Pain Management Market Size & Trends:

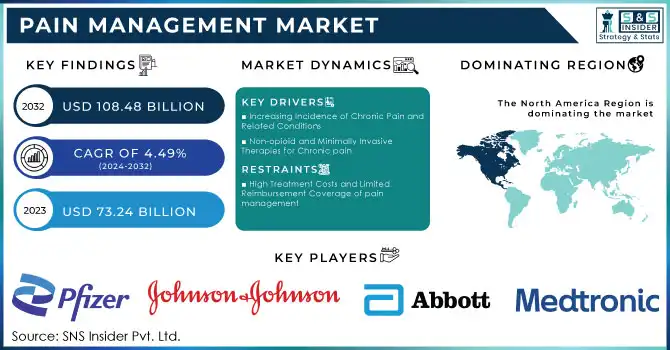

The Pain Management Market size was valued at USD 73.24 billion in 2023 and is expected to reach USD 108.48 billion by 2032, growing at a CAGR of 4.49% over the forecast period of 2024-2032.

Get More Information on Pain Management Market - Request Sample Report

The pain management market is witnessing robust growth, driven by the increasing prevalence of chronic pain conditions, a growing geriatric population, and advancements in pain management technologies. Chronic pain affects over 20% of adults globally, significantly impacting quality of life and healthcare systems. In the year 2023, 24.3% of grown-ups experienced persistent pain lasting for 3 months or more. Rising awareness of effective pain management solutions has fueled demand for innovative therapies and devices.

Non-opioid drugs are becoming increasingly popular for treatment as the global crisis related to opioids raises its ugly head, forcing practitioners and patients to find safety. Neuromodulator devices like spinal cord stimulation devices and TENS have also been widely adopted in patient populations as they significantly prove useful in chronic pain conditions, particularly neuropathy and back problems.

The market also benefits from expanding applications of regenerative medicine, such as stem cell therapies, for the treatment of musculoskeletal pain. Rapid advancements in biologics and personalized medicine are driving innovation in the pharmaceuticals segment. The market landscape has been reshaped by recent regulatory approvals and collaborations. For example, in 2024, the FDA approved a novel monoclonal antibody therapy for chronic migraine, marking a recent increase in biologic-based solutions. Furthermore, pain management systems are now AI-integrated, which would allow for precision treatment and monitoring.

Pain Management Market Analysis

Drivers

-

Increasing Incidence of Chronic Pain and Related Conditions

Chronic pain, a fact that affects 1 in 5 adults globally, is one of the significant drivers of the pain management market. Conditions such as arthritis, fibromyalgia, neuropathic pain, and cancer-related pain are on the increase with the aging population, sedentary lifestyles, and lifestyle-related diseases. Thus, the growing burden of chronic pain demands effective pain management solutions, driving the demand for both pharmacological and non-pharmacological treatments. The impact on healthcare systems and quality of life has led to increased funding for research and the introduction of new advancements in pain management therapies.

-

Non-opioid and Minimally Invasive Therapies for Chronic pain

In a market where increased attention has been drawn to opioid-based treatments with the global opioid crisis, there is an overall shift to safer alternatives. Innovations such as devices in neuromodulation technologies, such as spinal cord stimulators, and wearable pain management solutions address chronic and acute pain conditions better and cause fewer side effects. Other areas in regenerative medicine, such as stem cell therapies, and biologics such as monoclonal antibodies are promising avenues for less invasive pain relief. These advancements meet the growing demand for personalized and targeted pain management solutions, thereby further propelling market growth.

Restraints

-

High Treatment Costs and Limited Reimbursement Coverage of pain management

One of the major restrictions in the pain management market is the high cost of advanced therapies and devices, which makes it inaccessible to a significant portion of the global population. Treatments such as neuromodulation devices, regenerative medicine, and biologic drugs are often expensive in terms of upfront and maintenance costs. Furthermore, inconsistent and limited reimbursement policies across regions add more financial barriers for patients. This is quite challenging, particularly in low- and middle-income countries, because healthcare infrastructure and insurance coverage are quite less developed, and hence, the adoption of innovative pain management solutions is not widespread.

