Optical Interconnect Market Size Analysis:

The Optical Interconnect Market Size was valued at USD 17.89 billion in 2025 and is expected to grow at a CAGR of 14.14% to reach USD 67.14 billion by 2035.

The global market includes regional performance with a detailed analysis involving product, link level, fiber mode, data rate, application, and distance. For the purpose of high-speed data transmission, escalating demand drives the rapid adoption of optical links. Also, cloud infrastructure does now expand, and both AI-powered data centers and hyperscale data centers do increasingly deploy too. Next-generation digital ecosystems need these technologies to support massive data flow, low latency, with energy efficiency; they globally propel strong growth in telecommunications, enterprise, with data-intensive applications.

Over 80% of data center links within hyperscale environments now rely on optical interconnects rather than traditional copper cabling.

Market Size and Forecast:

-

Market Size in 2025 USD 17.89 Billion

-

Market Size by 2035 USD 67.14 Billion

-

CAGR of 14.14% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2021-2024

To Get More Information On Optical Interconnect Market - Request Free Sample Report

Optical Interconnect Market Trends:

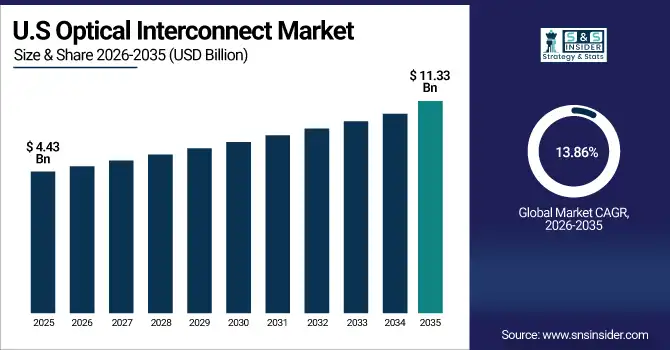

The U.S. Optical Interconnect Market size was USD 4.43 billion in 2025 and is expected to reach USD 11.33 billion by 2035, growing at a CAGR of 13.86% over the forecast period of 2026–2035.

The U.S. market experiences meaningful growth because photonic technologies get strongly adopted in hyperscale data centers, advanced computing, as well as 5G infrastructure. The U.S. also gains from AI training clusters, silicon photonics R\&D, and nationwide digital transformation initiatives. Due to all of these kinds of advancements within government and also enterprise sectors, the country is now a global innovation hub for optical connectivity solutions. These solutions drive rapid demand in links that must be high-speed and low-latency to support next-generation communication and computing architectures.

Over 95% of new hyperscale data center builds in the U.S. use optical fiber as the primary interconnect medium.

AI training workloads in the U.S. require interconnect speeds of 400 Gbps and beyond, driving photonic integration in HPC environments.

Optical Interconnect Market Dynamics:

• Rapid transition from copper to optical links inside data centers, driven by bandwidth scaling beyond 400G and the need to support 800G/1.6T architectures for AI and HPC workloads.

• Increasing adoption of co-packaged optics (CPO) and silicon photonics to reduce power consumption, signal loss, and latency in high-density switching and compute environments.

• Strong growth in optical interconnect deployment at the edge, supporting latency-sensitive applications such as AR/VR, autonomous systems, and real-time analytics.

• Rising emphasis on energy-efficient networking, with operators prioritizing optical solutions to meet sustainability targets and manage escalating data center power and cooling costs.

• Integration of optical interconnects into next-generation wireless infrastructure, including 5G Advanced and early 6G research, to enable ultra-high-speed backhaul and fronthaul connectivity.

Optical Interconnect Market Growth Drivers:

-

Surging demand for high-speed data transmission in hyperscale data centers and cloud infrastructure globally fuels optical interconnect adoption.

