Offshore Support Vessel Market Report Scope and Overview:

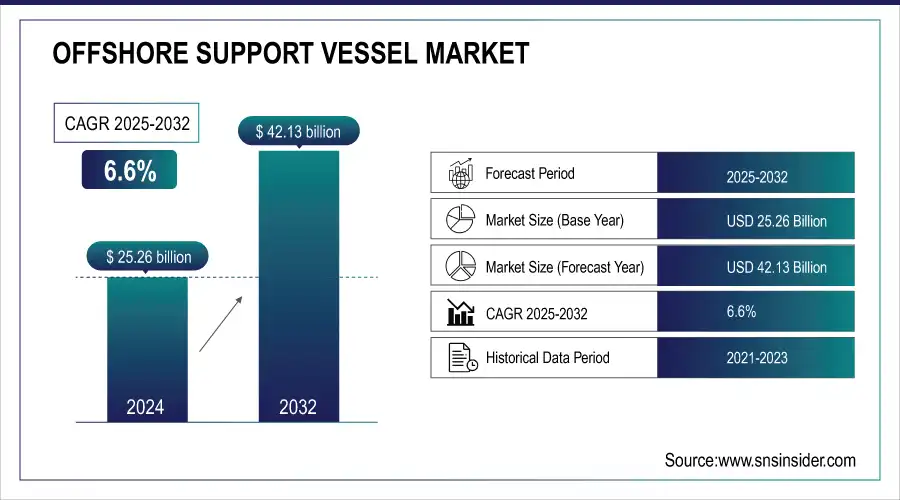

The Offshore Support Vessel Market size was valued at USD 25.26 billion in 2024 and will hit USD 42.13 billion by 2032 and grow at a CAGR of 6.6% by 2025-2032.

According to 46 CFR 125.160, a vessel that is propelled by machinery other than steam, does not meet the definition of a passenger vessel, is greater than 15 GT, and regularly transports goods, supplies, people other than the crew, or equipment in support of the exploration, exploitation, or production of offshore mineral or energy resources is referred to as an "offshore supply vessel.

Get More Information on Offshore Support Vessel Market - Request Sample Report

In order to support the exploration, exploitation, and production of offshore mineral and energy resources, the OSV has developed into a vessel of various functions. Some of the typical OSV varieties that we find on the market today are shown in the accompanying images and service descriptions.

Offshore Support Vessel Market Highlights:

-

Market scope includes pre-design feasibility studies, vessel categorization checks, class regulations and notations, dynamic positioning (DP) systems, hull optimization, emission and fuel reduction, and solutions for noise, vibration, and comfort

-

Drivers include expanding initiatives for sustainable energy and low-carbon power production boosting OSV demand, with governments and organizations funding renewable energy projects such as the U.K.’s USD 205.39 million support to Siemens Gamesa for offshore wind manufacturing

-

Restraints involve high capital costs and fluctuating global crude oil prices that impede market growth, as OSV construction requires specialized facilities, dry docking, and technical expertise, making operations costly

-

Opportunities arise from replacing and decommissioning ageing offshore infrastructure, especially in the North Sea, with over the next decade around 150 wells and 12 platforms expected to be retired annually

-

Regulatory and technical focus emphasizes compliance with International Maritime Organization (IMO) standards and continuous improvement of vessel reliability, safety, and operational efficiency

Offshore Support Vessel Market Covers Pre-design feasibility studies and categorization pre-checks, Regulations for classification and a lovely collection of class notations outlining the capabilities and functions of the vessel, Dynamic positioning (DP) systems and evaluation/improvement of essential systems' dependability, Optimisation of the hull, decreased emissions, and decreased fuel use, Solutions for noise, vibration, and comfort.

Offshore Support Vessel Market Drivers:

-

expanding initiatives to install more sustainable energy to boost demand for OSVs

In order to promote the use of low-carbon power production technology in various regions, several regional and international organisations have put out substantial policies. Furthermore, in order to reduce carbon emissions, several governments have set lofty goals for renewable energy projects. For instance, the U.K. government announced in August 2021 that it will finance Siemens Gamesa with around USD 205.39 million under the "Offshore Wind Manufacturing Investment Support" programme. The increased investment will maintain economic growth in the Humber and Yorkshire area, according to Siemens Gamesa. Offshore Support Vessel (OSV) market growth is anticipated to benefit from this.

Offshore Support Vessel Market Restraints:

-

High capital costs combined with fluctuating crude oil prices globally might impede market expansion.

The building of an offshore support vessel demands a sizably large sum of money in addition to highly specialised technical knowledge to meet the specific requirements. To create and store support boats, shipowners must develop specialised facilities like docking bays and construction facilities. Different capacity boats are constructed, maintained, and repaired in a dry dock unit area. Every ship must be dry-docked by the International Maritime Organisations (IMO) at regular intervals to keep its machinery, hull, structures, and other equipment in working order. Furthermore, suddenly fluctuating global petroleum prices have a significant impact on offshore exploration and production activities. Costly activities are unable to carry out due to lower crude oil prices.

