging Population Growth has a significant opportunity for the Non-opioid Pain Patches Market.

The Non-opioid Pain Patches Market has a tremendous scope of growth in emerging economies, fueled by enhanced accessibility to healthcare, increasing disposable incomes, and an expanding consciousness regarding non-opioid pain management products. These regions are experiencing swift advancement in healthcare infrastructure and regulatory assistance for alternative pain management therapies. In addition, the aging world population is on the increase, with the WHO projecting that more than 2 billion people will be 60 years and older by 2050—a population at significant risk for chronic pain diseases like arthritis, neuropathy, and musculoskeletal disorders. Since healthcare systems within these markets favor cost-efficient, long-term solutions for pain management, producers can capitalize on underserved medical requirements through increased distribution networks, regional product launches, and strategic alliances with local healthcare practitioners.

Challenges

-

The stringent regulatory landscape surrounding pain management products poses a major challenge for the Non-opioid Pain Patches Market.

The stringent regulatory environment around pain management products is a significant challenge to the Non-opioid Pain Patches Market. Institutions like the U.S. FDA and EMA demand rigorous clinical trials and safety information for new pain relief patches, which increases the time and cost of market entry. For instance, Qutenza (capsaicin 8%) was tried and re-formulated several times before gaining wider market approval. Moreover, gaining approval for higher-concentration or new formulation patches is even more difficult because of safety issues regarding skin irritation, absorption levels, and sustained efficacy. It also becomes challenging for companies to obtain reimbursement approvals from payers, as most non-opioid patches are regarded as secondary treatments. Such regulatory and reimbursement obstacles can hinder innovation and restrict patients' access to effective non-opioid pain relief products.

Non-opioid Pain Patches Market Segmentation Analysis

By Patch Type

The Lidocaine Patches segment dominated the Non-opioid Pain Patches Market with a 36.15% market share in 2023, as it has the widest application in the treatment of chronic pain, postherpetic neuralgia, and musculoskeletal disorders. The Lidocaine patches exert local analgesic effects through sodium channel blockade in nerve endings, suppressing pain sensation with minimal systemic side effects. The large prevalence of chronic pain disorders, especially in North America and Europe, has stimulated demand for Lidocaine 4% and 5% patches that are readily available over the counter or on prescription. Furthermore, favorable reimbursement policies, high clinical efficacy, and FDA approvals have supported their leadership in the market. Pharmaceutical industry leaders like Hisamitsu Pharmaceutical, Teva, and Endo Pharmaceuticals keep growing production, further cementing lidocaine's leadership as a go-to non-opioid pain reliever.

The Capsaicin Patches market is expected to grow the fastest over the forecast period, stimulated by growing clinical uptake, broadening research on neuropathic pain relief, and a growing need for long-lasting pain management drugs. Capsaicin from chili peppers activates TRPV1 receptors to numb pain channels for prolonged relief against diabetic neuropathy, osteoarthritis, and surgical pain. Veritas Pharma's Qutenza (8% capsaicin patch) has also garnered considerable interest by being a high-concentration product with analgesic action lasting three months following one dose. Moreover, increasing demand for plant-based and non-systemic pain relief, combined with the rising number of government programs that favor non-opioid treatments, is fueling market growth. Capsaicin formulation improvements, better patient compliance, and increased market presence in Asia-Pacific and Europe will continue to spur its growth.

By Distribution Channel

The Retail Pharmacies segment dominated the market with a 45% market share in 2023 through its excellent accessibility, convenience, and instant product availability. Retail pharmacies are the key distribution channel for over-the-counter (OTC) and prescription-based pain patches, such as Lidocaine and Diclofenac patches, which are well-prescribed for localized relief of pain. In the developed markets of North America and Europe, highly established pharmacy chains like CVS Health, Walgreens, and Boots offer convenient access to FDA-approved non-opioid painkillers, helping drive sales. Moreover, consultation by pharmacists and insurance reimbursement for prescription patches also help reinforce consumer confidence and uptake. The increased focus on self-medication and rapid pain relief solutions coupled with robust retail pharmacy networks in suburban and urban areas has fortified this segment's market leadership.

The Online Pharmacies segment is expected to experience the fastest growth with a 7.21% CAGR over the forecast period, fueled by the expansion of digital healthcare, growing e-commerce penetration, and burgeoning demand for home delivery of drugs. Online pharmacy stores provide discounted prices, subscription-based pain relief solutions, and access to a broad list of non-opioid pain patches, thus appealing to tech-friendly consumers and chronic pain patients who value convenience. The COVID-19 pandemic surged the use of telemedicine and online prescription fulfillment, resulting in growing demand for digital pharmacy services. Moreover, government efforts toward regulation and support of online pharmacy sales in North America and Asia-Pacific are aiding expansion. Businesses like Amazon Pharmacy, GoodRx, and specialized digital health platforms are also augmenting product accessibility, driving speedy growth in new markets such as India, China, and Latin America.