As hyperscale data centers expand globally, there's a critical need for high-speed, low-latency interconnect solutions to manage data-intensive workloads. Optical interconnects offer higher bandwidth, low power consumption, and increased scalability, making them vital for next-gen cloud computing, edge processing, and AI/ML acceleration. Rapid digitalization, coupled with increasing video content, IoT devices, and smart services, continues to pressure traditional copper-based systems, leading to large-scale deployment of optical links to meet performance expectations.

Video is expected to make up over 82% of all IP traffic by 2027, requiring ultra-fast, low-latency network backbones.

Optical interconnects can transmit data over 10 times farther than copper with up to 70% less power usage in dense computing environments.

Optical Interconnect Market Restraints:

-

High initial capital investment and complex integration limit adoption across cost-sensitive industries.

While optical interconnects deliver performance advantages, their deployment often requires substantial upfront investment in photonic components, specialized transceivers, and advanced packaging. Integration into legacy infrastructure poses compatibility issues, increasing implementation complexity. For smaller enterprises or budget-constrained sectors, these barriers hinder rapid adoption. Additionally, skilled workforce shortages and a lack of standardized photonic platforms contribute to longer deployment cycles and limit commercialization at lower market tiers.

Optical Interconnect Market Opportunities:

-

Expansion of edge computing and 6G research initiatives offer long-term growth avenues.

The move toward distributed computing—especially edge data centers—requires faster, localized data processing with robust interconnects. Optical technologies are well-suited to meet these demands with minimal latency and interference. Moreover, global investments in 6G research are exploring ultra-fast optical backhaul and terahertz communications, positioning optical interconnects as foundational technologies. These innovations promise to expand optical adoption beyond central data centers into mobile, embedded, and hybrid edge networks over the next decade.

Optical interconnects consume up to 60% less power per gigabit than electrical alternatives, which is critical for power-constrained edge environments.

The share of real-time applications—such as AR/VR and autonomous systems—requiring ultra-low latency has risen by 50% since 2021.

Optical Interconnect Market Segment Analysis:

By Product

Optical Transceivers dominated the Optical Interconnect Market with the highest revenue share of about 26.7% in 2025 due to their essential role in enabling high-speed communication across networks. These components serve as the backbone for transmitting and receiving data in data centers and telecom environments. Companies like II-VI Incorporated have been pivotal in advancing transceiver technologies to support 100G, 400G, and beyond. Their compatibility with multiple data rates and flexible integration into diverse infrastructures reinforces their market leadership across enterprise and carrier networks.

Silicon Photonics is expected to grow at the fastest CAGR of about 12.82% from 2026–2035, driven by rising demand for miniaturized, low-power interconnects in AI and cloud applications. These systems integrate optical functionality directly onto silicon chips, improving speed and energy efficiency. Intel Corporation, a leading player in this field, continues to invest in developing scalable silicon photonic platforms for server-to-server and chip-to-chip connections, making it easier for data centers to meet high-speed computing needs at reduced cost and power.

By Interconnect Level

Metro & Long-haul Optical Interconnect held the highest revenue share of about 42% in 2025 due to its widespread deployment in telecommunications and broadband backbone systems. These interconnects provide the bandwidth and distance needed for urban and international data transmission. Firms like Ciena Corporation play a crucial role in enabling these long-distance connections through high-capacity optical networking solutions. Their products support dense wavelength division multiplexing (DWDM), which helps carriers transmit massive data loads efficiently over hundreds of kilometers.

Chip & Board-Level Optical Interconnect is expected to grow at the fastest CAGR of about 24.5% from 2026–2035 as chiplet-based architectures and on-chip photonics demand surge in AI training and high-performance computing clusters. With increasing need for low-latency, high-throughput processing, companies such as Ayar Labs are pioneering optical I/O solutions that eliminate traditional bottlenecks in electronic interconnects, enabling chip-level data transfer speeds previously unachievable through copper-based alternatives.

