Online Pharmacy Market Size Analysis:

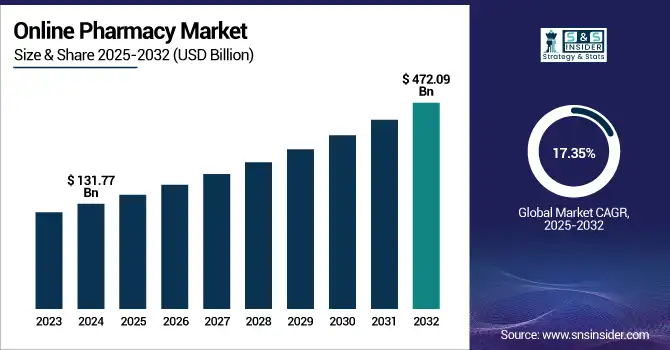

The Online Pharmacy Market size was valued at USD 131.77 billion in 2024 and is expected to reach USD 472.09 billion by 2032, growing at a CAGR of 17.35% over the forecast period of 2025-2032.

The global online pharmacy market is growing rapidly due to the increasing penetration of the internet, the demand for contactless healthcare services, and the benefit of home delivery. The promotion is also being catalysed by improvements in digital health platforms and e-prescription technologies. The consumer balance has slowly been tipping over to its mobile side for OTC and prescription purchases alike. The market is anticipated to grow at a steady pace owing to the supportive regulatory changes and the growing chronic disease prevalence, making online pharmacy a critical pillar in the future of healthcare delivery.

To Get more information on Online Pharmacy Market - Request Free Sample Report

The U.S. online pharmacy market size was valued at USD 47.41 billion in 2024 and is expected to reach USD 165.16 billion by 2032, growing at a CAGR of 16.94% over the forecast period of 2025-2032. The U.S. holds the largest market share in North America due to a sophisticated health care infrastructure and significant use of digital health technologies. The internet is prevalent in China, and the regulatory framework is accommodating, which further drives the adaptation of online pharmacy services in the country.

Global Online Pharmacy Market Dynamics:

Drivers

-

Market Growth is Driven by Growing Internet and Smartphone Penetration

The creation of strong internet connectivity and the widespread use of smartphones have allowed more consumers to become accustomed to the digital approach to services, including accessing pharmacies. As high-speed internet has become more mainstream, especially in urban and semi-urban regions, and a majority of the population now owns a smartphone, online pharmacies have become a convenient way to buy medicines. Such connectivity enables users to view products, seek advice from health professionals, and order medicines wherever they are, and at any time, shattering geographical barriers and improving accessibility.

About 5.5 billion people are on the internet, 68% of the world population, by 2024. This represents a 3.4% growth compared to 2023, and is a testament to the increasing global reach of digital access.

The number of smartphones in use globally is still on the rise, with 7 billion devices. By 2025, about 7.21 billion people are predicted to have smartphones, making up approximately 90% of the human population.

-

Growing Awareness of Digital Health Solutions is Propelling the Market Growth.

Increased adoption and trust in digital health technologies such as telemedicine, e-prescription, and mobile health apps. With growing comfort in these digital tools from both health care providers and patients, online pharmacies are becoming even more part of the health care ecosystem. It drove the consumer to ask for remote consultations and fill prescriptions over the internet, making digital pharmacies a popular choice for convenience, anonymity, and efficiency. Primarily concerning the digital health services and an interaction with the online pharmacies that propels the growth of the digital pharmacy market.

There are now 337,000 health apps, including the rise of disease-specific tools that bring value back to health systems.

Restraint

-

Rural Regions with Scarce Internet Access Are Hampering Market Expansion.

A significant hindrance to the online pharmacy market is the internet connectivity in rural and remote areas. Problems such as a lack of network infrastructure, low broadband speeds, and unreliable internet service prevent residents from accessing the online territory in much of those areas. As a result, a large percentage of the population is still unable to savor the convenience and availability that online pharmacies bring. This has caused a limitation to the market growth in these areas as the internet and digital literacy improve.

Online Pharmacy Market Segmentation Analysis:

By Product Type

The medication & treatments segment holds a significant share in the online pharmacy market in 2024 as it accounts for essential prescribed and over-the-counter medications for chronic and acute health issues. Given the importance of these medications, consumers are focused on convenience as well as immediate access, which has resulted in strong demand for online drug delivery platforms that offer reliable delivery and varied coverage. Furthermore, the rising incidence of chronic diseases and the growing aging patient pool globally are contributing to the stability of this segment, ensuring the importance of this segment in the online pharmacy industry.