Non-opioid Pain Patches Market Regional Insights

North America dominated the Non-opioid Pain Patches Market with a 40% market share in 2023 on account of its established healthcare system, high incidence of chronic pain disorders, and strict regulations governing the use of opioids. The CDC estimates that more than 50 million Americans have chronic pain, fueling the need for safer, non-opioid patches. Moreover, government support and FDA approvals for new pain management treatments, including the recent January 2025 approval of suzetrigine (Journavx), have fueled market growth. The dominance of key pharmaceutical firms, strong adoption rates of sophisticated pain management solutions, and robust reimbursement policies further support North America's leadership. With the relentless opioid epidemic leading healthcare professionals and patients towards non-addictive pain management measures, the area remains the largest user of non-opioid pain patches.

Asia-Pacific is witnessing the fastest expansion in the Non-opioid Pain Patches Market with 7.31% CAGR during the forecast period, due to increasing awareness of healthcare, a growing population of geriatric patients, and a transition toward non-opioid pain relief solutions. There has been a boom in cases of chronic pain in countries like China, India, and Japan due to aging populations and lifestyles, with a prevalence of arthritis, back pain, and neuropathy. The governments in the region are also coming up with stricter policies to stem opioid dependency and promote cost-efficient pain relief methods. Growth in e-commerce and online pharmacy platforms has also made it easier for patients to access pain patches. Additionally, heightened R&D investments, the foray of multinational pharmaceutical companies, and the increased trend towards self-medication are driving market growth, making Asia-Pacific the region with the highest growth rate for non-opioid pain management solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Non-opioid Pain Patches Market in the Key Players

-

Hisamitsu Pharmaceutical Co., Inc. (Salonpas Pain Relief Patch, Salonpas Lidocaine 4% Patch)

-

Teikoku Seiyaku Co., Ltd. (Lidoderm Patch, Fentanyl Transdermal Patch)

-

Mylan N.V. (Lidocaine Patch 5%, Diclofenac Epolamine Patch)

-

Endo Pharmaceuticals Inc. (Lidoderm Patch, Synera Patch)

-

Teva Pharmaceutical Industries Ltd. (Lidocaine Patch 5%, Fentanyl Transdermal System)

-

Sorrento Therapeutics, Inc. (ZTlido Patch, SP-102 (SEMDEXA))

-

Acorda Therapeutics, Inc. (Qutenza Patch, Zanaflex Capsules)

-

Pfizer Inc. (Flector Patch, Lyrica)

-

Allergan plc (Duragesic Patch, Fentanyl Transdermal System)

-

Novartis AG (Voltaren Gel, Exelon Patch)

-

Johnson & Johnson (Duragesic Patch, Tylenol Precise Pain Relieving Patch)

-

Sanofi S.A. (Icy Hot Lidocaine Patch, Aspercreme Lidocaine Patch)

-

GlaxoSmithKline plc (ThermaCare HeatWraps, Voltaren Arthritis Pain Gel)

-

Bayer AG (Aleve Direct Therapy TENS Device, AleveX Pain Relieving Patch)

-

Actavis plc (Lidocaine Patch 5%, Fentanyl Transdermal System)

-

Meda Pharmaceuticals Inc. (Lidoderm Patch, Synera Patch)

-

Watson Pharmaceuticals, Inc. (Lidocaine Patch 5%, Fentanyl Transdermal System)

-

Purdue Pharma L.P. (Butrans Patch, Hysingla ER)

-

Alza Corporation (Duragesic Patch, Nicoderm CQ Patch)

-

Scilex Pharmaceuticals Inc. (ZTlido Patch, SP-103)

Suppliers (These suppliers provide essential materials and technologies for manufacturing non-opioid pain patches.)

-

Schott AG

-

3M Drug Delivery Systems

-

LTS Lohmann Therapie-Systeme AG

-

Sekisui Chemical Co., Ltd.

-

Henkel AG & Co. KGaA

-

Nitto Denko Corporation

-

Avery Dennison Medical

-

AdhexPharma

Recent Development in the Non-opioid Pain Patches Market

-

In January 2025, the U.S. Food and Drug Administration (FDA) approved oral tablets of Journavx (suzetrigine) 50 mg, which represents the launch of the first-in-class non-opioid analgesic for the relief of moderate to severe acute pain in adults. Journavx reduces pain by acting on sodium channels in the peripheral nervous system, blocking pain messages before they reach the brain. This approval is a major step forward in non-opioid pain management, representing a new method for managing acute pain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 991.40 million |

| Market Size by 2032 | US$ 1701.82 million |

| CAGR | CAGR of 6.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Patch Type (Lidocaine Patches, Diclofenac Patches, Methyl Salicylate Patches, Capsaicin Patches, Ketoprofen Patches, Others [Herbal, Menthol, etc.]) • By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, Others [Supermarkets/Hypermarkets, DTC]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hisamitsu Pharmaceutical Co., Inc., Teikoku Seiyaku Co., Ltd., Mylan N.V., Endo Pharmaceuticals Inc., Teva Pharmaceutical Industries Ltd., Sorrento Therapeutics, Inc., Acorda Therapeutics, Inc., Pfizer Inc., Allergan plc, Novartis AG, Johnson & Johnson, Sanofi S.A., GlaxoSmithKline plc, Bayer AG, Actavis plc, Meda Pharmaceuticals Inc., Watson Pharmaceuticals, Inc., Purdue Pharma L.P., Alza Corporation, Scilex Pharmaceuticals Inc., and other players. |