By Fiber Mode

Single Fiber Mode dominated the Optical Interconnect Market with the highest revenue share of about 61.5% in 2025, primarily due to its extensive use in long-distance and backbone optical communication networks. This mode supports minimal dispersion and high-speed transmission over long ranges. Lumentum Holdings Inc. is one of the key providers of single-mode solutions, offering robust transceivers and optical amplifiers that facilitate seamless transmission across telecom and enterprise infrastructure networks.

Multifiber Mode is expected to grow at the fastest CAGR of about 14.68% from 2026–2035 due to its suitability for short-range, high-throughput applications such as intra-data center and rack-level connectivity. These cables allow simultaneous transmission of multiple light signals, improving density and scalability. CommScope is enhancing its position in this segment by offering advanced multifiber connectivity solutions like MPO/MTP assemblies that enable faster installations and greater bandwidth within high-performance computing environments.

By Data Rate

10–50 Gbps segment held the highest revenue share of about 30.5% in 2025, largely due to its widespread use in mid-range telecom and enterprise networks. It offers a balance between performance and cost, supporting a wide range of existing infrastructures. Companies like Fujitsu Optical Components continue to provide reliable and efficient 10G to 50G optical modules, maintaining high demand in regional networks, aggregation layers, and enterprise interconnects.

More than 100 Gbps segment is projected to grow at the fastest CAGR of about 15.53% from 2026–2035, driven by explosive growth in AI workloads, ultra-HD content, and cloud-native applications requiring ultra-fast interconnects. Key innovators such as Infinera Corporation are delivering scalable, high-capacity optical platforms that can handle terabit-level data transmission, powering the evolution of next-generation cloud and hyperscale data infrastructures.

By Application

Data Communication led the Optical Interconnect Market with the highest revenue share of about 58.5% in 2025 due to the booming demand from hyperscale data centers, high-performance computing, and the growing reliance on AI and analytics. This segment demands ultra-fast and scalable interconnect solutions to support massive data throughput and low-latency processing. It is also expected to grow at the fastest CAGR of about 14.63% from 2026–2035 as enterprises and service providers expand their digital infrastructure across cloud and edge environments. Companies like Cisco Systems and Arista Networks are heavily investing in advanced optical networking technologies, integrating high-speed optical interfaces into networking equipment to meet the evolving needs of next-generation AI-driven data ecosystems.

By Distance

The Less than 10 Km distance segment dominated the Optical Interconnect Market with the highest revenue share of about 46.2% in 2025, driven by the growing demand for short-reach, high-speed links in data centers and enterprise campuses. These connections are vital for low-latency, high-throughput server-to-switch and intra-rack communications. Broadcom Inc. plays a key role in this space with its wide range of reliable short-reach optical modules. This segment is also expected to grow at the fastest CAGR of about 14.89% from 2026–2035, as cloud providers scale dense architectures and workloads become more distributed and latency-sensitive. Companies like Finisar (now part of II-VI) are leading the development of low-cost, energy-efficient interconnects tailored for edge computing and compact data center environments.

Optical Interconnect Market Regional Analysis:

North America Optical Interconnect Market Insights

North America dominated the Optical Interconnect Market with a revenue share of 36.2% in 2025, driven by significant investments in hyperscale data centers, silicon photonics R&D, and robust internet infrastructure. The region benefits from the presence of major cloud providers and tech innovators, establishing it as a key hub for advanced optical connectivity and next-generation interconnect solutions.

-

The U.S. dominates the North America Optical Interconnect Market due to its advanced hyperscale data centers, strong investment in silicon photonics, and leadership in AI and cloud infrastructure, supported by key players driving innovation across high-speed interconnect technologies.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Optical Interconnect Market Insights

Asia Pacific is expected to grow at the fastest CAGR of 14.99% from 2026–2035, fueled by rapid urbanization, increasing data consumption, and widespread 5G deployment. Countries like China, India, and Japan are heavily investing in cloud infrastructure and high-speed connectivity, positioning the region as a major growth engine for optical interconnect technologies across telecom, enterprise, and government sectors.