Pain Management Market Segmentation Analysis

Pain Management by Types

Non-steroidal anti-inflammatory Drugs (NSAIDs) segment dominated the pain management market with a market share of 34% in 2023, mainly due to their efficacy, cost-effectiveness, and availability. The drugs are widely used for arthritis and musculoskeletal disorders, as they can reduce pain, inflammation, and fever. Their easy availability over the counter and established safety profiles made them a first-line treatment option, which is driving growth in the pain management sector. As more patients seek NSAIDs for relief, this segment contributes significantly to market revenue.

The Antimigraine segment is predicted to show the fastest growth throughout the forecast period driven by the growth of the prevalence of a disorder that affects more than 12% of all global inhabitants. Recent FDA approvals of monoclonal antibody therapies are revolutionizing this migraine treatment by providing targeted, highly effective relief. This leads to rapid market expansion as more people desire the advanced, specialized treatments required to manage their chronic migraines. The growth in the adoption of these therapies will continue to drive the market in the future.

Pain Management by Indication

In 2023, The Neuropathic Pain Management Solutions segment dominated the market due to delegated neuropathic conditions, diabetic neuropathy, and postherpetic neuralgia. These diseases are chronic and complicated, afflicting around 7-10% of the population worldwide; hence, research and development remains high, making neuropathic pain one of the largest markets.

Musculoskeletal pain was the fastest-growing segment contributing 16% of market share in 2023, driven by the rising prevalence of conditions such as back pain and osteoarthritis, affecting over 1.7 billion people worldwide. Demand for innovative, minimally invasive treatments and regenerative therapies is further accelerating this growth.

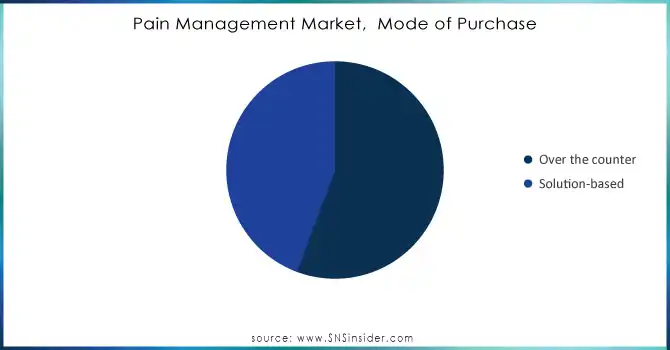

Pain Management by Mode of Purchase

The Over-The-Counter (OTC) segment dominated the pain management market in 2023, as consumers prefer easy access and affordability. Common OTC products such as NSAIDs and acetaminophen are accessible for pain relief and are often the first choice of many individuals seeking self-care solutions. In 2023, the OTC segment recorded a significant 15% year-on-year growth as these products are often more affordable and perceived as safer than prescription medications. This reflects the wider global shift towards self-medication and increasing dependence on over-the-counter drugs to alleviate pain among consumers.

Need Any Customization Research On Pain Management Market - Inquiry Now

Pain Management by End-User

The Emergency Clinics And Facilities segment dominated the end-user pain management market due to the primary centers for advanced pain management therapies, including surgical interventions and neuromodulation. These facilities are the first point of contact for patients with chronic and severe pain.

The Clinical Gadget Organizations segment is the fastest-growing in the pain management market, driven by innovations in wearable devices and neuromodulation technologies. The segment is boosted by growing AI-integrated solutions along with partnerships between companies and research institutions to match the rising demand for options for non-invasive relief from pain.

Pain Management Market Regional Insights

In 2023, the North America region dominated the pain management market, bolstered by its advanced healthcare systems, high levels of awareness, and significant investments in research and development. With around 20% of adults affected by chronic pain, the region is also burdened with a large number of pain-related conditions. Added to this is the availability of advanced technologies such as neuromodulation devices and an increasing shift toward non-opioid therapies, further strengthening the market. The U.S. takes the lead in the development and approval of new pain management treatments, including the monoclonal antibody for migraine approved by the FDA in 2024. This is further cementing North America's position as a global leader in the area.