Offshore Support Vessel Market Opportunities:

-

Replacing ageing offshore infrastructure and decommissioning it.

Due to the epidemic, oil and gas businesses have reduced their capital expenditures and operating costs; therefore, decommissioning operations is expected to incur higher costs. The market for offshore support vessels is anticipated to see new growth potential as a result of the North Sea's ageing offshore infrastructure. Decommissioning Insight study, Clyde and Co. Oil & Gas UK predicted that over the next ten years, 150 wells will be abandoned yearly and roughly 12 platforms will be withdrawn from the UK North Sea.

Offshore Support Vessel Market Segment Analysis:

By Material

Steel is the most commonly used material for offshore support vessel hulls due to its high strength, durability, and cost-effectiveness. However, composite materials and aluminum are the fastest-growing choices, gaining traction in specialized vessels where weight reduction, improved fuel efficiency, or enhanced corrosion resistance is important.

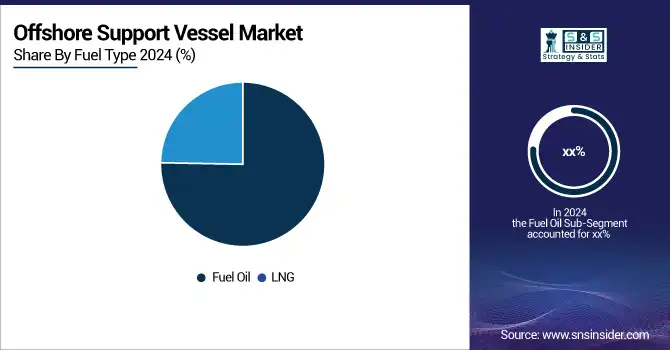

By Fuel Type

Fuel oil continues to dominate as the primary fuel for offshore support vessels due to its widespread availability and established infrastructure. However, LNG is the fastest-growing alternative, driven by stricter environmental regulations and the push for cleaner, low-emission operations, making it increasingly attractive for modern, sustainable offshore vessel fleets.

By Type

Platform Support Vessels (PSVs) and Anchor-handling Tug Supply Vessels (AHTS) dominate the offshore support vessel market, holding the largest share due to their essential roles in oil and gas operations. Multipurpose Support Vessels (MPSVs) and Crew Vessels are the fastest-growing, driven by offshore wind projects and the need for versatile, flexible operations.

By Application

Shallow water operations dominate offshore support vessel activities in regions such as the Gulf of Mexico, North Sea, and Southeast Asia. Meanwhile, deepwater applications are the fastest-growing segment, expanding rapidly due to new offshore oil and gas discoveries and the development of offshore wind projects in deeper waters.

By End-User Industry

Offshore Oil & Gas remains the largest end-user of offshore support vessels, driving consistent demand across global markets. Offshore wind, however, is the fastest-growing segment, particularly in Europe, Asia-Pacific, and North America, fueled by renewable energy targets and the increasing number of new offshore wind farm installations.

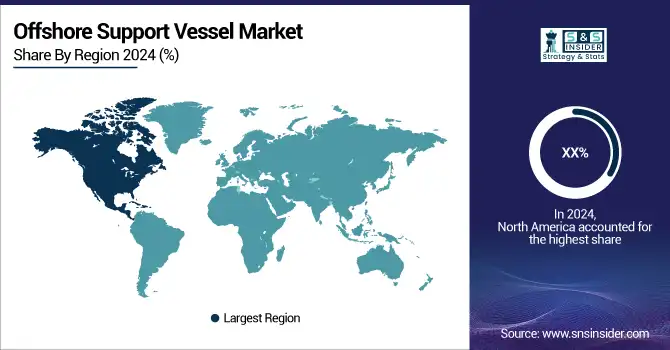

Offshore Support Vessel Market Regional Analysis:

North America Offshore Support Vessel Market Trends:

North America will see enormous expansion, Because of the increased production from both conventional and unconventional reservoirs. The regional landscape will also improve as a result of growing investments by oil and gas companies in the exploration of high-volume deposits. To give an example from the recent past, in the seas of the U.S. Gulf of Mexico, a major energy firm by the name of Equinor discovered a new reservoir with a net oil pay of over 200 feet.

Need any customization research on Offshore Support Vessel Market - Enquiry Now

Europe Offshore Support Vessel Market Trends:

Europe’s offshore support vessel market is expected to grow steadily, driven by the expansion of offshore oil & gas projects in the North Sea and the rapid development of offshore wind farms. Investments in renewable energy and decommissioning of aging platforms are also supporting demand for specialized vessels.

Asia-Pacific Offshore Support Vessel Market Trends:

The Asia-Pacific region is witnessing rapid growth due to rising offshore exploration activities in countries like China, India, and Australia. Increasing energy demand, deepwater discoveries, and investments in offshore wind projects are driving the deployment of advanced OSVs, particularly in shallow and deepwater operations.