-

China leads the Asia Pacific Optical Interconnect Market owing to rapid 5G deployment, vast data center expansion, and substantial government support for photonics and digital infrastructure, making it a central hub for manufacturing and deploying optical interconnect solutions at scale.

Europe Optical Interconnect Market Insights

Europe holds a significant position in the Optical Interconnect Market, driven by steady advancements in 5G networks, industrial automation, and digital infrastructure modernization. Countries like Germany, the UK, and France are investing in high-speed data networks and AI ecosystems. The region also benefits from a strong presence of telecom equipment manufacturers and supportive regulations for digital transformation initiatives across industries.

-

Germany dominates the European Optical Interconnect Market due to its strong industrial infrastructure, advanced fiber-optic network, and leadership in Industry 4.0. Significant investments in data centers and telecom innovation, along with government support, position Germany as the regional market leader.

Latin America (LATAM) and Middle East & Africa (MEA) Optical Interconnect Market Insights

The Middle East & Africa region is led by the UAE, driven by rapid smart city projects, advanced 5G deployment, and robust digital infrastructure investments. In Latin America, Brazil dominates the market due to expanding telecom networks, increasing data center establishments, and growing adoption of high-speed cloud and connectivity solutions.

Optical Interconnect Market Key Players:

Major Key Players in Optical Interconnects Market are Cisco Systems, Inc., Intel Corporation, Broadcom Inc., Ciena Corporation, II-VI Incorporated (now Coherent Corp.), Lumentum Holdings Inc., Fujitsu Optical Components, Infinera Corporation, Ayar Labs, Arista Networks, Inc and others.

Competitive Landscape for Optical Interconnect Market:

Broadcom Inc. is a leading supplier of optical interconnect solutions, offering high-speed Ethernet switch ASICs, PHYs, and optical components for data centers and cloud networks. The company enables 400G, 800G, and next-generation optical connectivity supporting hyperscale, AI, and HPC infrastructures.

-

In May 2025, Broadcom unveiled its third-generation Co-Packaged Optics (CPO) technology supporting 200 Gbit/s per lane, designed for AI-scale networks, highlighting ecosystem readiness with improved thermal prototypes and OSAT process enhancements.

Ciena Corporation is a key player in the optical interconnect market, providing high-capacity coherent optical systems, pluggable transceivers, and photonic platforms. Its solutions enable scalable, low-latency, and energy-efficient connectivity for hyperscale data centers, cloud networks, and high-performance computing environments.

-

In December 2024, Ciena introduced its WaveLogic 6 Extreme (1.6 Tbit/s) coherent optics solution and launched coherent-lite pluggables (WaveLogic 6 Nano), tested in metro and data center environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 17.89 Billion |

| Market Size by 2035 | USD 67.14 Billion |

| CAGR | CAGR of 14.14% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

By Product (Cable Assemblies, Connectors, Optical Transceivers, Free Space Optics, Fiber, and Waveguides, Silicon Photonics, PIC-based Interconnects, Optical Engines) • By Interconnect Level (Metro & Long-haul Optical Interconnect, Board-to-Board & Rack-Level Optical Interconnect, Chip & Board-Level Optical interconnect)• By Fiber Mode (Single Fiber Mode, Multifiber Mode) • By Data Rate (Less than 10 GBPS, 10 - 50 Gbps, 50 - 100 Gbps, More than 100 Gbps) • By Application (Data Communication, Telecommunication) • By Distance (Less than 10 Km, 11 - 100 Km, More than 100 Km) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cisco Systems, Inc., Intel Corporation, Broadcom Inc., Ciena Corporation, II-VI Incorporated (now Coherent Corp.), Lumentum Holdings Inc., Fujitsu Optical Components, Infinera Corporation, Ayar Labs, Arista Networks, Inc. |