The Asia Pacific region is expected to have the fastest growth throughout the forecast period. The reason for this growth is due to the large, aging population; the increasing incidence of lifestyle-related diseases; and improvement in healthcare infrastructure. The region is highly plagued with musculoskeletal disorders, especially widespread back pain and arthritis, which greatly affect its population. With increased awareness about the available pain management alternatives and increased disposable incomes, advanced therapies are increasingly being used. In addition, government programs that enhance healthcare access and also investments in the production of medical devices are promoting the market. Most of these are taking place in populous countries like China and India, with rapidly developing pharmaceutical industries.

Key Players in Pain Management Market

• Pfizer Inc. (Celebrex, Lyrica)

• Johnson & Johnson (Janssen Pharmaceuticals) (Nucynta, Tylenol)

• Eli Lilly and Company (Emgality, Cymbalta)

• Teva Pharmaceutical Industries (Ajovy, Actiq)

• Abbott Laboratories (Proclaim XR, Voltaren Gel)

• Boston Scientific Corporation (Spectra WaveWriter, Vercise DBS)

• Medtronic plc (Intellis, SynchroMed II)

• GlaxoSmithKline (GSK) (Panadol, Voltfast)

• Novartis AG (Aimovig, Voltaren XR)

• Sanofi (Ketoprofen, Plaquenil)

• Allergan (AbbVie) (Botox, Bystolic)

• AstraZeneca (Nexium, Seroquel)

• Bayer AG (Aspirin, Aleve)

• Purdue Pharma (OxyContin, MS Contin)

• Endo Pharmaceuticals (Percocet, Lidoderm)

• Zogenix, Inc. (Sumavel DosePro, Relday)

• Takeda Pharmaceuticals (Trintellix, Amitiza)

• Merck & Co., Inc. (Arcoxia, Zostavax)

• Bristol Myers Squibb (Opdivo, Abraxane)

• Nevro Corp. (Senza, Omnia)

Key Suppliers (Raw Materials, Active Pharmaceutical Ingredients (Apis), Packaging, And Specialized Components)

• BASF SE

• Evonik Industries AG

• Lonza Group

• Catalent, Inc.

• West Pharmaceutical Services, Inc.

• DSM Nutritional Products

• DuPont (Pharmaceutical Solutions)

• Eastman Chemical Company

• Ashland Global Holdings Inc.

• 3M Health Care

Recent Developments

-

In March 2023, Pfizer Inc. received U.S. FDA approval for ZAVZPRET (zavegepant), a nasal spray that is the first and only calcitonin gene-related peptide (CGRP) receptor antagonist for the acute treatment of migraines with or without aura in adults. The approval followed a successful Phase 3 study, where ZAVZPRET demonstrated statistically superior outcomes to a placebo, achieving pain freedom and freedom from the most bothersome symptom within two hours post-dose

-

On August 22, 2023, Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson, announced that the European Commission granted conditional marketing authorization for TALVEY (talquetamab) as a monotherapy to treat adults with relapsed and refractory multiple myeloma (RRMM). This approval applies to patients who have undergone at least three prior therapies and showed disease progression after the last treatment

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 73.24 Billion |

| Market Size by 2032 | US$ 108.48 Billion |

| CAGR | CAGR of 4.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Non-steroidal Anti-inflammatory Drugs (NSAIDs), Anticonvulsants, Sedatives, Narcotics, Antimigraine Specialists, Antidepressants, Others) •By Indication (Neuropathic Pain, Cancer Pain, Facial Pain and Migraine, Musculoskeletal Pain, Fibromyalgia, Chronic Back Pain, Joint Pain, Headache, Post-operative Pain) •By Mode of Purchase (Over the Counter, Prescription-based) •By End-User (Hospitals and Clinics, Pharmaceutical Companies, Medical Device Companies, Research, Academic Institutions, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., Johnson & Johnson, Eli Lilly and Company, Teva Pharmaceutical Industries, Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, GlaxoSmithKline (GSK), Novartis AG, Sanofi, Allergan (AbbVie), AstraZeneca, Bayer AG, Purdue Pharma, Endo Pharmaceuticals, Zogenix, Inc., Takeda Pharmaceuticals, Merck & Co., Inc., Bristol Myers Squibb, Nevro Corp., and other players. |

| Key Drivers | •Increasing Incidence of Chronic Pain and Related Conditions •Non-opioid and Minimally Invasive Therapies for Chronic pain |

| Restraints | •High Treatment Costs and Limited Reimbursement Coverage of pain management |