Latin America Offshore Support Vessel Market Trends:

Latin America’s OSV market is expanding, supported by offshore oil discoveries in Brazil and other South American countries. Investments in deepwater production, particularly in the Santos and Campos basins, are fueling demand for Platform Support Vessels, AHTS vessels, and multipurpose support vessels.

Middle East & Africa Offshore Support Vessel Market Trends:

The Middle East and Africa at cheap capital costs, due to the large, untapped reservoirs that are available in it is anticipated that these regions will account for a sizeable portion of the market. As a result, the addition of cutting-edge FPSO vessels to produce bulk quantities from various offshore deposits is expected to significantly enhance the regional landscape. The Nigerian Agip Exploration Ltd. announced an acquisition in January 2021.

Offshore Support Vessel Market Competitive Landscape:

Tidewater Inc., established in 1956 and headquartered in Houston, Texas, is a leading provider of offshore support vessels and marine services for the global energy industry. Operating the world’s largest OSV fleet, the company supports offshore oil, gas, and wind projects with towing, anchor handling, supply transport, and subsea services.

- Tidewater Inc. announced in March 2023 that it has reached a final deal to buy 37 platforms from Solstad Offshore ASA (SOFF). PSVs, or supply vessels.

Bourbon Offshore Services, established in 1948 and headquartered in Marseille, France, is a leading provider of offshore marine services specializing in the oil, gas, and renewable energy sectors. The company offers a comprehensive range of services, including offshore logistics, anchor handling, towing, subsea operations, and integrated logistics support. With a global presence in over 30 countries and a fleet of modern vessels, Bourbon Offshore Services is committed to delivering safe, efficient, and sustainable solutions to its clients.

- Tethys Marine & Logistics, a Guyanese business, will join Bourbon Marine & Logistics as a partner in April 2023 and become a 51% stakeholder of the Bourbon Guyana Joint Venture. Bourbon Guyana will be the first indigenous operator of offshore support vessels, completely complying with the most recent local content laws, with 75% Guyanese Directors.

Maersk A/S, commonly known as Maersk, is a Danish integrated container logistics company founded on April 16, 1904, by Arnold Peter Møller and his father Peter Mærsk Møller in Svendborg, Denmark. Headquartered in Copenhagen, Maersk operates in over 130 countries and employs more than 100,000 people globally. The company offers a comprehensive range of services, including container shipping, port operations, supply chain management, warehousing, and air freight.

- Three L-class anchor handlers will be used by Maersk under a three-year agreement with Petrobras, a state-owned Brazilian multinational business in the petroleum sector, to perform a variety of anchor handling tasks including rig moves. This action is a part of Maersk's attempts to fortify its position as a leading supplier of integrated solutions in the Brazilian market for supply chain services.

Offshore Support Vessel Market Key Players:

-

Wärtsilä (Finland)

-

Damen Shipyards Group (Netherlands)

-

Solstad Offshore ASA (Norway)

-

Maersk Supply Service (Denmark)

-

SEACOR Marine Holdings (U.S.)

-

Tidewater Marine (U.S.)

-

Siem Offshore (Norway)

-

BOURBON (France)

-

MMA Offshore Limited (Australia)

-

Havila Shipping ASA (Norway)

-

Edison Chouest Offshore (U.S.)

-

Nam Cheong Offshore Pte. Ltd (Malaysia)

-

Hornbeck Offshore (U.S.)

-

OSM Maritime Group (Norway)

-

Pacific Radiance Ltd (Singapore)

-

GulfMark Offshore (U.S.)

-

Farstad Shipping ASA (Norway)

-

Eastern Shipbuilding Group (U.S.)

-

Vroon Offshore Services (Netherlands)

-

Atlantic Offshore (U.S.)

| Report Attributes | Details |

| Market Size in 2024 | USD 25.26 Billion |

| Market Size by 2032 | USD 42.13 Billion |

| CAGR | CAGR of 6.6% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Offshore Support Vessel Materials, Cladding Materials) • By Fuel Type (Fuel Oil, LNG) • By Type (Anchor-handling Tug Supply Vessels, Platform Support Vessels, Multipurpose Support Vessels, Standby and Rescue Vessels, Crew Vessels, Seismic Vessels, Chase Vessels, Other Vessels) • By Application (Deepwater, Shallow Water) • By End-user industry (Offshore Oil & Gas, Offshore Wind) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Wartsila (Finland), Damen Shipyards Group (Netherlands), Solstad Offshore ASA (Norway), Maersk Supply Service (Denmark), SEACOR Marine Holdings (U.S.), Tidewater Marine (U.S.), Siem Offshore (Norway), BOURBON (France), MMA Offshore Limited (Australia), Havila Shipping ASA (Norway), Edison Chouest Offshore (U.S.), Nam Cheong Offshore Pte. Ltd (Malaysia), Hornbeck Offshore (U.S.) |