The health, wellness, and nutrition segment is projected to be the fastest-growing segment in the forecast period owing to increasing consumer demand for preventive healthcare and comprehensive well-being. A rise in interest regarding supplements, vitamins, and other natural health products, paired with an increase in health issues occurring due to lifestyle, is driving the demand. This is supplemented by the super convenience of online shopping with personalized product recommendations, as well as e-commerce penetration reaching all-time highs in emerging markets as consumers become more proactive about improving their holistic health.

By Platform

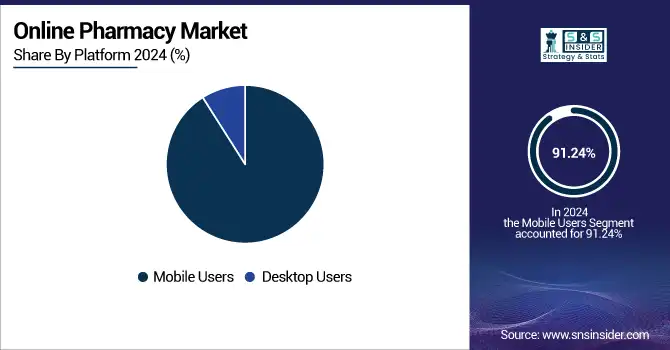

The mobile users segment dominated the online pharmacy market share with a 91.24% in 2024, with the rapid adoption of smartphones and the convenience they bring to receive healthcare services. As mobile devices allow users to access the internet, order drugs, and have them delivered anywhere and at any time, digital pharmacies have proven to be particularly convenient. The addition of customer-oriented apps, in-app payments, and real-time tracking of orders on mobile has further improved the customer experience and has provided the most extensive usage and market share or dominance in 2024.

The mobile users segment is anticipated to exhibit the fastest growth in the forecast period as the proliferation of smartphones is still on the rise across the world, aided by higher penetration in developing countries. With increasing digital literacy and enhanced mobile internet penetration, the percentage of consumers using mobile platforms to address healthcare needs is rising. Moreover, mobile app-based teleconsultations and innovations, including the use of AI for personalized recommendations and high integration with wearable health devices, are anticipated to continue driving growth, making mobile the preferred online pharmacy services platform.

By Drug Type

In 2024 online pharmacy market is dominated by the prescription medicines segment with an 83.14% market share. Participants are due to their patients with chronic health conditions that require ongoing drug therapy, and patients with acute health conditions needing timely access to prescription drugs are their target audience. For patients with mobility challenges or who live in more remote locations, online pharmacies serve as a practical and discreet line of access to these essential meds. The rising prevalence of chronic diseases and the increasing adoption of e-prescriptions among healthcare providers have boosted the demand for prescription medicines through online channels.

The OTC medicines segment is projected to exhibit the fastest growth in the forecast years due to increasing consumer awareness regarding self-care and preventive health. Over-the-counter products: From vitamins to supplements to common remedies, more people are seeking over-the-counter products as a quick fix, without a prescription. Increasing availability of services, low cost, and widening range of products offered through online mode are facilitating adoption at a rapid pace amongst the tech-savvy young population who are looking for convenience in their health needs.

Regional Insights:

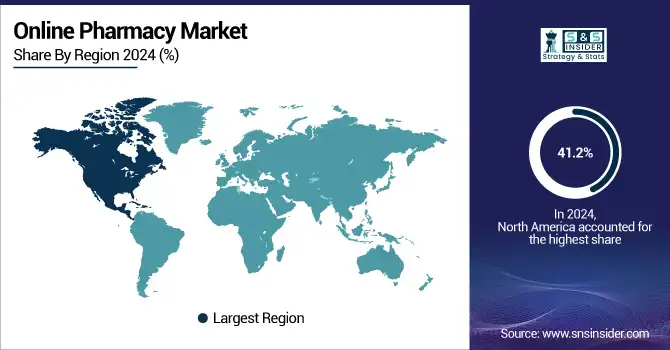

North America dominated the online pharmacy market with a 41.2% market share in 2024, due to the well-established healthcare infrastructure, high penetration of internet and smartphone users, and the early adoption of digital health technologies. The leadership is accompanied by emerging top market players, CVS Health, Walgreens, and Amazon Pharmacy. Furthermore, the proliferation of insurance coverage and the increase in consumer demand for convenience, along with favorable regulatory policies regarding telehealth, telemedicine, and e-prescriptions, have made it possible for online pharmacy services to expand quickly. Additionally, the pandemic made a push for some sort of digital transformation in healthcare, which led North America to a solid position in leading the market.

The fastest growing region of the online pharmacy market is Asia Pacific with an 18.48% CAGR over the forecast period, owing to the significant size coupled with increasing penetration of the internet in urban as well as rural areas and rising demand for advanced healthcare. With growing online pharmacy platforms, including e-pharmacies, government initiatives to promote digital health, and e-commerce, India and China are among the countries experiencing the highest growth in their e-pharmacy market. Moreover, the growing prevalence of chronic diseases, the need for cost-effective drugs, and contactless healthcare solutions to driving market growth in the region in turn. Regional growth has been driven by local players, and startups are quickly scaling operations.

The online pharmacy market in Europe is witnessing significant growth, which can be attributed to a few significant factors. The rise of chronic diseases and the elderly population are two of the biggest drivers because these populations need regular medicine and can get it easily from online pharmacies. For instance, in Germany, the proportion of the population over the age of 60 is more than 30%, which increases demand for prescription medications and will help to drive e-pharmacies.

The widespread availability of the Internet and smartphones in Europe is another factor that promotes online pharmacy services. Digital health initiatives implemented in countries such as Germany and the UK, such as mandatory e-prescriptions, have made it easier for patients to buy drugs over the internet. Telemedicine and AI-driven personalization add to the customer experience and show why online pharmacies are becoming a go-to for those looking for efficiency and convenience with their healthcare.

The online pharmacy market in Latin America has moderate growth because of the rising middle class and internet access. This expansion is being propelled by countries that have implemented government initiatives to increase access to essential medicines. Nonetheless, barriers such as economic instability, lack of internet access in rural areas, and fears of data insecurity are still hindering the speed at which these technologies are evolving. However, these challenges have not held back the improvement of access and convenience of digital health platforms and telemedicine services for consumers.

The online pharmacy market in the Middle East & Africa (MEA) is experiencing moderate growth, with increasing internet and smartphone penetration coupled with a higher preference for digital healthcare transactions. This growth is being fueled by key countries, particularly Saudi Arabia, the UAE, and Egypt, through government efforts to enhance digital health initiatives in the region. Although challenges such as partial internet penetration in certain regions, regulatory nuances, and trust concerns exist, e-pharmacies are overcoming them with ease by providing flexible payment options, working in tandem with local pharmacies, and embracing telemedicine and AI technologies to improve engagement and experience.

Get Customized Report as per Your Business Requirement - Enquiry Now

Online Pharmacy Market Key Players

CVS Health Corporation, Walgreens Boots Alliance, Amazon Pharmacy, Alibaba Health Information Technology, Netmeds, Tata 1mg, PharmEasy, Rite Aid Corporation, Capsule Pharmacy, Apollo Pharmacy, and other players.

Recent Developments in the Online Pharmacy Market

-

Apr. 2024- Walgreens is expanding its specialty pharmacy services and investing in its capabilities as the company further grows its core pharmacy business to improve patient outcomes and provide greater value to payers and partners. The company introduced Walgreens Specialty Pharmacy, a holistic offering that expands access to care for patients with complex, chronic conditions and enables partnerships that drive profitability for Walgreens’ pharmacy business. The company is also making investments that will transform its specialty pharmacy offerings, including gene and cell therapy services.

-

In October 2024, Amazon Pharmacy plans to open pharmacies in 20 new cities across the U.S. in 2025, more than doubling the number of cities where customers can get Same-Day Delivery of their medications. Amazon is leveraging its vast logistics network and advanced automation technology to solve one of pharmacy’s biggest pain points: the lack of convenient, affordable access to medications.

Online Pharmacy Market Report Scope:

Report Attributes Details Market Size in 2024 USD 131.77 Billion Market Size by 2032 USD 472.09 Billion CAGR CAGR of 17.35% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product Type (Medication & Treatments, Health, Wellness, and Nutrition, Personal Care and Essentials, Others)

• By Platform (Mobile Users, Desktop Users)

• By Drug Type (OTC Medicines, Prescription Medicines)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles CVS Health Corporation, Walgreens Boots Alliance, Amazon Pharmacy, Alibaba Health Information Technology, Netmeds, Tata 1mg, PharmEasy, Rite Aid Corporation, Capsule Pharmacy, Apollo Pharmacy, and other players.